Yesterday, the Bank of America released a 141 page research report on the digital asset ecosystem titled: “Digital Assets Primer: Only the first inning”.

Here’s a summary of its findings..

Here’s a summary of its findings..

Corporations aren’t risking being left behind

“Companies aren't taking the risk of ignoring digital assets and applications and are actively exploring this new technology and its use cases. Leading tech companies, banks and others are adjusting their approach”

“Companies aren't taking the risk of ignoring digital assets and applications and are actively exploring this new technology and its use cases. Leading tech companies, banks and others are adjusting their approach”

The ecosystem is diverse & thriving

“Hundreds of companies are now within the digital asset ecosystem providing infra support, marketplaces & apps”

“Digital asset-related M&A ytd jumped to $4.2bn, up from $940m in 2020 & $2.5bn in 2019, indicating a dynamic & maturing industry”

“Hundreds of companies are now within the digital asset ecosystem providing infra support, marketplaces & apps”

“Digital asset-related M&A ytd jumped to $4.2bn, up from $940m in 2020 & $2.5bn in 2019, indicating a dynamic & maturing industry”

Bitcoin is leading the way

“The digital asset market has reached $2.1tn in value with $100bn+ in daily transaction and trading volume. Bitcoin has become one of the largest assets by market value in the world and its value continues to appreciate ytd”

“The digital asset market has reached $2.1tn in value with $100bn+ in daily transaction and trading volume. Bitcoin has become one of the largest assets by market value in the world and its value continues to appreciate ytd”

Corp interest is growing

The BofA Predictive Analytics team used Natural Language Processing to analyze 161,322 earnings call transcripts from 1Q’09 through August 2, 2021, which found corporate interests in digital assets is at an all time high.

The BofA Predictive Analytics team used Natural Language Processing to analyze 161,322 earnings call transcripts from 1Q’09 through August 2, 2021, which found corporate interests in digital assets is at an all time high.

Crypto is going mainstream

“It’s estimated that 14% (21.2mn) of US adults own digital assets and an additional 13% (19.3mn) plan to buy digital assets in 2021. Notably, the average age of these potential buyers is 44 and 53% of the potential buyers are female”

“It’s estimated that 14% (21.2mn) of US adults own digital assets and an additional 13% (19.3mn) plan to buy digital assets in 2021. Notably, the average age of these potential buyers is 44 and 53% of the potential buyers are female”

Individual interest in Alt Coins is rising

“Twitter mentions of $BTC fell to 44% of all mentions ytd through August across the 7 coins listed from 63% in 2020”

“Altcoins mentions increasing across both Twitter & Reddit with Reddit mentions of $DOGE jumping 3032% in Jan’21”

“Twitter mentions of $BTC fell to 44% of all mentions ytd through August across the 7 coins listed from 63% in 2020”

“Altcoins mentions increasing across both Twitter & Reddit with Reddit mentions of $DOGE jumping 3032% in Jan’21”

Interest in CBDC’s is growing

“Central banks from countries that represent over 90% of global GDP are reported to be exploring CBDC’s”

“Central banks from countries that represent over 90% of global GDP are reported to be exploring CBDC’s”

NFT’s are on the move

“The rise of NFTs caught even old-time digital asset players by surprise (even OGs). NFT sales increased to $3bn+ in August 2021, up from $250mn in 2020 driven by corporate, celebrity and individual demand”

“The rise of NFTs caught even old-time digital asset players by surprise (even OGs). NFT sales increased to $3bn+ in August 2021, up from $250mn in 2020 driven by corporate, celebrity and individual demand”

DeFi is booming

“DeFi applications are a fast-growth segment of the digital asset ecosystem with Total Value Locked used for decentralized finance applications increasing to $90bn in August 2021 from $17bn in August 2020”

“DeFi applications are a fast-growth segment of the digital asset ecosystem with Total Value Locked used for decentralized finance applications increasing to $90bn in August 2021 from $17bn in August 2020”

Volatility is declining with increased adoption/ownership

“BTC volatility is still high at nearly 70% annualized volatility; however, it is showing signs of maturing from when it breached 300% in 2013”

“BTC volatility is still high at nearly 70% annualized volatility; however, it is showing signs of maturing from when it breached 300% in 2013”

Illicit use of digital assets is declining

“Illicit activity using digital assets likely represented less than 1% of digital asset transactions last year, down from 2.1% in 2019”

“For comparison, the US estimates that 2-5% of global GDP is connected to illicit activity.”

“Illicit activity using digital assets likely represented less than 1% of digital asset transactions last year, down from 2.1% in 2019”

“For comparison, the US estimates that 2-5% of global GDP is connected to illicit activity.”

Institutions are here

“It’s still early innings for institutional digital asset adoption, but data provided by Coinbase suggests that institutional adoption and trading volumes are accelerating in absolute terms and relative to retail adoption”

“It’s still early innings for institutional digital asset adoption, but data provided by Coinbase suggests that institutional adoption and trading volumes are accelerating in absolute terms and relative to retail adoption”

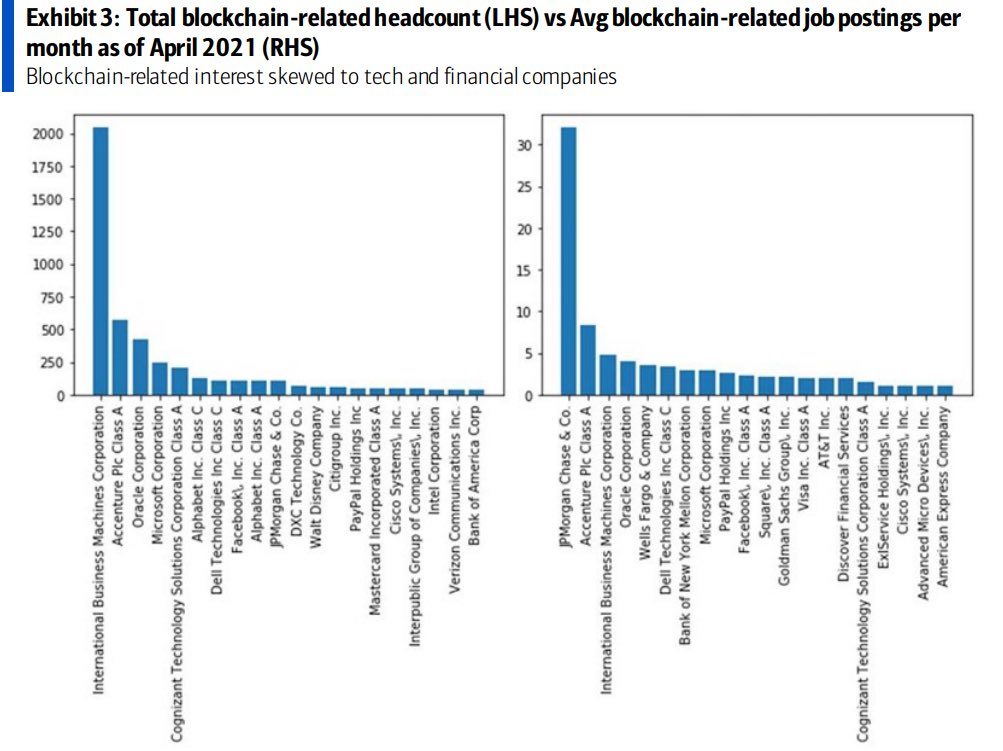

Private sector is adopting blockchain tech

“If banks do not adopt CBDCs, they risk falling behind the demands of evolving marketplaces. A recent survey shows 86% of firms in the US & 70% outside the US already have, or are in the process of building, blockchain-oriented teams”

“If banks do not adopt CBDCs, they risk falling behind the demands of evolving marketplaces. A recent survey shows 86% of firms in the US & 70% outside the US already have, or are in the process of building, blockchain-oriented teams”

BTC adoption & hodling is increasing

“The rate of newly created BTC addresses has decelerated since the price appreciation from Nov’20 through Apr’21, but the rate of active bitcoin addresses has decelerated faster, indicating that investors are holding BTC for extended periods”

“The rate of newly created BTC addresses has decelerated since the price appreciation from Nov’20 through Apr’21, but the rate of active bitcoin addresses has decelerated faster, indicating that investors are holding BTC for extended periods”

$BTC large transactions are growing

“Looking at on-chain data, we find that large bitcoin tx’s of $100k or more have increased by 106% y/y through Aug 31st”

“We believe the acceleration in large transactions indicates the entrance of institutional investors into the market”

“Looking at on-chain data, we find that large bitcoin tx’s of $100k or more have increased by 106% y/y through Aug 31st”

“We believe the acceleration in large transactions indicates the entrance of institutional investors into the market”

Ethereum is leading the way in development

“We view the number of repositories, or projects, on a blockchain as an indication of developer interest and future demand for the blockchain’s native digital asset”

“We view the number of repositories, or projects, on a blockchain as an indication of developer interest and future demand for the blockchain’s native digital asset”

Bullish on long term prospects

“Despite regulatory headwinds, we are bullish on the prospects for digital assets as it enters the mainstream. We anticipate significant growth as use cases move beyond BTC’s store of value thesis to an industry characterized by product innovation”

“Despite regulatory headwinds, we are bullish on the prospects for digital assets as it enters the mainstream. We anticipate significant growth as use cases move beyond BTC’s store of value thesis to an industry characterized by product innovation”

• • •

Missing some Tweet in this thread? You can try to

force a refresh