We have not researched a stock on the TL in a very long time. I am back now. Class is back in session📚

We will take a JSE favourite who has been knocked by the pandemic. We all respect them for what they do for Vitality of their members.

Let's dig much deeper into DISCOVERY📚

We will take a JSE favourite who has been knocked by the pandemic. We all respect them for what they do for Vitality of their members.

Let's dig much deeper into DISCOVERY📚

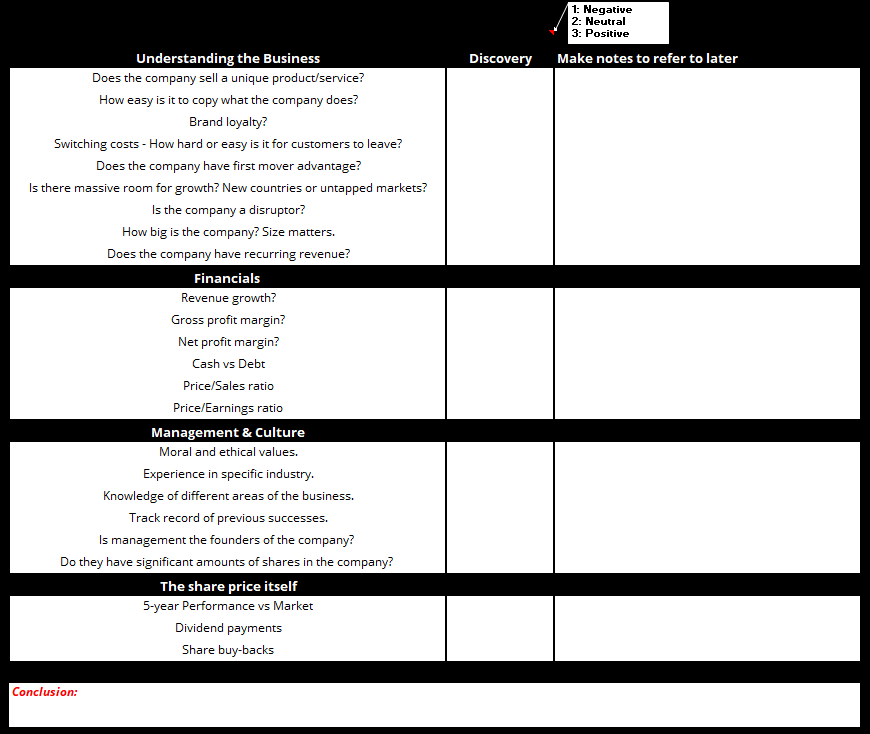

I am going to use the sheet to guide me, as always.

Time allocation, whether it takes you a week or 30mins:

75% - Understanding the Business

15% - Financials

9% - Management & Culture

1% - The share price itself

Time allocation, whether it takes you a week or 30mins:

75% - Understanding the Business

15% - Financials

9% - Management & Culture

1% - The share price itself

The person who can tell me something about Discovery that I never knew (coz they dug that deep), wins a R250 @EasyEquities voucher on Friday

Disclaimer: You do not have to invest it into Discovery😂

Start digging

Disclaimer: You do not have to invest it into Discovery😂

Start digging

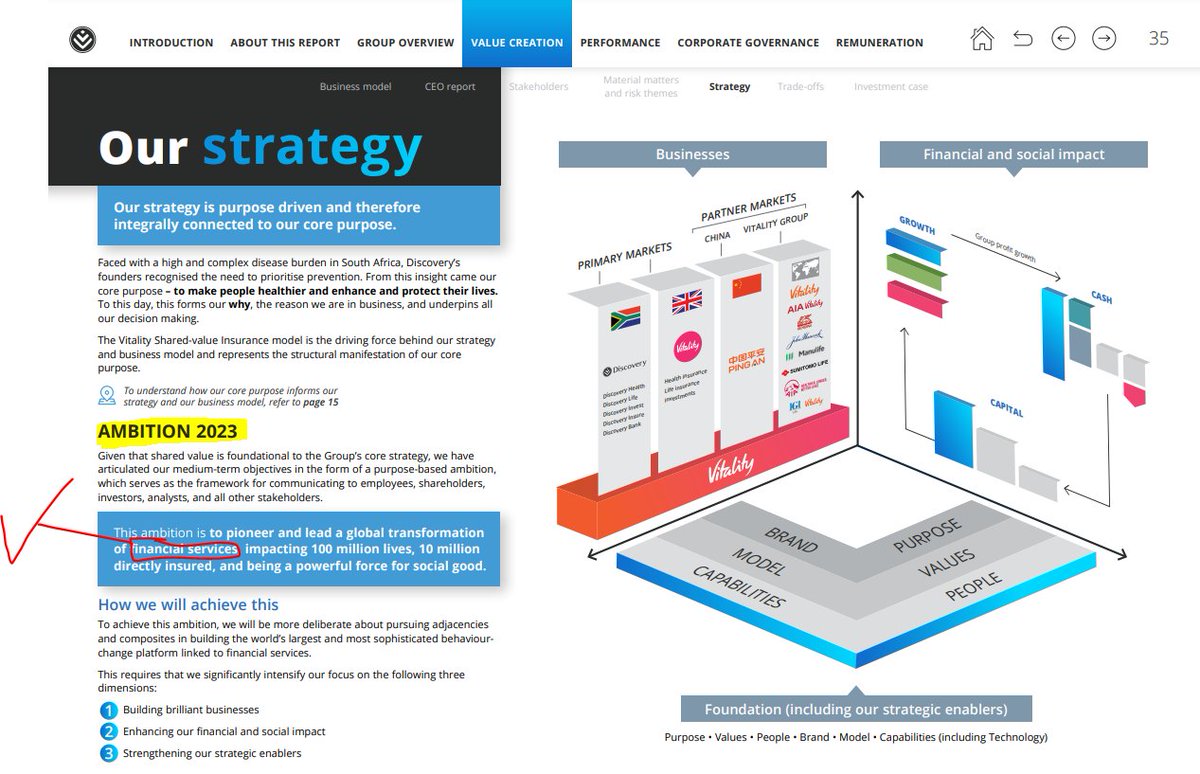

@EasyEquities Coz I love you guys...I want you to dig into the blue and red...

We all know Covid killed the "Established businesses".

With Adrian Gore, the magic happens in with:

"Emerging businesses" (blue)

"Where he is spending billions" (red)

That commentary is "hint-hint"

We all know Covid killed the "Established businesses".

With Adrian Gore, the magic happens in with:

"Emerging businesses" (blue)

"Where he is spending billions" (red)

That commentary is "hint-hint"

China has over 1 billion people. Whenever a SA company slowly starts building positions in China, I take notice📚

When Discovery started reporting on Discovery Bank a few years ago, those red circled read "(excluding Discovery Bank)"🤯

Sometimes you need to learn to read between the lines in what companies are NOT saying

📚📚📚

Sometimes you need to learn to read between the lines in what companies are NOT saying

📚📚📚

From the entire 121 pages of the Discovery Annual report, this page sums it all up

Discovery aims to be the leading financial services provider impacting 100 million lives. I always look at where companies are going...NOT where they have been📚

Will unpack the risks tomorrow❗️

Discovery aims to be the leading financial services provider impacting 100 million lives. I always look at where companies are going...NOT where they have been📚

Will unpack the risks tomorrow❗️

Today, I wanna unpack the risks related to Discovery and also look at the valuation

Discovery currently captures approximately 32% of the retail-affluent segment of the SA market. That is a huge market share, so exactly where will future growth come from?

Peak at competitors👀

Discovery currently captures approximately 32% of the retail-affluent segment of the SA market. That is a huge market share, so exactly where will future growth come from?

Peak at competitors👀

According to owler.com $DSY has revenue of $2.5bn, $OMU 1st with $10bn. $OMU however plays in only certain $DSY sectors and is also 150 years older. We can't compare the two outright.

I compared $DSY to its immediate competitors, which are "tiny" medical aids

I compared $DSY to its immediate competitors, which are "tiny" medical aids

• • •

Missing some Tweet in this thread? You can try to

force a refresh