Let’s talk about something highly innovative, yet still controversial to many people.

𝘚𝘵𝘢𝘣𝘭𝘦𝘤𝘰𝘪𝘯𝘴…

𝘚𝘵𝘢𝘣𝘭𝘦𝘤𝘰𝘪𝘯𝘴…

What are stablecoins?

These are digital assets represented as tokens on a blockchain, usually Ethereum, that are made to minimize volatility.

They are often pegged to other fiat currencies, and backed by reserve assets.

However there are now many more iterations of this…

These are digital assets represented as tokens on a blockchain, usually Ethereum, that are made to minimize volatility.

They are often pegged to other fiat currencies, and backed by reserve assets.

However there are now many more iterations of this…

You may be familiar with the term thanks to Gary Gensler, who recently compared them to “poker chips” at the casino

but what he failed to acknowledge were the undeniable, strong use cases for these digital tokens on the blockchain

(this isn’t the first time he’s been confused)

but what he failed to acknowledge were the undeniable, strong use cases for these digital tokens on the blockchain

(this isn’t the first time he’s been confused)

https://twitter.com/CroissantEth/status/1443248647852990470

In fact, these “poker chips” have grown from just a $20B valuation at the start of 2021, all the way to a market capitalization of $120B+ at the time of this writing

This growth was the result of their programmability and wide range of use

The ignorance shown here is astounding

This growth was the result of their programmability and wide range of use

The ignorance shown here is astounding

So… what makes stablecoins so special?

To understand this we have to take a look at a problem that we see all too often in the financial market:

Lack of yield.

The average savings account in the United States is now paying 0.06% APY

At 5.3% CPI, you’re losing money by saving

To understand this we have to take a look at a problem that we see all too often in the financial market:

Lack of yield.

The average savings account in the United States is now paying 0.06% APY

At 5.3% CPI, you’re losing money by saving

On the other hand, we have areas of decentralized finance, offering users more than 10% APY on several pools for stable coins.

The yields can get even higher, with riskier routes.

Leading us to wonder, why is there such a discrepancy between tradfi and DeFi yield?

The yields can get even higher, with riskier routes.

Leading us to wonder, why is there such a discrepancy between tradfi and DeFi yield?

The simple answer comes down to matters of programmability, which I will explain a bit more…

These DeFi protocols aren’t simply printing free money, with unrealistic yields.

For example, Yearn’s $USDC vault offers a strong 7% APY.

How?

These DeFi protocols aren’t simply printing free money, with unrealistic yields.

For example, Yearn’s $USDC vault offers a strong 7% APY.

How?

The vault has strategies approved by governance, with a flow that looks something like this:

->deposit $USDC

->supplies $USDC to Compound

->gets flashloan from $DYDX to boost APY

->earned $COMP gets harvested + sold for $USDC and invested back into vault

pretty cool, right?

->deposit $USDC

->supplies $USDC to Compound

->gets flashloan from $DYDX to boost APY

->earned $COMP gets harvested + sold for $USDC and invested back into vault

pretty cool, right?

Then there’s also other strategies which combine fundamentals of other DeFi applications to increase demand.

The Yearn $USDC vault lends tokens to Alpha Homora to generate yield, which is then borrowed by users to perform leveraged yield farming on their platform.

The Yearn $USDC vault lends tokens to Alpha Homora to generate yield, which is then borrowed by users to perform leveraged yield farming on their platform.

If we then wanted to go even further, we could then take a look at magic internet money.

The protocol allows these types of yield bearing interest tokens to be deposited as collateral to borrow a stablecoin called $MIM

Possibilities are endless on this open network.

The protocol allows these types of yield bearing interest tokens to be deposited as collateral to borrow a stablecoin called $MIM

Possibilities are endless on this open network.

https://twitter.com/pastryeth/status/1447323178917941254

As you can see there are a wide range of decentralized applications being built with unique demand for stablecoins, each leveraging one another

and when you also consider the fact that we now have more than 200K tokens + 3000 dApps on Ethereum…

The demand starts to make sense.

and when you also consider the fact that we now have more than 200K tokens + 3000 dApps on Ethereum…

The demand starts to make sense.

There are many different spins and attempts of the stablecoin model, which users can choose for their own benefits.

$DAI is a stable token pegged to $1, which can be obtained by providing different types of collateral in DeFi

It is governed by $MKR, & has been live for 4 years

$DAI is a stable token pegged to $1, which can be obtained by providing different types of collateral in DeFi

It is governed by $MKR, & has been live for 4 years

Then there’s things like $USDC, which is more regulated, backed by cash equivalents and short-duration U.S. Treasuries

$USDC is the world’s fastest-growing, fully regulated dollar digital stablecoin

& if we really wanted to dig into this concept…

$USDC is the world’s fastest-growing, fully regulated dollar digital stablecoin

& if we really wanted to dig into this concept…

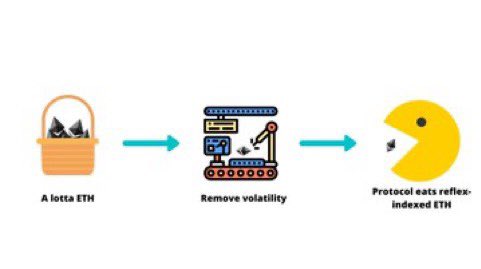

We could take a look at $RAI, made by Reflexer. The DeFi protocol has a reflex index, which “eats” the volatility of certain assets

This makes the (non-pegged) stablecoin $RAI, fully backed by pure $ETH, and the system is always over collateralized.

+ there is “ungovernance”

This makes the (non-pegged) stablecoin $RAI, fully backed by pure $ETH, and the system is always over collateralized.

+ there is “ungovernance”

https://twitter.com/CroissantEth/status/1443997493688209415

What all of these share in common are a simple premise.

Decentralized lending for anyone with an internet connection. The effects of this across the world are going to be huge.

There is no credit score, no bank with insane interest rates, no bias, or boundaries in DeFi.

Decentralized lending for anyone with an internet connection. The effects of this across the world are going to be huge.

There is no credit score, no bank with insane interest rates, no bias, or boundaries in DeFi.

With all these things considered, there is one thing I’m sure of.

These “poker chips” sure sound a lot better than Gary Gensler’s advice of saving $5 a week in college at 8% APY to have $130,000 by the time you are 65 years old.

Anyways, I hope you all enjoyed this thread! 🥐

These “poker chips” sure sound a lot better than Gary Gensler’s advice of saving $5 a week in college at 8% APY to have $130,000 by the time you are 65 years old.

Anyways, I hope you all enjoyed this thread! 🥐

https://twitter.com/garygensler/status/1440705940567719944

• • •

Missing some Tweet in this thread? You can try to

force a refresh