An *enormous thread* on alleged @Google @Facebook collusion based on the just-released *unredacted* complaint from the Texas AG. First filed December.

Anything PURPLE is newly unredacted.

Yellow/Orange is just normal highlights.

1/?

Anything PURPLE is newly unredacted.

Yellow/Orange is just normal highlights.

1/?

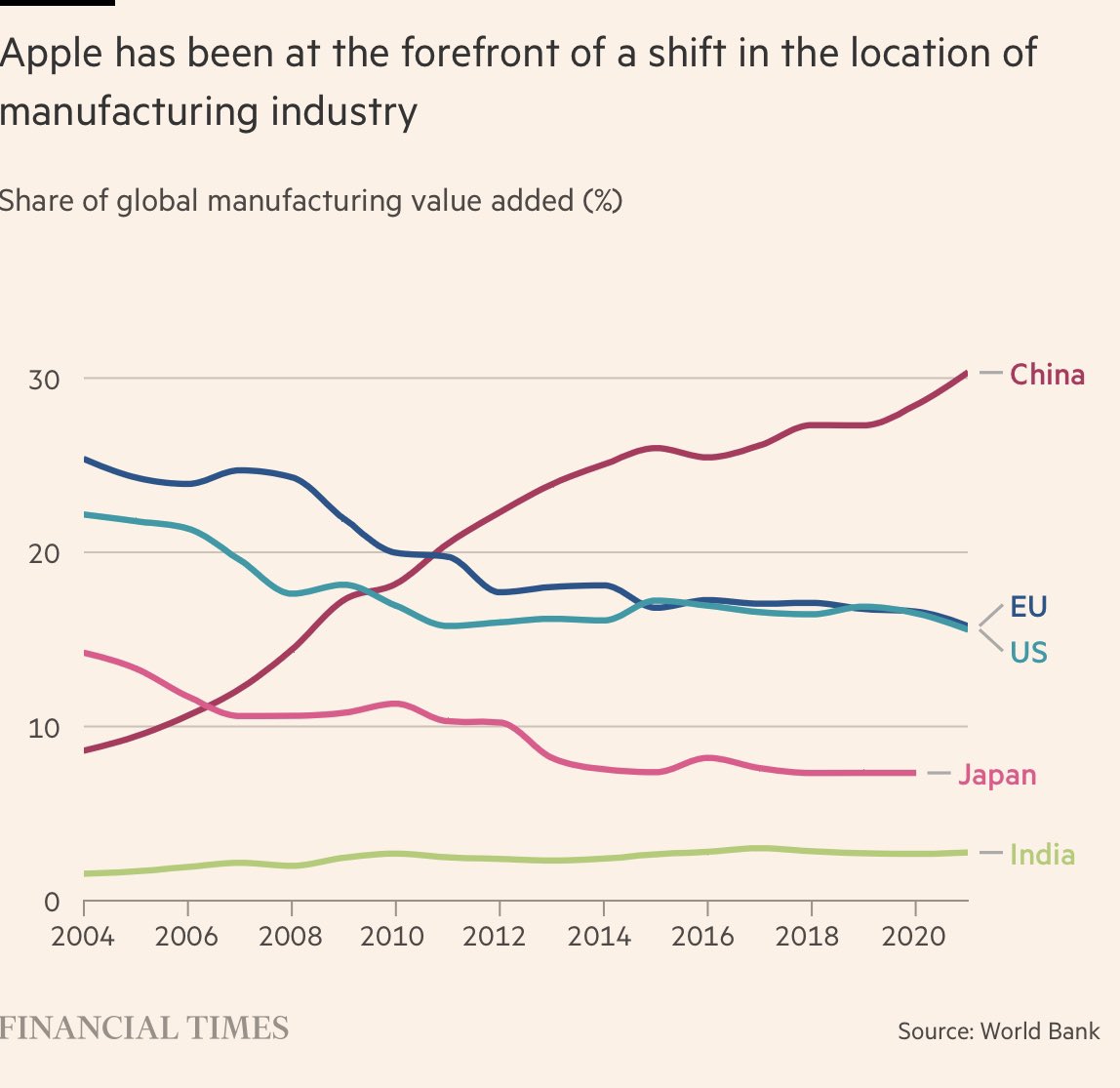

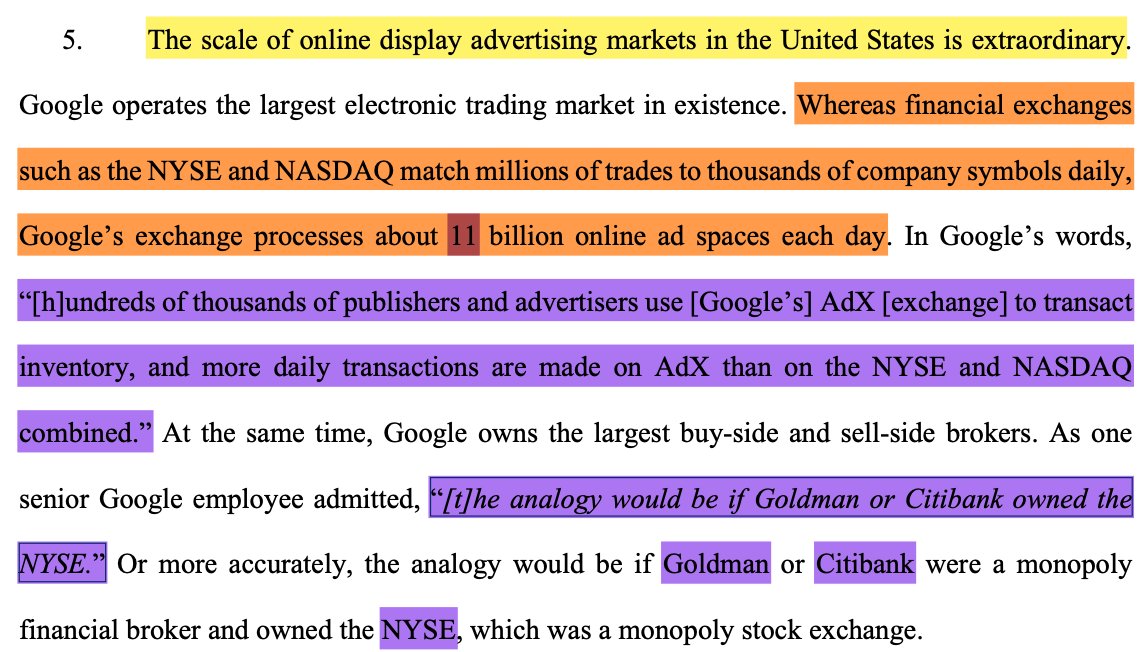

Online advertising is enormous. Google's Exchange process processes 11bn online ad spaces / day.

Google says "more daily transactions are made on AdX than on the NYSE and NASDAQ combined."

Google says "more daily transactions are made on AdX than on the NYSE and NASDAQ combined."

Google also owns the largest buy-side and sell-side brokers. "It is pitcher, batter, and umpire, all at the same time," says complaint.

Senior GOOG employee: “[t]he analogy would be if Goldman or Citibank owned the NYSE.”

More to the point -- if NYSE was the only stock exchange

Senior GOOG employee: “[t]he analogy would be if Goldman or Citibank owned the NYSE.”

More to the point -- if NYSE was the only stock exchange

Google started a programme Dynamic Allocation, ostensible to maximize revenue for publishers. In reality it was to "snatch publishers' best inventory at the expense of publishers' best interests," complaint alleges.

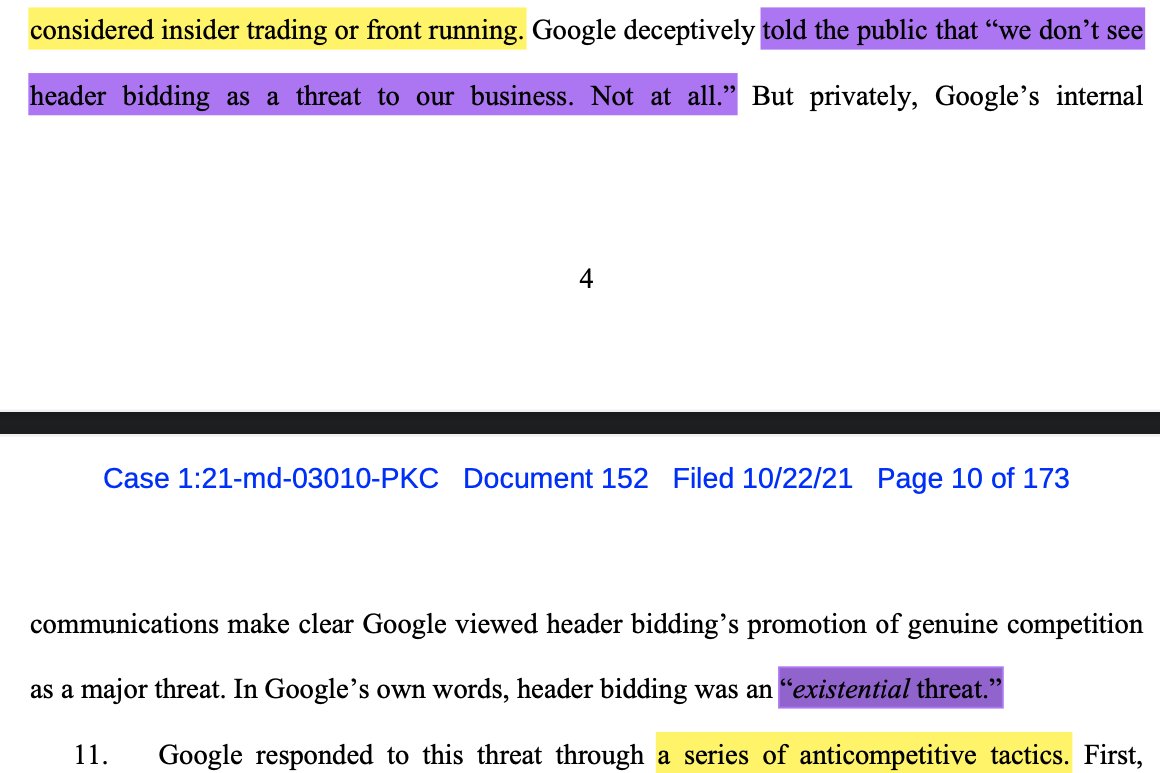

To respond, competitors came up with HEADER BIDDING: publishers could route ad inventory to multiple exchanges to solicit highest bid. By 2016, this was adopted by 70% of major US on-line publishers

GOOG to public: "Not at all" a threat to us

GOOG in private: existential threat”

GOOG to public: "Not at all" a threat to us

GOOG in private: existential threat”

Google's response - "secretly made its own exchange win, even when another exchange submitted a higher bid," complaint alleges.

The program's name: Jedi.

The program's name: Jedi.

Google's own words: Jedi program “generates suboptimal yields for publishers and *serious risks of negative media coverage if exposed externally*.”

One GOOG employee proposed **"NUCLEAR OPTION"** of cutting GOOG exchange fees down to zero.

One GOOG employee proposed **"NUCLEAR OPTION"** of cutting GOOG exchange fees down to zero.

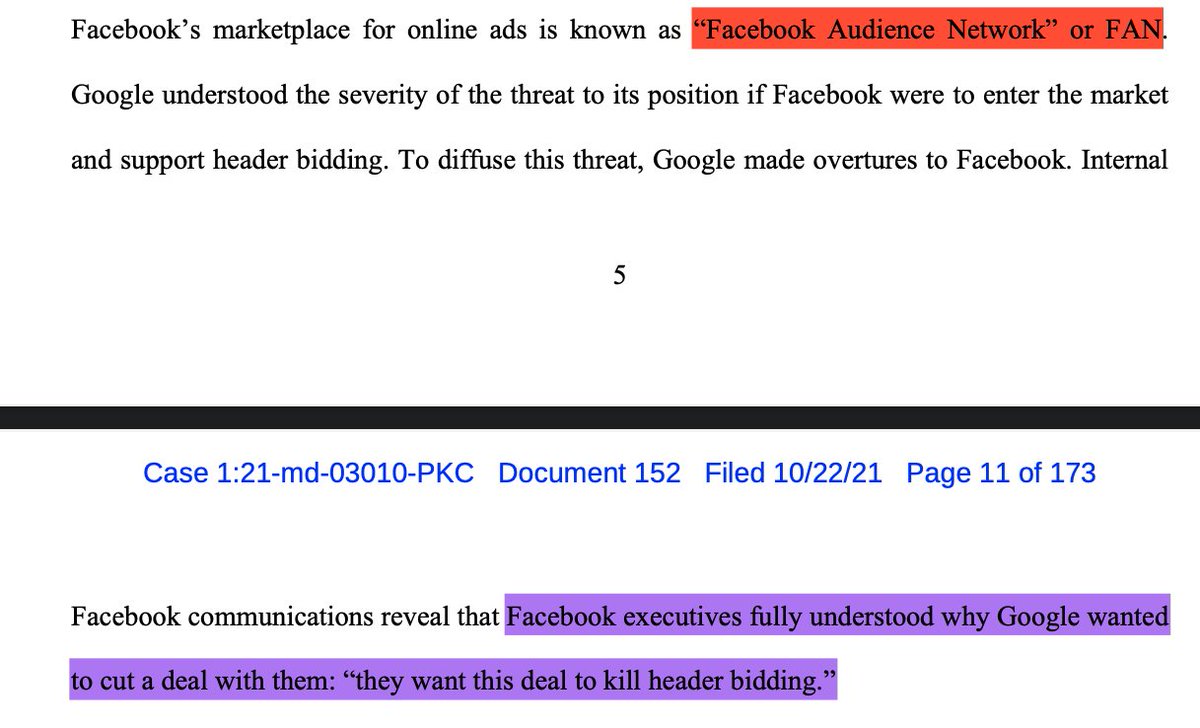

Then comes @Facebook. In March 2017 Facebook throws its weight behind header bidding. Big threat.

"Facebook communications reveal that Facebook executives fully understood why Google wanted to cut a deal with them: “they want this deal to kill header bidding.”

"Facebook communications reveal that Facebook executives fully understood why Google wanted to cut a deal with them: “they want this deal to kill header bidding.”

Google doesn't want to compete with Facebook. Says it would rather "build a moat" by collaborating instead.

Facebook anticipated this in "an 18 month head bidding strategy" -- new unredacted detail.

Facebook anticipated this in "an 18 month head bidding strategy" -- new unredacted detail.

Facebook and Google allegedly agreed on quotas for how often Facebook would win publishers's auctions -- "literally manipulating the auction with minimum spends and quotas for how often Facebook would bid and win," complaint alleges.

Google employees discussed "a Jedi mind trick" on the industry to cut off exchanges in header bidding.

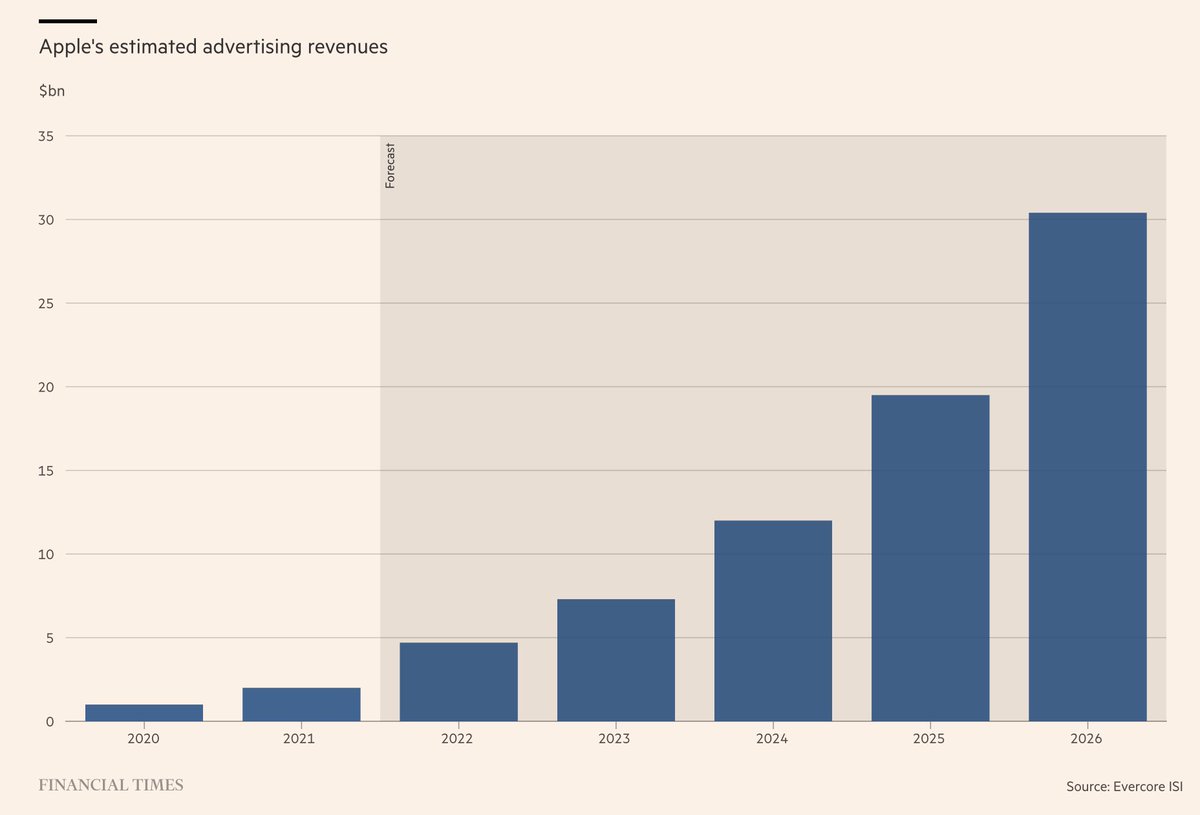

Newly unredacted "tax" figure:

"Google now uses its immense market power to extract a very high tax of 22 to 42 percent of the ad dollars otherwise flowing to the countless online publishers and content producers such as online newspapers"

"Google now uses its immense market power to extract a very high tax of 22 to 42 percent of the ad dollars otherwise flowing to the countless online publishers and content producers such as online newspapers"

Old but still juicy: Complaint alleges:

"the open internet is now threatened by a single company"

+

"Google’s current dominance is also merely a preview of its future plans"

+

"Google uses “privacy” as a pretext to conceal its true motives."

"the open internet is now threatened by a single company"

+

"Google’s current dominance is also merely a preview of its future plans"

+

"Google uses “privacy” as a pretext to conceal its true motives."

Unredacted figures:

"publishers generally make almost all (~80 percent) of their revenue from just a small portion (~20 percent) of their impressions."

"publishers generally make almost all (~80 percent) of their revenue from just a small portion (~20 percent) of their impressions."

Old, still juicy:

"Now, Google monopolizes the publisher ad server market for display inventory through its product called Google Ad Manager (GAM).

Today, GAM controls over 90 percent of this product market in the United States."

"Now, Google monopolizes the publisher ad server market for display inventory through its product called Google Ad Manager (GAM).

Today, GAM controls over 90 percent of this product market in the United States."

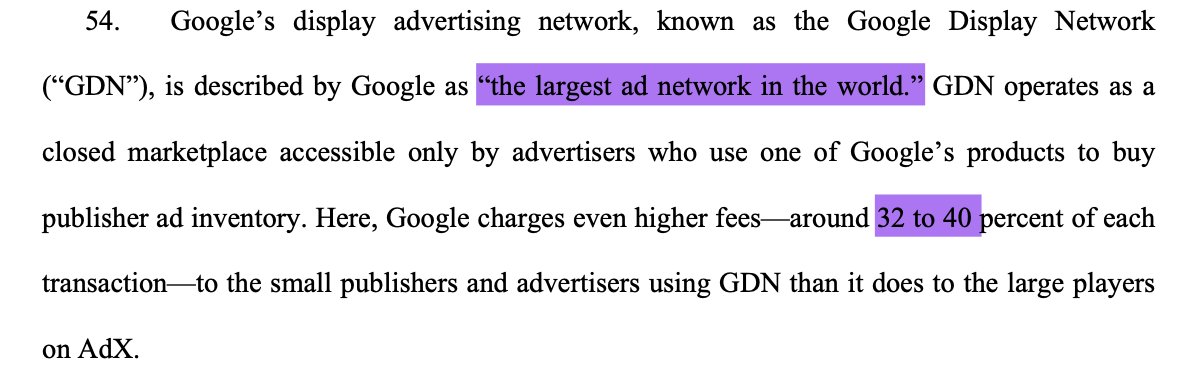

How much Google's exchange charges:

"Google’s exchange charges publishers 19 to 22 percent of exchange clearing prices, which is double to quadruple the prices of some of its nearest exchange competitors."

"exponentially higher than analogous exchange fees on a stock exchange."

"Google’s exchange charges publishers 19 to 22 percent of exchange clearing prices, which is double to quadruple the prices of some of its nearest exchange competitors."

"exponentially higher than analogous exchange fees on a stock exchange."

A Google employee conceded: an exchange shouldn't be an immensely profitable business ... (it should be) like a public good used to facilitate buyers and sellers."

"Google internal documents suggest that Google’s share of the market* is eight times larger than FAN’s.

*Market here is mobile app network market

*Market here is mobile app network market

"Google Ads" - ad buying tool for what Google calls "smaller, less sophisticated advertisers" charges 8-9% commission to purchase inventory from exchange; or 15% from Google's exchange.

Google considered “creating a completely neutral platform like the NYSE,” they ultimately chose instead to stack the deck in their favor by owning the exchange.

Google gives itself speed advantages - that's how it wins 80%+ of auctions on AdX

Google gives itself speed advantages - that's how it wins 80%+ of auctions on AdX

"GOOG's unilateral ability to extract non-competitive ad server fees demonstrates its monopoly power."

New: GOOG charges 5% of gross spend for routing inventory to non-G exchanges

Its ad server charges 10% fee of gross transactions for routing inventory to non-Google ad networks

New: GOOG charges 5% of gross spend for routing inventory to non-G exchanges

Its ad server charges 10% fee of gross transactions for routing inventory to non-Google ad networks

"Industry experts compare a change in ad servers to “switching engines in mid-flight.” Google’s internal documents confirm publishers’ high switching costs. Because switching costs are high, publishers are effectively locked in."

Google's ad exchange held 60% share of all display ad inventory sold on US exchanges by Oct 2019.

Among high-value users, its market share is "over 80%"

"Google’s closest exchange competitors typically transact a mere 4 to 5 percent of the same publishers’ exchange impressions"

Among high-value users, its market share is "over 80%"

"Google’s closest exchange competitors typically transact a mere 4 to 5 percent of the same publishers’ exchange impressions"

cc @eric_seufert @DinaSrinivasan @alexdbauer @keleftheriou @AdTechExplained @dhh @jason_kint @CoryMckane @corinnejames @antoniogm @hackingbutlegal @ashleygjovik @larakiara @thezedwards

More coming....

More coming....

re Google’s monopoly power in the display ad exchange

market and charging "supra-competitive prices"

-They are 19-22% of every trade, vs. closest competitors paying 5-15%.

And still, smaller players can't grow.

market and charging "supra-competitive prices"

-They are 19-22% of every trade, vs. closest competitors paying 5-15%.

And still, smaller players can't grow.

Good felt pressure in 2018 on its 20% fee, in 2018.

Yet: Its fee increased from 20% in 2017 to 22% in 2019.

"Google has insulated its exchange from any of the competitive market dynamics that would otherwise incentivize them to lower their prices."

Yet: Its fee increased from 20% in 2017 to 22% in 2019.

"Google has insulated its exchange from any of the competitive market dynamics that would otherwise incentivize them to lower their prices."

"When rival exchanges attempted to gain market share by lowering prices in 2017, Google’s exchange maintained or even increased prices and still increased share. Competing exchanges have not been able to meaningfully increase share, despite some cutting take rates by half"

"GDN charges high double-digit commissions of at least 32 percent on advertising transactions, which, according to public sources, is double the “standard rate” elsewhere in the industry."

Why does Google charge such high rates?

Because "we can," executive said in 2016. "Smaller pubs don't have alternative revenue sources."

Because "we can," executive said in 2016. "Smaller pubs don't have alternative revenue sources."

"Prior to Google’s anticompetitive conduct, the markets for ad exchanges and publisher ad servers were competitive...."

In 2009, when Yahoo process 9bn daily ad impressions, Google's exchange transacted fewer than 200m.

In 2009, when Yahoo process 9bn daily ad impressions, Google's exchange transacted fewer than 200m.

"GOOG monopolized the exchange and ad server markets by forcing publishers to license its ad server and trade in its exchange in order to receive bids from 1m+ advertisers

Google presentation, 2014: "AdX is the only platform with direct access to the entirety of AdWords demand."

Google presentation, 2014: "AdX is the only platform with direct access to the entirety of AdWords demand."

GOOG in 2013 document:

Google are "artificially handicapping [their] buyside [Google Ads] to boost the attractiveness of [their] sell-side (AdX). Specifically, to limit [Google Ads] to buying only on AdX, an exclusivity that makes AdX more attractive to sellers.”

Google are "artificially handicapping [their] buyside [Google Ads] to boost the attractiveness of [their] sell-side (AdX). Specifically, to limit [Google Ads] to buying only on AdX, an exclusivity that makes AdX more attractive to sellers.”

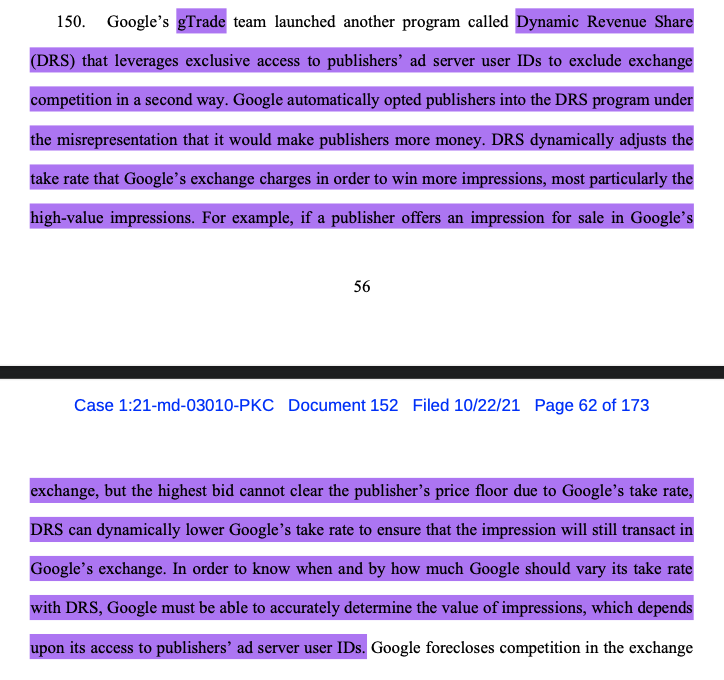

A bunch of unredacted material on Google's gTrade team relating to how it allegedly manipulates bids without disclosing:

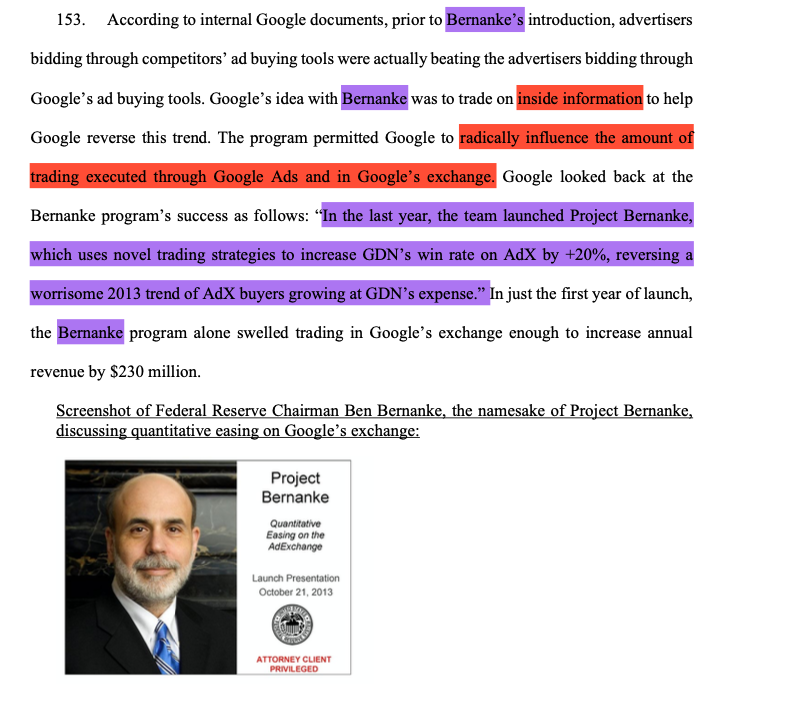

gTrade came up with Project Bernanke to use "privileged access to detailed information regarding what advertisers historically bid to help advertisers using Google Ads beat (competitors)."

This is how it works:

This is how it works:

"Google's idea with Bernanke was to trade on inside information.... Permitted Google to radically influence the amount of trading executed through Google Ads."

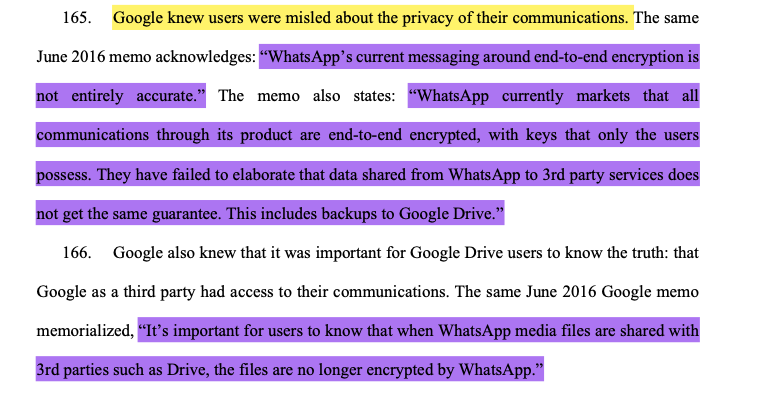

In 2015, Google signed agreement with WhatsApp to give users option of backing up their messages.

Users were led to believe they were encrypted. They were not. @MikeIsaac

Google knew users were mislead. See quotes:

Users were led to believe they were encrypted. They were not. @MikeIsaac

Google knew users were mislead. See quotes:

"By June of 2016, about 434 million WhatsApp users backed up approximately 345 billion WhatsApp files to Google Drive, netting for Google Drive about a quarter of a billion new Google Drive customers."

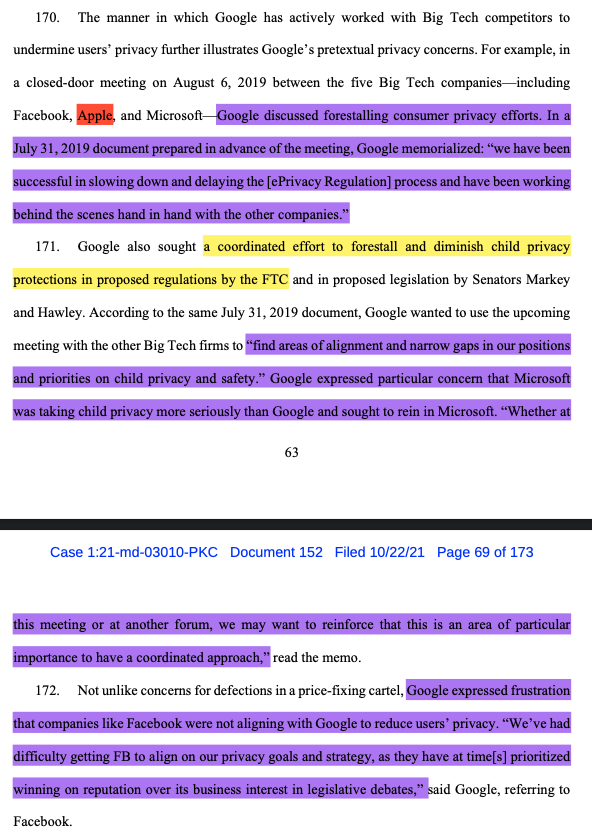

New section: Google secretly met with competitors to discuss competition and forestall consumer privacy effort:

Aug 6, 2019: Facebook, Apple, Microsoft & Google discussed *forestalling consumer privacy efforts*

Google prep doc: “we have been successful in slowing down and delaying the [ePrivacy Regulation] process and have been working behind the scenes hand in hand with other companies.”

Google prep doc: “we have been successful in slowing down and delaying the [ePrivacy Regulation] process and have been working behind the scenes hand in hand with other companies.”

Google prep doc says aim was to “find areas of alignment and narrow gaps in our positions and priorities on child privacy and safety.”

GOOe expressed particular concern that MSFT was taking child privacy more seriously than Google and sought to rein in Microsoft.

GOOe expressed particular concern that MSFT was taking child privacy more seriously than Google and sought to rein in Microsoft.

Google was frustrated @Facebook was not aligning with it to reduce users’ privacy.

“We’ve had difficulty getting FB to align on our privacy goals and strategy, as they have at time[s] prioritized winning on reputation over its business interest in legislative debates."

“We’ve had difficulty getting FB to align on our privacy goals and strategy, as they have at time[s] prioritized winning on reputation over its business interest in legislative debates."

GOOG asks MSFT to stop "subtle privacy attacks". Outlines "ways we can work together"

AG: GOOG presents a public image of caring about privacy, but coordinates closely with Big Tech to lobby the government to delay or destroy measures that would actually protect users’ privacy.

AG: GOOG presents a public image of caring about privacy, but coordinates closely with Big Tech to lobby the government to delay or destroy measures that would actually protect users’ privacy.

And...Ending this for now. Got other things to do, alas.

I'm at point 185, page 67, of 481 points and 142 pages.

If you're in this space, happy to share my PDF with all unredactions highlighted. DM me.

More insights in this thread:

I'm at point 185, page 67, of 481 points and 142 pages.

If you're in this space, happy to share my PDF with all unredactions highlighted. DM me.

More insights in this thread:

https://twitter.com/thezedwards/status/1451590714450579457?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh