Starting the Beginner’s Pathway thread for Fundamental Investing.

One Chadarmod on timeline posted that I’m giving gyan without having experience or expertise.

So I’ll begin with paying my portfolio performance tribute to these charlies.

One Chadarmod on timeline posted that I’m giving gyan without having experience or expertise.

So I’ll begin with paying my portfolio performance tribute to these charlies.

https://twitter.com/dillikibiili/status/1445250851744796673?s=21https://t.co/ml7rsnrfJP

Fundamentals based investing can generate serious wealth as the most famous (rather infamous) Warren Buffett has shown.

In India also we have many success stories like @VijayKedia1 @Raamdeo R K Damani Rakesh Jhunjhunwala Late Chandrakant Sampat and many many more....

In India also we have many success stories like @VijayKedia1 @Raamdeo R K Damani Rakesh Jhunjhunwala Late Chandrakant Sampat and many many more....

Though I can't stop mentioning that both Rakesh Jhunjhunwala and R K Damani were traders in their initial days.

Rakesh Jhunjhunwala still trades, he once said Traing is fun, its le fatafat, de fatafat

timesnownews.com/business-econo…

Rakesh Jhunjhunwala still trades, he once said Traing is fun, its le fatafat, de fatafat

timesnownews.com/business-econo…

A lot of people (specially the beginners) buy stocks based on some friend's recommendation : XYZ le le, pukka chalega, maine bhi le rakha hai.

Few might have made money this way, but most do not. Why ?

There has to be a process.

Few might have made money this way, but most do not. Why ?

There has to be a process.

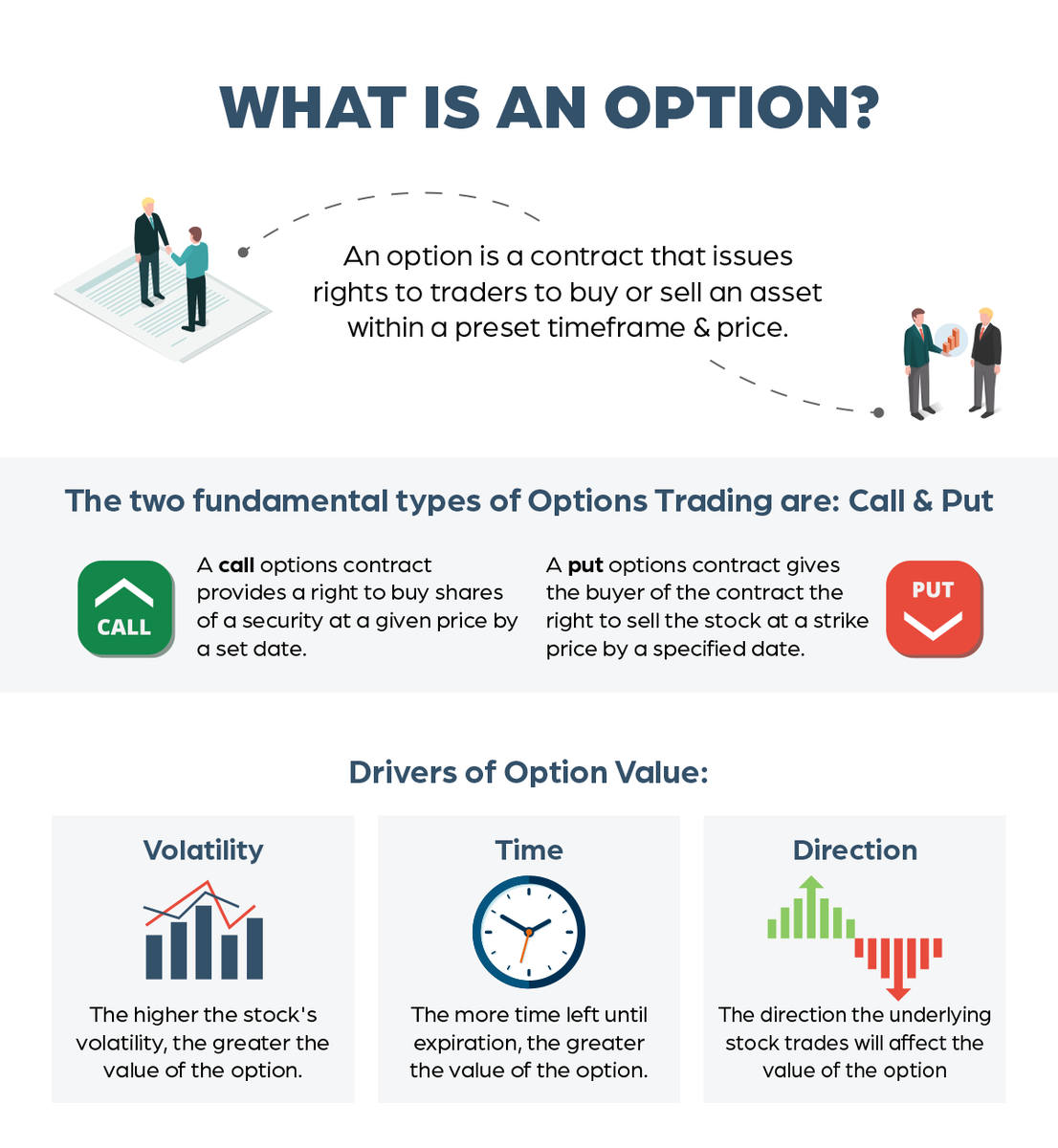

Fundamentals based investing need thorough analysis of the Business & Company.

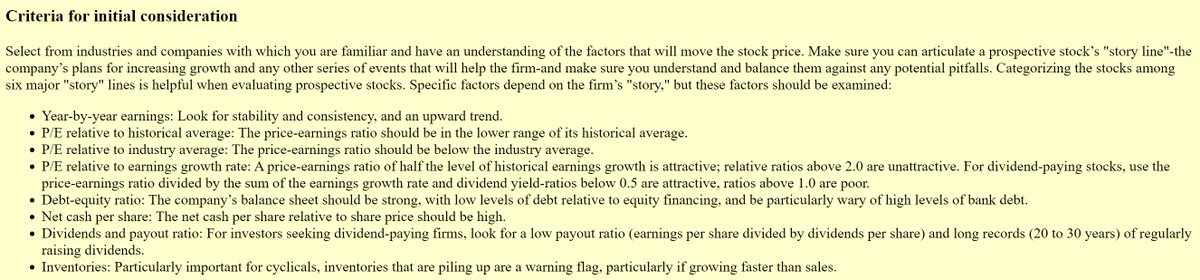

Here is a preliminary checklist by the legendary investor Peter lynch

Here is a preliminary checklist by the legendary investor Peter lynch

What Peter lynch advised to avoid:

Hot stocks in hot industries.

Small firms) with too big plans

Profitable companies engaged in diversifying acquisitions. Lynch terms these "diworseifications."

Companies in which one customer accounts for 25% to 50% of their sales.

Hot stocks in hot industries.

Small firms) with too big plans

Profitable companies engaged in diversifying acquisitions. Lynch terms these "diworseifications."

Companies in which one customer accounts for 25% to 50% of their sales.

After we identify industry and companies to analyze further, we need to do valuation which is very tough work.

Here is a very good example of how can we analyze a company.

fundooprofessor.wordpress.com/2011/04/24/van…

Here is a very good example of how can we analyze a company.

fundooprofessor.wordpress.com/2011/04/24/van…

Another very good example of how to analyse a company from the same Fundoo Professor @Sanjay__Bakshi

dropbox.com/s/u4t57djk10e8…

dropbox.com/s/u4t57djk10e8…

As investors, we have to think as owners and not just a person buying a piece of stock.

safalniveshak.com/market-caps-no…

safalniveshak.com/market-caps-no…

There are so many parameters to judge a company, that it may look daunting to some people. if there has to be one simple thing what would it be ?

Answer is ROCE

capitalmind.in/2018/07/guest-…

Answer is ROCE

capitalmind.in/2018/07/guest-…

Today one friend asked in tweet that many companies do not pay dividend and keep investing for expanding business.

Such companies can be very good companies tif they can generate more than their cost of capital by doing this.

capitalmind.in/2018/05/fundas…

Such companies can be very good companies tif they can generate more than their cost of capital by doing this.

capitalmind.in/2018/05/fundas…

Many companies show accounting profits but actually the cash is king.

capitalmind.in/2018/04/fundas…

capitalmind.in/2018/04/fundas…

When the current bull market started by bouncing from the March lows, many people missed the bus.

This inevitably happens, because people were talking about the rally not sustaining and Nifty going to 5000

😆

Many emptied their portfolio at 12000 and other such levels

This inevitably happens, because people were talking about the rally not sustaining and Nifty going to 5000

😆

Many emptied their portfolio at 12000 and other such levels

There is one very good tool Screener for screening various companies for further analysis

screener.in/screens/97687/…

screener.in/screens/97687/…

Another highly recommended resource for value investing is forum.valuepickr.com

The quality of content is top notch.

The quality of content is top notch.

Here is another free resource for stocks analysis

There are really some helpful guys out there 🙏

intrinsicvalueinvest.wordpress.com/2021/01/03/exc…

There are really some helpful guys out there 🙏

intrinsicvalueinvest.wordpress.com/2021/01/03/exc…

Here are gold nuggests of investing wisdom of @Atulsingh_asan

Thanks @ar_inamke for compiling these.

twitter.com/compose/tweet

Thanks @ar_inamke for compiling these.

twitter.com/compose/tweet

A very good resource recommended for all. Yo wont find this content anywhere else, because it has come from the real life experience and not from text books.

finkarma.in

Thanks @kach0289 bhai for making your knowledge accessible to all in such simple language.

finkarma.in

Thanks @kach0289 bhai for making your knowledge accessible to all in such simple language.

I have had my share of multibaggers (and multibeggars too 😆)

The crux of fundamental investing is buy good companies at reasonable prices (GARP) and not to go for Buy at Any Price (BAAP). Then wait for long....

safalniveshak.com/shut-up-and-wa…

The crux of fundamental investing is buy good companies at reasonable prices (GARP) and not to go for Buy at Any Price (BAAP). Then wait for long....

safalniveshak.com/shut-up-and-wa…

Most people can't wait and that's what doesn't let them enjoy the fruits of Value investing.

They stop the compounding, when its about to kick in.

wealthydiligence.com/best-investors…

They stop the compounding, when its about to kick in.

wealthydiligence.com/best-investors…

I conclude this fundamental investing thread with these wise words from my Fauzi friend @AnkurJayakar who is an expert in people/personality assessment also.

https://twitter.com/AnkurJayakar/status/1443619496413962246?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh