1/ A quick thread on the EABL [@EABL_PLC] and Abasa Bank Kenya [@AbsaKenya] situation that was featured in the Business Daily today.

There are a few things that raise eyebrows that may need a more detailed explanation from 2 of Kenya's oldest and largest firms.

There are a few things that raise eyebrows that may need a more detailed explanation from 2 of Kenya's oldest and largest firms.

2/East African Breweries PLC [@EABL_PLC] is Africa’s leading alcohol beverage company celebrating 100 years in the brewing business.

The custodian of the Tusker brand.

The Group MD & CEO is Jane Karuku, appointed in 2021.

The custodian of the Tusker brand.

The Group MD & CEO is Jane Karuku, appointed in 2021.

3/ ABSA Bank Kenya [@AbsaKenya] (formerly known as Barclays Bank) is one of Kenya's oldest and largest banks.

The CEO is Jeremy Awori [@jeremyawori].

The CEO is Jeremy Awori [@jeremyawori].

4/

ABSA is regulated by the Central Bank of Kenya [@CBKKenya] which is headed by Patrick Njoroge [@njorogep].

@EABL_PLC and @AbsaKenya listed entities on the Nairobi Securities Exchange [@NSE_PlC] are also regulated by the Capital Markets Authority [@CMAKenya]

ABSA is regulated by the Central Bank of Kenya [@CBKKenya] which is headed by Patrick Njoroge [@njorogep].

@EABL_PLC and @AbsaKenya listed entities on the Nairobi Securities Exchange [@NSE_PlC] are also regulated by the Capital Markets Authority [@CMAKenya]

5/ This is the story @BD_Africa story as written by Victor Juma

businessdailyafrica.com/bd/corporate/c…

businessdailyafrica.com/bd/corporate/c…

6/

So yesterday, EABL indicated that they are raising around Ksh 11B.

So @EABl_PLC issued an Information Memorandum which has financial details to enable it to issue a Medium Term Note (MTN).

Here is a copy for the nerds (only 237 pages long btw): mwangocapital.files.wordpress.com/2021/10/eabl-2…

So yesterday, EABL indicated that they are raising around Ksh 11B.

So @EABl_PLC issued an Information Memorandum which has financial details to enable it to issue a Medium Term Note (MTN).

Here is a copy for the nerds (only 237 pages long btw): mwangocapital.files.wordpress.com/2021/10/eabl-2…

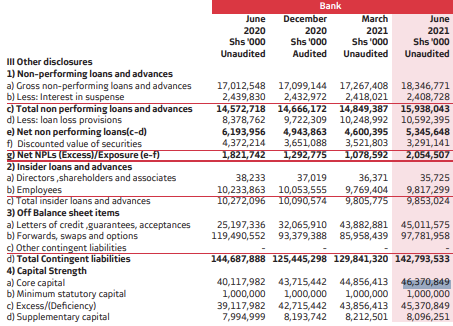

7/ From the IM and from the annual report of EABL, one can see that Absa Kenya has loaned Kshs 18.8B to EABL.

There is a possibility this could be syndicated from Absa Group, the holding company, but this is not mentioned in either the annual report or the IM.

There is a possibility this could be syndicated from Absa Group, the holding company, but this is not mentioned in either the annual report or the IM.

8/ In Kenya, the @CBKenya’s Prudential Guidelines a Kenyan bank cannot lend more than 25% of its Core Capital to a single borrower.

It’s a precaution to ensure the bank doesn’t run into major problems should the borrower default.

More here for nerds: centralbank.go.ke/wp-content/upl…

It’s a precaution to ensure the bank doesn’t run into major problems should the borrower default.

More here for nerds: centralbank.go.ke/wp-content/upl…

9/ Now for the (quick) math:

A. ABSA Kenya’s core capital on 30 June 2021 was Ksh 46.4B

B. ABSA Kenya’s loans to EABL as of 30 June 2021 were Ksh 18.8B

A/B= 40.6%

That’s a lot more than 25%. This is the question the reporter was asking.

A. ABSA Kenya’s core capital on 30 June 2021 was Ksh 46.4B

B. ABSA Kenya’s loans to EABL as of 30 June 2021 were Ksh 18.8B

A/B= 40.6%

That’s a lot more than 25%. This is the question the reporter was asking.

10/ What's more interesting though is this:

The current EABL Chief Financial Officer - Risper Ohaga - worked for ABSA/Barclays prior to being appointed EABL’s CFO in 2018.

The current EABL Chief Financial Officer - Risper Ohaga - worked for ABSA/Barclays prior to being appointed EABL’s CFO in 2018.

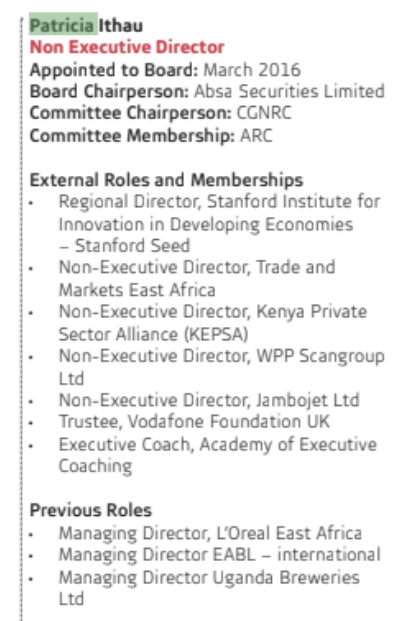

11/

The Stockbroker, arranger, placing agent, and receiving bank for the MTN are all part of Absa.

The chair of Absa Securities is @patriciaIthau who is a Non-Executive Director of Absa and has held previous roles at EABL.

ABSA and EABL seem tightly linked on executives.

The Stockbroker, arranger, placing agent, and receiving bank for the MTN are all part of Absa.

The chair of Absa Securities is @patriciaIthau who is a Non-Executive Director of Absa and has held previous roles at EABL.

ABSA and EABL seem tightly linked on executives.

13/ One would expect the IM to have all the relevant information but the IM issued on 7 Oct 2021 provides information from (unaudited?) accounts of period to 31 Dec 2020

EABL has released updated information in its Annual Report of Year ended 30 June 2021

The IM needs updating

EABL has released updated information in its Annual Report of Year ended 30 June 2021

The IM needs updating

14/ So whereas all seemed well with Loan/Core Capital on 31 Dec 2020, it is not the case on 30 Jun 2021.

Dec 2020 vs June 2021. The difference is this loan maturing July 2022 of Kshs 11B that Absa gave EABL.

Is this the loan that EABL is looking to retire with the MTN?

Dec 2020 vs June 2021. The difference is this loan maturing July 2022 of Kshs 11B that Absa gave EABL.

Is this the loan that EABL is looking to retire with the MTN?

15/ This now begs a few questions:

1. Where is the regulator @cbkkenya in all this given this high exposure Absa seems to have to EABL?

2. Why didn’t CMA insist on an IM with the latest information since the EABL 20/21 FY results had already been published?

1. Where is the regulator @cbkkenya in all this given this high exposure Absa seems to have to EABL?

2. Why didn’t CMA insist on an IM with the latest information since the EABL 20/21 FY results had already been published?

16/ A response from @AbsaKenya.

Still begs the question why it's Absa Kenya that is listed in the @EABL_PLC annual report as the lender.

Still begs the question why it's Absa Kenya that is listed in the @EABL_PLC annual report as the lender.

• • •

Missing some Tweet in this thread? You can try to

force a refresh