Put some elbow grease into this one, here is an updated thread on how I personally use @unusual_whales to help me find quality intraday set ups (WITH AN EXAMPLE).

Make sure to follow @snorlax_support for any support related questions you may have.

Let's get into it.

Make sure to follow @snorlax_support for any support related questions you may have.

Let's get into it.

| Options Alerts 🚨|

Going through the options alert feed is extremely helpful to see what kind of unusual activity the 🐳may be picking up.

My Emoji Filters (Deselect all first):

Select:

- Ask Side

- Intraday

- Intraday/Week

Deselect:

Block:

- Bid Side

- Leap

- Index

Going through the options alert feed is extremely helpful to see what kind of unusual activity the 🐳may be picking up.

My Emoji Filters (Deselect all first):

Select:

- Ask Side

- Intraday

- Intraday/Week

Deselect:

Block:

- Bid Side

- Leap

- Index

| Options Alerts 🚨| - EXAMPLE

As we look through today's alerts, we see one fire for $AFRM $145 C 10/15 - Underlying: $137.31

We have:

OTM ☑️

Weekly ☑️

High OI ☑️

High Volume ☑️

These are all important because it shows short-term urgency as well as volume hitting early

As we look through today's alerts, we see one fire for $AFRM $145 C 10/15 - Underlying: $137.31

We have:

OTM ☑️

Weekly ☑️

High OI ☑️

High Volume ☑️

These are all important because it shows short-term urgency as well as volume hitting early

| The Live Flow 🌊 |

The live flow is one of the most important tools @unusual_whales has to offer. It shows you real time options activity as its coming through.

I like to tweak the filters so we only see the flow that matters to us.

You can search your ticker, or multiple

The live flow is one of the most important tools @unusual_whales has to offer. It shows you real time options activity as its coming through.

I like to tweak the filters so we only see the flow that matters to us.

You can search your ticker, or multiple

| The Live Flow 🌊 | Pt. 2

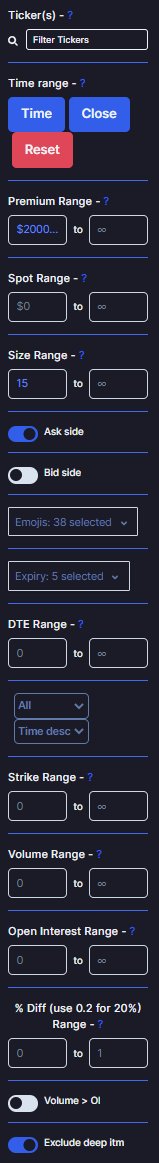

Filter Settings:

- Premium Range: Min $25K

- Ask Only selected

Emojis (Deselect all):

Select:

- Ask Side

- Intraday

- Intraday/Week

Block:

- Bid Side

- Leap

- Index

Expiry:

Nearest 5 Dates

Toggle:

Exclude deep ITM

OTM only

Filter Settings:

- Premium Range: Min $25K

- Ask Only selected

Emojis (Deselect all):

Select:

- Ask Side

- Intraday

- Intraday/Week

Block:

- Bid Side

- Leap

- Index

Expiry:

Nearest 5 Dates

Toggle:

Exclude deep ITM

OTM only

| The Live Flow 🌊 | - EXAMPLE

When we search our ticker $AFRM we pull up only it's flow.

The alert fired at 9:07am so we will check flow up until then.

As you can see the flow was incredibly bullish, all targeting OTM strikes

Chart had a 4 point move post alert

When we search our ticker $AFRM we pull up only it's flow.

The alert fired at 9:07am so we will check flow up until then.

As you can see the flow was incredibly bullish, all targeting OTM strikes

Chart had a 4 point move post alert

| Historical Flow 📜|

I use the Historical flow page for one main feature, the historical table.

One thing I love to see here is table divergence with current price action... What does this mean?

I want to see a drastic change in P/C ratio with little change in the underlying

I use the Historical flow page for one main feature, the historical table.

One thing I love to see here is table divergence with current price action... What does this mean?

I want to see a drastic change in P/C ratio with little change in the underlying

| Historical Flow 📜| Pt. 2

If im looking for next-day plays, I really like a play who's underlying stays fairly stable, but who's P/C ratio drops by roughly 1/2.

This shows drastic change in the sentiment on the ticker PRIOR to a move (Usually)

If im looking for next-day plays, I really like a play who's underlying stays fairly stable, but who's P/C ratio drops by roughly 1/2.

This shows drastic change in the sentiment on the ticker PRIOR to a move (Usually)

| Historical Flow 📜| - Example

$OPAD Fri Sep 3rd - P/C ratio: 0.45

$OPAD Tue Sep 7th - P/C ratio: 0.09

Next few days we saw price run from $9.80 - $15.86

$OPAD Fri Sep 3rd - P/C ratio: 0.45

$OPAD Tue Sep 7th - P/C ratio: 0.09

Next few days we saw price run from $9.80 - $15.86

| Flow Levels 🎚️ |

The way I analyze the flow levels is pretty simple, I look for the peaks.

For all of them (1K, 5K, 15K, 30K) I focus on the nearest 1-3 Expiry and I check the strikes for the levels whales are targeting

The way I analyze the flow levels is pretty simple, I look for the peaks.

For all of them (1K, 5K, 15K, 30K) I focus on the nearest 1-3 Expiry and I check the strikes for the levels whales are targeting

| Flow Levels 🎚️ | Pt. 2

10/15 expiry we can see the 1K is slightly bullish, 5K roughly even, 15K and 30K bullish (big dogs wanna eat).

Where can the price run to?

Strikes targeted: $12.5, $15, $17.5, $20

10/15 expiry we can see the 1K is slightly bullish, 5K roughly even, 15K and 30K bullish (big dogs wanna eat).

Where can the price run to?

Strikes targeted: $12.5, $15, $17.5, $20

| Intraday Analyst🔍 |

One of my favorite aspects of UW.

Here you see tons of information like Darkpool volume, Biggest options trades, Specific options chains with OI and Volume, price targets, latest news, and most active chains

One of my favorite aspects of UW.

Here you see tons of information like Darkpool volume, Biggest options trades, Specific options chains with OI and Volume, price targets, latest news, and most active chains

| Intraday Analyst🔍 | Pt. 2

The biggest options trades table can give you a very good idea of which direction the whales want the underlying to move.

The most active chains can help you make a choice for picking your contracts by showing you which is favored by the majority

The biggest options trades table can give you a very good idea of which direction the whales want the underlying to move.

The most active chains can help you make a choice for picking your contracts by showing you which is favored by the majority

I hope this thread provided some clarity on the way that I use UW, my favorite aspects of the tools that I like, and potentially how you can use them as a part of your trading day!

Good luck and happy whale hunting!

Shout out to @unusual_whales @snorlax_support

Good luck and happy whale hunting!

Shout out to @unusual_whales @snorlax_support

• • •

Missing some Tweet in this thread? You can try to

force a refresh