As we are approaching the 10th anniversary of Litecoin, I figured it's a good time to do a long Twitter 🧵 on the history of Litecoin from my perspective.

My memory of events can be hazy at times, so for those mentioned, feel free to add or correct anything I say. Here goes...

My memory of events can be hazy at times, so for those mentioned, feel free to add or correct anything I say. Here goes...

The first altcoin to Bitcoin is actually Namecoin. It used the same mining algorithm as Bitcoin, sha256d. After Namecoin came about a dozen other altcoins: Ixcoin, Iocoin, Solidcoin, Tenebrix, etc. This was all before Litecoin was launched. Every one of these coins are now dead.

These altcoins experimented on different things like faster block times and different mining algorithm. Bitcoin at the time was predominantly mined by GPUs. Tenebrix brought back CPU mining with Scrypt. This is actually very important because miners are the coin's first users.

And it's important for anyone to be able to easily mine the coin. If your miner base is large, your user base is large. And those are the users that will actively push for adoption and help make the coin succeed.

The problem though with these altcoins was fairness.

The problem though with these altcoins was fairness.

Most of these altcoins have a huge premine. Tenebrix for example had 7 million coins premined. That means the the creator has incentives to pump the coin to a high price so he/she can profit massively without much work. You get things like creators bribing exchanges for listing.

Since the coins were just printed out of thin air, it's cheap to collude with exchanges to pump the coin. We've seen that happen with ICOs in 2017.

If a coin was not premined, you get things like ninja mining. That's when a coin is released silently to friends and family.

If a coin was not premined, you get things like ninja mining. That's when a coin is released silently to friends and family.

And it might be released without the source code or with only Windows binary. That way, a small number of users get to profit early on.

This was the landscape of altcoins before Litecoin. So what I tried to do with Litecoin was to change all of that. Fairness was crucial.

This was the landscape of altcoins before Litecoin. So what I tried to do with Litecoin was to change all of that. Fairness was crucial.

I basically took everything that's good from these altcoins (speed, CPU mining) and did a fair launch. And that's why Litecoin succeeded where others failed.

The name Litecoin came to me pretty quickly. I thought of something like an Elitecoin first. Then Litecoin jumped out.

The name Litecoin came to me pretty quickly. I thought of something like an Elitecoin first. Then Litecoin jumped out.

The best part was that all the domains were available. So on 10/4/11, I bought them all on GoDaddy. What a great move in hindsight. So now, we don't have something like litecoin.com promoting Litecoin Cash instead of Litecoin. $38.85 well spent! 😂

I worked on the code for a few days. To be honest, Litecoin was not hard to code up. The hardest part was actually to create the genesis block. Satoshi never documented how he did it and the code to do that was not checked in with the Bitcoin source code.

So I had to do some reverse engineering and managed to create the genesis block on 10/7/11

blockchair.com/litecoin/block…

What a lot of people didn't know is that I put the headline of Steve Job's death in the genesis hash. This proves that the genesis block was created after 10/5/11.

blockchair.com/litecoin/block…

What a lot of people didn't know is that I put the headline of Steve Job's death in the genesis hash. This proves that the genesis block was created after 10/5/11.

On 10/8/11, I announced Litecoin to bitcointalk.org. BitcoinTalk is basically the only place that people chatted about Bitcoin. No one used reddit, Twitter, Facebook.

The code was available for anyone to download and compile. So they can check the code to make sure.

The code was available for anyone to download and compile. So they can check the code to make sure.

Here's the launch thread: bitcointalk.org/index.php?topi…

Binaries were also available for those that trusted me and didn't know how to compile the code for themselves. People were able to immediately mine on testnet to make sure everything works on their system. This is very important.

Binaries were also available for those that trusted me and didn't know how to compile the code for themselves. People were able to immediately mine on testnet to make sure everything works on their system. This is very important.

That way everyone can be prepared to mine at launch. So the launch would be fair.

To accomplish this, I of course had to share the genesis block with everyone. But I can't just do that because people can mine a long chain in private from that genesis block.

To accomplish this, I of course had to share the genesis block with everyone. But I can't just do that because people can mine a long chain in private from that genesis block.

At launch, if they release that long chain, it will become the longest chain and they would win all those early blocks. So what I did was to lock in a block after the genesis block. I mined block 2 and 3 and hard coded those hashes in the code but I withheld a couple parameters.

Without those 2 parameters, one cannot start mining on the mainnet, but they can easily mine on testnet.

So I lied, there was a 2 block premine of 100 coins. 😂

The genesis coins cannot be spent.

Then I did a poll on what time we should launch the coin:

bitcointalk.org/index.php?topi…

So I lied, there was a 2 block premine of 100 coins. 😂

The genesis coins cannot be spent.

Then I did a poll on what time we should launch the coin:

bitcointalk.org/index.php?topi…

I did everything I could think of to make this as fair as possible. As you can see, the winning time was not what I voted on. It actually was a very inconvenient time for me! But crowd (albeit very small) has spoken.

So I prepared everything for to launch at that time.

So I prepared everything for to launch at that time.

Over the next few days, I did everything to help people get their system set up.

A few minutes before the actual launch time, I posted this. Of course this was a link to Rick Astley's video. I had to. 😁

A few minutes before the actual launch time, I posted this. Of course this was a link to Rick Astley's video. I had to. 😁

At launch, I posted the config paramters that were needed to mine on mainnet. All everyone had to do was paste that into their litecoin config file, restart their client, and they will be happily mining real LTC.

Of course, there was a mad rush of people mining LTC at the start.

Of course, there was a mad rush of people mining LTC at the start.

There was quite a bit of chain orphaning as the difficulty was set a bit low. There was no way for me to predict how successful the launch was going to be.

I myself only managed to get a handful of blocks. People for the most part were very happy with how the launch went.

I myself only managed to get a handful of blocks. People for the most part were very happy with how the launch went.

I think I managed to pull off the fairest launch of any coin. And that is one of the biggest reasons why Litecoin succeeded. Surprisingly, very very few coins copied Litecoin's launch.

Ok, that's it for now. I will tweet more later about what happened between launch and now.

Ok, that's it for now. I will tweet more later about what happened between launch and now.

I forgot to mention that I chose Litecoin because Litecoin is the lighter version of Bitcoin. It's faster, cheaper, and easier to use.

And we got to see a young & unknown (at the time) @VitalikButerin hating on the name. I prefer Litecoin over Etherium. Wait, is it Ethereum? 😂

And we got to see a young & unknown (at the time) @VitalikButerin hating on the name. I prefer Litecoin over Etherium. Wait, is it Ethereum? 😂

The original logo was inspired by this image. Cool image but it didn't translate well into a good looking logo.

bitcointalk.org/index.php?topi…

But we did get some cool acrylic Litecoin collectible made by Mike Caldwell (@casascius), make of Casascius physical bitcoin.

bitcointalk.org/index.php?topi…

But we did get some cool acrylic Litecoin collectible made by Mike Caldwell (@casascius), make of Casascius physical bitcoin.

The second logo was designed by @Mjbmetals. I still like that quite a lot. It looks well next to that Bitcoin logo.

bitcointalk.org/index.php?topi…

bitcointalk.org/index.php?topi…

And the current logo is designed by Robbie Coleman (@robertfcoleman) and his team.

Of course being decentralized, there are many other logos that people have created and used. Some are pretty wacky. And people can use whatever logo they want and I can't do anything about it. 😂

Of course being decentralized, there are many other logos that people have created and used. Some are pretty wacky. And people can use whatever logo they want and I can't do anything about it. 😂

Soon after the launch, Litecoin was added to BTC-e. That helped a lot as miners had access to liquidity pretty quickly. Litecoin quickly become one of the most popular coin on BTC-e. The BTC-e chat/troll box was one of the most innovative thing at the time. Many have copied it.

From 2011 to 2013, I spent a lot of time supporting Litecoin's early growth and pushed for adoption wherever I can. I pretty much talked to all the exchanges to support LTC. I realized that liquidity is super important for a coin. Without liquidity, you can't do anything.

Merchants and merchant processors can't accept a coin if there's no liquidity. Because they have to cash out to fiat when they accept the cryptocurrency, lack of liquidity makes it hard to sell the coin without moving the price too much.

In May of 2013, Bitfinex launched support for Litecoin.

financemagnates.com/cryptocurrency…

This was a huge deal for Litecoin. It’s the first major exchange to support LTC.

financemagnates.com/cryptocurrency…

This was a huge deal for Litecoin. It’s the first major exchange to support LTC.

At the Bitcoin 2013 conference, I remember attending a talk by Bitstamp Co-Founder and CEO Nejc Kodrič( @nejc_kodric). During the Q&A after the talk, I asked him if Bitstamp will add Litecoin. I think he just chuckled and went to the next question.

@nejc_kodric I remember thinking to myself that one day they will add Litecoin. And it will be because it was the right business decision for them to add LTC.

And that did happen but 4 years later in June of 2017: blog.bitstamp.net/post/let-there…

And that did happen but 4 years later in June of 2017: blog.bitstamp.net/post/let-there…

And a similar thing with BitPay. At the same conference, I asked the Co-Founder of BitPay, Tony Gallippi (@TonyGallippi) and I think he said he will think about it just to get me off his back. Lol

Happy to see BitPay added LTC this year!

bloomberg.com/press-releases…

Happy to see BitPay added LTC this year!

bloomberg.com/press-releases…

Sometime late 2012 to early 2013, 2 of the largest exchanges in China, @Okcoin and @HuobiGlobal, added support for LTC. That was huge. The trading volume was also pretty crazy, but unclear how much of that was fabricated.

Litecoin was a very popular coin in China.

Litecoin was a very popular coin in China.

In 2013, I thought it was time for me to step away from Litecoin. I was very fortunate to find Warren Togami (@wtogami), Founder of the Fedora Project, to take over as Litecoin lead developer. Warren is amazing and we were very lucky to have him at the helm of development.

There were quite a few bugs & scares along the way. I think we've also helped Bitcoin fix some bugs. Warren, feel free to elaborate if you want on what kind of technical issues Litecoin faced around that time. I was glad we had Warren to deal with them so that I didn't have to!😂

Mid 2013 was also when I decided to go all in crypto career-wise. I had been working at Google for 6 years by then, and it became clear to me that Google wasn't interested in doing anything crypto related. And so I decided to work full time on crypto.

It started with an email to Coinbase support to add Litecoin. Olaf Carlson-Wee (@zxocw), Founder & CEO of Polychain Capital now, was super friendly and the answer was the same: not now but maybe later?

But that conversation eventually turned into me possibly joining Coinbase.

But that conversation eventually turned into me possibly joining Coinbase.

I interviewed at Coinbase and on paper, it sounded like a horrible deal. I would have to commute to SF, which was an hour each way, take a 50% or so pay cut, work twice as hard, and miss out on all the Google perks. But it was a no-brainer for me.

Coinbase was the hot startup and THE crypto company that is making Bitcoin easy to use. I knew that if Bitcoin didn't succeed, Litecoin wasn't going anywhere either. So I took that job and I knew I will eventually convince Coinbase to support Litecoin... but not right away.

In March of 2014, @YourBTCC finally added Litecoin support. BTCC was the first crypto exchange in China and at one point the largest. It was actually co-founder by my brother, Bobby Lee (@bobbyclee), CEO of @BalletCrypto now. Although it was a huge news, what took him so long?!

But at least he created a cool banner for it. 😁

coindesk.com/markets/2014/0…

After that, there were rumors of @MtGox finally adding its second coin, Litecoin. At the time MtGox had like 97% of the total Bitcoin trading volume. Support of LTC would be huge for Litecoin's liquidity.

coindesk.com/markets/2014/0…

After that, there were rumors of @MtGox finally adding its second coin, Litecoin. At the time MtGox had like 97% of the total Bitcoin trading volume. Support of LTC would be huge for Litecoin's liquidity.

The rumors were actually true. I was talking to the CEO, Mark Karpelès (@MagicalTux) almost on a daily basis in mid 2015. He was dealing with a lawsuit and upgrading the trade engine to something he called the Midas engine. If you were around then, you would have heard of it.

And I guess, unbeknownst to everyone else, he was also dealing with his exchange having lost thousands of BTC to hacks and bad code. So Litecoin didn't end up launching on MtGox as the hack blew it up before that happened. In hindsight, it was a blessing in disguise.

Actually MtGox lost about 850,000 BTC !!! And people are still dealing with bankruptcy courts trying to get some money back after 5+ years.

In October 2015, Brian Armstrong (@brian_armstrong), CEO of Coinbase, sent a controversial tweet. Although I disagreed with him, he's not totally wrong. At the time, it was best for companies like Coinbase to focus on providing the best product for Bitcoin and not get distracted.

That changed though in 2016. The was when Litecoin trade volume exploded on Chinese exchanges and it was clear to me that Coinbase was leaving a lot of money on the table by not supporting altcoins. And it made business sense for Coinbase to add altcoins.

This was also when Ethereum was starting to get big. So I put together a proposal to Brian and Fred Ehrsam (@FEhrsam) to add both LTC and ETH to Coinbase. Basically the reasoning was that it was clear that Coinbase could make a lot of money if it let people trade ETH and LTC.

There was a lot of unsatisfied demand. People in the US had no easy way to store and trade these coins. And Coinbase would steal a lion share of the demand if we added the 2 coins to start.

Both Brian and Fred like the idea but they crossed out LTC. They just want to do ETH.

Both Brian and Fred like the idea but they crossed out LTC. They just want to do ETH.

Although I went along with the plan, it kind of rubbed me the wrong way. Litecoin had a much higher global trade volume at the time and was the #2 coin in marketcap. So although it's fair that Ethereum had more potential, we went out of our way to not launch LTC at the same time.

This was one of the reasons why I decided to take 3 months off from Coinbase in 2016 to focus my efforts back to Litecoin.

At the time SegWit was being pushed for Bitcoin and it was running into a lot of roadblocks. It was technically sound and a great upgrade for Bitcoin.

At the time SegWit was being pushed for Bitcoin and it was running into a lot of roadblocks. It was technically sound and a great upgrade for Bitcoin.

But for some reason, it was being blocked by miners. Now in hindsight, we know why that was the case. But at that time, there was so much FUD around SegWit that it seemed hopeless that it will ever be adopted by Bitcoin. SegWit was need for Lightning Networks to function well.

I realized that here's a chance for Litecoin to do something to help Bitcoin. If we can get SegWit on Litecoin, it can clear out all the FUD and prove that SegWit is safe and a good upgrade for Bitcoin.

Back then the biggest FUD was the anyone-can-spend FUD.

Back then the biggest FUD was the anyone-can-spend FUD.

Basically the fear was that once SegWit is activated, miners can steal any coins sent to SegWit addresses. Anyone technical enough knows that this was not true. It was not possible for miners to steal coins that way. Unfortunately Bitcoin testnet was not useful here.

Testnet can test out the technical function of the blockchain but it can't test out the game theory of the blockchain. That's because there's no real value in testnet coins, so there's no reason for attackers to attack the chain if they can't profit from it. Litecoin changes that

If SegWit is on Litecoin, there will be incentives for people to attack it. If miners can steal millions from anyone-can-spend coins, they would.

So I had my mind set on get SegWit on Litecoin. This was much harder that I expected! At the time Warren stepped down as lead dev.

So I had my mind set on get SegWit on Litecoin. This was much harder that I expected! At the time Warren stepped down as lead dev.

Shaolin Fry (@shaolinfry) of UASF fame, joined the Litecoin development team to help us get SegWit activated on Litecoin.

This was also around the time we formed the Litecoin Foundation (@LTCFoundation).

This was also around the time we formed the Litecoin Foundation (@LTCFoundation).

Xinxi Wang (@TheRealXinxi) and Franklyn Richards (@LitecoinDotCom) joined me as Director to the Litecoin Foundation and we had Loshan (@loshan1212) and Thrasher (@thrasher_au) as developers working on the code.

People started to become excited about Litecoin again!

People started to become excited about Litecoin again!

In January of 2017, I wrote my vision about SegWit and LN on Litecoin and Bitcoin: medium.com/@SatoshiLite/m…

But, man was it hard to get SegWit activated on Litecoin though. More later...

But, man was it hard to get SegWit activated on Litecoin though. More later...

For those of you new to crypto (probably 90% of you), you might not have heard of SegWit. Here's more on SegWit: en.wikipedia.org/wiki/SegWit

SegWit stands for Segregated Witness. It's basically an upgrade that would separate out the signature (i.e. witness) from the transaction.

SegWit stands for Segregated Witness. It's basically an upgrade that would separate out the signature (i.e. witness) from the transaction.

SegWit treats the witness portion different than the rest with respect to block size. So it's effectively a 2 times increase in block size. SegWit also fixes a transaction malleability issue, which affected MtGox because MtGox didn't track transactions well when the hash changed.

Solving transaction malleability allows for the Lightning Network to function.

So SegWit fixes a major issue, increase block size by 2x, and allows for LN to scale Bitcoin/Litecoin even more. It's a win/win/win. When I first heard of it, I was really excited about it activating!

So SegWit fixes a major issue, increase block size by 2x, and allows for LN to scale Bitcoin/Litecoin even more. It's a win/win/win. When I first heard of it, I was really excited about it activating!

The problem is that mining at the time was quite centralized. It basically revolved around one big player: Bitmain. Because Bitmain controlled the most efficient ASIC, they had a lot of sway over the miners. If miners don't cooperate, Bitmain may withhold future ASICs.

The co-founder of Bitamin, Jihan Wu (@JihanWu), is a big supporter of scaling Bitcoin onchain. Basically, he belives Bitcoin can just hard fork to increase the block size and there's no reason why we need to do something complicated like SegWit and LN.

Most of the developers of Bitcoin believe that scaling onchain reduces decentralization of Bitcoin as it makes it much harder for people to run a node if it's too resource intensive. This is what I believe in also and why we think SegWit was the best solution.

Unfortunately that became very contentious. Because Jihan had a lot of influence, he single-handedly was able to block SegWit activation on Bitcoin. And because Bitmain also made one of the most efficient Litecoin miners, he had a lot of influence on Litecoin miners also.

The difference between Bitcoin and Litecoin is me. Bitcoin is more decentralized. There's no one to come out to speak on what their vision of Bitcoin is. But for Litecoin, I can come out and tell the world my vision for Litecoin, which I have done.

This makes it much harder for miners to block SegWit on Litecoin because they think that's best for Litecoin when I'm publicly saying the opposite. This is why a bit of centralization is more efficient. It's like the difference between a benevolent dictator and a democracy.

A democracy is much less efficient but it's best for the long run as a benevolent dictator can easily turn bad.

Anyways, this was what I set out to do. I met and talked to many miners throughout the end of 2016 to early 2017. I talked to Innosilicon, another LTC ASIC maker.

Anyways, this was what I set out to do. I met and talked to many miners throughout the end of 2016 to early 2017. I talked to Innosilicon, another LTC ASIC maker.

Innosilicon was immediately on board with SegWit. They agreed with me that it's the best path forward. And they were able to convince some of their customers to support SegWit.

One of their customers was a huge LTC miner. He owned about 5% of the hashrate. Having him was huge.

One of their customers was a huge LTC miner. He owned about 5% of the hashrate. Having him was huge.

The problem was that this miner had his ASICs with a mining farm controlled by Jihan. He was able to get cheap electricity and was afraid that if he signaled for SegWit, he might get cut off from this cheap electricity. Lots of drama, but in the end, he signaled for SegWit.

In February 2011, SegWit signaling started on Litecoin. Basically miners will signal whether or not they supported SegWit in the blocks they mined. If 75% of blocks signal for SegWit within a 2-week timeframe, it will lock and SegWit will activate after some time.

LitecoinPool (@ltcpool) was the first pool to support SegWit. They did a vote among the miners in the pool and IIRC, it was overwhelmingly in favor of SegWit.

F2pool promised to support it but they didn't signal right away. Wang Chun (@satofishi) is the founder of F2pool.

F2pool promised to support it but they didn't signal right away. Wang Chun (@satofishi) is the founder of F2pool.

I chatted with Chun a lot during that time period. He basically told me that because he's a pool and not a miner, he's not afraid of Jihan as Jihan has no power over him. But he's still concerned that he might lose hashrate if his signaled as miners might be convinced to leave.

So over the next month, F2pool actually flipped flopped. They would signal and then stop signaling. The market reacted accordingly. When F2pool started signaling, the price will go up, and vice versa.

It became clear as day that the market wants Litecoin to get SegWit!

It became clear as day that the market wants Litecoin to get SegWit!

On 2/14/21, with the help of the large miner, we were at 20% signaling. This was a long way from the 75% needed in order to activate SegWit.

https://twitter.com/satoshilite/status/831568633880932352

On April 1st, F2pool finally signaled SegWit for good this time. And of course the LTC price popped right afterwards. It was really hard for miners to deny that SegWit is good for Litecoin... at least for their pocketbooks.

https://twitter.com/SatoshiLite/status/848401462484795392

But of course more drama ensues. Jihan wanted me to personally visit him and the miners in China to convince them about SegWit. I didn't feel like that was necessary. I wanted them to chat with me via video chat but they refused. It was a power play move and I didn't like it.

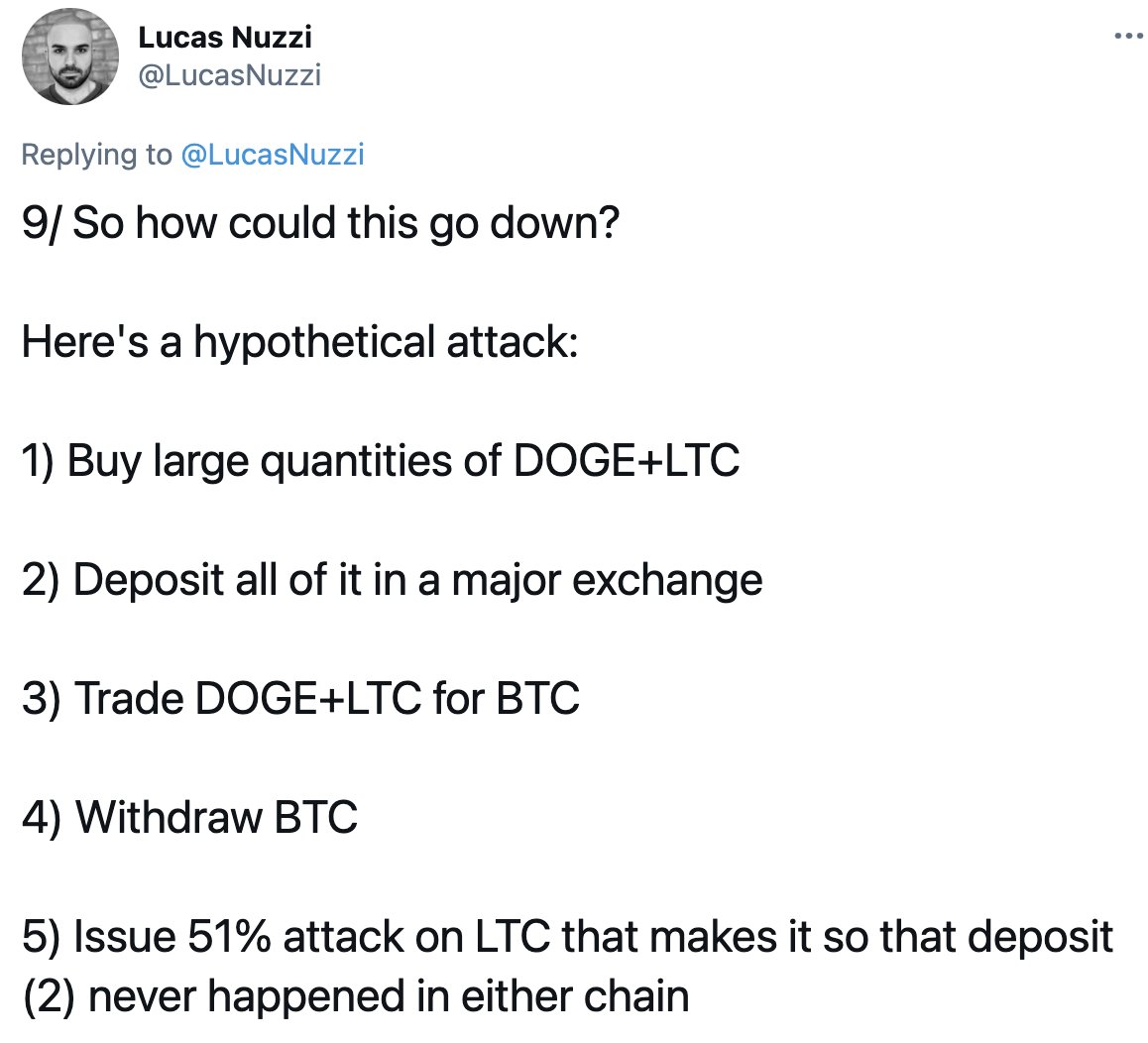

Over the next week, more and more miners started signaling for SegWit and it started to look inevitable. And then this happened. Bitmain was building a ton of LTC miners and was going to turn them all on themselves to block the upgrade. 😡

https://twitter.com/shaolinfry/status/850995104240336896

All this was just wrong. Users wanted SegWit. Markets wanted it. Why are miners, basically 1 person, able to block something that is good for Litecoin and Bitcoin.

In the end, miners are being paid to do one thing, which is to collect transactions into blocks and broadcast them.

In the end, miners are being paid to do one thing, which is to collect transactions into blocks and broadcast them.

They shouldn't have the power to block an upgrade like this. And that's why I decided to pull the UASF trump card out. I wore the UASF hat made by @Excellion and tweeted this out on April 11th.

https://twitter.com/satoshilite/status/851967863829127168

@Excellion UASF stands for User Activated Soft Fork. What it means is that instead of having the soft fork (SegWit) being miner activated, the user decides to activate the soft fork in a future date. If the majority of users and exchanges run the UASF code, SegWit will activate.

And when SegWit activates, miners will have to comply and mine the chain with SegWit, because the chain without SegWit would be worthless. That's the idea of UASF.

This really scared the miners. UASF basically kneecaps them. And this is what happened.

This really scared the miners. UASF basically kneecaps them. And this is what happened.

https://twitter.com/jiangzhuoer/status/855070061735821313

On April 21, I met with Jihan, Innosilicon, and miners for over 8 hours IIRC. It was exhausting. We ironed out our differences and came to an agreement.

https://twitter.com/satoshilite/status/855388084040421377

Although this seems so bad for a decentralized cryptocurrency to have a closed door meeting to make decisions that affect the future of Litecoin, I felt like it was a compromise I'm willing to take. It's better than an all out war between the miners and I.

Here's a good article on SegWit on Litecoin and why it matters: coindesk.com/markets/2017/0…

After the agreement, signaling jumped to like 90%. It really showed how centralized mining was at the time.

After the agreement, signaling jumped to like 90%. It really showed how centralized mining was at the time.

On May 10, SegWit finally activate on Litecoin! 🥳🎉

https://twitter.com/SatoshiLite/status/862339300783833088

It felt like the whole crypto space was waiting for this. Christian Decker (@Snyke) made the first LN payment on Litecoin. Shows that even Bitcoin developers were excited about LN on Litecoin and immediately tested it out right after SegWit activated.

https://twitter.com/snyke/status/862419970990501890

3 days later, I posted a $1m bounty on a SegWit address: reddit.com/r/litecoin/com…

I basically said here's $1m on an anyone-can-spend address. Come steal it if you can. This was to prove that all the FUD about SegWit was just dumb. I did it anonymously at the time to.

I basically said here's $1m on an anyone-can-spend address. Come steal it if you can. This was to prove that all the FUD about SegWit was just dumb. I did it anonymously at the time to.

On August 24, SegWit activates on Bitcoin with the help of UASF!

It's hard to know exactly how much Litecoin helped with this. I feel like it definitely has helped. My guess is it still would have happened eventually but might have taken much longer.

bitcoinmagazine.com/technical/segr…

It's hard to know exactly how much Litecoin helped with this. I feel like it definitely has helped. My guess is it still would have happened eventually but might have taken much longer.

bitcoinmagazine.com/technical/segr…

On September 1, first LN request/payment happened on Litecoin between @jackmallers and I.

Go check out what Jack is doing now with Strike (@ln_strike) and everything he'd done with El Salvador and Twitter tipping.

Go check out what Jack is doing now with Strike (@ln_strike) and everything he'd done with El Salvador and Twitter tipping.

https://twitter.com/SatoshiLite/status/903676576356737025

On September 20, I did my first on chain atomic swap with @decredproject between LTC and DCR. This shows how one can move coins between different chains in a decentralized way. It was a great proof of concept and paved the way for decentralized exchanges.

https://twitter.com/satoshilite/status/910534107058233344

And on November 16, the first ever cross-chain swap between BTC and LTC via Lightning happened! This fulfilled my vision of LTC and BTC moving seamlessly on the Lightning Network.

That's it for the history of SegWit and LN on Litecoin. More later...

That's it for the history of SegWit and LN on Litecoin. More later...

https://twitter.com/lightning/status/931277111490265088

Oh, forgot to mention, there was also the first cross-chain atomic swap between Litecoin and Bitcoin with John Stefanopoulos (@JStefanop1).

John is the creator of the awesome FutureBit LTC miners. He's helping with the decentralization of mining!

John is the creator of the awesome FutureBit LTC miners. He's helping with the decentralization of mining!

https://twitter.com/SatoshiLite/status/911328252928643072?s=20

After taking the summer off in 2016 to work on Litecoin SegWit, I went part time at Coinbase and worked mostly from home. At that time I asked Brian if we can add LTC support given how successful the Ethereum launch was. Brian reluctantly agreed to launch on GDAX only.

Coinbase did not put any resources behind this launch and pretty much just quietly launched the LTC/BTC and LTC/USD trading pairs with an empty order book. For reasons unknown to me, Brian & Fred refused to do a full launch on GDAX & Coinbase like we did with ETH.

We did not follow the Ethereum launch, which I helped design, that was extremely successful. So the LTC launched on GDAX was a huge failure IMO. Fred had refused to let Coinbase hold any LTC and due to conflict of interest, I didn't feel it was right for me to argue with him.

But without holding some LTC, we cannot launch on Coinbase and I knew this would seriously hurt the launch. We didn't even have any LTC to pay miner fees. I had to personally lend Coinbase my own LTC! I was really disappointed that we did this launch as an afterthought.

This was the state of crypto trading a month before launch. It wasn't like Litecoin was a small coin. It was the #5 coin with trading volume that almost matched Etheruem's and LTC wasn't even on Coinbase. So I was extremely frustrated and felt a bit slighted.

It would have been easy to launch on both GDAX and Coinbase. Actually, it would have been easier since we already have a successful launch plan to follow. Coinbase basically had to go out of the way to cripple the Litecoin launch and not even hold any LTC to pay for miner fees.

I believed launching LTC would be a good move for Coinbase financially because there was a ton of unmet demand for LTC trading in the US. And I was frustrated that Brian and Fred did not see that and they were just doing it to please me I guess. That just didn't feel right.

I decided then that I would leave Coinbase to focus on Litecoin. I told Brian I was going to resign and transition everything by early 2017. But they asked me to say a bit longer to make sure there was enough time to transition everything.

I had pretty much given up ever seeing LTC launched on Coinbase, the main site. That is until I made a last ditch attempt in April. At that time due to SegWit signaling, GDAX was seeing huge volumes of trading. So I made a sort of a passive aggressive tweet at Brian.

This was definitely not a staged tweet and reply. I actually didn't expect Brian to reply at all, but I was extremely glad to see him agree with me.

So right away, I gathered the team together at Coinbase to launch Litecoin. I didn't even talk to Brian after his Twitter reply.

So right away, I gathered the team together at Coinbase to launch Litecoin. I didn't even talk to Brian after his Twitter reply.

I didn't want him to change his mind. Face with tears of joy

I took it as his approval and just got the team together to make it happen. Litecoin launched on Coinbase in May.

And June 9 was my last day, but that was planned 6+ months in advance.

I took it as his approval and just got the team together to make it happen. Litecoin launched on Coinbase in May.

And June 9 was my last day, but that was planned 6+ months in advance.

https://twitter.com/SatoshiLite/status/873343321296429056

Litecoin trading volume shot through the roof as expected on both GDAX and Coinbase. I believe Litecoin made Coinbase over $100m in revenue in 2017. Brain even emailed to apologize for what I had to go through. He agreed that adding Litecoin was super lucrative for Coinbase.

It definitely felt good to be proven correct!

This ends my rant on Coinbase. And I guess you can blame me for turning Coinbase into a shitcoin casino that it is today. 😂

More later...

This ends my rant on Coinbase. And I guess you can blame me for turning Coinbase into a shitcoin casino that it is today. 😂

More later...

As you all know, I infamously sold all my LTC at the end of 2017. Since this is more a thread about Litecoin than a thread about me, I won't spend too much time talking about it, but I do want to address it.

First of all, due to the fair mining I described in detail at the beginning, I didn't have a ton of LTC to begin with. I bought and mined all my LTC just like any other Litecoin supporter. I had more than most because I got in early but I knew of many people with a lot more.

Pretty much every other altcoin had a huge premine. Even Ethereum had like 70% coins premined. There's nothing wrong with a premine, except I think there are different fiduciary duties when you created a coin with a big premine for yourself.

When I sold my LTC, what I wanted to accomplish was 3 things:

1) Remove the fear of a Satoshi stash

2) Make Litecoin more decentralized

3) Align my motivation/incentive to Litecoin adoption versus LTC price rise

1) Remove the fear of a Satoshi stash

2) Make Litecoin more decentralized

3) Align my motivation/incentive to Litecoin adoption versus LTC price rise

Being the creator of Litecoin, I would want Litecoin to succeed even if I didn't hold any LTC. I think I have proven that to be true over the past 4 years. So I'm focused on the success and adoption of Litecoin and not on the price of LTC. I believe that's the best for Litecoin.

In early 2018, a company named LitePay came on the scene. They promised to be the BitPay of Litecoin. Will provide merchant services for merchants accepting Litecoin and have a LTC debit card for consumers to spend LTC everywhere. This was huge news for Litecoin.

People were very excited about LitePay and the Litecoin Foundation even invested $50k in the startup.

At the end though, LitePay turned out to be a dud. It didn't launch and the company shut down. It was likely a failed startup, although I'm not 100% sure if it wasn't a scam.

At the end though, LitePay turned out to be a dud. It didn't launch and the company shut down. It was likely a failed startup, although I'm not 100% sure if it wasn't a scam.

LitePay received $100k in investment from the foundation and another investor and failed to deliver. The community was extremely disappointed and it was a black eye for the foundation.

But this got us to work harder to deliver on these failed promises.

But this got us to work harder to deliver on these failed promises.

Since then, we have launched @LTCPayCom, a self-hosted merchant processing service. We also partnered with @UnbankedHQ to launch the Litecoin Card, which is a Visa card backed by LTC. You can sign up for the card here: litecoin-card.com

We fulfilled LitePay's promises.

We fulfilled LitePay's promises.

And of course, BitPay started supporting LTC this year. This is also big for Litecoin being used as payments. BitPay recently announced that merchants using @Verifone terminals can choose to easily accept LTC from a BitPay, @blockchain, or @BRDHQ wallet.

verifone.com/en/us/press-re…

verifone.com/en/us/press-re…

In July of 2018, the foundation partnered with @tokenpay and @tokensuisse to purchase a small stake in @TEN31Bank. Ten31 has plans to store LTC for consumers and work with merchants to accept LTC.

Speaking of banks, there's also this news last week!

Speaking of banks, there's also this news last week!

https://twitter.com/satoshilite/status/1445421018877624323

In September 2018, we held our first Litecoin Summit. It was a big success. It was great to have supporters of Litecoin all come together in one place.

blockmanity.com/news/events/li…

It's been tough the past 2 years to do an in person summit, but we plan to do one as soon as we can.

blockmanity.com/news/events/li…

It's been tough the past 2 years to do an in person summit, but we plan to do one as soon as we can.

We even had Litecoin superfan @TheJohnKimShow drop everything he was doing and drive his LTC truck for a 30 day tour of the country to end at the Summit.

Read about his crazy tale: decrypt.co/51514/the-man-…

Although the price was down, people were still passionate about Litecoin.

Read about his crazy tale: decrypt.co/51514/the-man-…

Although the price was down, people were still passionate about Litecoin.

In December, we had an opportunity to sponsor @ufc 232. There was our tiny Litecoin logo on the UFC mat. 😂

It was actually the first time we revealed our new blue logo. It was a lot of fun to be there. They even gave me a cut out of the blood-splattered mat with the logo. Lol

It was actually the first time we revealed our new blue logo. It was a lot of fun to be there. They even gave me a cut out of the blood-splattered mat with the logo. Lol

In June of 2019, we did another sponsorship funded by a few Litecoin supporters. Litecoin was named the Official Cryptocurrency of the Miami Dolphins.

miamidolphins.com/news/litecoin-…

I think the 2 sponsorships were cool at the time, but it ended up not doing much in terms of adoption.

miamidolphins.com/news/litecoin-…

I think the 2 sponsorships were cool at the time, but it ended up not doing much in terms of adoption.

I think funds would be better off spent on development of Litecoin. That's why we started a fund for developing Confidential Transactions and Mimble Wimble (now known as MWEB) on Litecoin in 2019: medium.com/@mrilirgashi/l…

We have raised over 1800 LTC for the fund!

We have raised over 1800 LTC for the fund!

After SegWit, I turned my focus on fungibility on Litecoin. You can ready my other tweet thread about this and why fungibility is so important.

https://twitter.com/SatoshiLite/status/1089935081337085952

David Burkett (@DavidBurkett38), developer of Grin++, joined the team to work on MWEB for Litecoin. David has tons of experience on MimbleWimble with his work on Grin, and he was the perfect person to lead this project.

Here's his monthly progress:

Here's his monthly progress:

https://twitter.com/DavidBurkett38/status/1201167714976440325

The code is being audited right now, and we are very close to releasing it. After release, it will take some time for it to be activated. I expect that will happen early next year. This will be a huge next chapter for Litecoin. Exciting times!

Something happened in October of 2020 that was totally unexpected. PayPal announced support of Litecoin out of the blue.

litecoin.com/en/news/paypal…

This was actually the first time something big happened to Litecoin without anything to do with me.

litecoin.com/en/news/paypal…

This was actually the first time something big happened to Litecoin without anything to do with me.

PayPal did not reach out to me beforehand. Actual there's no reason they needed to! Litecoin is a decentralized cryptocurrency after all. It was honestly very satisfying to see this happen. They support LTC b/c it's a good business decision and not b/c of my constant nagging. 😂

Every now and then, I get a new exchange reach out to me to to see if I will pay them some LTC for them to support Litecoin. It's ridiculous. So I always just reply that they can send 1000 LTC to me and I will give them permission to add LTC. That shuts them up pretty quick.😁

Litecoin was launched at 8pm PDT on October 12, but we've always celebrated Litecoin's launch on October 13 because it was the 13th using UTC timezone.

In 7.5 hours, it will be exactly 10 years since I launched the Litecoin network. The network has never gone down ever since! 😲

In 7.5 hours, it will be exactly 10 years since I launched the Litecoin network. The network has never gone down ever since! 😲

The blockchain for all intents and purposes is alive. I cannot shut it down and I know Litecoin will outlive me. These 10 years have been a wild ride. Here's to 10 more. 🥂

It's amazing what Satoshi Nakamoto has created. I am privileged to have played a tiny part in all of this.

It's amazing what Satoshi Nakamoto has created. I am privileged to have played a tiny part in all of this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh