Thread incoming. AGs lawsuit v Google posted upon orders of court. Simply put, there is A LOT. I previously called Google "screwed" despite redactions but there are more eye poppers.

I'm starting with Facebook market rigging allegations. Congrats Sheryl Sandberg on redaction. /1

I'm starting with Facebook market rigging allegations. Congrats Sheryl Sandberg on redaction. /1

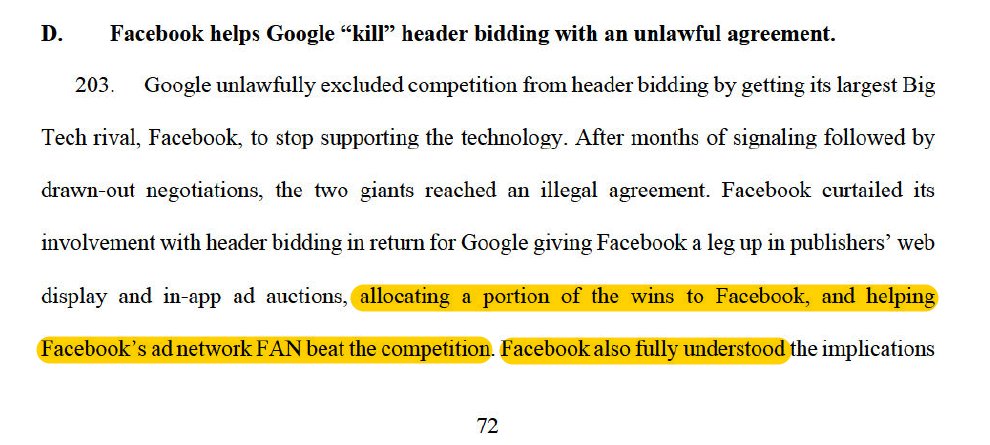

It's pretty amazing to see the actual quotes from discovery. For instance the express purpose to "kill HB." That's short for "header bidding" which was a significant threat to Google's business. /2

Header bidding was bad because it allowed publishers to bypass fees which we now learn ranged between 19-22% of revenues. Also, a bit of foreshadowing here in the removed redactions as to why Facebook was a part of the threat. /3

We now have internal email which explains the game which header bidding also risks disrupting - giving priority to Google's AdX despite it meaning less revenues for the publishers. Hello, SEC. One company can't participate all sides of market at this dominance. /4

This is why killing header bidding was the #1 priority for a top Google executive. See the new information which is now unsealed ... and just let me know if it's at all unclear. /5

According to these allegations, Google's initial way for this executive to achieve this goal involved just stopping competition, innovation and investment. "forestall major industry investment in FB..." /6

Who would be the biggest target here? Well, Facebook had announced it was entering the market. (note, there are allegations that was done for bait)... we knew this but it's helpful to see the complaint in clear text and what Facebook got in return. /7

We hadn't seen Facebook's own internal messages showing it was blatantly obvious why Google wanted this alleged quid pro quo with Facebook so they would exit the market. "They want to kill header bidding." Yeah, that's clear. /8

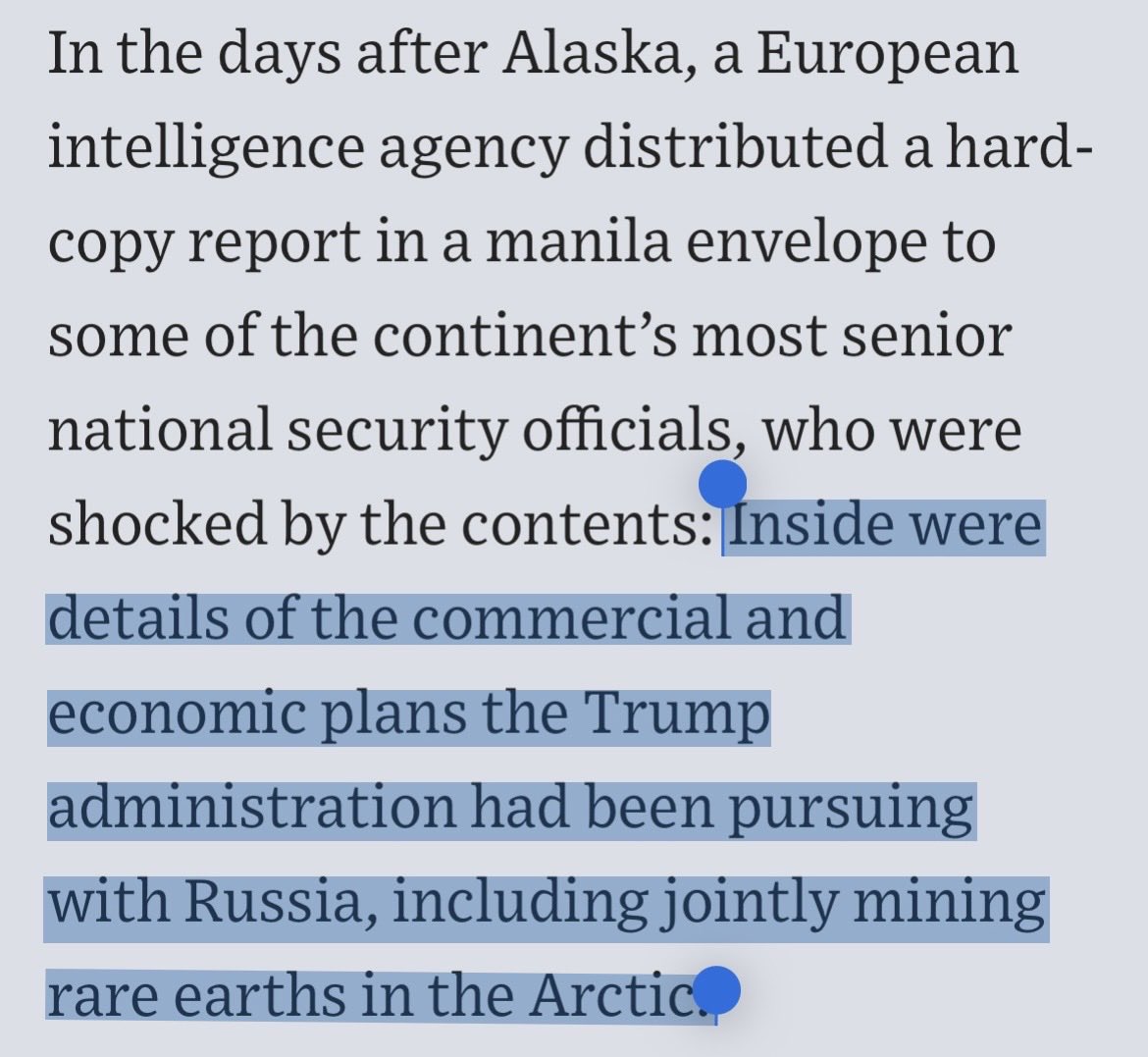

OK, into the actual agreement. A number of the terms are included as screen shots. Allegations are it involved upfront agreement on auction frequency, win rates and minimum spend plus handling regulator threats. /9

It also involved providing a bunch of help in identifying users, allegations compare some of the methods to "inside trading" in that Facebook was uniquely win certain terms to block inside info. Congrats, Dan. /10

A gag order on its lower fees which absolutely impact how auction dynamics work. When I always have called Facebook and Google a duopoly, it was my hope people would understand the two companies were taking most growth and a deal like this plays into it. /11

As you think about way real-time markets work, it's not only about pricing, too. It's about access to that data and even the effects of terms around time guarantees and thresholds. Facebook got longer time, again likely due to its market size and Google wanting to "Kill HB." /12

Just read the unsealed parts in yellow and think through the effects of a guaranteed spend, guaranteed bid participation and minimum win rate in an auction where each time you win it negatively impacts the rest of the market. /13

Here is (just some of) the previously language in the Facebook and Google allegedly illegal market rigging deal. Do you think this drew any red flags for the executives reviewing the deal? /14

I'm going to go read the rest of unsealed complaint. Here is a tease into an area which boils my blood. How various forums facilitate Google controlling and influencing the industry - in this case undermining consumer privacy - which has economic impact on the rest of market. /15

During this intermission, here is a link to my December thread on the case that was widely read. It's also here so I can go back and compare my notes. /16

https://twitter.com/jason_kint/status/1339349312694837250?s=20

OK, I'm back. This is deadly. The yellow in this section is what Google tried to keep redacted and has now been unsealed. Read it. Understand it. Much of the entire online information and monetization market flows through it. /17

It's interesting how Google execs repeat themselves on internal messages, "for clarity," while knowing this was entirely unclear to their users. ps delete WhatsApp, it's owned by Facebook. /18

I'm back. Feels like some monopoly rents. For the journalists out there, these are jobs in your newsrooms. /19

Interesting Google wanted to keep what is in yellow hidden from the public record. This "value" is as determined by Google's design influence over digital advertising. I've written about this but in a world of direct response, micro-targeted audiences, yeah, this is true. /20

More stuff Google didn't want you to see, in yellow showing how much they take from publishers. This doesn't even count the value of the data they extract by having a larger surveillance advertising biz than any other company. /21

when the monopolist fully acknowledges their business is able to collect rents only because it's a monopoly. Unbelievable. Thank you for unsealing the quotes in yellow this morning! /22

Small publishers and local newspapers are often Google's frontline of defense against privacy and other threats to its surveillance capitalism because they are so dependent on Google for monthly checks. Yet for every $100 they earn, Google is taking $47 to $66. /23

wow, we finally have a number. 75% of the ad impressions in the United States are served by Google Ad Manager according to Google's internal docs. I'm sure the fact they also own the dominant browser, search engine, buying platforms is irrelevant. /25

so a publisher has to pay 10% of gross revenues for any impressions they want to route outside of Google's monopoly supply chain. that 10% is A LOT of newsroom jobs. /26

Not much of a secret to anyone who has switched ad servers... but unsealed in yellow suggests internal Google docs confirm that switching costs are high. ps @vestager this explains why almost no publishers jumped ship when Google abused GDPR. /27

prices go down, demand goes up. do I have that right? I've even heard of a non-profit exchange that can't compete against Google because of this. /29

If yellow now unsealed is in Google's own writing, it seems like pretty clear foreclosure of the market by tying together with its marketplace dominance. /30

woah. a lot of redactions now unsealed when you get to the section on the 'gTrade' team. this is quant r&d to manipulate the market that funds most of the internet. WTF. No wonder Google wanted it redacted. /31

We're not at the "Project Bernanke" part of the program. We learned about this in Google's response when they screwed up their redactions but it's interesting to see the full complaint. Nice Google included the photo in this ill-advised project name. /32

for those not watching closely, the allegations are that this Bernanke program involved special access to advertisers' bidding history across the net to helped them minimize purchase prices... that publishers didn't know about... /33

You could do an entire masters class on how this impacts publishing. I had never heard them use the term, "cookie concentration," but just know ultimately it steers the news and entertainment market to click baiting to create valuable cookies which Google can skim with milk. /33

Missed this the first time as it was entirely redacted. In Google's goal to kill the competitive threat of header bidding, employees acknowledged pricing at $0 to win the market still wouldn't be effective as it wouldn't kill it and that was the core problem. /34

wow again. the unsealed quotes from internal google documents really put the evidence into the real-world. "if imposing limits pushes them [publishers] more to Jedi - then we should keep those limits in place." /36

Those who track the Facebook "Oversight Board" will get a kick out of the line unsealed this morning in yellow. Sheryl Sandberg is ex-Google, I wonder if this is in the Silicon Valley monopoly playbook? /37

oh good grief. it was in their own emails...

"[b]y charging non-transparently on both sides, we give ourselves some flexibility to react and counteract market changes. If we face tons of pricing pressure on the buy-side, we can fall back on the sell-side, and vice-versa.” /38

"[b]y charging non-transparently on both sides, we give ourselves some flexibility to react and counteract market changes. If we face tons of pricing pressure on the buy-side, we can fall back on the sell-side, and vice-versa.” /38

Sorry, phone keeps ringing. I did a double-take on this one. How in the &*^%$% is Facebook allegedly telling Google to not allow publishers (you know, the news and entertainment companies) to set price floors for their inventory in auctions??? How much $ did that shift? /39

Just when Google thought I was done, here is #40 as the court has unsealed the line alleging how YouTube was leveraged to move the market towards Google's video buying technology. /40

• • •

Missing some Tweet in this thread? You can try to

force a refresh