🏆 We are partnering with Oliver Kell @1charts6 to bring you an exclusive Swing Trading Masterclass.

To register and learn directly from the US Investing Champion click the link below:

traderlion.com/swing-trading-…

Here is a thread describing more about it. 🧵

To register and learn directly from the US Investing Champion click the link below:

traderlion.com/swing-trading-…

Here is a thread describing more about it. 🧵

This has been in the works for a few months now. Oliver and the team have been meeting regularly to outline the webinars and build digital workbooks which you will be able to print and use to mark up charts in real-time with Oliver.

Each session will be held as a Zoom Webinar and will include a QnA session with Oliver.

They will be recorded and you will have lifetime access, so you will be able to watch them over and over to cement the concepts.

They will be recorded and you will have lifetime access, so you will be able to watch them over and over to cement the concepts.

The sessions will be hosted by @RichardMoglen who will be moderating and selecting key questions.

Oliver will be sure to address those after presenting the material to make sure you come out of each session with a clear picture of his process.

Oliver will be sure to address those after presenting the material to make sure you come out of each session with a clear picture of his process.

The length of each session will be dependent on the topics covered but we are shooting for at least an hour and a half and most likely over 2 hours including QnA.

Session 1: Market Cycle Mastery 🏆

The focus of this session is to help you interpret the market conditions and identify where we are within the price cycle.

The focus of this session is to help you interpret the market conditions and identify where we are within the price cycle.

We will be going through extensive examples to show you how Oliver stays in tune with the market and alters his trading style depending on the stage we are in.

Session 2: Finding True Market Leaders 📈

In this live session, Oliver will be going through his process of stock selection and explaining how he narrows down his focus lists to find true market leaders.

In this live session, Oliver will be going through his process of stock selection and explaining how he narrows down his focus lists to find true market leaders.

By focusing on only the best possible setups and concentrating on those opportunities, you have the highest chance of outperforming.

Session 3: Superperformance Setups 🦸

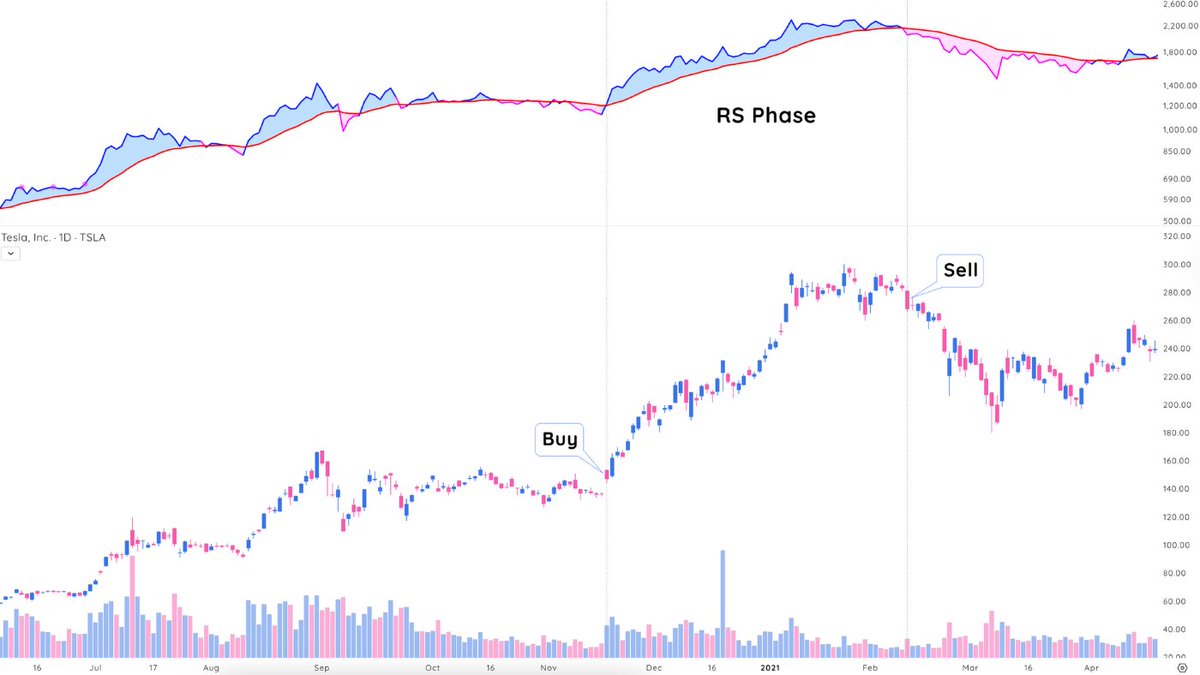

Once you have identified the true market leaders, it’s all about position management and finding low-risk setups. Oliver will be sharing nuanced strategies including multi-timeframe analysis to show how he enters and exits positions.

Once you have identified the true market leaders, it’s all about position management and finding low-risk setups. Oliver will be sharing nuanced strategies including multi-timeframe analysis to show how he enters and exits positions.

Session 4: Building a Champion Mindset 🧠

Becoming a successful trader is much more than technical analysis and risk management. Oliver will be going in-depth into routines and discussing how he handles setbacks to come back stronger. This will be the most important session.

Becoming a successful trader is much more than technical analysis and risk management. Oliver will be going in-depth into routines and discussing how he handles setbacks to come back stronger. This will be the most important session.

Our goal with this masterclass is to create a timeless resource and allow you to interpret the market through Oliver's eyes.

We look forward to seeing you there!

traderlion.com/swing-trading-…

We look forward to seeing you there!

traderlion.com/swing-trading-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh