Coingecko tracks more than 125 decentralized exchanges.

Why does the world need the new DEX protocol, Astroport?

And how could it possibly become one of the industry’s leading DEXes?

Here’s how…

🧵👇

Why does the world need the new DEX protocol, Astroport?

And how could it possibly become one of the industry’s leading DEXes?

Here’s how…

🧵👇

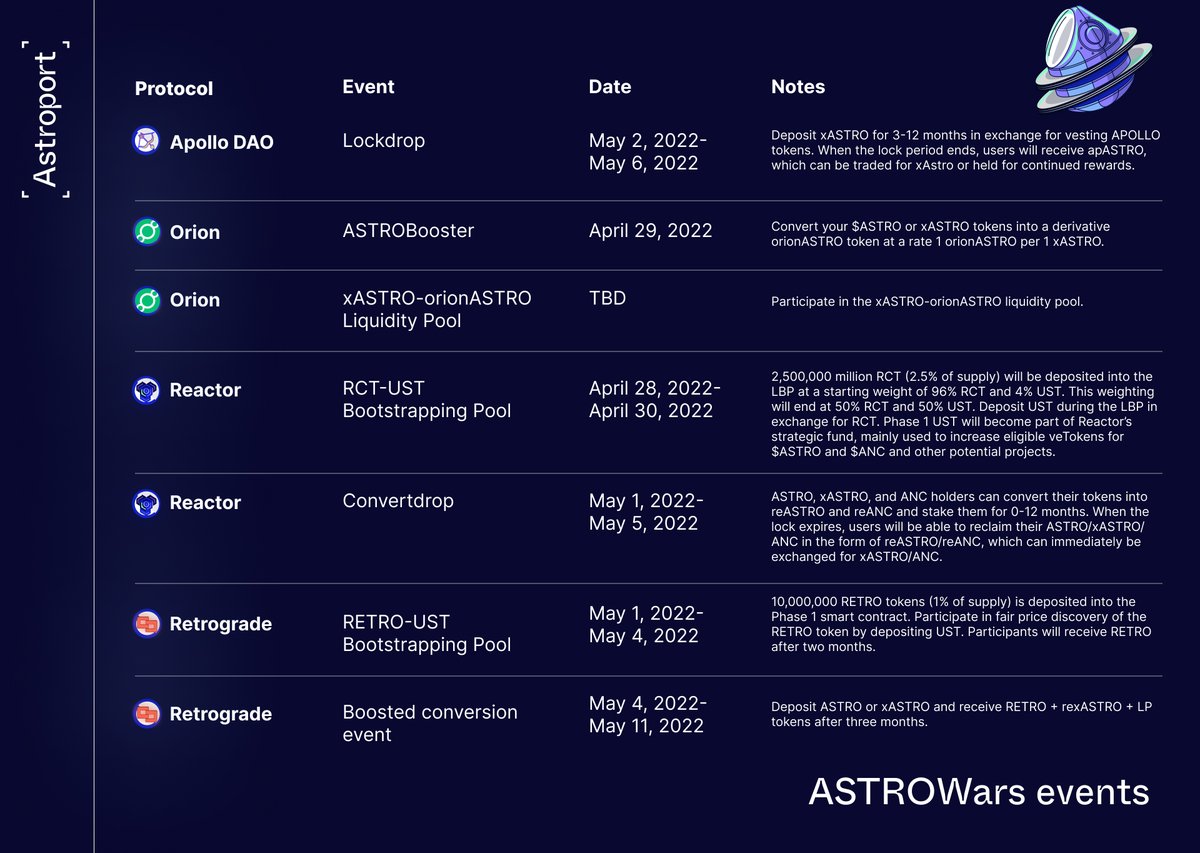

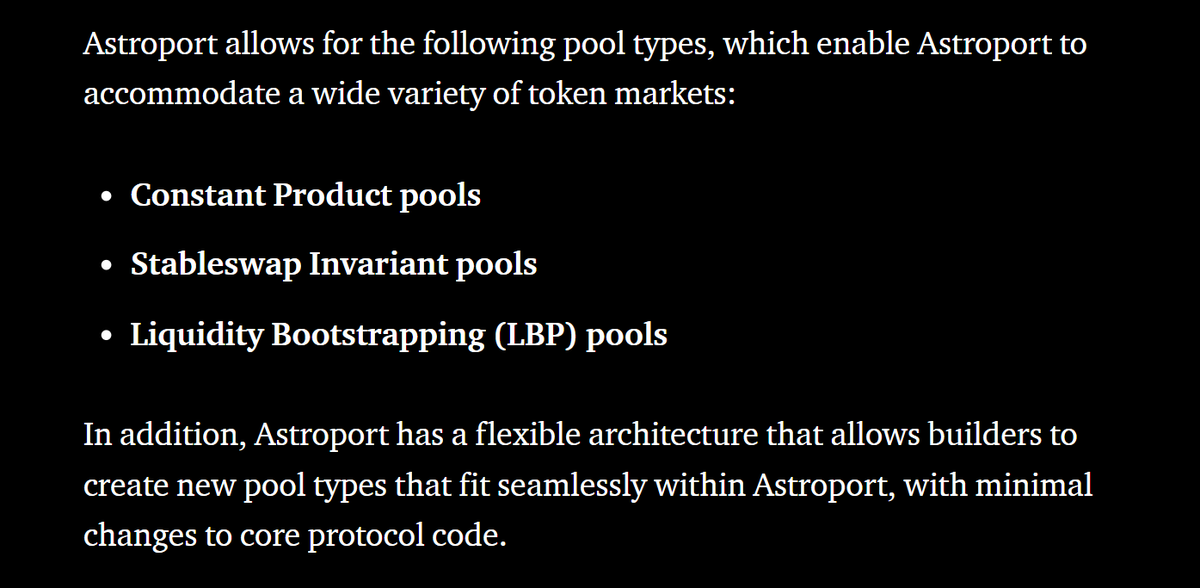

Most DEXes support a single type of liquidity pool.

Astroport enables three.

It also has a flexible architecture so devs & governance can easily add more pool types in the future.

Astroport enables three.

It also has a flexible architecture so devs & governance can easily add more pool types in the future.

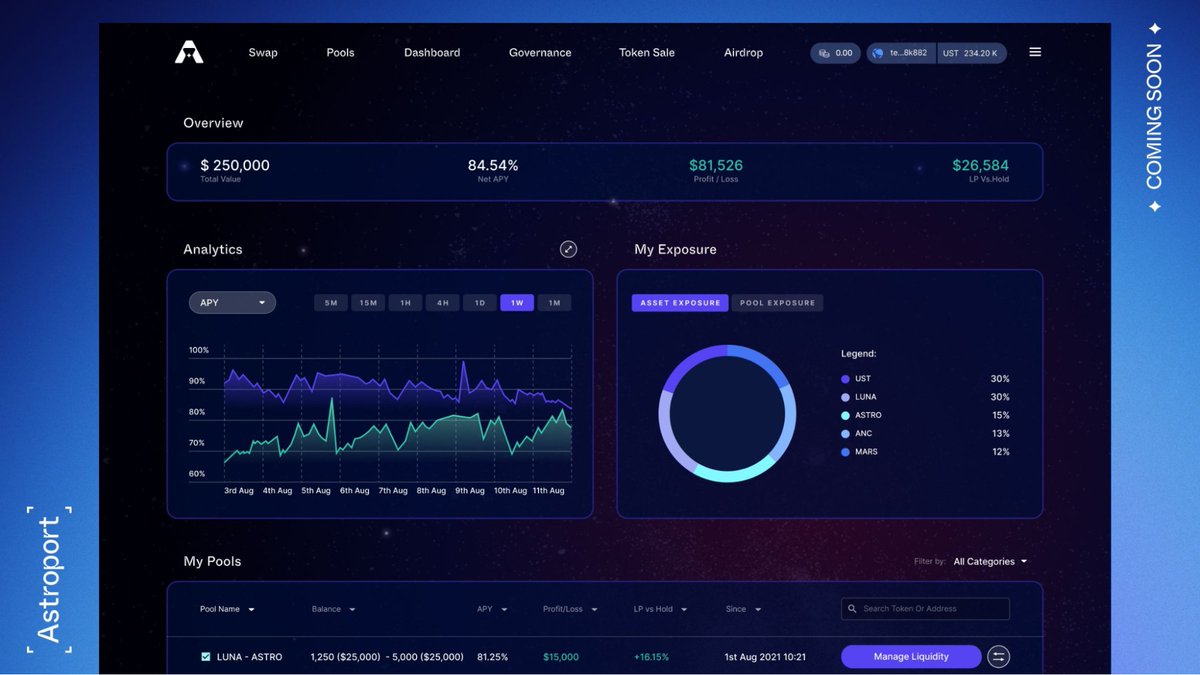

Information = power.

No more “flying blind” or cobbling together DIY spreadsheets.

The companion web UI for Astroport gives LPs built-in tools, charts & metrics to track fees, APYs, gains/losses and more.

No more “flying blind” or cobbling together DIY spreadsheets.

The companion web UI for Astroport gives LPs built-in tools, charts & metrics to track fees, APYs, gains/losses and more.

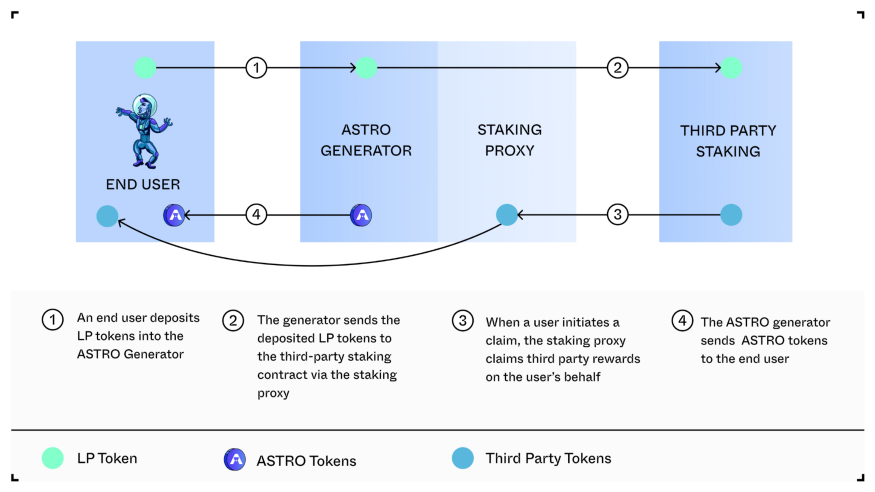

Astroport supports “dual liquidity mining” with its ASTRO Generators.

No longer will you have to choose between supplying liquidity on say @mirror_protocol and a DEX.

You’ll be able to earn rewards from BOTH simultaneously ($MIR + $ASTRO).

No longer will you have to choose between supplying liquidity on say @mirror_protocol and a DEX.

You’ll be able to earn rewards from BOTH simultaneously ($MIR + $ASTRO).

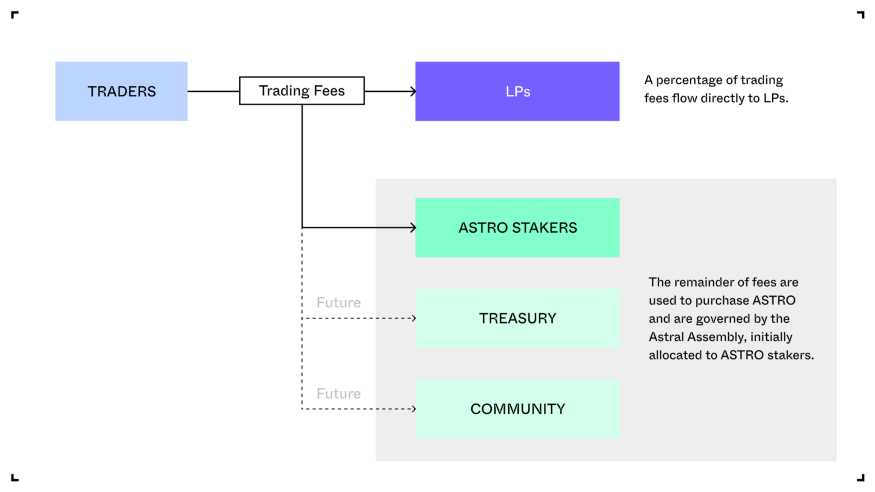

From Day 1, fees will flow to LPs AND stakers.

LPs earn in real-time as trades happen.

LPs earn in real-time as trades happen.

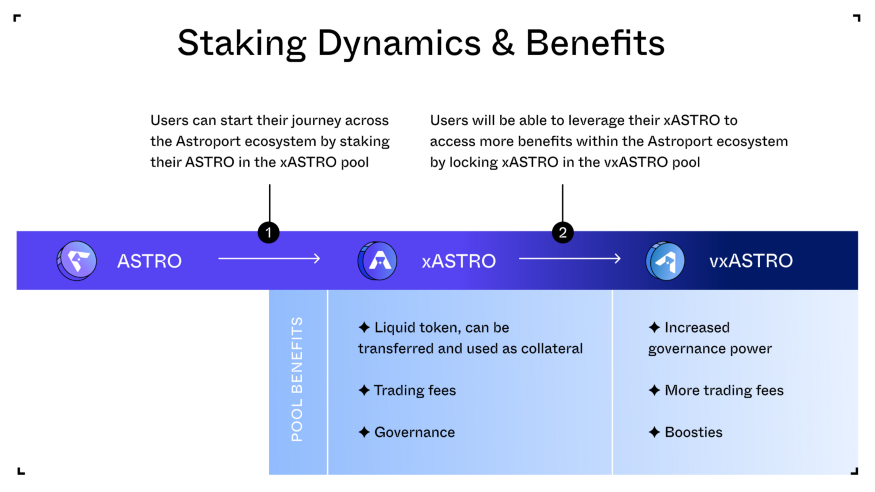

LPs govern the system by staking $ASTRO for $xASTRO or $vxASTRO.

Then, Astroport will apply a portion of LP fees to buying $ASTRO and adding it to the staking pool.

That means each $xASTRO and $vxASTRO will be worth more $ASTRO over time.

Then, Astroport will apply a portion of LP fees to buying $ASTRO and adding it to the staking pool.

That means each $xASTRO and $vxASTRO will be worth more $ASTRO over time.

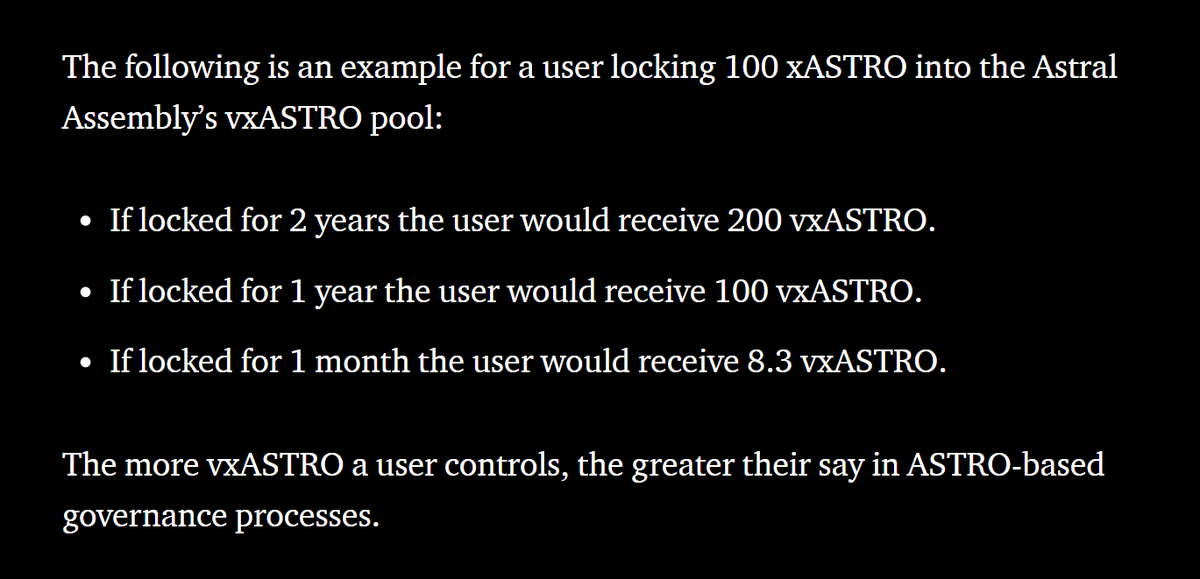

Astroport governance will be led by $ASTRO stakers in the Astral Assembly.

$xASTRO is for flexible users/governors—it can be returned to unstake $ASTRO at any time. $vxASTRO is for more committed users/governors.

How do you get $vxASTRO? By locking $xASTRO in the Time Vault.

$xASTRO is for flexible users/governors—it can be returned to unstake $ASTRO at any time. $vxASTRO is for more committed users/governors.

How do you get $vxASTRO? By locking $xASTRO in the Time Vault.

$vxASTRO comes with more benefits, too. Holders of this non-transferrable "token" get

✦ A bigger share of trading fees; and

✦ The ability to vote on the pools that get the biggest “boosties” in the ASTRO Generators (that is bonus rewards for liquidity-mining for certain pools)

✦ A bigger share of trading fees; and

✦ The ability to vote on the pools that get the biggest “boosties” in the ASTRO Generators (that is bonus rewards for liquidity-mining for certain pools)

It’s the perfect circle.

All LPs are incentivized to lock $xASTRO so they can vote to send bonus rewards to their favorite pools.

All LPs are incentivized to lock $xASTRO so they can vote to send bonus rewards to their favorite pools.

There will be no “decentralization theater” on Astroport.

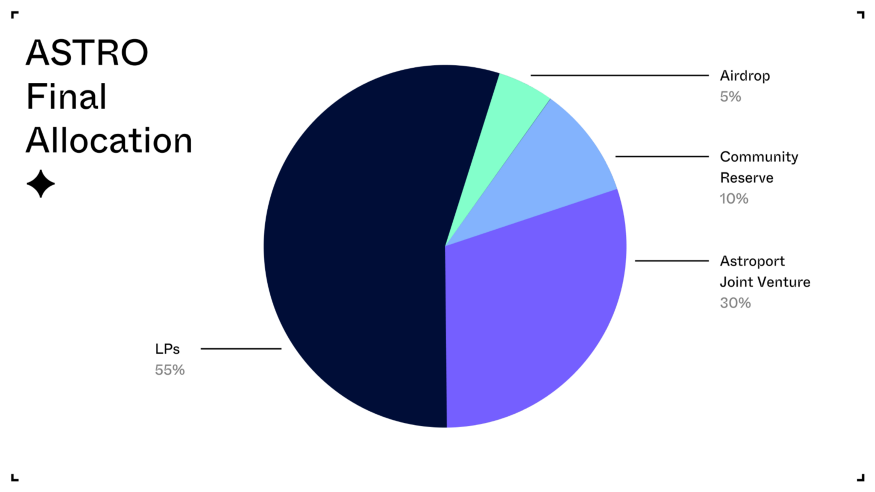

70% of all $ASTRO tokens will ultimately go directly to the protocol and its uses and allocation will be determined by the community.

70% of all $ASTRO tokens will ultimately go directly to the protocol and its uses and allocation will be determined by the community.

Astroport will be fundamental architecture for the @terra_money galaxy.

But the story shouldn’t end there.

If Astral Assemblers and builders deem it so, it could use bridges to be the liquidity layer for traders who don’t even use Terra or have TerraStation installed.

🤯

But the story shouldn’t end there.

If Astral Assemblers and builders deem it so, it could use bridges to be the liquidity layer for traders who don’t even use Terra or have TerraStation installed.

🤯

✦ Prepare for lift-off soon ✦

And as always, please DYOR and be mindful of the information and disclaimers in the Astroport litepaper: astroport.medium.com/astroport-lite…

And as always, please DYOR and be mindful of the information and disclaimers in the Astroport litepaper: astroport.medium.com/astroport-lite…

• • •

Missing some Tweet in this thread? You can try to

force a refresh