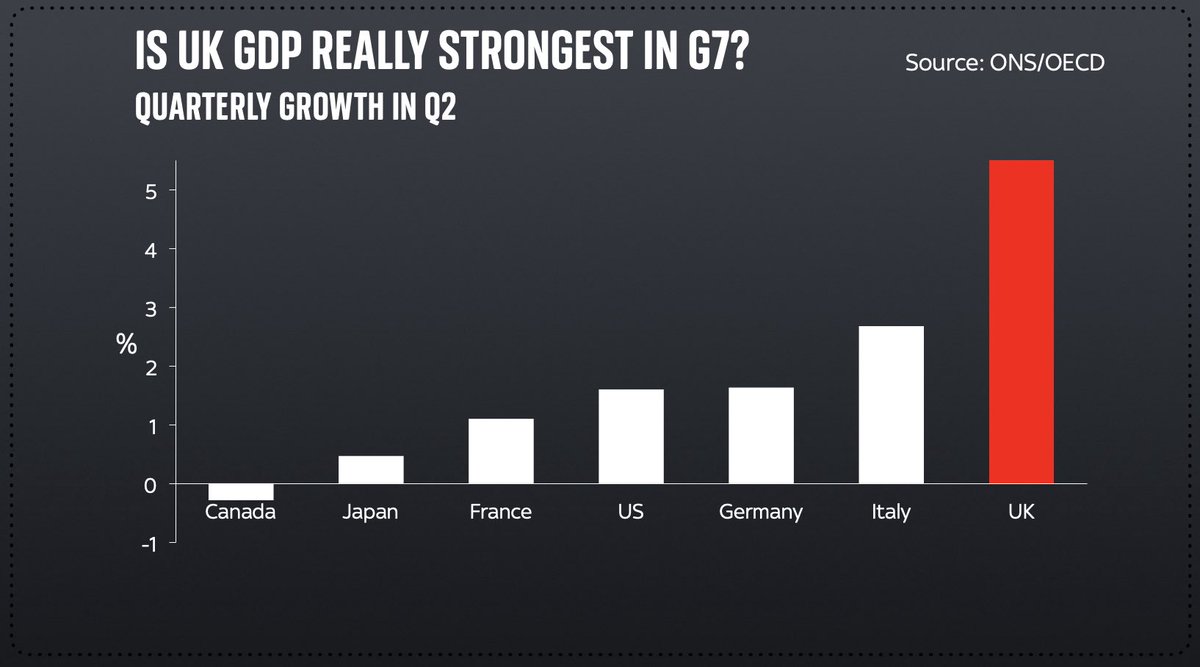

Half an hour left til Budget. Here are a few nuggets to ponder. Let’s start with a claim @RishiSunak may make (tho am hoping he doesn’t): that UK is fastest growing economy in G7.

It’s true if u look at Q2 alone (chart 1).

But look at GDP since covid and UK is mid/low table (ch2)

It’s true if u look at Q2 alone (chart 1).

But look at GDP since covid and UK is mid/low table (ch2)

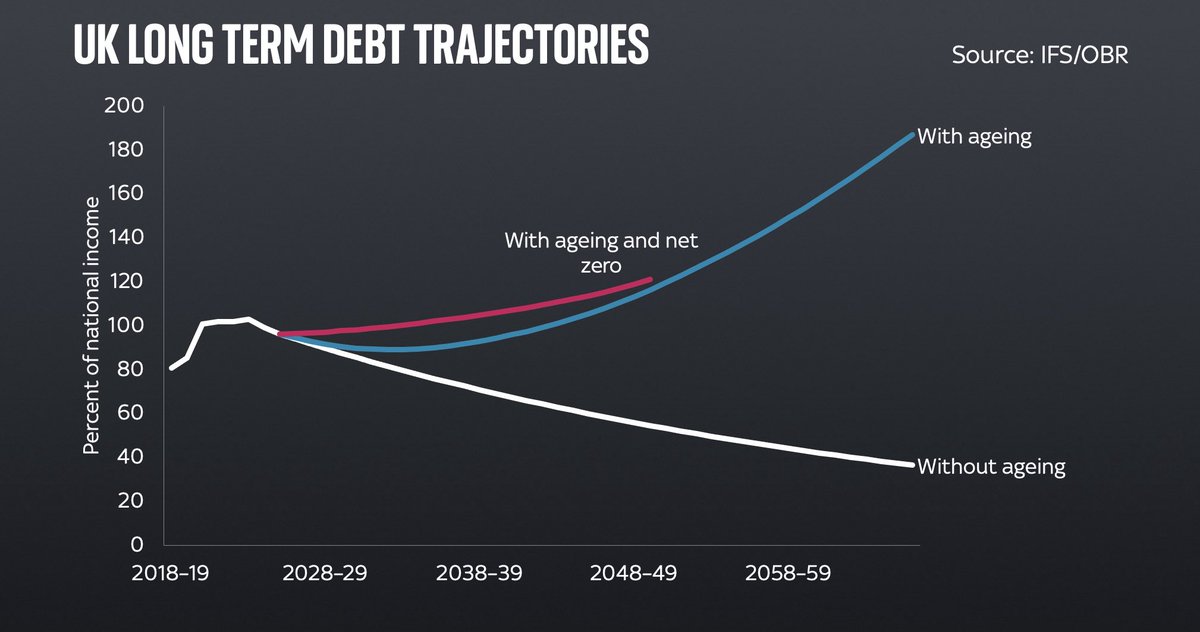

There’ll be lots of talk about fiscal responsibility and keeping the public finances in order.

All very well but by far the biggest issue in the coming decades is health-related costs which massively outweigh net zero. What does this govt do in the face of that?

All very well but by far the biggest issue in the coming decades is health-related costs which massively outweigh net zero. What does this govt do in the face of that?

After all, this govt has already set aside a large slug of the extra spending review money to health. The real question is what happens to other depts. Do they get real terms Budget increases? Does the era of austerity live on in certain corners of Whitehall?

More broadly, the Spending Review is a big moment. It’s really the first Conservative Spending Review in the modern era: the last two were one-year mostly-ticking-over jobbies. All G Osborne’s were not about SAVING money not spending it. 3.2% real terms increases is not nothing!

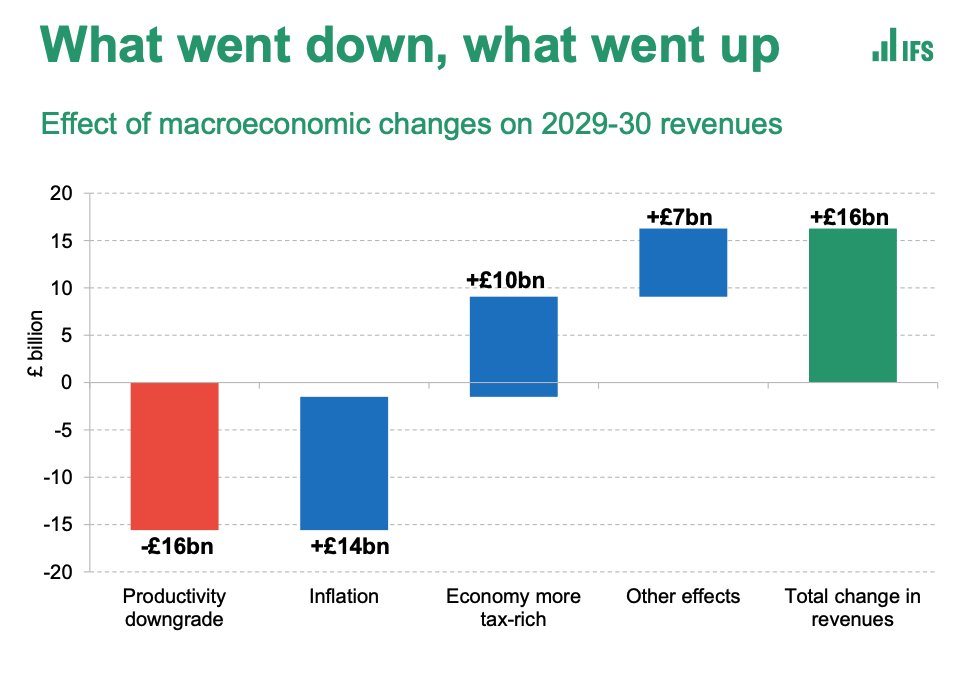

We’ll get new fiscal rules from the Chancellor. Part of his justification will be that the govt remains vulnerable to rising debt costs. The mechanics of this are interesting if nerdy. Attached is a helpful primer from @TheIFS:

Here’s one way of looking at this: back in the day the main thing that pushed up debt interest was rising borrowing. These days it’s not so much rising borrowing as rising interest rates. Look: the bars on the right are now higher than the bars on the left.

Another interesting consequence of QE (partly explained in that IFS thing above) is that it means while the UK looks like it has very long debt maturities (which shield it from rising int rates), actually when you adjust for QE it’s 10yrs not 15yrs…

Worth saying: not everyone is convinced that this represents the sword of Damocles the Chancellor might suggest it does. @DuncanWeldon for one thinks the BoE could easily deal with this by adopting rules the ECB already has. We’ll see. duncanweldon.substack.com/p/britains-mac…

But the MAIN chart overshadowing this Budget is prob this one. Gas prices.

Households are facing a monumental squeeze this winter due to higher bills. That many are simultaneously facing the withdrawal of UC support intensifies it. Much of today will ultimately come back to this

Households are facing a monumental squeeze this winter due to higher bills. That many are simultaneously facing the withdrawal of UC support intensifies it. Much of today will ultimately come back to this

• • •

Missing some Tweet in this thread? You can try to

force a refresh