- My first deep dive on here -

- Mo-BRUK $MBR -

Mobruk is the polish national leader in processing of industrial waste

- Mo-BRUK $MBR -

Mobruk is the polish national leader in processing of industrial waste

Introduction

Mobruk was founded by Józef Mokrzycki in 1985 and is a family-led company with 5 facilites, a market share up to 25% and a market cap of 1.3b PLN/280m Eur

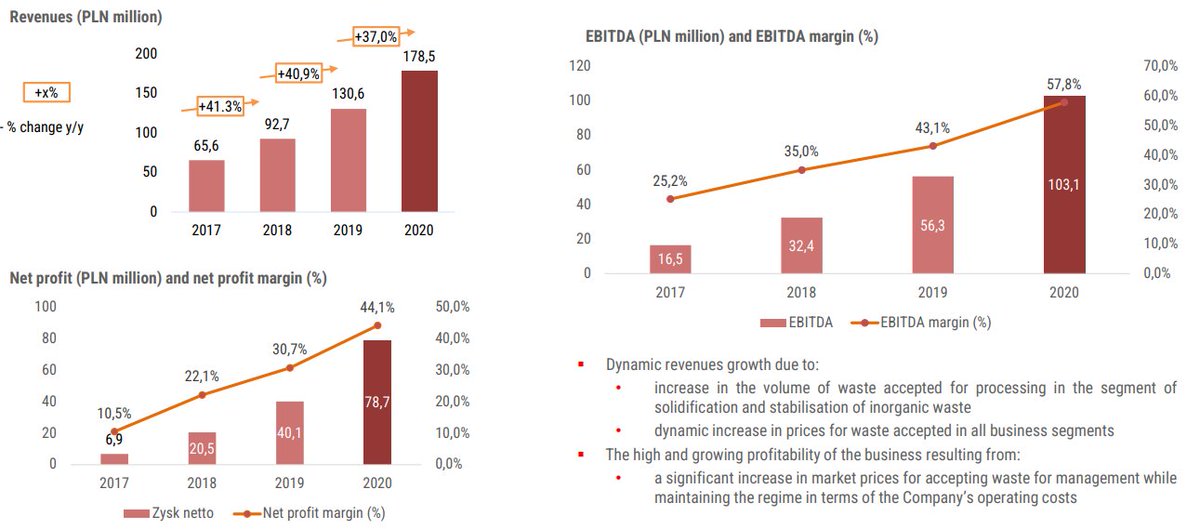

2020:

Revenue: 178,5 PLN million

EBITDA margin: 57,8%

net profit margin: 44,1%

Mobruk was founded by Józef Mokrzycki in 1985 and is a family-led company with 5 facilites, a market share up to 25% and a market cap of 1.3b PLN/280m Eur

2020:

Revenue: 178,5 PLN million

EBITDA margin: 57,8%

net profit margin: 44,1%

Business

Mobruk operates in three areas of waste mangement

- incineration

- solidification and stabilisation

- RDF production

Depending on the type of waste they either burn, recycle, store or produce alternative fuel

Mobruk operates in three areas of waste mangement

- incineration

- solidification and stabilisation

- RDF production

Depending on the type of waste they either burn, recycle, store or produce alternative fuel

Next to gaining revenue by selling their recycled waste they get paid for accepting the waste. As you can see the prices are rising and Mobruk benefits.

Dont waste waste

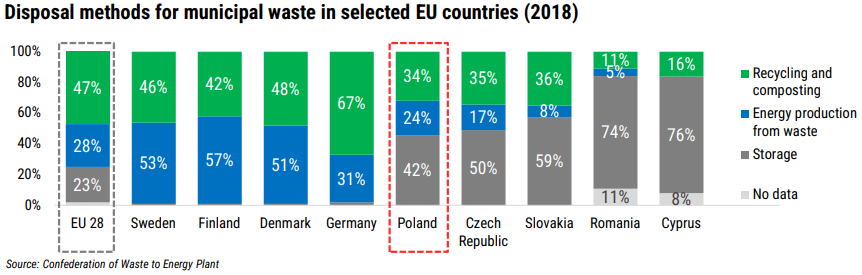

With all that they want to become an even bigger part oft he circular economy in poland which got a lot of room to grow in comparison.

With all that they want to become an even bigger part oft he circular economy in poland which got a lot of room to grow in comparison.

Further than that the EU set up targets for reuse and recycling of municipal waste:

- 55% in 2025

- 60% in 2030

- 65% in 2035

- no recyclable waste allowed to store after 2030 in the EU

- 55% in 2025

- 60% in 2030

- 65% in 2035

- no recyclable waste allowed to store after 2030 in the EU

Enviromental time bombs

There are are over 800 locations of enviromental time bombs and illegal waste disposal in Poland like below. Mobruk is cleaning up these places in corporation with local authorities. The media is naming them 'lokal Chernobyl's'.

There are are over 800 locations of enviromental time bombs and illegal waste disposal in Poland like below. Mobruk is cleaning up these places in corporation with local authorities. The media is naming them 'lokal Chernobyl's'.

Acquisitions

they reviewed available acquisition options in H1 and are currently in talk with possible candidates so the first acquisition may be finalised this year. With that Mobruk will try diversify through more segments and geographically to northern parts of Poland.

they reviewed available acquisition options in H1 and are currently in talk with possible candidates so the first acquisition may be finalised this year. With that Mobruk will try diversify through more segments and geographically to northern parts of Poland.

Dividend policy

Something i don't like: they pay out 50% - 100% of net revenue. Definitely have to keep an eye on that especially when i think about planed acquisitions and debt. But for now thats not a red flag for me.

Something i don't like: they pay out 50% - 100% of net revenue. Definitely have to keep an eye on that especially when i think about planed acquisitions and debt. But for now thats not a red flag for me.

Shareholder structure

35% is owned by the family through 'Ginger Capital'

Rest is free float, but another 23,8% are owned by AgioFunds.

35% is owned by the family through 'Ginger Capital'

Rest is free float, but another 23,8% are owned by AgioFunds.

Valuation and first half 2021

no net debt

forward P/E around 13,7.

forward EV/EBITDA 9,6.

Which seems pretty fair for these growthrates and margins.

no net debt

forward P/E around 13,7.

forward EV/EBITDA 9,6.

Which seems pretty fair for these growthrates and margins.

All in all i think Mobruk is an exciting company with a strong position in an important industry because Poland has to catch up in their waste management and obviously the rising focus on enviromental protection and sustainability.

I don’t own any $MBR shares at the moment but I probably will in the future. Thanks for reading.

• • •

Missing some Tweet in this thread? You can try to

force a refresh