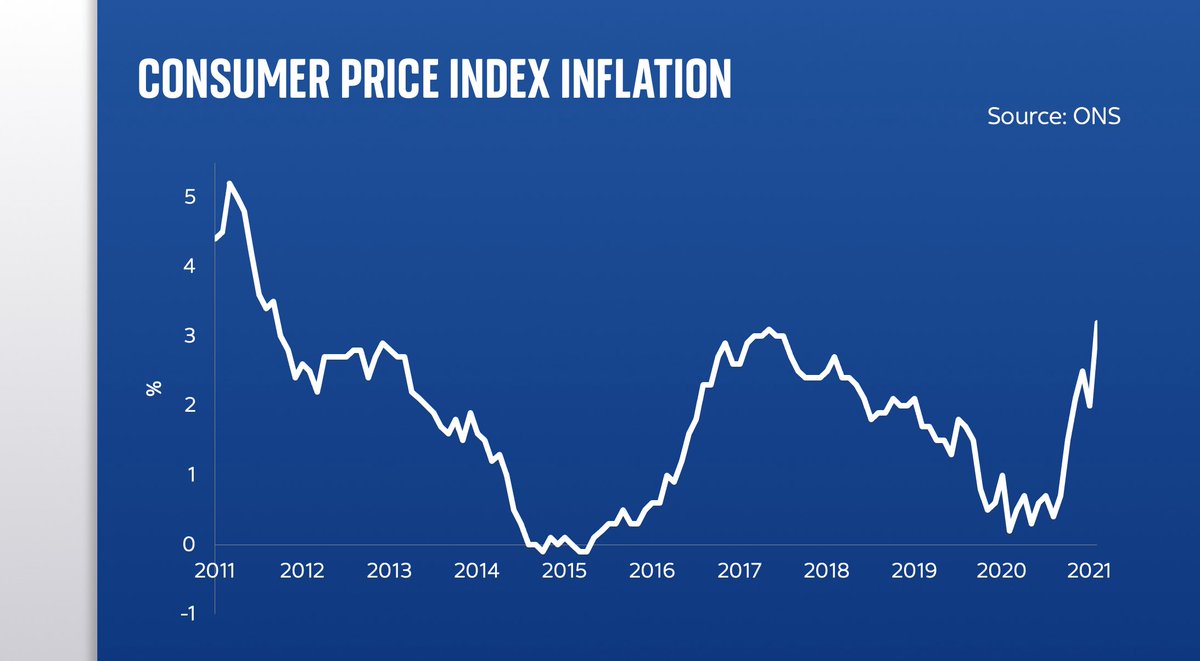

BIG jump in UK CPI inflation.

Up from annual rate of 2% in July to 3.2% in Aug.

Not just the highest level of inflation since 2012, it’s also the biggest month-on-month change in the level in the history of this inflation measure (going back to 1997)

Up from annual rate of 2% in July to 3.2% in Aug.

Not just the highest level of inflation since 2012, it’s also the biggest month-on-month change in the level in the history of this inflation measure (going back to 1997)

Here’s one reason to believe the inflation rise may be temporary: the main contributing factor was a BIG jump in prices, this year vs last, in restaurants.

And what was happening last year? Eat Out to Help Out.

Once that washes out, some of the upward pressure should go away…

And what was happening last year? Eat Out to Help Out.

Once that washes out, some of the upward pressure should go away…

Here’s a reason to believe the rise in inflation may NOT be temporary. Lots of pricing pressure in the pipeline, inc THIS: energy prices are going up v v fast, which will feed into household bills in the coming months. And that’s before you consider costs of raw goods…

You don’t have to look far to find other prices rising very FAST. These are factory gate prices - in other words the wholesale prices companies (as opposed to consumers) pay for materials. And just look: from metals to chemicals to wood, they’re all rising at record rates…

On top of everything else, here’s another inflationary side-effect of the semiconductor shortage.

Not enough chips to go into new cars means not enough new cars which means used car prices are going through the roof (dotted line compares price growth this yr with previous years)

Not enough chips to go into new cars means not enough new cars which means used car prices are going through the roof (dotted line compares price growth this yr with previous years)

• • •

Missing some Tweet in this thread? You can try to

force a refresh