The second illiquid firm to take your mind of the broader market (and just maybe make you pick up something illiquid) is...

Polish Ifirma $IFI - a peer to the Swedish cloud accounting software firm Fortnox $fnox .

Polish Ifirma $IFI - a peer to the Swedish cloud accounting software firm Fortnox $fnox .

https://twitter.com/SerialAcquirers/status/1439921966488637443

Managed by @Wojtek7919, who in his Swedish hat (!) might be able to answer further questions/correct me.

I get a great vibe from talking with this guy. A thrifty character with skin in the game. He will blow (a little) cash on non-core projects.

I get a great vibe from talking with this guy. A thrifty character with skin in the game. He will blow (a little) cash on non-core projects.

This may paint a complex equity story, but it doesn't matter. The core business affords this.

Here's an investor chat: sii.org.pl/13648/aktualno…

Here's an investor chat: sii.org.pl/13648/aktualno…

Ifirma doesn't share Fortnox's growth strategy of partnering with accounting firms. Instead, Polish accounting firms see Ifirma as a "ruthless competitor, and rightly so" (Wojciech in an email exchange).

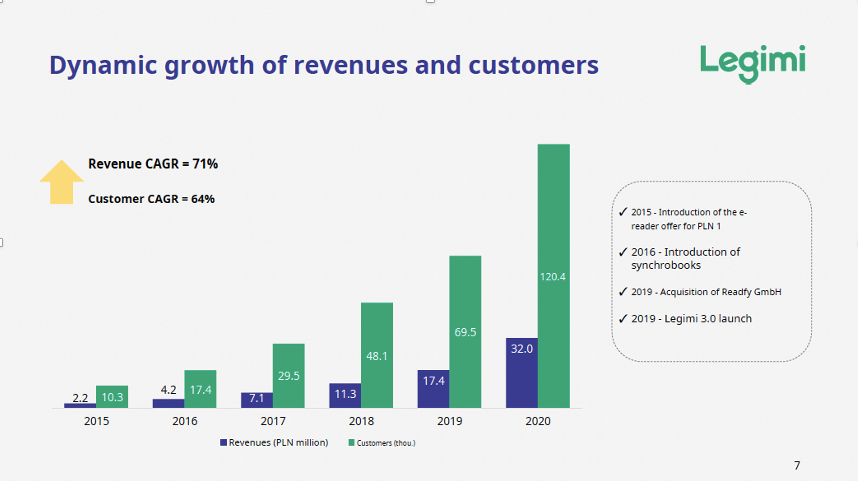

So don't expect Fortnox growth rates. But the lock-in/moat could be more significant for Ifirma.

Ifirma has 3 segments; core SaaS/accounting office, outsourcing/recruitment, and a new CRM product. I would have preferred just core, but guess the recruitment hustle at least eases talent restraints in core. CRM also seems to be a low-risk bet in terms of invested capital

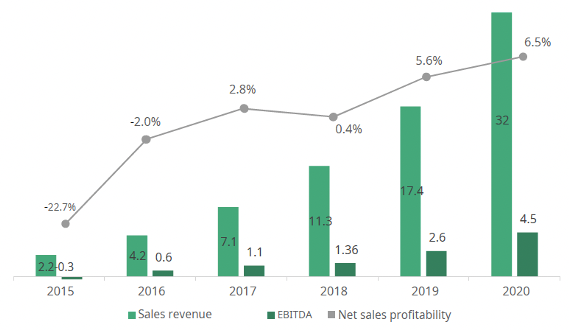

The "internet accounting" (think Fortnox) has a fixed subscription price (hiked price in May of about 25%-30%), and the "accounting office" is based on docs sent. 94% of 1H21 revenues were from core.

"Our profits (and margins) will most likely be much higher this year, and likely again next year, because of new pricing introduced in Q2 and growth of the customer base." - Wojciech in an email

Assuming a step up to an 18% EBIT margin in 2025, 70% cash conversion of EBIT until then, a 12% average revenue growth rate, and an exit multiple of 20x EBIT 2025E would yield an IRR of >15%. Feels reasonable enough.

I'm long. No advice.

I'm long. No advice.

• • •

Missing some Tweet in this thread? You can try to

force a refresh