There are over 60+ upcoming IPOs over the next one month. Brief details on each company in thread🧵below.

Retweet ones you are excited about! Comment for more details.

1/n 👇

Retweet ones you are excited about! Comment for more details.

1/n 👇

1. Paradeep Phosphates

#⃣ 3rd largest private sector maker & distributor of non-urea fertilizers in India

#⃣ 2nd largest in DAP volume sales as of Mar'21

#⃣ Key brand: ‘Jai Kisaan - Navratna’

#⃣ 80.5% S/H with a JV of Zuari Agro

#⃣ Issue size: ₹ 1,255 cr

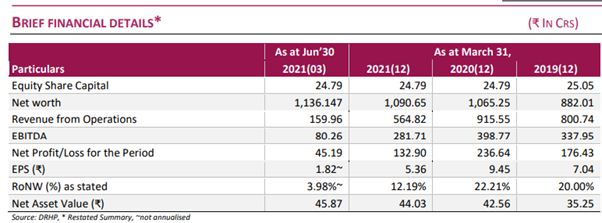

#⃣ Financials below

#⃣ 3rd largest private sector maker & distributor of non-urea fertilizers in India

#⃣ 2nd largest in DAP volume sales as of Mar'21

#⃣ Key brand: ‘Jai Kisaan - Navratna’

#⃣ 80.5% S/H with a JV of Zuari Agro

#⃣ Issue size: ₹ 1,255 cr

#⃣ Financials below

2. Northern Arc Capital

#⃣ NBFC providing loans to households & SMEs directly & indirectly via originator partners

#⃣Products: Microfinance, Affordable housing, CV finance, agri-finance, SME

#⃣ AUM: ₹ 5200 cr

#⃣ Issue size: ₹ 300 cr

#⃣ Financials below:

#⃣ NBFC providing loans to households & SMEs directly & indirectly via originator partners

#⃣Products: Microfinance, Affordable housing, CV finance, agri-finance, SME

#⃣ AUM: ₹ 5200 cr

#⃣ Issue size: ₹ 300 cr

#⃣ Financials below:

3. Chemspec Chemicals

#⃣ Speciality chemicals maker

#⃣ Products:

1. Additives used in skin & hair care products by FMCGs (among Top 2 globally)

2. APIs for anti-hypertension drugs

3. UV absorber ingredients

#⃣ Facility: Taloja, MH

#⃣ Issue: ₹ 700 cr (OFS)

#⃣ Financials below:

#⃣ Speciality chemicals maker

#⃣ Products:

1. Additives used in skin & hair care products by FMCGs (among Top 2 globally)

2. APIs for anti-hypertension drugs

3. UV absorber ingredients

#⃣ Facility: Taloja, MH

#⃣ Issue: ₹ 700 cr (OFS)

#⃣ Financials below:

4. Star Health & Allied Insurance

#⃣ Largest private health insurer and largest retail health insurance company in India

#⃣ Covers 2.05 cr lives via health ins. in FY21

#⃣ Retail: Group Health = 89%:11%

#⃣ GWP of ₹9,349 cr in FY21

#⃣ Investors: Westbridge, RJ

#⃣ Financials 👇

#⃣ Largest private health insurer and largest retail health insurance company in India

#⃣ Covers 2.05 cr lives via health ins. in FY21

#⃣ Retail: Group Health = 89%:11%

#⃣ GWP of ₹9,349 cr in FY21

#⃣ Investors: Westbridge, RJ

#⃣ Financials 👇

5. Ruchi Soya (FPO)

#⃣ Highlights:

1. Largest integrated palm oil refining co. in India

2. #1 in soya foods (Nutrela)

3. Acquired ‘Patanjali’ pf. of packaged foods (biscuits, noodles & cereals)

4. Entered Neutraceuticals in FY22

#⃣ Issue: ₹ 4,300 cr (FPO)

#⃣ Financials below

#⃣ Highlights:

1. Largest integrated palm oil refining co. in India

2. #1 in soya foods (Nutrela)

3. Acquired ‘Patanjali’ pf. of packaged foods (biscuits, noodles & cereals)

4. Entered Neutraceuticals in FY22

#⃣ Issue: ₹ 4,300 cr (FPO)

#⃣ Financials below

6. Nykaa

#⃣ Fastest growing beauty, personal care (BPC) and fashion products platform in India

#⃣BPC market size: ₹10 TN+ by FY25

#⃣ Inventory led model + own private label brands + omni-channel sales

#⃣ IPO size: ₹ 525 cr (QIB+HNI: 90%)

#⃣ Profitable e-com

#⃣ Financials 👇

#⃣ Fastest growing beauty, personal care (BPC) and fashion products platform in India

#⃣BPC market size: ₹10 TN+ by FY25

#⃣ Inventory led model + own private label brands + omni-channel sales

#⃣ IPO size: ₹ 525 cr (QIB+HNI: 90%)

#⃣ Profitable e-com

#⃣ Financials 👇

7. Go Air (Go First)✈️

#⃣ Fast growing ultra-low-cost carrier (ULCC)

#⃣ Gained domestic market share from 8.8% in FY18 to 10.8% in FY20

#⃣ Lower cost structure than IndiGo

#⃣ 50 routes out of 157 are profitable

#⃣ Promoter: Wadia family

#⃣ IPO size: ₹ 3,600 cr

#⃣ Financials 👇

#⃣ Fast growing ultra-low-cost carrier (ULCC)

#⃣ Gained domestic market share from 8.8% in FY18 to 10.8% in FY20

#⃣ Lower cost structure than IndiGo

#⃣ 50 routes out of 157 are profitable

#⃣ Promoter: Wadia family

#⃣ IPO size: ₹ 3,600 cr

#⃣ Financials 👇

8. CMS Info Systems

#⃣ India’s largest cash management company

#⃣ Segments: Cash mgmt, ATM services & others

#⃣ Clients: Banks, retail & e-com (outsourced services)

#⃣ Industry (₹85 B) growth 16-17% CAGR

#⃣ IPO size: ₹ 2,000 cr OFS (Retail: 35%)

#⃣ Financials 👇

#⃣ India’s largest cash management company

#⃣ Segments: Cash mgmt, ATM services & others

#⃣ Clients: Banks, retail & e-com (outsourced services)

#⃣ Industry (₹85 B) growth 16-17% CAGR

#⃣ IPO size: ₹ 2,000 cr OFS (Retail: 35%)

#⃣ Financials 👇

9. Policy Bazaar

#⃣ India's largest online platform for insurance & lending products (Bank bazaar)

#⃣ Asset light aggregator model (match-making)

#⃣ 50% market share in Term Life processing

#⃣ Entering offline insurance

#⃣ IPO size: ₹ 6,017 cr (Fresh issue: 65%)

#⃣ Financials👇

#⃣ India's largest online platform for insurance & lending products (Bank bazaar)

#⃣ Asset light aggregator model (match-making)

#⃣ 50% market share in Term Life processing

#⃣ Entering offline insurance

#⃣ IPO size: ₹ 6,017 cr (Fresh issue: 65%)

#⃣ Financials👇

10. Fino Payments Bank

#⃣ Rural-focussed payments bank

#⃣ Segments: MicroATM, AEPS, DBT/ Remittances, CASA opening

#⃣ Asset light (does not lend)

#⃣ Revenue: Commissions of 0.5-1% per Trsn.

#⃣ FY21 Trsn.: 10.4 cr on AEPS - (121% you)

#⃣ IPO size: ₹ 300 cr

#⃣ Financials👇

#⃣ Rural-focussed payments bank

#⃣ Segments: MicroATM, AEPS, DBT/ Remittances, CASA opening

#⃣ Asset light (does not lend)

#⃣ Revenue: Commissions of 0.5-1% per Trsn.

#⃣ FY21 Trsn.: 10.4 cr on AEPS - (121% you)

#⃣ IPO size: ₹ 300 cr

#⃣ Financials👇

11. Adani Wilmar 🧂

#⃣ FMCG w. focus on kitchen commodities - edible oil, wheat flour, rice, pulses & sugar

#⃣ One of the fastest growing packaged food companies

#⃣ Other segments: Personal care, Oleochemicals

#⃣ Promoter: Adani Group

#⃣ IPO size: ₹ 4,500 cr

#⃣ Financials👇

#⃣ FMCG w. focus on kitchen commodities - edible oil, wheat flour, rice, pulses & sugar

#⃣ One of the fastest growing packaged food companies

#⃣ Other segments: Personal care, Oleochemicals

#⃣ Promoter: Adani Group

#⃣ IPO size: ₹ 4,500 cr

#⃣ Financials👇

12. Waaree Energies ☀️

#⃣ Key player in solar energy industry focused on PV module manufacturing

#⃣ Installed capacity of 2 GW

#⃣ Industry: Renewable capacity up from 31.6 GW in FY14 to 140 GW in FY21

#⃣ Has 3 mfg. facilities in Gujarat

#⃣ IPO size: ₹ 1,350 cr

#⃣ Financials👇

#⃣ Key player in solar energy industry focused on PV module manufacturing

#⃣ Installed capacity of 2 GW

#⃣ Industry: Renewable capacity up from 31.6 GW in FY14 to 140 GW in FY21

#⃣ Has 3 mfg. facilities in Gujarat

#⃣ IPO size: ₹ 1,350 cr

#⃣ Financials👇

13. Fincare Small Finance Bank

#⃣ Digital-focused SFB: MFI and SME loans

#⃣ Highest growth rate in advances in peers

(AUM CAGR of 30% b/w FY17 to FY20)

#⃣ Industry consolidation w. top 6 players

#⃣ CASA: 24%; CAR: 29.6%

#⃣ NPAs are high

#⃣ IPO size: ₹ 1,350 cr

#⃣ Financials👇

#⃣ Digital-focused SFB: MFI and SME loans

#⃣ Highest growth rate in advances in peers

(AUM CAGR of 30% b/w FY17 to FY20)

#⃣ Industry consolidation w. top 6 players

#⃣ CASA: 24%; CAR: 29.6%

#⃣ NPAs are high

#⃣ IPO size: ₹ 1,350 cr

#⃣ Financials👇

14. OYO (Oravel Stays)

#⃣ Leading budget stay and hospitality player

#⃣ Focused on reshaping short-stay accommodation

#⃣ Post Covid, count of hotel rooms on its network has declined by >50% around 530,000

#⃣ IPO size: ₹ 8,430 Cr (fresh issue: ₹ 7,000 cr)

#⃣ Financials 👇

#⃣ Leading budget stay and hospitality player

#⃣ Focused on reshaping short-stay accommodation

#⃣ Post Covid, count of hotel rooms on its network has declined by >50% around 530,000

#⃣ IPO size: ₹ 8,430 Cr (fresh issue: ₹ 7,000 cr)

#⃣ Financials 👇

15. Paytm

#⃣ India’s leading payments co. with 34 cr customers & over 2.1 cr merchants

#⃣ Business segments: Payment wallets, Payments Bank, Paytm Mall, Paytm Money, Paytm Insurance, E-com, etc

#⃣ Largest investment by Warren Buffet in India

#⃣ IPO: ₹ 16,600 cr

#⃣ Financials

#⃣ India’s leading payments co. with 34 cr customers & over 2.1 cr merchants

#⃣ Business segments: Payment wallets, Payments Bank, Paytm Mall, Paytm Money, Paytm Insurance, E-com, etc

#⃣ Largest investment by Warren Buffet in India

#⃣ IPO: ₹ 16,600 cr

#⃣ Financials

Note: Thread in progress. Balance IPOs list to be added by tomorrow.

We know these are only prelim info. Please ask your questions, share links or put your thoughts on individual names for a more detailed and fruitful discussion :)

We know these are only prelim info. Please ask your questions, share links or put your thoughts on individual names for a more detailed and fruitful discussion :)

16. Global Health Ltd

#⃣ Amongst the top multi-specialty hospitals under ‘Medanta’ brand in Delhi & Lucknow

#⃣ 4 hospitals w. ~2,600 beds (1,250 in Delhi NCR)

#⃣ Specializes in Cardiology, Neurosciences, Oncology, Ortho, liver transplant, Urology

#⃣ Issue: 500crs

#⃣ Financials

#⃣ Amongst the top multi-specialty hospitals under ‘Medanta’ brand in Delhi & Lucknow

#⃣ 4 hospitals w. ~2,600 beds (1,250 in Delhi NCR)

#⃣ Specializes in Cardiology, Neurosciences, Oncology, Ortho, liver transplant, Urology

#⃣ Issue: 500crs

#⃣ Financials

17. Veeda Clinical Research

#⃣ Leading clinical research organization

#⃣ Partnered with pharma cos. for providing solutions like bioequivalence studies and pre-clinical trials across North America, Europe & Asia

#⃣ Issue: ~700 crs (Fresh - 331)

Read: expresspharma.in/indian-cro-ind…

#⃣ Leading clinical research organization

#⃣ Partnered with pharma cos. for providing solutions like bioequivalence studies and pre-clinical trials across North America, Europe & Asia

#⃣ Issue: ~700 crs (Fresh - 331)

Read: expresspharma.in/indian-cro-ind…

18. Sahajanand Medical Tech

#⃣ Leading medical devices co. focused on vascular devices & stents

#⃣ Increasing market share in India (21% --> 31%); strong in Europe region

#⃣ Only listed player in this space is Poly Medicare

#⃣ Issue: Rs 1500 crs (Fresh: 410crs)

#⃣ Low margins

#⃣ Leading medical devices co. focused on vascular devices & stents

#⃣ Increasing market share in India (21% --> 31%); strong in Europe region

#⃣ Only listed player in this space is Poly Medicare

#⃣ Issue: Rs 1500 crs (Fresh: 410crs)

#⃣ Low margins

19. Sterlite Power Transmission

#⃣ 2 segments:

1. Infrastructure: Operate power transmission assets in India & Brazil

2. Solutions: Manufactures sub-parts like power conductors, optical ground wires

#⃣ Benefits from 100% rural electrification focus

#⃣Issue:1250 crs

#⃣Financials

#⃣ 2 segments:

1. Infrastructure: Operate power transmission assets in India & Brazil

2. Solutions: Manufactures sub-parts like power conductors, optical ground wires

#⃣ Benefits from 100% rural electrification focus

#⃣Issue:1250 crs

#⃣Financials

20. Vedant Fashion (Manyavar)

#⃣ Largest Men-Branded ethnic wear player in India in terms of revenue & profits

#⃣ Wedding wear market exp. growth at 15%-17%

#⃣ Multi-brands under 'Manyavar'; multi-channel

#⃣ Multiple celebrity brand ambassadors

#⃣ IPO size: NA

#⃣ Financials:

#⃣ Largest Men-Branded ethnic wear player in India in terms of revenue & profits

#⃣ Wedding wear market exp. growth at 15%-17%

#⃣ Multi-brands under 'Manyavar'; multi-channel

#⃣ Multiple celebrity brand ambassadors

#⃣ IPO size: NA

#⃣ Financials:

21 C.E. Info System (MapmyIndia)

#⃣ Leading mapping, data, IOT & geospatial company

#⃣ Built detailed digital maps of 7.5L Indian villages & 7,500+ cities

#⃣ Partnered with ISRO recently for satellite imagery

#⃣Industries catered: BFSI, telecom, FMCG, logistics etc

#⃣Financials

#⃣ Leading mapping, data, IOT & geospatial company

#⃣ Built detailed digital maps of 7.5L Indian villages & 7,500+ cities

#⃣ Partnered with ISRO recently for satellite imagery

#⃣Industries catered: BFSI, telecom, FMCG, logistics etc

#⃣Financials

22. MobiKwik Systems

#⃣ Key player in Indian Payments focused on:

1. Mobile wallets: Retail/SME focus; high competition

2. Buy Now pay later: fast growing segment, key growth driver

#⃣ 10 cr+ customers

#⃣ Processed payments over $1.6 BN in FY21

#⃣ Issue: 1900crs (fresh-1500cr)

#⃣ Key player in Indian Payments focused on:

1. Mobile wallets: Retail/SME focus; high competition

2. Buy Now pay later: fast growing segment, key growth driver

#⃣ 10 cr+ customers

#⃣ Processed payments over $1.6 BN in FY21

#⃣ Issue: 1900crs (fresh-1500cr)

23. Tracxn

#⃣ Leading global intelligence (SaaS) platform on start-ups/ emerging tech

#⃣ Has coverage of over 14 lakh companies across 300 Technology sub-segments & over 30 countries

#⃣ 70% revenues from outside India

Check out podcast with the founders

#⃣ Leading global intelligence (SaaS) platform on start-ups/ emerging tech

#⃣ Has coverage of over 14 lakh companies across 300 Technology sub-segments & over 30 countries

#⃣ 70% revenues from outside India

Check out podcast with the founders

24. Jana Small Finance Bank

#⃣One of top 4 SFBs

#⃣Unsecured loans: ~70% of the loan book focused on MSMEs, affordable housing & gold loans

#⃣Key metrics:

GNPA: 2.5%- 6MFY21 v/s 8.4%- FY19

CAR: 20.1%- 6MFY21 v/s 18.8%- FY19

#⃣Issue size: 700crs (Fresh)

#⃣Financials below:

#⃣One of top 4 SFBs

#⃣Unsecured loans: ~70% of the loan book focused on MSMEs, affordable housing & gold loans

#⃣Key metrics:

GNPA: 2.5%- 6MFY21 v/s 8.4%- FY19

CAR: 20.1%- 6MFY21 v/s 18.8%- FY19

#⃣Issue size: 700crs (Fresh)

#⃣Financials below:

25. Arohan Financial Services

#⃣ NBFC-MFI with a focus on low-income states

#⃣ B/w FY17-20, it grew 68% CAGR (2nd highest)

#⃣Key metrics:

1. Till FY20, GNPA was 0, in FY21- spiked to ~11%

2. Comfortable PCR

3. CAR (FY21): 24.3% v/s. 24.8% in FY20

#⃣Issue: 850cr

#⃣Financials

#⃣ NBFC-MFI with a focus on low-income states

#⃣ B/w FY17-20, it grew 68% CAGR (2nd highest)

#⃣Key metrics:

1. Till FY20, GNPA was 0, in FY21- spiked to ~11%

2. Comfortable PCR

3. CAR (FY21): 24.3% v/s. 24.8% in FY20

#⃣Issue: 850cr

#⃣Financials

26. Wellness Forever Medicare

#⃣ India’s 3rd largest omnichannel retail pharmacy

#⃣ Hybrid model of medicines & FMCG products

#⃣ Products:

1. FMCG & health

2. Nutraceuticals & Medical Equipments

3. OTC & prescription

#⃣ Issue:400crs

#⃣ Risk: E-pharmacy growth

#⃣ Financials

#⃣ India’s 3rd largest omnichannel retail pharmacy

#⃣ Hybrid model of medicines & FMCG products

#⃣ Products:

1. FMCG & health

2. Nutraceuticals & Medical Equipments

3. OTC & prescription

#⃣ Issue:400crs

#⃣ Risk: E-pharmacy growth

#⃣ Financials

27. Medplus Health Services

#⃣ 2nd largest pharmacy retailer in India (# of stores & revenue)

#⃣ First pharmacy in India to do omnichannel sales

#⃣ As per Technopak, modern pharmacy retail segment est. grow at 27% CAGR

#⃣ Risk: E-pharmacy growth

#⃣ IPO: 1,639 cr

#⃣ Financials

#⃣ 2nd largest pharmacy retailer in India (# of stores & revenue)

#⃣ First pharmacy in India to do omnichannel sales

#⃣ As per Technopak, modern pharmacy retail segment est. grow at 27% CAGR

#⃣ Risk: E-pharmacy growth

#⃣ IPO: 1,639 cr

#⃣ Financials

28. LE Travenues Technology (Ixigo)

#⃣ India’s 2nd largest OTA in terms of operating revenue & gross bookings

#⃣ Flight & rail tickets, hotels, cabs etc

#⃣ 3x growth in op. revenue between FY19 & FY21

#⃣ Industry seeing consolidation

#⃣ Issue: 1600crs (Fresh+OFS)

#⃣ Financials

#⃣ India’s 2nd largest OTA in terms of operating revenue & gross bookings

#⃣ Flight & rail tickets, hotels, cabs etc

#⃣ 3x growth in op. revenue between FY19 & FY21

#⃣ Industry seeing consolidation

#⃣ Issue: 1600crs (Fresh+OFS)

#⃣ Financials

29. Fusion Micro Finance

#⃣ MFI with focus on low-income, low penetration states (<5 MFIs)

#⃣ Key states: Bihar, UP & Odisha

#⃣ B/w FY18-21, it grew 44% CAGR (3rd highest)

#⃣ Metrics:

AUM: ~4,800 cr

GNPA (FY21): 2.8% (FY20: 1.1%)

CAR (FY21): 35%

#⃣ Issue: 600cr

#⃣ Financials:

#⃣ MFI with focus on low-income, low penetration states (<5 MFIs)

#⃣ Key states: Bihar, UP & Odisha

#⃣ B/w FY18-21, it grew 44% CAGR (3rd highest)

#⃣ Metrics:

AUM: ~4,800 cr

GNPA (FY21): 2.8% (FY20: 1.1%)

CAR (FY21): 35%

#⃣ Issue: 600cr

#⃣ Financials:

If you have come this far and found this helpful, please subscribe for our weekly update at multipie.co

You will also get added to our app waitlist.

You will also get added to our app waitlist.

• • •

Missing some Tweet in this thread? You can try to

force a refresh