1/11 The Reserve app has been out about a year now, mostly invite-only.

It has been a tremendous journey so far and we're really glad you were here with us. 🙏

Now it's time for us to share some stats! 📈

It has been a tremendous journey so far and we're really glad you were here with us. 🙏

Now it's time for us to share some stats! 📈

2/11 Let's start by taking a look at the growth in customers.

Our customer base often grew faster than our systems at that time could handle, causing us to have to implement the invite-only system.

Despite that, we're proud of the adoption numbers that we've achieved so far ⬇️

Our customer base often grew faster than our systems at that time could handle, causing us to have to implement the invite-only system.

Despite that, we're proud of the adoption numbers that we've achieved so far ⬇️

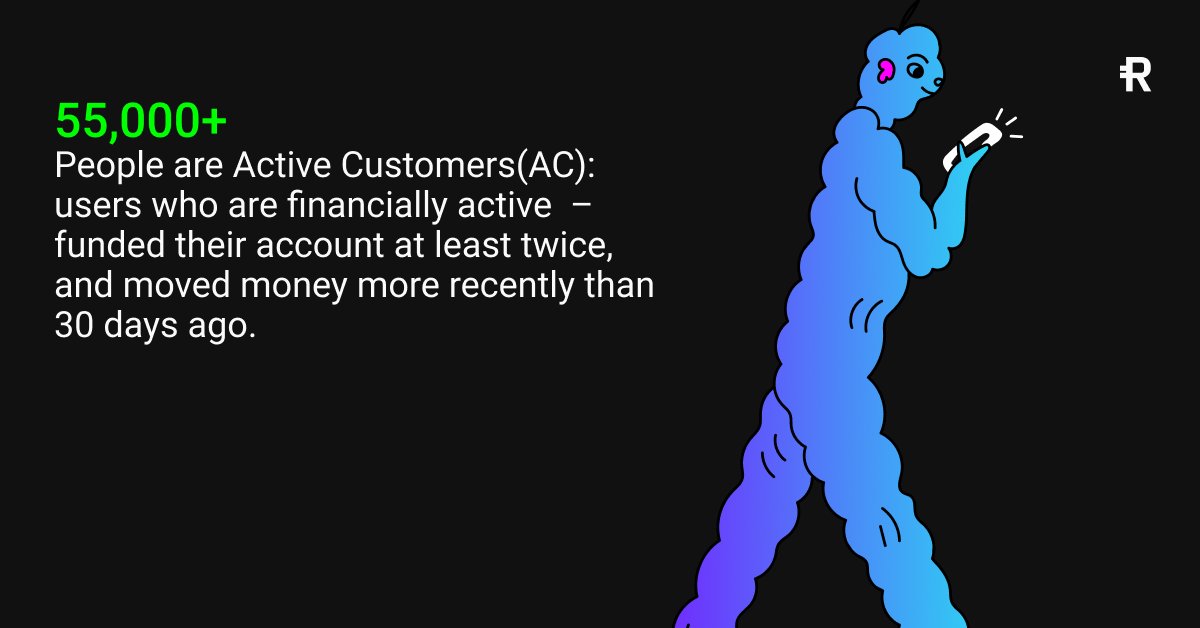

3/11 We also want to keep track of how many of those customers are most active, as those are the ones that benefit the most from our app.

Here's how we define an Active Customer (AC) and how many of those we currently have ⬇️

Here's how we define an Active Customer (AC) and how many of those we currently have ⬇️

5/11 Reserve customers are not traders, it’s mostly normal people that use the app to save their hard-earned money from depreciating, pay their groceries or use it to send money to friends. ⬇️

6/11 Interesting to note is that, out of all the volume that gets transacted in the Reserve app, 25% is done by retail customers & 75% is institutional.

However, only 0,001% of the total transactions made are done by institutions 🧐

However, only 0,001% of the total transactions made are done by institutions 🧐

7/11 To put that in numbers, in the last few months about $19 million per month was transacted by retail customers versus $43 million per month by businesses. 👀

8/11 Now let us take a look at merchants.

The more merchants choose to accept Reserve, the more useful the Reserve app becomes. Thus, this is a crucial area for us to focus on.

We're very pleased to announce that we've experienced significant growth in this area👀

The more merchants choose to accept Reserve, the more useful the Reserve app becomes. Thus, this is a crucial area for us to focus on.

We're very pleased to announce that we've experienced significant growth in this area👀

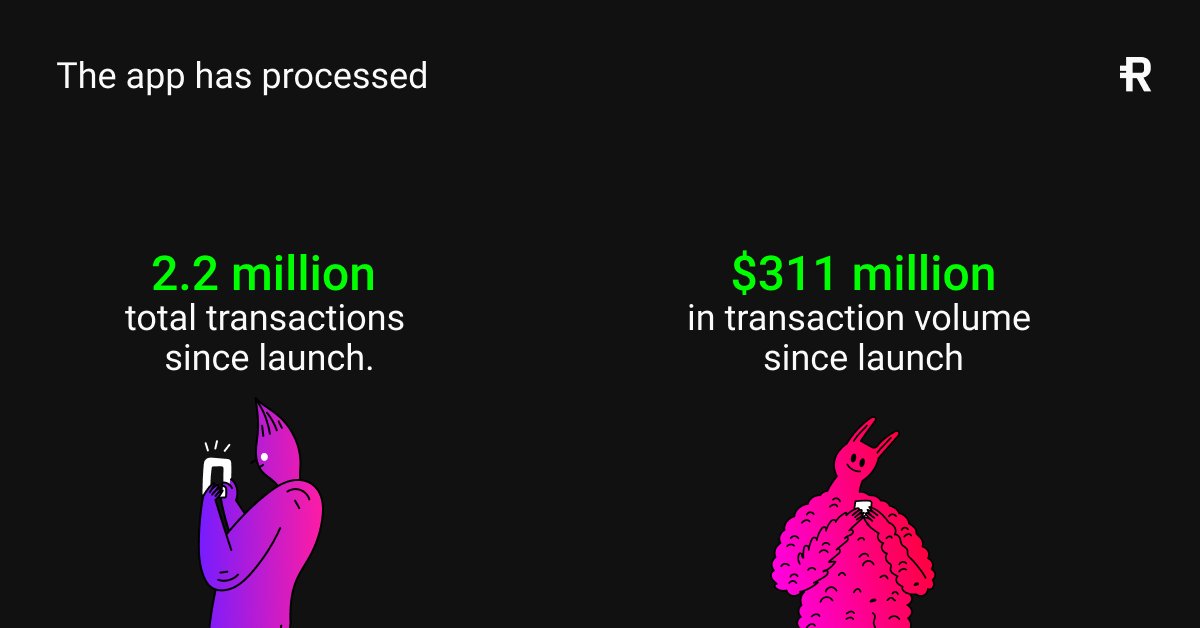

9/11 In total, the Reserve app has processed 2,2 million transactions since launch and about $311 million in volume - numbers that we are very proud of!

10/11 While we're very pleased with the growth that we've achieved so far, we're only at the beginning of what we ultimately want to achieve - and there is still a lot of work to be done 💪

11/11 A big THANK YOU to the community that is helping us change the reality for people living in inflationary economies. 🙏

We hope you join us on this journey 💪

We hope you join us on this journey 💪

• • •

Missing some Tweet in this thread? You can try to

force a refresh