Then there's World of Wojak which is just Wojaks and also promising to maybe throw a pizza party or something, IDK, give me money

Can't forget Dimez, which is selling virtual bags of crack rocks, which has a needless to say robust roadmap for the future

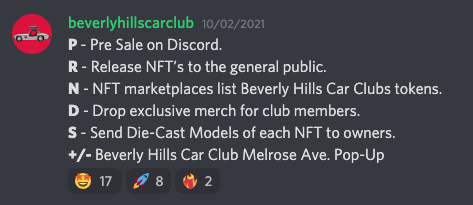

Literally as I posted that I was invited to join the Beverly Hills Car Club whomsts' roadmap uses the acrostic PRNDS (very easy to retain, good marketing)

And I have now received a second invite to the Beverly Hills car Club from a different bot.

Then we've got GenMAP which I think speaks for itself

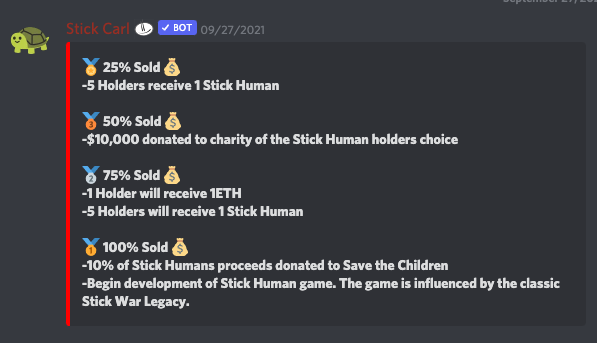

Next up Stick Human which will start development of a knockoff of an iOS game based on a Flash game if they sell all 11,111 sticks for 0.02 Eth (222.22 Eth total, approximately $800k USD assuming you can cash it out in the first place)

Long Ween Club was promising to make vinyl toys, but they removed that from the roadmap on the Discord

Pro Camel Riders thinks this gif is something that should make you excited and not the biggest own-goal in recent history.

Also they might make a comic book if people give them $2.4m USD

Also they might make a comic book if people give them $2.4m USD

Senzu Seeds is selling seeds you can plant in a video game that doesn't exist, but might if they can get a smidge over $1m USD

Bumping Uglies, not merely another unregulated hedge fund, but also maybe a "matchmaking, breeding, and play-to-earn studding game" if people buy $???? worth of a completely different coin on a completely different marketplace from everything else in the ecosystem.

Apenauts, another hedge fund, but on the SOL coin

And not remotely last, but certainly least, NFTits, the

hedge fund/comic book/future movie property whose creators are most likely to show up in my mentions thanking me for the exposure because "any press is good press"

hedge fund/comic book/future movie property whose creators are most likely to show up in my mentions thanking me for the exposure because "any press is good press"

Honourable mention for tonight goes to Crypto Pump Whales, a literal pump-and-dump scheme that doesn't even pretend it's not and openly admits they can't do it on the big exchanges because they'll get banned for TOS. The top sticky is the admin admitting to getting phished.

Invited to five more NFTs and two more pump-and-dump groups overnight.

Cash Cows, cows you milk for cash.

Long Neck Cartel, racist giraffes.

Pug Force, pugs that are cops.

Gorilla Club, gorillas.

And HoodPunks which, you know what, I’ll just leave this here:

Cash Cows, cows you milk for cash.

Long Neck Cartel, racist giraffes.

Pug Force, pugs that are cops.

Gorilla Club, gorillas.

And HoodPunks which, you know what, I’ll just leave this here:

16 more invites just this morning. I'm going to need to start a spreadsheet to actually keep track of these

A thing that’s somewhat surprising about this degree of laziness. Only two of these have something that can really be described as a tangible attached product. Only one promising a game even bothered to have mock-up screenshots. This is surprising to me because...

Logic would dictate that the modicum of effort it requires to mock up a preview of your game/comic/animation would help you stand out in a high competition environment, doubly so when basically no one is bothering.

We know it’s a low hurdle as even scam kickstarters manage it.

We know it’s a low hurdle as even scam kickstarters manage it.

The implied answer is buyers don’t actually care. Evidence of work on an end product doesn’t improve your odds of success, it’s an irrelevant factor in the calculus of the market.

What *does* seem to be effective (or at least perceived as effective) as it’s regularly employed, is a promise of charitable donations, specific or vague.

It speaks to market anxieties about appearing wealth-obsessed, parasitic, and destructive.

It speaks to market anxieties about appearing wealth-obsessed, parasitic, and destructive.

I haven't really focused on it yet, but Stoner Cats, one of the few that seemingly does have an actual product, (a cartoon voiced by Mila Kunis, Chris Rock, Jane Fonda, Ashton Kutcher, and others) only scrapes across that line very barely with a single 5 minute episode.

The singular review I've found of the episode sums it up as largely unremarkable, like something you'd find on 2013 Newgrounds from a decent animator who just isn't very funny.

It is so unmemorable that no one has bothered to bootleg it.

It costs at least $1000 to access.

It is so unmemorable that no one has bothered to bootleg it.

It costs at least $1000 to access.

But don't worry, it's all decentralized.

Minus, I guess, the servers that the video is hosted on. And the server that does the authentication. And the web portal that allows you to watch the video. And the Discord chatroom.

Minus, I guess, the servers that the video is hosted on. And the server that does the authentication. And the web portal that allows you to watch the video. And the Discord chatroom.

But the database that holds the note saying you have permission to watch the video, that's decentralized! no one can take that away!

Unless the miners who keep the database updated get bored or move on and stop updating it. Or a new version comes out and breaks it.

Unless the miners who keep the database updated get bored or move on and stop updating it. Or a new version comes out and breaks it.

I just remembered I haven't highlighted Betting Kongs, which is currently in the running for "most likely to actually go to jail" b/c they love gambling so much they want their own casino. They have no experience running a casino. It's an Always Sunny plot, to the detail.

Like, gosh, it really is curious that only a handful of large companies, globally, are able to navigate the labyrinthian rules involved in gambling across international borders. I'm sure that's purely because they just haven't put enough gumption into it.

I showed this pitch to a friend who did work on the backend of online casinos, specifically interfacing with compliance, and she just went silent for a bit before "they would literally face fewer consequences if they just stole the money instead."

NFT Worlds is selling "a string of numbers compatible with Minecraft's world generator" and not Minecraft seeds

This thread from Cory Doctorow is psychologically relevant in the way the devs frame their work as just-so-happening to produce results compatible with and identical to Minecraft's world gen rules.

https://twitter.com/doctorow/status/1445902599148883974?s=20

Anyway, fashionista chickens.

Okay, you know how being a F2P player in games like Hearthstone often involves a lot of frustration from being frequently matched against players with dramatically better decks?

Now imagine the buy-in just to get to *that* level was north of $450.

Now imagine the buy-in just to get to *that* level was north of $450.

Something that tickles me is the way that the projects will just describe a vision of a truly awful game.

"Imagine if you could rent your sword to other players!"

"Imagine if holding a Gen 1 mon made you five times as powerful!"

"Imagine if you could sell your rare drops for $!"

"Imagine if you could rent your sword to other players!"

"Imagine if holding a Gen 1 mon made you five times as powerful!"

"Imagine if you could sell your rare drops for $!"

An extremely relevant case study is Diablo 3's Real Money Auction House.

If powerful items can be freely traded amongst the entire player base then drop odds need to be balanced around the entire player base. Which means your average play session is deeply unsatisfying.

If powerful items can be freely traded amongst the entire player base then drop odds need to be balanced around the entire player base. Which means your average play session is deeply unsatisfying.

Basic 1/10 stuff becomes 1/1000.

Truly rare items that in a compartmentalized environment would be 1/10,000 odds need to be 1/1,000,000,000.

You know someone who got something good once, but that's about it.

Truly rare items that in a compartmentalized environment would be 1/10,000 odds need to be 1/1,000,000,000.

You know someone who got something good once, but that's about it.

"Imagine if you could rent another player your good sword"

Okay, now imagine a game where you need to rent your sword.

Okay, now imagine a game where you need to rent your sword.

Implicit in all the pitches, baked into the FOMO, is "get in now, get in early, so that if this takes off, YOU can be the boot stepping on the neck!"

Watched this guy spend $37,000 on a plot of land in Axie. Seemed suspicious for an account with 0 Twitch subs and 800 Twitter followers.

Turns out their whole deal is running a sweatshop inside the game.

Turns out their whole deal is running a sweatshop inside the game.

Axie is probably the most respectable enterprise in this whole endeavour, in the sense that they have a working game that exists, and I pretty much instantly stumbled into a sub-scam just by checking Twitch to see what the $450 game was like.

Not that, you know, Axie isn't also built on fraud.

https://twitter.com/excerpta/status/1447026425295425540?s=20

There is, deep in the core, a foundational disconnect in values. By volume, compared to "line goes up" dickheads, the amount of stuff in the space that's driven by artists, tinkerers, and people who want to make neat things regardless of how much it can be sold for rounds to zero

A lot of the hay made over all this will use phrases like "internet native", meaning that it rises out of the vernacular culture of the internet at large, but it really doesn't.

It is overwhelmingly driven by finance bros and trust fund kids who know little, if anything, about the communities that they claim they're "improving," leading things like spending $3000 on a plan to house flip a virtual plot of land in a video game they don't understand.

Most of the NFTs being pushed by brands and artists aren't internal products. Teams approach them, offer to do all the dev and just say "all you need to do is sign off on the art."

And if they burn your audience they slink off into the night.

And if they burn your audience they slink off into the night.

https://twitter.com/FoldableHuman/status/1447665542362329090?s=20

And it has to be driven by those people, because every meaningful state change requires paying Gas, a processing fee to the people who run the computes that keep the ledger updated, and Gas is auctioned on a highest-bidder-first system. It's pay-to-play at all levels.

Since there's no cap on Gas the average price of just doing a transaction fluctuates between $15 and $300, and the snap price can be thousands.

I have spent days pondering "well what if you took the interesting technology and discarded the obsession with exclusivity?" and Gas is the reason why I ultimately discard it. Every neat idea cooked up in NFTs, which are scant few, can be replicated faster, cheaper, and fairer.

The Immutable Blockchain. All hail code.

Can't wait to dump all my critical documents and records into this ecosystem.

Can't wait to dump all my critical documents and records into this ecosystem.

To explain what happened here, NFT Worlds released one part of their application allowing you to "explore" your purchased Minecraft world, and it provided a backdoor for someone to replace their worlds with "rarer" worlds and trick people into buying them.

lmao "the problem is it wasn't EVEN MORE on-chain"

Jesus Christ, you loser, it's software not fucking magic.

Jesus Christ, you loser, it's software not fucking magic.

https://twitter.com/ThatsTheGwei/status/1448411983410188289?s=20

Crypto nerds have been itching for the opportunity to put things like real estate deeds and medical records "onto blockchain" for a decade now, insisting that the best place to store these is an open air database.

The entire exercise is fundamentally sociopathic.

The entire exercise is fundamentally sociopathic.

Apologists wouldn’t shut up about reading The Infinite Machine, so I grabbed a copy off a decentralized P2P network like a good Web3 netizen, and while it’s written like hagiography it functions as a list of crypto’s many philosophical failures.

“We need to solve transaction fees!” - crypto has comical transaction fees

“We need to support the unbanked of the world!” - the UX is miserable and hostile to non-programmers

“We’ll replace Argentina’s peso!” - Argentinians use BTC only as a portal to convert pesos to USD.

“We need to support the unbanked of the world!” - the UX is miserable and hostile to non-programmers

“We’ll replace Argentina’s peso!” - Argentinians use BTC only as a portal to convert pesos to USD.

I'm not having a good day with this, the endless lofty claims that are always "just around the corner" while the demonstrable product is just all the destructive exploitation and illusory speculation of the current system magnified and accelerated, I'm pissed off.

Ah, yes, the every day problem of moving large sums of money across borders pseudonymously. Truly fixing the problems of the financial system and not merely working around the regulations already well-off people find obnoxious.

Every pitch of NFT gaming in the wake of Steam’s ban on NFT/blockchain games is like

1 - tokenize everything in your game

2 - ?????

3 - Metaverse!

1 - tokenize everything in your game

2 - ?????

3 - Metaverse!

It all treats the actual game dev as a trivial element that can just be willed into existence. What happens when, one generation in, game devs decide they can’t be bothered to recreate art assets for your Drunk Ape Butthole Club exclusive, owned by literally one person?

Lofty claim that they become building blocks, but they really don’t. They’re not even game assets, they’re the concept of a game asset. The NFT of a chair in The Sims does not magically confer a properly modelled chair with a working hit box for Skyrim.

What happens when devs are like “we’re not letting you transfer your WoW gold here because it would annihilate our game’s economy”?

Sorry, you can’t port your Dickthrusher Sword, we expect you to progress through our progression that we designed with intent.

Sorry, you can’t port your Dickthrusher Sword, we expect you to progress through our progression that we designed with intent.

Once you take “I want my money to make me overpowered in every game, simultaneously” off the table, what are you left with? A persistent player profile? A shared cash shop currency?

The main thing that remains is "I want to be able to sell in-game stuff for $." And, as we see with Axie Infinity, once you open that door you'll have people setting up industrial monster farming cartels before you even have a meaningful casual player base.

The Llama Pass is a great demonstration of how completely disconnected you can be from reality and still be taken seriously by the crypto community. Like promising to give away "3-5 Teslas" as a lower stretch goal than publishing the rarity distribution *that they built.*

Crypto Astronuts launched their minting on Saturday, but only sold 1262 of their planned 10,000 in the first 24h, working out to ~$350,000 but far short of the $2.8m target.

Failure to sell out in the first day is project death because the system is self-competing.

Failure to sell out in the first day is project death because the system is self-competing.

Everyone is looking to flip, it's a question of how fast. If the average resale falls below the mint cost, the project dies. The buyers, unable to re-sell their Astronuts for even 1/4 what they paid for them, have spent a days debating ways to manipulate the price back up.

The project leaders have done their part to manipulate the price, "burning" the un-minted Astronuts by altering the mint starting time to 16 October 2099, but the floor price still sits at ~$90, well below the $300 mint cost.

The Discord chat is deeply depressing, hours and hours of people alternating between tepid "this is really about community, yeah?" pep talks and complaining about the floor price. Because none of them are there for the community, they're only there for the price.

Everyone pitching this as a great, dynamic alternative to something like Kickstarter or Patreon is full of it. You could not ask for a more toxic, disloyal audience to try and fund a project through.

Book Twitter has been alight all day with Realms of Ruin, an NFT-based fanfiction contest spearheaded by several bestselling YA authors that managed to go through the entire cycle from announcement to cancellation in about 5 hours.

There are a lot of reasons for pushback, the project was aimed at minors, the copyright issues are myriad, the idea wasn't very good, but I think the root is accidentally elucidated in Julie Zhuo's description (from a now-deleted Medium post)

https://twitter.com/BadWritingTakes/status/1450956334459936772?s=20

The philosophy here, a story that is community-created and owned, is philosophically incompatible with crypto, which operates, intentionally and by design, on strict notions of property and possession. Collective ownership, formal or colloquial, is antithetical to crypto.

For the record if any of the authors involved want to talk, I have so many questions. How was this pitched to you, by who? How were you told it would function? What did you believe you were selling? What did you imagine readers would think?

This is a good rundown of the Realms of Ruin situation, though there's a couple paragraphs I want to highlight because I think they miss the point in a way that speaks to the broader state of things.

techcrunch.com/2021/10/26/ins…

techcrunch.com/2021/10/26/ins…

This, for example, is largely fantasy and also just wrong. There's no intrinsic chain of influence that's tracked, only a chain of ownership. Even if your story influences mine I can just... not say so. The connection is entirely analog.

Also the royalties are not intrinsic. They're a common feature of popular "smart contracts" but they still need to be coded into the NFT. It's exactly the same as the sentence that follows: you don't get royalties unless you have a contract that stipulates royalties.

Lastly this statement on values is extremely misleading. The money still has to come from somewhere, and the dominant Web3 model, encased in crypto, is to replace ad-based monetization with financialization.

Basically if you're already not fond of ad-based monetization you're really not going to like monetization based on betting on fractionalized derivatives of the artwork packaged into abstract financial instruments.

I'm doing spot checks on the spreadsheet and of five that I've followed up on 1 never launched and 3 took whatever money they got and ran.

The anthropologically fascinating thing is that the absolutely toxic positivity, just completely unhinged "we've got this, team! Hodl! Hodl! Sweep the floor! To the moon!" continues basically three days past the edge of it being obvious the devs are never logging on again.

I must say, though, I am shocked, SHOCKED, that the "start planning the game three months after getting the money" project wasn't above board.

Calvin Becerra lost three expensive tokens to a hilariously analog scam and it's rapidly turning into a landmark case study in both the flaws of the crypto ecosystem and the vaporous nature of its claims.

He has successfully petitioned for the largest marketplaces to blacklist the tokens, ceding de facto censorial power to the marketplaces. The next step would be for BAYC to repeal any member benefits associated with those tokens, admitting that the privileges exist at their whim.

On a whole other level, though, is that he minted a token of a photo of a note and sent the token to the wallet of the thieves.

This is notable for a couple reasons.

This is notable for a couple reasons.

First is that the recipients immediately posted the token to OpenSea for sale, which is an absolute chad move.

Second it reveals a massive security and privacy hole in the entire system, which is that people who are so inclined can attempt to dump tokens into your wallet (pending acceptance) which can contain malicious code, abusive messages, unsolicited dick pics, etc.

It's basically Sam Jackson's character in Jurassic Park.

We have all the problems of a major bank and a major social media network.

We have all the problems of a major bank and a major social media network.

Fellas, it seems like there might be something of a flaw in our strict "code is law" and "possession dictates ownership" economy

You know what, I might attend this guy's next Motivation Tour just to hear the anecdote about the time he got tricked by some scammers, knuckled down, bit the bullet, and just paid the ransom allowing the anonymous scammers to make a healthy profit on their $0 investment.

Bear with me a hot second, but there's three relevant OpenSea accounts that Calvin has willingly attached himself to in the course of this. C310E7, where the apes were "stolen" from, FCFB7C where the "plx giv apes bak" note was sent from, and alphacandy where this token sits.

The transaction history on this ape, 4696, goes from an account KJ1D to Calvin (C3) two days ago for 8 Eth, then from Calvin back to KJ1D for 0.03 Eth, back to Calvin (C3) for another 0.03 Eth, from Calvin (C3) to Calvin (FC) for 33 Eth, then from Calvin (FC) to to Calvin (alpha)

And, oh, wouldn't you look at that, it definitely makes it look like there was an actual 33 Eth (~$158k) sale and not just Calvin moving 33 Eth from one wallet to another! Line go up!

Apparently Twitter is hiding this tweet from people, probably because all the random numbers, abbreviations, and crap make it look like spam.

Also this is in regards to the fourth headband ape, not any of the three "stolen" apes (which look a lot less stolen in this light).

Also this is in regards to the fourth headband ape, not any of the three "stolen" apes (which look a lot less stolen in this light).

I don't think I've mentioned DeFi and inherently deflationary economies yet.

This is getting away from NFTs specifically, but they're entwined.

For a second here let's pretend crypto succeeds and replaces all currency.

This is getting away from NFTs specifically, but they're entwined.

For a second here let's pretend crypto succeeds and replaces all currency.

Every coin is designed to be inherently finite. The original pitch with Bitcoin is that it would mimic gold. There's a bunch of gold that's basically laying out in the open in rivers, then shallow veins, deep veins, and sub-oceanic veins. Over time it gets harder to get more gold

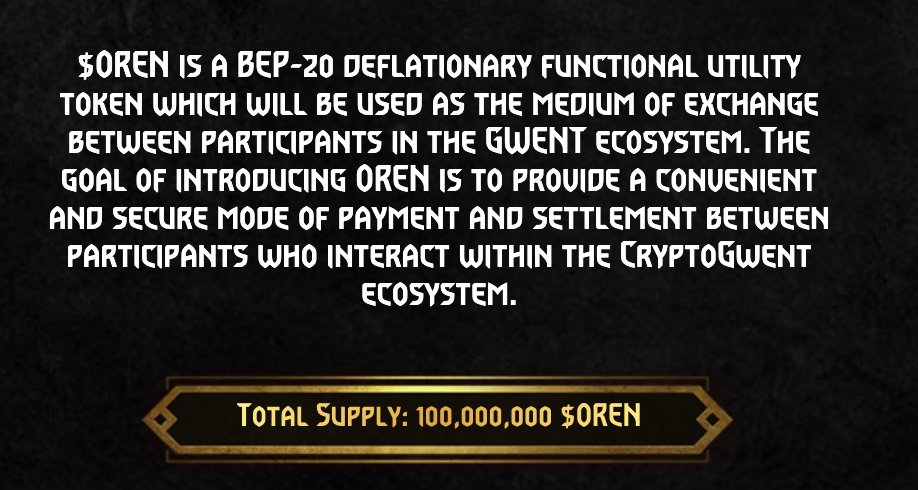

So every coin is designed to get harder and harder to get over time. But the release rate is *crafted*, and there is a hard cap that it asymptotically approaches. The (hilariously IP infringing) CryptoGwent has a fixed supply that trickles out over 3 years.

(Which, you will notice, means they basically don't have a plan after that, it's a three year experation date on their (hilariously IP infringing) game. It honestly just screams "rug pull" to me, but I'm just a humble hater who can't see the *opportunities*.)

What happens, and what has long been a selling point of crypto, is that as time goes on the theoretical purchasing power of a single coin goes up (and up and up and up). This is the whole "if you bought 1 BTC when mining was cheap it's worth sooooo much now" line.

This is also part of the environmental cost. Proof-of-work is leveraged against the electricity required to solve the increasingly complex equations that enforce the asymptotic mining schedule.

(Proof of Stake is fundamentally the same, just fewer people need to validate every transaction kicking the energy cost can further down the road; when evangelists say "Sol is low cost/impact" what they mean is "Sol is low cost/impact *at the moment*")

The result, by design, is strictly deflationary, which has two hallmarks: currency will always be harder to get tomorrow than today, and the price of goods and labour will inevitably be cheaper.

Now, if you're an early adopter or someone with vast reserves of currency this is in your favour. Your stockpile gives you more and more and more purchasing power as things get cheaper and cheaper and cheaper.

If you're at the bottom, if you do not have reserves and have to earn-and-spend every month, this sucks.

If you have to take on debt as a necessity (vs as an asset) it quadruple sucks.

If you have to take on debt as a necessity (vs as an asset) it quadruple sucks.

Anything you buy with that debt that can't be leveraged will definitionally be worth less than what you pay for it. Your interest will make your debt go up while your ability to earn to pay it off goes down.

So a lot of DeFi advocates have this pitch that gets really gross when you unpack it. "We can help the unbanked of the world!"

"You know what impoverished Appalachian villages need? Securities trading and access to deflationary debt!"

"You know what impoverished Appalachian villages need? Securities trading and access to deflationary debt!"

If you're curious about the future of "Play to Earn" gaming, the Discord for Farmer's World, a sub-Farmville level timer game and reportedly the most popular P2E game at the moment, players are discussing which crops they can grow and still sleep without penalty.

Now, unhealthy sleep patterns and video games are no stranger, whether it be midnight releases or in game timers that reset in the middle of the night, this isn't strictly new.

Difference is most games don't have a $5000 buy-in with a promise of material ROI if you keep up with your timers.

The basic loop is this: crops require 42 interactions to harvest, and players can interact every 4 hours. If you miss two consecutive interactions you're penalized 1 interaction for every missed timer thereafter.

42 interactions on a 4 hour timer, 7 straight days of clicking every 4 hours, day or night. If you go absent up to 11 hours at once then you're merely extending that to 7 days + 11 hours. At 12 hours you're docked a point and effectively lose 4 hours in addition to the real time.

The idea is that because of the promise of profit people buy in for steep prices but rarely cash out; all their "earnings" (paid in scrip) are redirected into buying more in-game plots/cows/crops, and the owners get to skim on every transaction.

This makes it easy to create the illusion of value and return: it took months and months but you've gone from 1 $5000 cow to 4 $5000 cows! You've got $20,000! But you don't. You have stock, that doesn't mean you have buyers.

This is really common mentality in WoW gold farming, where someone will brag about how they made "150k gold in ten minutes" by just adding up the theoretical value of a bunch of junk that takes months and months to actually sell.

Anyway, expect to see a lot more of this in the coming years as all the worst Free to Play devs pivot to this pseudo-MLM format, getting people to pay hundreds, if not thousands, to buy into a promise of unrealizable future profits "just for playing a game."

Blockchain games have come so far in just a few short years 🤗

https://twitter.com/FoldableHuman/status/1014392874304016384

The greatest thing about the whole crypto ecosystem is that blockchain gives you a comprehensive list of everyone who already fell for one scam.

The entire concept of MetaMask is such an unmitigated nightmare, I don't know why anyone would trust it.

I legitimately do not understand how any artist, musician, or videographer who has worked on the web could even start to rationalize it.

I legitimately do not understand how any artist, musician, or videographer who has worked on the web could even start to rationalize it.

Like, the problems that MetaMask (and competitors) exist to solve is first that every game, dapp, defi scam, and DAO has their own coin and/or chain that you need to deal with if you want to be involved in the ecosystem, so managing them becomes a nightmare.

And second is that in order for any regular-ass website to talk to "on-chain" stuff there needs to be a protocol for the two to talk to each other.

Now, months ago I saw some absolutely unhinged raving about how MetaMask finally solves the single-login problem in a way that Facebook and Google never managed to, and just, like, have we learned nothing?

Like, within the concept space of crypto, in their own mental model, MetaMask is effectively like logging into every random ass forum using your bank account, driver's license, credit card number, and the pink slip to your car at the same time.

The thing we learned about single-log in isn't that it lets Ol' Zuck know a wee bit too much about you, it's that it creates an enormous point of failure where one mistake with a less-than-trustworthy handshake compromises every single connected service you use.

And that's not all! Even just the fact that a wallet manager is necessary because common practice is already to maintain multiple different wallets of the same kind purely to obfuscate your activity because it turns out an immutable blockchain makes it super easy to spy on you.

Also, just another pivot point in how illusory all the success is, how the "successful" projects are pure smoke fuelled by existing wealth, Party Ape Billionaire Club has been running billboards very aggressively.

They're partnered with The Red Ape Family, the "world's first NFT cartoon" (not even true, Stoner Cats already exists/sucks in that space), who are partnered with 2chains. They even sold out their premiere!

Pure smoke.

Oh and just to confirm how juicy MetaMask is as a target, bots come out of the woodwork with phishing links just for even mentioning them, and do so with a blatancy normally reserved for “windows update” worms from 2003

I'm obsessed with the absolute disconnect between the myth of BAYC holders as high rolling, serious contenders in the marketplace, a threat to traditional media, and the absolute amateur crap they actually produce.

Like, you're supposedly drowning in cash from all your HODLing, and yet you can't hire animators who know to use an alpha channel or garbage matte properly?

Okay, so this is where it gets complicated. BAYC allows for you to create commercial derivatives of any apes you own. But the attribute system means that a lot of apes are functionally indistinguishable, differing only by mouth shape or a hat.

https://twitter.com/TBranin/status/1465430156244398089?s=20

One of the animators on the show just extracted the different BAYC base elements and used the mouths to animate the mouth flaps. In theory this basic animation could transform your ape into an infringing ape.

Additionally it's extremely unclear how rights transference is meant to be handled if you create a derivative of an ape while you hold it, but then later sell the token.

This has been optimistically framed as "decentralized collaboration" but, one, fanfiction already does that and does it better, and two, the overt commercial aspirations turn this into an industry of selling merch for an IP that barely exists, offloading production onto buyers.

Four of these were full on delete-the-server-and-run rugpulls.

https://twitter.com/FoldableHuman/status/1446141272511500291?s=20

Wolf Game built their entire game into the Ethereum blockchain. A bug was found in some of their code that provided a potential exploit. They cannot patch it and have instead been forced to recreate the entire game from scratch and issue entirely new tokens.

The end goal of the crypto machine is the financialization of everything. Any benefits of digital uniqueness are a quirk, a necessary precondition of turning everything into stocks.

https://twitter.com/DjangoWexler/status/1465821413273923587?s=20

Me: this is all just a gateway to endless layers of DRM

Crypto evangelists: no! It will be decentralized and finally free!

Crypto creator: behold my new layer of DRM!

Crypto evangelists: 🍆💦 🍆💦 🍆💦 T H E F U T U R E I S H E R E 🍆💦 🍆💦 🍆💦

Crypto evangelists: no! It will be decentralized and finally free!

Crypto creator: behold my new layer of DRM!

Crypto evangelists: 🍆💦 🍆💦 🍆💦 T H E F U T U R E I S H E R E 🍆💦 🍆💦 🍆💦

• • •

Missing some Tweet in this thread? You can try to

force a refresh