A Thread on~ R I S K M A N A G E M E N T 🧵

Risk is inseparable from return in the stock market arena.

If risk can be managed, traders can open themselves up to making money in the market.

It is an important but often overlooked pre-requisite to successful active trading

Risk is inseparable from return in the stock market arena.

If risk can be managed, traders can open themselves up to making money in the market.

It is an important but often overlooked pre-requisite to successful active trading

Point being~ Anyone who has earned decent profit can lose it all in a split second without proper risk management.

So how do we develop the best techniques to curb the risks of the market?

So how do we develop the best techniques to curb the risks of the market?

1. PLAN YOUR TRADES

It's said~ Every battle is won before it is fought.

Having a plan & key pointers to focus on before executing a trade gives an edge.

~Does it meet the entry criteria?

~Is RR in favor?

~Does it fit in with the trend?

This helps to key emotions at bay.

It's said~ Every battle is won before it is fought.

Having a plan & key pointers to focus on before executing a trade gives an edge.

~Does it meet the entry criteria?

~Is RR in favor?

~Does it fit in with the trend?

This helps to key emotions at bay.

2. FOLLOW MARKET TREND

Markets are dynamic and constantly changing.

Identifying & riding the trend is one of the most rewarding strategy in itself to mitigate the risk.

Sometimes it's a task to do so but once you get your hands on it, things will get simplified.

Markets are dynamic and constantly changing.

Identifying & riding the trend is one of the most rewarding strategy in itself to mitigate the risk.

Sometimes it's a task to do so but once you get your hands on it, things will get simplified.

3. PORTFOLIO DIVERSIFICATION

Making sure you make the most of your trading means never putting your eggs in one basket.

The diversified portfolio protects you from the market fluctuations in a specific sector or the specific company.

This ensures a balanced equation.

Making sure you make the most of your trading means never putting your eggs in one basket.

The diversified portfolio protects you from the market fluctuations in a specific sector or the specific company.

This ensures a balanced equation.

4. ASSESS YOUR RISK TAKING CAPACITY

The markets are uncertain & you might end up loosing all your wealth due to one wrong trade.

You should assess your income sources & determine an amount which you feel you can trade with or invest to get saved from this blow-up.

The markets are uncertain & you might end up loosing all your wealth due to one wrong trade.

You should assess your income sources & determine an amount which you feel you can trade with or invest to get saved from this blow-up.

5. STOP-LOSS & TAKING PROFIT

Determine open & close position.

SL is the price at which a trader sells a stock & takes loss on the trade.

TP point is the price at which a trader sells a stock & takes profit on the trade.

These 2 factors are the key drivers of risk management.

Determine open & close position.

SL is the price at which a trader sells a stock & takes loss on the trade.

TP point is the price at which a trader sells a stock & takes profit on the trade.

These 2 factors are the key drivers of risk management.

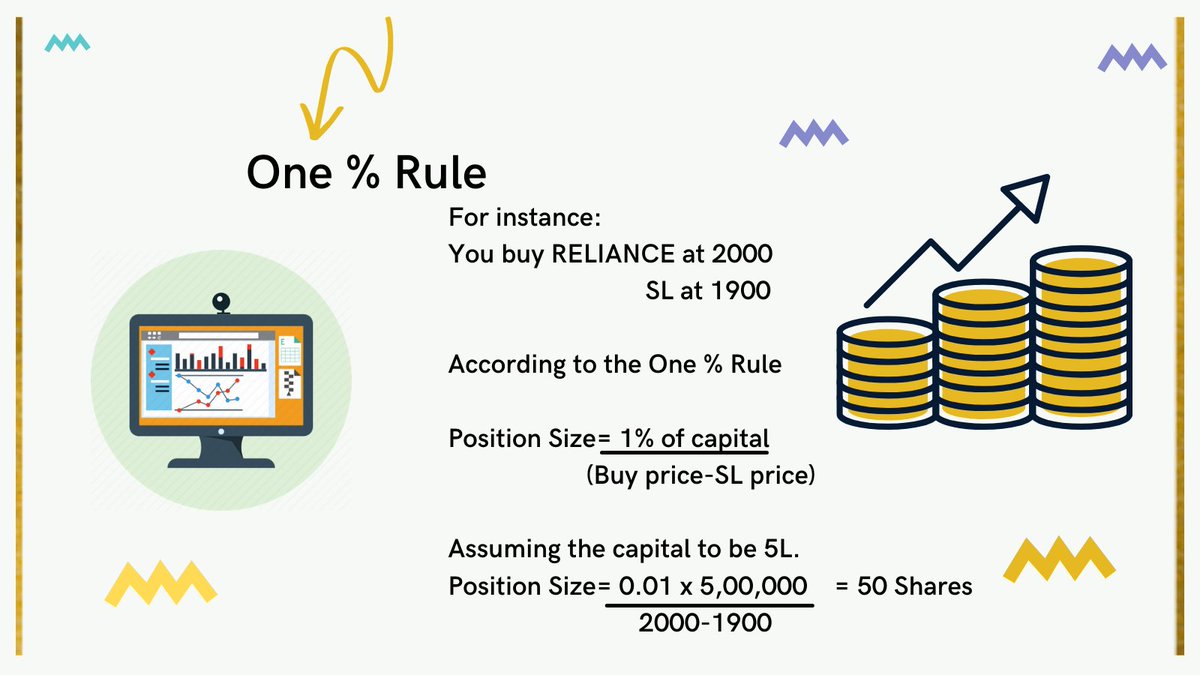

6. One % Rule

Even if everything goes wrong in a row & if we are risking just 1% of capital in each trade.

It'll take 100 trades to lose it all.

Many traders lose entirely in just 5-7 trades.

They trade with position size way bigger than their risk management should allow.

Even if everything goes wrong in a row & if we are risking just 1% of capital in each trade.

It'll take 100 trades to lose it all.

Many traders lose entirely in just 5-7 trades.

They trade with position size way bigger than their risk management should allow.

We should always know when we plan to enter or exit a trade before executing.

By using SL; We can minimize not only losses but also the number of times a trade is exited needlessly.

In conclusion, make your battle plan ahead of time so you'll already know you've won the war.

By using SL; We can minimize not only losses but also the number of times a trade is exited needlessly.

In conclusion, make your battle plan ahead of time so you'll already know you've won the war.

• • •

Missing some Tweet in this thread? You can try to

force a refresh