Q: How have the valuations of the largest financial services firms fared over the last 3 years?

A: Not great (data below)

We're seeing a dramatic changing of the guard in financial services

It was happening gradually

Now, it's happening suddenly

Here's why

A: Not great (data below)

We're seeing a dramatic changing of the guard in financial services

It was happening gradually

Now, it's happening suddenly

Here's why

https://twitter.com/asanwal/status/1413171509565263872

2/ First, a framework to evaluate this through courtesy of Ernest Hemingway in The Sun Also Rises where he asks

"How did you go bankrupt?"

"How did you go bankrupt?"

3/ The answer

"To ways...Gradually and then suddenly"

This is the creative destruction we're seeing in financial services right now

"To ways...Gradually and then suddenly"

This is the creative destruction we're seeing in financial services right now

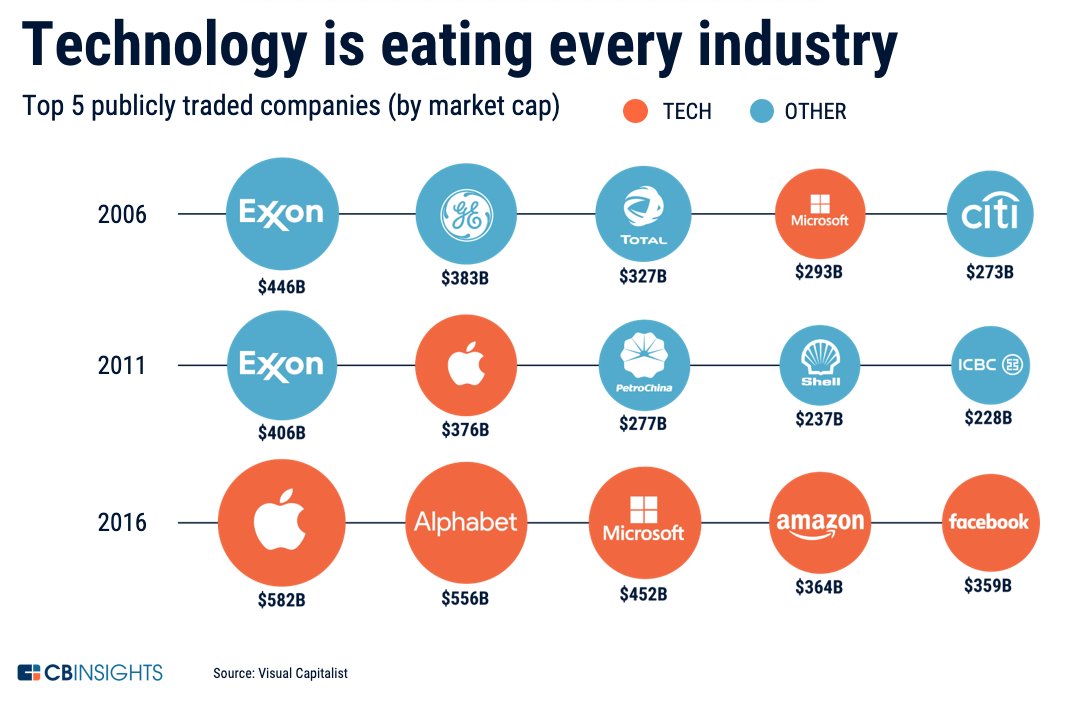

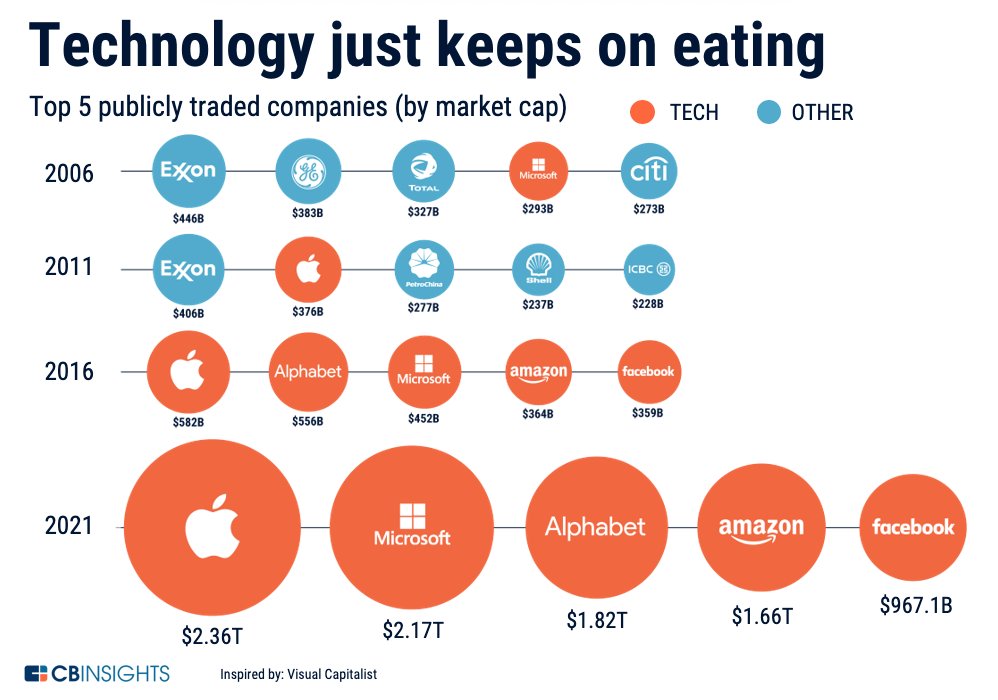

4/ We all know software is eating the world

It's been happening for a while

But here's the data

In 2006, 1 of the 5 most valuable cos was a tech co

In 2011, it was still 1

In 2016, tech ran the table

It's been happening for a while

But here's the data

In 2006, 1 of the 5 most valuable cos was a tech co

In 2011, it was still 1

In 2016, tech ran the table

5/ What's even wilder is the picture in 2021

Tech just keeps winning

Oil & gas, financial services, etc are nowhere to be found

Tech just keeps winning

Oil & gas, financial services, etc are nowhere to be found

6/ Financial services firms saw this and started talking about becoming more technology forward

This is from my @CBinsights Future of Fintech keynote in 2018

This is from my @CBinsights Future of Fintech keynote in 2018

7/ In 2018, they started to see their competitive set be redrawn

I used to work at American Express and when I was there, we talked about our competitors being Citi, Visa, Mastercard, Cap One, etc

Now it's Paypal, Stripe, Affirm, etc

I used to work at American Express and when I was there, we talked about our competitors being Citi, Visa, Mastercard, Cap One, etc

Now it's Paypal, Stripe, Affirm, etc

8/ But in 2018, when I talked about Gradually Then Suddenly coming to financial services, it felt like we were still in the "gradually" part

What does that look like?

Here's an example. See if you can name the company (it's not from financial services)

Stock chart below

What does that look like?

Here's an example. See if you can name the company (it's not from financial services)

Stock chart below

11/ That company was Blackberry / Research in Motion

Look at these headlines right before the sudden fall

Look at these headlines right before the sudden fall

12/ But you'll argue that financial services firms are different

It's highly regulated, they have moats, they have massive balance sheets, they have brands, etc

True but that's not enough

Suddenly is here for financial services

Why? 2 reasons

It's highly regulated, they have moats, they have massive balance sheets, they have brands, etc

True but that's not enough

Suddenly is here for financial services

Why? 2 reasons

13/ Those 2 reasons:

1. An absolute flood of fintech innovation capital

2. The great financial services unbundling

Let's unpack those a bit

1. An absolute flood of fintech innovation capital

2. The great financial services unbundling

Let's unpack those a bit

14/ Before I get into why this capital is so important, it's worth paring this with the fact that it's become cheaper to create a startup

AWS, Azure, No-code, Low-code, etc have made the building part cheaper

That means more insurgents can start up

AWS, Azure, No-code, Low-code, etc have made the building part cheaper

That means more insurgents can start up

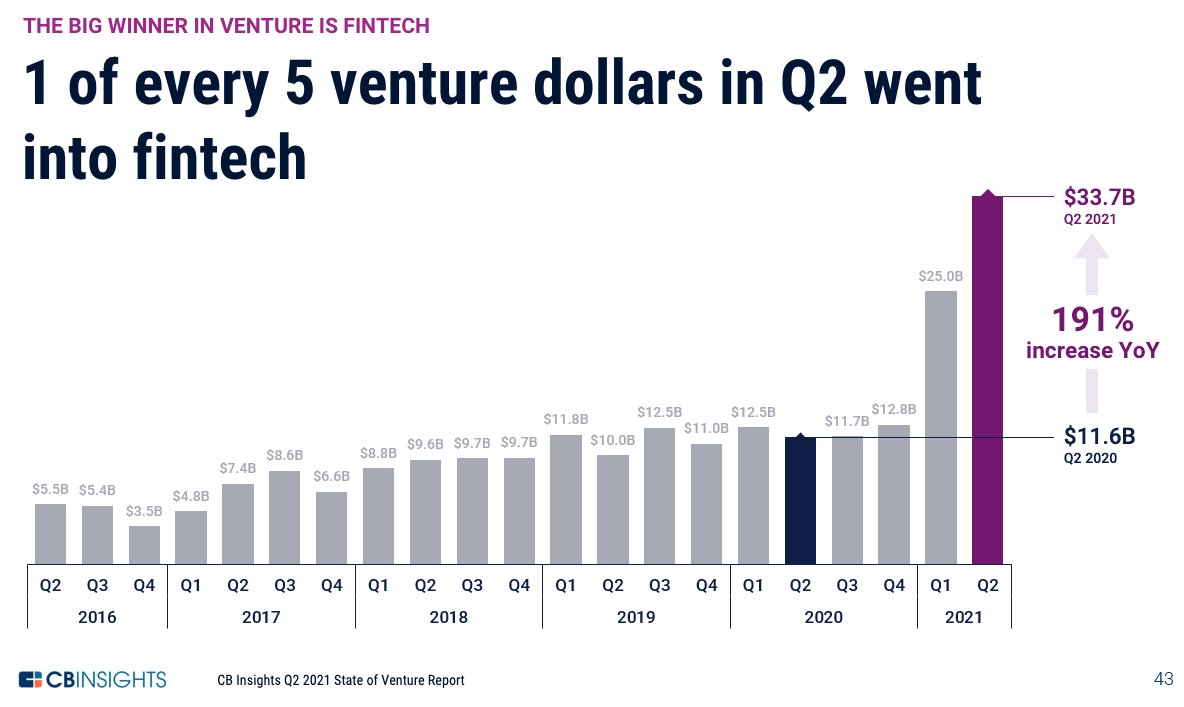

15/ Fintech startups have APIs, embedded finance, BaaS, open banking protocols, etc as well

But they have an absolute deluge of capital coming their way

In Q2'21, $1 of every $5 venture dollars went to fintech ($33.7B)

But they have an absolute deluge of capital coming their way

In Q2'21, $1 of every $5 venture dollars went to fintech ($33.7B)

16/ This capital is also coming from the smartest investors out there a la @sequoia @Accel @a16z @IndexVentures @RibbitCapital

19/ So we have smart founders paired with smart investors tackling a giant market

Add in recent successful fintech exits which ultimately serve to spur more financing

The venture "circle of life"

Add in recent successful fintech exits which ultimately serve to spur more financing

The venture "circle of life"

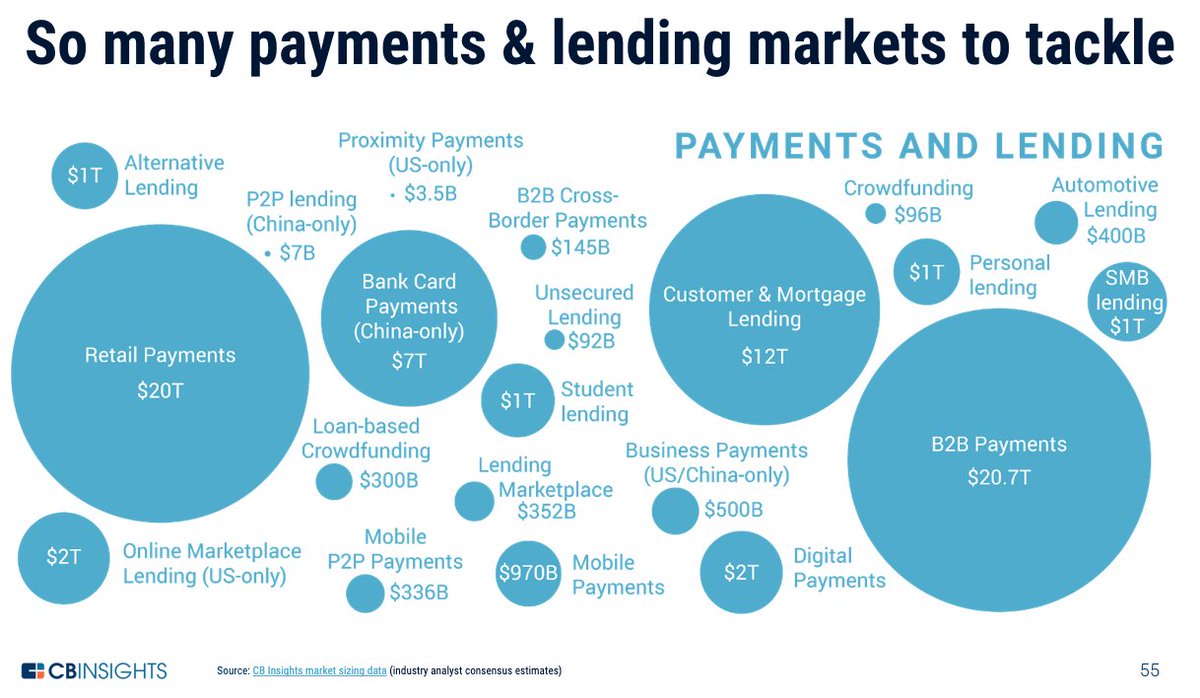

20/ So a ton of smart innovation capital is flowing into fintech

The 2nd force is unbundling of financial services

When legacy FS companies think about markets, they only get excited by giant markets

We can call this the "curse of the TAM"

The 2nd force is unbundling of financial services

When legacy FS companies think about markets, they only get excited by giant markets

We can call this the "curse of the TAM"

21/ Bastardizing Jeff Bezos quote on margins, we find legacy banks, payment firms, insurers, etc obsess on TAM

And thus leave openings for startups who are unafraid to 'niche down' to build a beachhead in a market

And thus leave openings for startups who are unafraid to 'niche down' to build a beachhead in a market

22/ Here are examples of what most legacy FS folks might argue are small TAM markets that startups are willing to tackle and building valuable franchises in

"Teen-focused challenger banks"

"Teen-focused challenger banks"

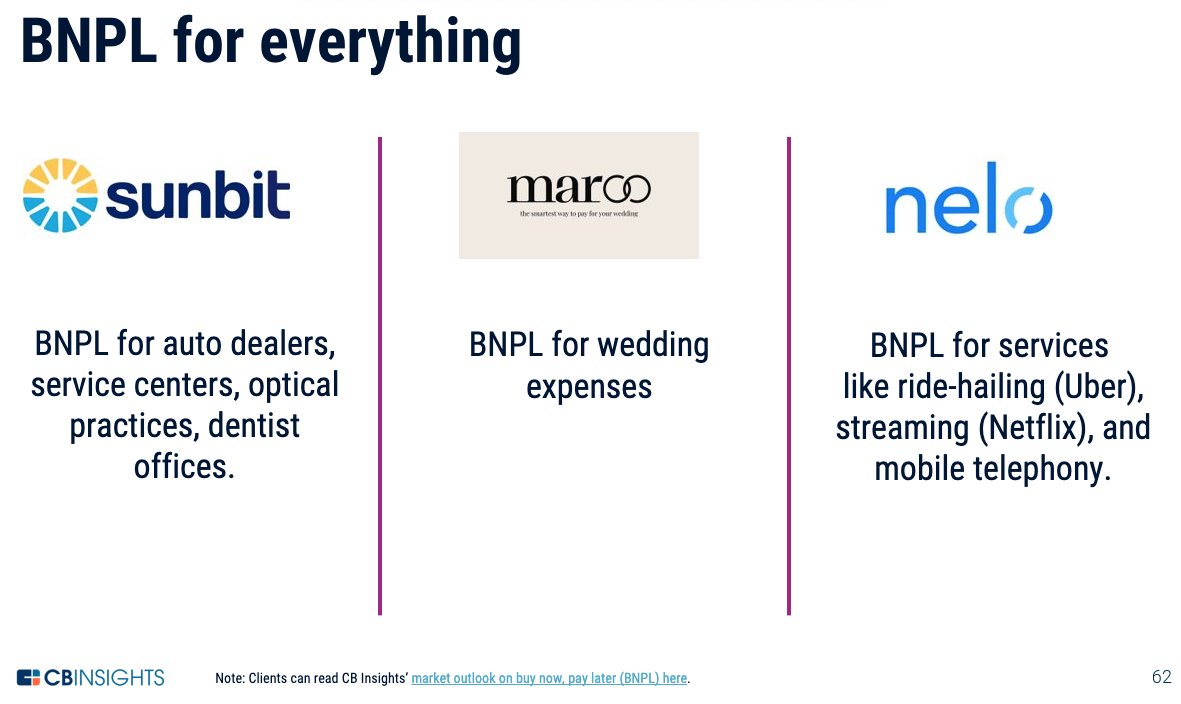

23/ BNPL comes to every service, product imaginable

You think a large legacy financial services firm is going to tackle BNPL for weddings or auto dealers?

Hell no

Ain't no TAM in that

You think a large legacy financial services firm is going to tackle BNPL for weddings or auto dealers?

Hell no

Ain't no TAM in that

24/ How about giving access to an asset class like supply chain financing or sports memorabilia or startups?

No legacy FS firm is going to put resources ($$, their best people, etc) on this

And these are where startups build credibility and grow from

No legacy FS firm is going to put resources ($$, their best people, etc) on this

And these are where startups build credibility and grow from

25/ Imagine being at a big bank or payments co and pitching

"We should build an app to help divorced parents manage shared expenses"

or

"Let's focus on unbanked workers, mostly 1st and 2nd immigrants"

These are not the types of ideas you bring if you want to move up

"We should build an app to help divorced parents manage shared expenses"

or

"Let's focus on unbanked workers, mostly 1st and 2nd immigrants"

These are not the types of ideas you bring if you want to move up

26/ I'm not saying all these cos are great ideas / will succeed

But a handful of them will make it and start doing other things

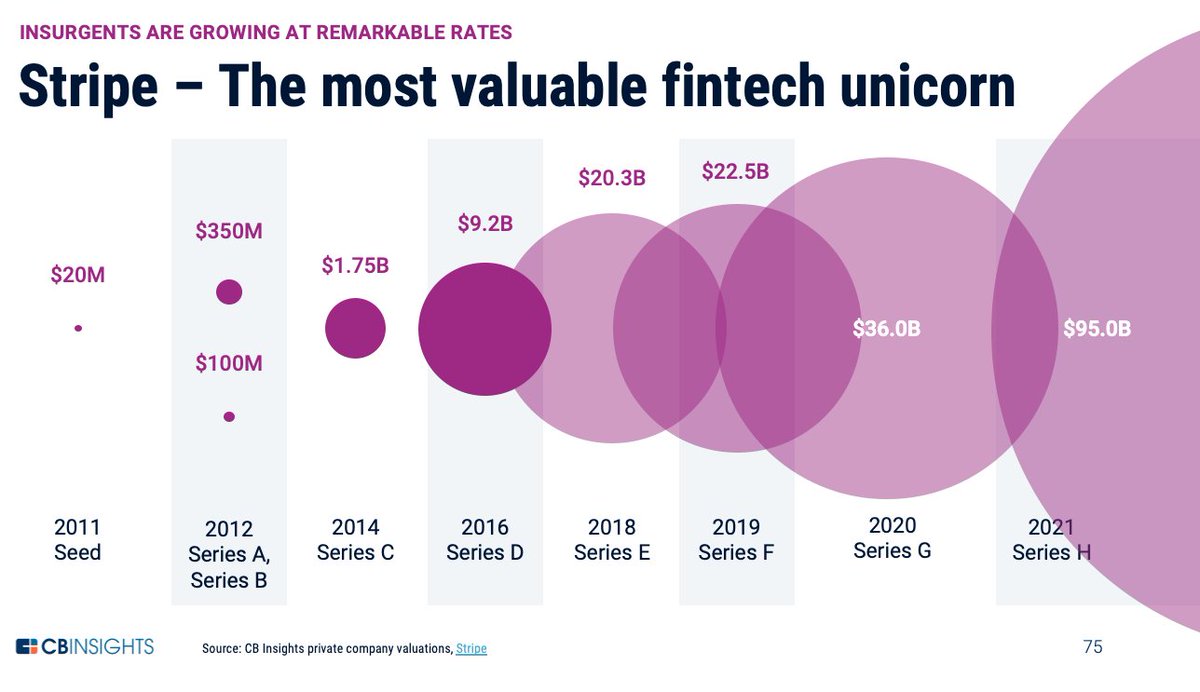

Look @stripe's relationships which suggest their moves into BNPL, banking, b2b payments, etc

Product "land & expand"

But a handful of them will make it and start doing other things

Look @stripe's relationships which suggest their moves into BNPL, banking, b2b payments, etc

Product "land & expand"

27/ So lots of capital + great unbundling means these startups can and will grow quickly

Now let's go back and look at the most valuable financial services firms from 2018

Now let's go back and look at the most valuable financial services firms from 2018

28/ Since then, 9 of 14 have actually seen market cap declines

This is against the backdrop of a crazy bull market

This is against the backdrop of a crazy bull market

29/ Now, let's look at the valuation climbs of some of the insurgent fintech companies

Quotes are by media outlets / pundits over time :)

Quotes are by media outlets / pundits over time :)

33/ Can't do animations on Twitter so bear w/ me on this one

x-axis is age of co

y-axis is valuation

The OGs in FS are 60-200+ years old (the dots on the right)

On the left is the new guard

They're not as big (yet) but they've created massive value in a fraction of time

x-axis is age of co

y-axis is valuation

The OGs in FS are 60-200+ years old (the dots on the right)

On the left is the new guard

They're not as big (yet) but they've created massive value in a fraction of time

34/ I was reminded of this great graphic on technology adoption over time

The telephone took 105 years to reach 90% of US households

While the internet & cellphone did it in 15 years

Something similar is occurring in financial services

The telephone took 105 years to reach 90% of US households

While the internet & cellphone did it in 15 years

Something similar is occurring in financial services

35/ The level of creative destruction coming to financial services is massive and it is now coming not gradually, but suddenly

Last thought

Or actually a question

All the fintech unicorns at present are worth ~1 JP Morgan Chase

Who would you buy?

Last thought

Or actually a question

All the fintech unicorns at present are worth ~1 JP Morgan Chase

Who would you buy?

36/ Want the full "Gradually, then Suddenly: The Sequel" presentation?

Lots of good data and dataviz on financial services and why incumbent FS firms better get their isht together

Grab it here -- cbinsights.com/research/repor…

It's free

Lots of good data and dataviz on financial services and why incumbent FS firms better get their isht together

Grab it here -- cbinsights.com/research/repor…

It's free

37/ Fresh out of the oven

Q3'21 Fintech data is now out, and it was a killer quarter

Funding up 96% vs 2020 and we're only 3 quarters in

Fintech is still en fuego 🔥

cbinsights.com/research/repor…

Q3'21 Fintech data is now out, and it was a killer quarter

Funding up 96% vs 2020 and we're only 3 quarters in

Fintech is still en fuego 🔥

cbinsights.com/research/repor…

• • •

Missing some Tweet in this thread? You can try to

force a refresh