B2B marketplaces are going to be big

$2.3B invested in them since 2019

But there is not a ton written about them

So here's a summary of my favorite articles, podcasts & principles on B2B marketplaces

🧵

$2.3B invested in them since 2019

But there is not a ton written about them

So here's a summary of my favorite articles, podcasts & principles on B2B marketplaces

🧵

https://twitter.com/asanwal/status/1343710387842256907

2/ This by the team @BessemerVP is a great starting point

They discuss

1. What's changed that makes B2B marketplaces possible today

2. The qualities of successful B2B marketplaces

3. B2B marketplace models esp for high-friction goods

bvp.com/atlas/b2b-mark…

They discuss

1. What's changed that makes B2B marketplaces possible today

2. The qualities of successful B2B marketplaces

3. B2B marketplace models esp for high-friction goods

bvp.com/atlas/b2b-mark…

3/ This by @onecaseman is particularly relevant to many B2B marketplaces

He digs into into 4 strategies for how to thrive in low frequency marketplaces.

Examples are more consumer but the principles likely hold for B2B

caseyaccidental.com/low-frequency-…

He digs into into 4 strategies for how to thrive in low frequency marketplaces.

Examples are more consumer but the principles likely hold for B2B

caseyaccidental.com/low-frequency-…

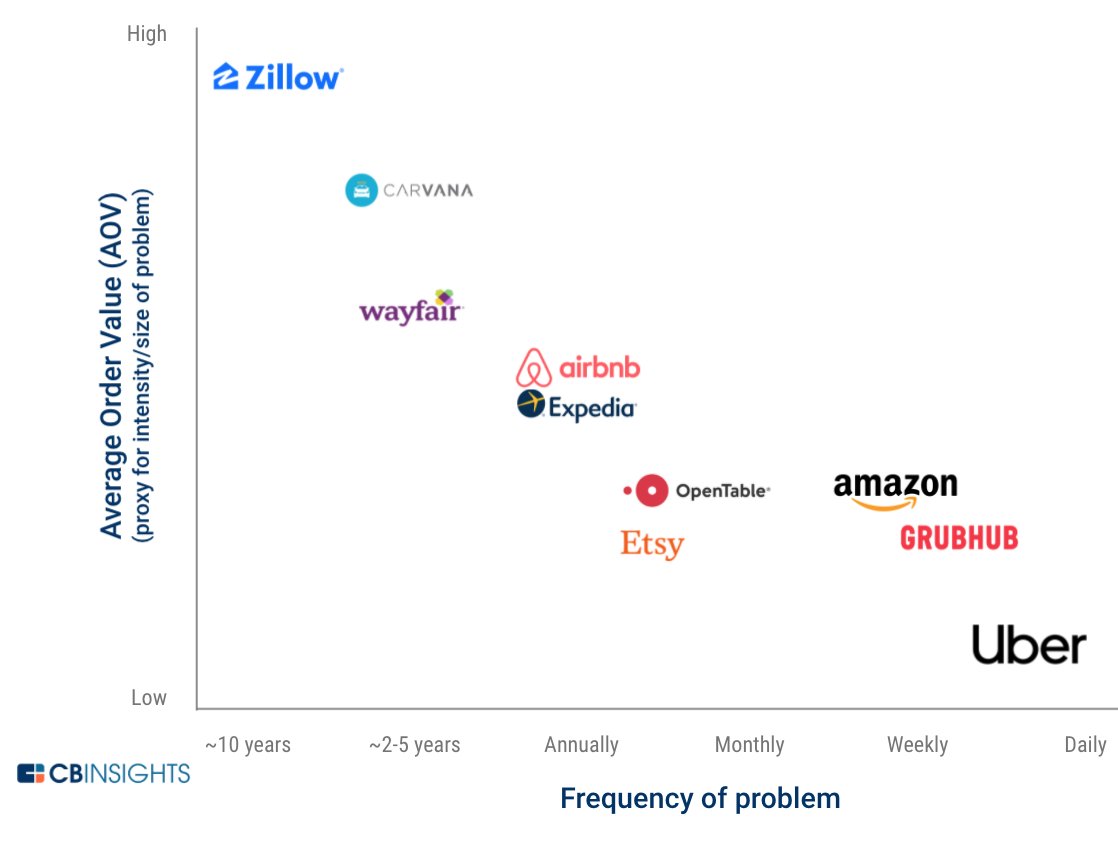

4/ Here is a quick way to think about frequency vs average order value (AOV)

The examples here are more consumer but again, within B2B, we're seeing a diversity of marketplaces along this spectrum

Varies by good, industry

The examples here are more consumer but again, within B2B, we're seeing a diversity of marketplaces along this spectrum

Varies by good, industry

5/ @BoweryCapital has done a number of great conversations with B2B marketplace investors and operators and you can see the index of those here

bowerycap.com/blog/insights/…

I'll highlight a couple I particularly liked

bowerycap.com/blog/insights/…

I'll highlight a couple I particularly liked

6/ This convo with AJ Rohde of @thomabravo is a good one

AJ is firmly in the camp for B2B marketplaces that the demand side is what you have to ‘tip’ first stating “you get a lot more done when the demand side (OEMs) blesses you.”

bowerycap.com/blog/insights/…

AJ is firmly in the camp for B2B marketplaces that the demand side is what you have to ‘tip’ first stating “you get a lot more done when the demand side (OEMs) blesses you.”

bowerycap.com/blog/insights/…

7/ This w/ @fabricegrinda is also good

Versus AJ, Fabrice believes B2B startups "lock in your supply by offering biz a free SaaS tool to incorporate into their workflows & manage their teams”

Clearly, there is no formula for B2B marketplaces

bowerycap.com/blog/insights/…

Versus AJ, Fabrice believes B2B startups "lock in your supply by offering biz a free SaaS tool to incorporate into their workflows & manage their teams”

Clearly, there is no formula for B2B marketplaces

bowerycap.com/blog/insights/…

8/ "Magical Growth Loops" by @lennysan is excellent [paywall]

He covers:

Supply driving demand

Demand driving supply

Demand driving demand

Supply driving supply

Again, bit more consumer focused but highlights likes of Faire showing relevance to B2B

lennysnewsletter.com/p/magical-grow…

He covers:

Supply driving demand

Demand driving supply

Demand driving demand

Supply driving supply

Again, bit more consumer focused but highlights likes of Faire showing relevance to B2B

lennysnewsletter.com/p/magical-grow…

9/ No thread on marketplaces would be complete without @bgurley's thinking

More consumer focused but here's some of the greatest hits IMO

10 factors to consider when evaluating a marketplace is 🔥

abovethecrowd.com/2012/11/13/all…

More consumer focused but here's some of the greatest hits IMO

10 factors to consider when evaluating a marketplace is 🔥

abovethecrowd.com/2012/11/13/all…

10/ For B2B marketplaces, a couple of pts in it are particularly relevant

#3 Where the technology offering greatly enhances the user experience

#9 Being part of the payment flow is superior to not being a part of the payment flow.

#3 Where the technology offering greatly enhances the user experience

#9 Being part of the payment flow is superior to not being a part of the payment flow.

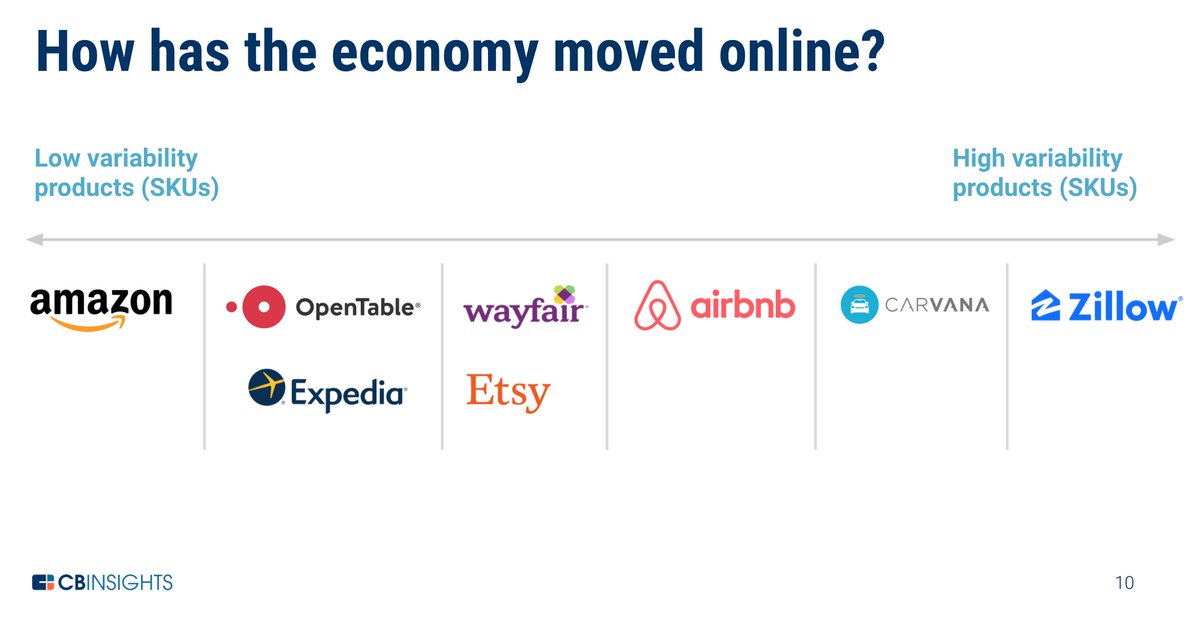

11/ We are seeing an incredible diversity in B2B marketplaces right now

And they're starting to attack more complex, highly variable "SKUs" and higher consideration B2B buying decisions

And they're starting to attack more complex, highly variable "SKUs" and higher consideration B2B buying decisions

12/ This evolution in B2B marketplaces we're seeing from low variability SKUs to more highly variable SKUs is very analogous to what we've observed in consumer-focused marketplaces

13/ This by @jbreinlinger which is from 7 years ago on what type of marketplace are you is very enlightening

Given AOV and complexity of B2B purchases, it would seem most will be double commit but not always

acrowdedspace.com/post/957422754…

Given AOV and complexity of B2B purchases, it would seem most will be double commit but not always

acrowdedspace.com/post/957422754…

14/ Here is a graphic to explain and highlight the differences between a buyer vs supplier picks vs a double commit marketplace

15/ Another gem by @bgurley on @patrick_oshag podcast

He covers

- liquidity quality in a marketplace

- network effects and capturing those

And my favorite, why you want demand-side promiscuity in a marketplace

podcasts.apple.com/us/podcast/inv…

He covers

- liquidity quality in a marketplace

- network effects and capturing those

And my favorite, why you want demand-side promiscuity in a marketplace

podcasts.apple.com/us/podcast/inv…

16/ Bowery metrics to evaluate both buy and sell side liquidity

"Liquidity is simply how easily and quickly buyers and sellers can find each other in the marketplace. A2-sided B2B marketplace should track both seller & buyer liquidity"

bowerycap.com/blog/insights/…

"Liquidity is simply how easily and quickly buyers and sellers can find each other in the marketplace. A2-sided B2B marketplace should track both seller & buyer liquidity"

bowerycap.com/blog/insights/…

17/ A simple view on 2 dominant strategies to get to marketplace liquidity

Either by focusing on geography or category

Almost universal agreement that B2B marketplaces should start narrow, get liquidity and then expand

Niche down FTW!

Either by focusing on geography or category

Almost universal agreement that B2B marketplaces should start narrow, get liquidity and then expand

Niche down FTW!

18/ I've got ~30 more podcasts and articles to go through by the likes of @peteflint of @NFX, @jeff_jordan & @andrewchen of @a16z as well as more from likes of @jbreinlinger, @lennysan and @onecaseman so will continue to add to this

In the meantime, 2 things

First, a question

In the meantime, 2 things

First, a question

20/ If we assume covid accelerated that by 2-3x, it still means 70-80% of the economy remains offline

This spells massive opportunity for B2B marketplaces

More resources to be added

Any resources on B2B marketplaces you really love?

This spells massive opportunity for B2B marketplaces

More resources to be added

Any resources on B2B marketplaces you really love?

21/ this by @JamesCurrier @NFX is 💯

Learnings:

- in B2B mkts w/ brokers, help them do jobs better

- don’t fear managed marketplace to create liquidity

- network fx is goal but may embed a SaaS tool into the workflow of demand or supply-side

nfx.com/post/24-ways-b…

Learnings:

- in B2B mkts w/ brokers, help them do jobs better

- don’t fear managed marketplace to create liquidity

- network fx is goal but may embed a SaaS tool into the workflow of demand or supply-side

nfx.com/post/24-ways-b…

• • •

Missing some Tweet in this thread? You can try to

force a refresh