Crypto is a systemic shock that’ll make society more equal.

Rising inequality is an inevitable feature of capitalism. But like all systemic shocks through history, the rise of crypto’ll help reset wealth distribution.

Here’s why & what it means for your own wealth strategy 👇

Rising inequality is an inevitable feature of capitalism. But like all systemic shocks through history, the rise of crypto’ll help reset wealth distribution.

Here’s why & what it means for your own wealth strategy 👇

Wealth inequality is at the highest in US history. It causes social upheaval & is bad for economy (weak purchasing power of middle class = no demand to drive growth).

People say technology change, globalization, and lack of skill training are reasons for this rising inequality.

But actually even without any of those, increasing wealth concentration is *inevitable* in any capitalistic society.

But actually even without any of those, increasing wealth concentration is *inevitable* in any capitalistic society.

Let's look at 3 simple reasons why and how crypto helps address each.

Reason 1: the magic of compounding

Current median net worth in US is $120k. The top 1% wealth club starts at $11 million. So the wealth gap btw the two classes is $10.88 million.

Current median net worth in US is $120k. The top 1% wealth club starts at $11 million. So the wealth gap btw the two classes is $10.88 million.

If we assume the average person & the rich both get 5% annual return on their net asset holdings (not true as I’ll talk about below, but bear w/ me), in 10 yrs the wealth gap would balloon to $17.72 million— an increase of 60%.

This widening of wealth gap is mechanical because of compounding returns.

How fast does the average person’s net worth need to grow to keep wealth gap constant in 10 years?

50% a year.

How fast does the average person’s net worth need to grow to keep wealth gap constant in 10 years?

50% a year.

Mind you, this is just to keep the gap unchanged, not even shrinking. And it’s assuming the rich person’s assets still only return 5% a year.

If you’re thinking, “How’s the average Joe gonna get 50% every year for his money? It’s damn hopeless.”

You’re right. Almost.

Except we’re in a tectonic shift of economic structure that happens maybe once a century.

You’re right. Almost.

Except we’re in a tectonic shift of economic structure that happens maybe once a century.

If you bet on the instigator of such shifts, you can get outsized returns— The annual return of ethereum and bitcoin are both over 200% in past 5 and 10 years.

But you say, it’s not like the rich can’t invest in crypto. How’s that gonna change inequality? Hold that thought. I’ll come back to it in a min.

Reason 2: The rich can buy more assets

If you’re in the top 1% of wealth, you get over half million $ a year in capital income even on a 5% return. If you save half of that to reinvest, you still have plenty left to afford a good lifestyle.

If you’re in the top 1% of wealth, you get over half million $ a year in capital income even on a 5% return. If you save half of that to reinvest, you still have plenty left to afford a good lifestyle.

But if you’re the average person, you get $6000 in capital income. That’s barely enough to buy a year’s groceries, let alone reinvesting.

The rich can save more—> buy more assets—> own bigger & bigger shares of the economic pie.

The rich can save more—> buy more assets—> own bigger & bigger shares of the economic pie.

The ongoing global asset shortage reinforce wealth concentration. When there’s limited supply of desirable assets, e.g. urban real estate, prices get bid up. I talked about this in a previous article. And guess who lose out in the bid? Hint: not the top 1%.

https://twitter.com/RealNatashaChe/status/1435316969998192643?s=20

Crypto is a shock to the status quo b/c it creates new types of assets that have better features than many existing asset classes.

We now have crypto assets that both serve as new stores of values (e.g. NFT, bitcoin) and benefit from economic growth (e.g. staking, liquidity pools).

The result is drastically lowered entry barrier for owning capital.

The result is drastically lowered entry barrier for owning capital.

Currently the average person’s main asset is the house they live in. As housing price skyrockets, entry into middle class gets harder. And when you have a heavy mortgage, it’s difficult to save and acquire other assets.

But as crypto increases asset supply pool and variety in the economy, it will help curb price increases in physical assets like real estate. (The rise of remote work go in the same direction to flatten housing prices.)

Overtime more people can afford to buy a house simply to live in, direct their savings to other assets, and invest more like the rich.

https://twitter.com/RealNatashaChe/status/1435317004043358211?s=20

This won’t change anything at the top of income distribution (the rich can still buy whatever assets they want). But it will level up the bottom— more capital ownership at lower income tier— and help reduce overall inequality.

Reason 3: The rich get higher returns on assets

Aside from the house they live in, the capital of average person is tied up in pension contribution & liquid assets like savings account. Both yield meager returns.

Aside from the house they live in, the capital of average person is tied up in pension contribution & liquid assets like savings account. Both yield meager returns.

In contrast, the capital of the rich are in investment properties, private equities & other higher-return asset classes.

And don’t get me started on the “accredited investor” regulation in the US, which protects the average Joe from nothing except better investment opportunities 🤡

So our starting assumption that both the rich and poor get 5% annual return on investment is patently untrue. The reality is prob something like 10% vs 2%.

But crypto changes that pattern. Here’s why.

When the economy goes through a paradigm shift, the embodiment of capital changes—

• 18th century capital: farm land

• 19th century capital: factories, machines, gov bonds

• 20th century capital: urban real estate, stocks

When the economy goes through a paradigm shift, the embodiment of capital changes—

• 18th century capital: farm land

• 19th century capital: factories, machines, gov bonds

• 20th century capital: urban real estate, stocks

During such a shift, the rich from the old paradigm lose out b/c the asset classes which their wealth is denominated in either get destroyed or plummet in value.

This is in fact the primary way that a capitalistic economy resets wealth distribution— through massive creative destruction of asset classes. Without such disruption, existing wealth will grow more concentrated in fewer hands over time for reasons we talked about above.

(BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 taschalabs.com/newsletter)

In Jane Austen’s England, the rich was the landed gentry. Mr Darcy’s 10,000 pounds a year was rentier incomes from agricultural land.

But the landowners suffered major decline when agricultural exports from the new continent (America) flooded world market in late 19th century, and destroyed the return on English farm land.

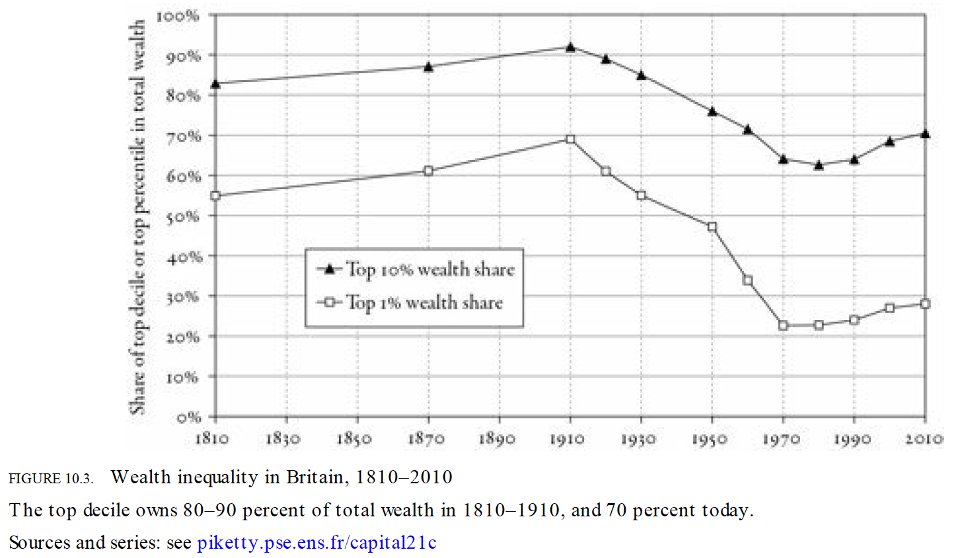

The result is a major drop in wealth inequality of Britain since early 20th century.

The result is a major drop in wealth inequality of Britain since early 20th century.

The same happened in World War II.

The wealthy in America, having already suffered a blow from the great depression, got destroyed further as the values of their foreign asset holdings (e.g. Russian gov bonds) dropped to nothing.

The wealthy in America, having already suffered a blow from the great depression, got destroyed further as the values of their foreign asset holdings (e.g. Russian gov bonds) dropped to nothing.

The result is economy became more equal after WWII, until inequality rose again in 1980s.

https://twitter.com/RealNatashaChe/status/1442201290126151693

A similar history is starting to play out today and will continue for years to come as crypto asset classes grow. We’ll look back and realize:

• 21st century capital: digital assets

• 21st century capital: digital assets

A similar shakeout among the wealthy class will happen as the values of tradFi assets appreciate slower than digital or even drop.

You say, nothing stops the rich from buying crypto.

You say, nothing stops the rich from buying crypto.

True. But nothing stopped British landowners of 19th century from buying factories & machines either. They were the ones with money after all.

There were indeed some farm land owners who got involved in industrial revolution and did well, just like there’re rich people today who are crypto whales. But most simply didn’t see the systemic shock coming and became its casualties.

Many in the top 1% are beneficiaries of several generations of capital accumulation. Being rich today is not equal to having vision of tomorrow. When you have a good thing going, why rock the boat?

That’s why much of the old money will continue following conventional wisdom in portfolio management— percentage split btw stocks & bonds, diversification btw growth & value, etc.

That kind of strategy works well in peace time-- when the future looks just like the past. But it will stumble in war time. By *war time*, I do not mean just armed conflicts, but any time when there’re major clashes btw old & new paradigms.

Total global stock market cap is $120 trillion, real estate value $350 trillion. Total crypto market cap is $2 trillion. If crypto grows at the same pace as in the past 5 yrs for next 5-6 yrs, it will surpass global equity & real estate combined in market cap by 2027.

So if you don’t think we are in war time right now, wake up.

You say, crypto won’t grow as fast going forward. Regulations are coming. Fed will raise rates. It’s all a bubble.

You say, crypto won’t grow as fast going forward. Regulations are coming. Fed will raise rates. It’s all a bubble.

Sure. But keep in mind we’re only seeing the beginning of innovations in a space that has huge momentum.

New L1s, L2s & side chains are reducing the cost of on chain infrastructure fast. That’ll spur new waves of applications and use cases. NFT alone grew 1000% this year & it’s barely getting started.

Boundaries & definitions of “assets” will continue to morph. It’ll take a long time for regulations to keep up.

If this is not the greatest disruption to wealth, at least matching the scale of industrial revolution & two world wars, I don’t know what is.

If this is not the greatest disruption to wealth, at least matching the scale of industrial revolution & two world wars, I don’t know what is.

Some implications for your wealth strategy (not financial advice):

• physical assets like real estate may have limited upside. They’re not on the right side of history. Despite ST boom, you may see long term weakness.

• physical assets like real estate may have limited upside. They’re not on the right side of history. Despite ST boom, you may see long term weakness.

• buying crypto as “portfolio diversification” is only PR message for your average mutual fund manager. The truth is you don’t bet on the instigator of a paradigm shift just to diversify a portfolio, when you know the instigator will one day become *the* portfolio.

Like this? Don’t forget to

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @realnatashache

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @realnatashache

p.s. If you have questions / thoughts, feel free to put in the comments. I may do a discussion video for Q&A if the questions are interesting.

Thanks for your questions. The Q&A video is here

https://twitter.com/RealNatashaChe/status/1444795113377521666?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh