Today Income Tax Department has announced rollout of a new statement - AIS (Annual Information Statement)

This will give u all details (well almost all!) about YOUR financial transactions during the year

This is a thread to tell u what it is and how do u get the AIS

(1/n)

This will give u all details (well almost all!) about YOUR financial transactions during the year

This is a thread to tell u what it is and how do u get the AIS

(1/n)

First of all,

What is AIS (Annual Information Statement)?

You know earlier Income Tax used to give statement 26AS

AIS is a much detailed one - with many more details included - like your Savings Interest, all Mutual Fund txns during the year etc

(2/n)

What is AIS (Annual Information Statement)?

You know earlier Income Tax used to give statement 26AS

AIS is a much detailed one - with many more details included - like your Savings Interest, all Mutual Fund txns during the year etc

(2/n)

Will 26AS be stopped?

a) Now you can get both 26AS and also AIS

b) Both put together, Income Tax department knows all your financial txns

c) And it's good as now you will find it very easy to know and submit details for your Income Tax returns

(3/n)

a) Now you can get both 26AS and also AIS

b) Both put together, Income Tax department knows all your financial txns

c) And it's good as now you will find it very easy to know and submit details for your Income Tax returns

(3/n)

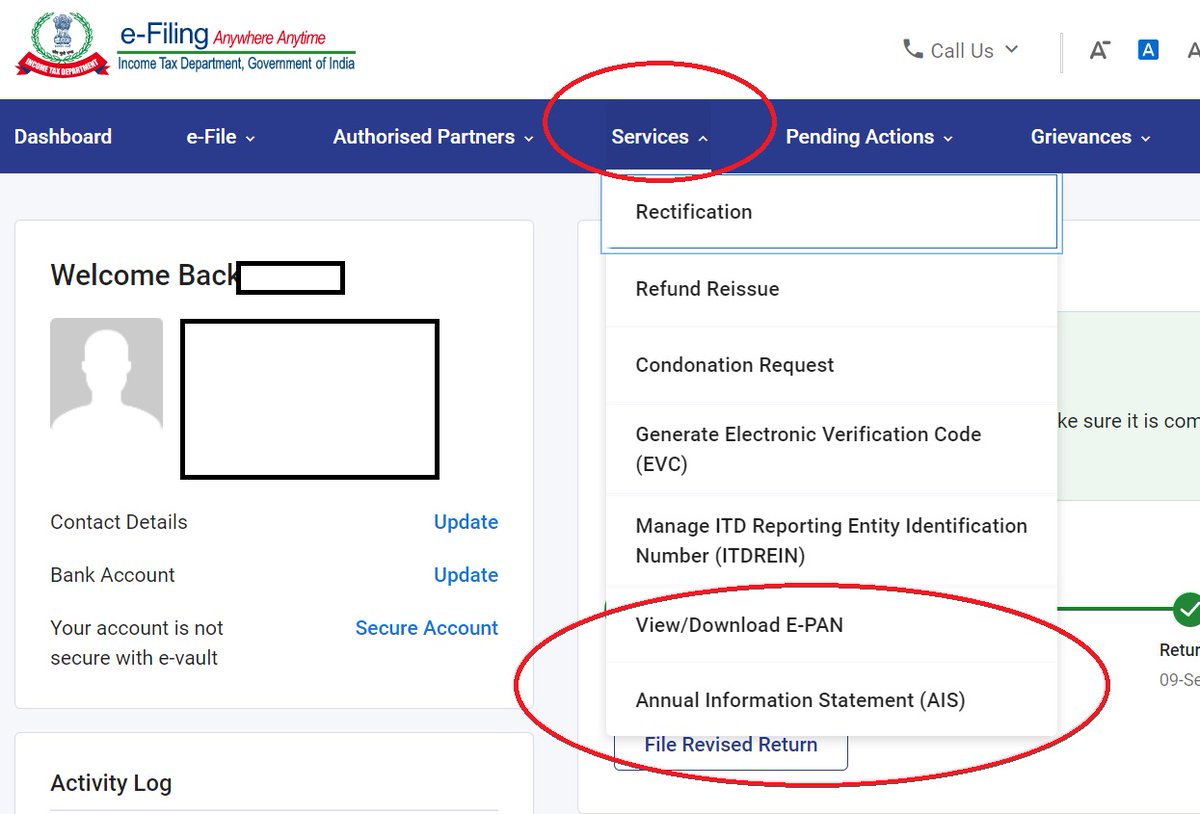

How to access my AIS?

a) Log in to your Income Tax account at incometax.gov.in

b) Go to Services Tab

c) Last option in this tab is the AIS option

Screenshot below

a) Log in to your Income Tax account at incometax.gov.in

b) Go to Services Tab

c) Last option in this tab is the AIS option

Screenshot below

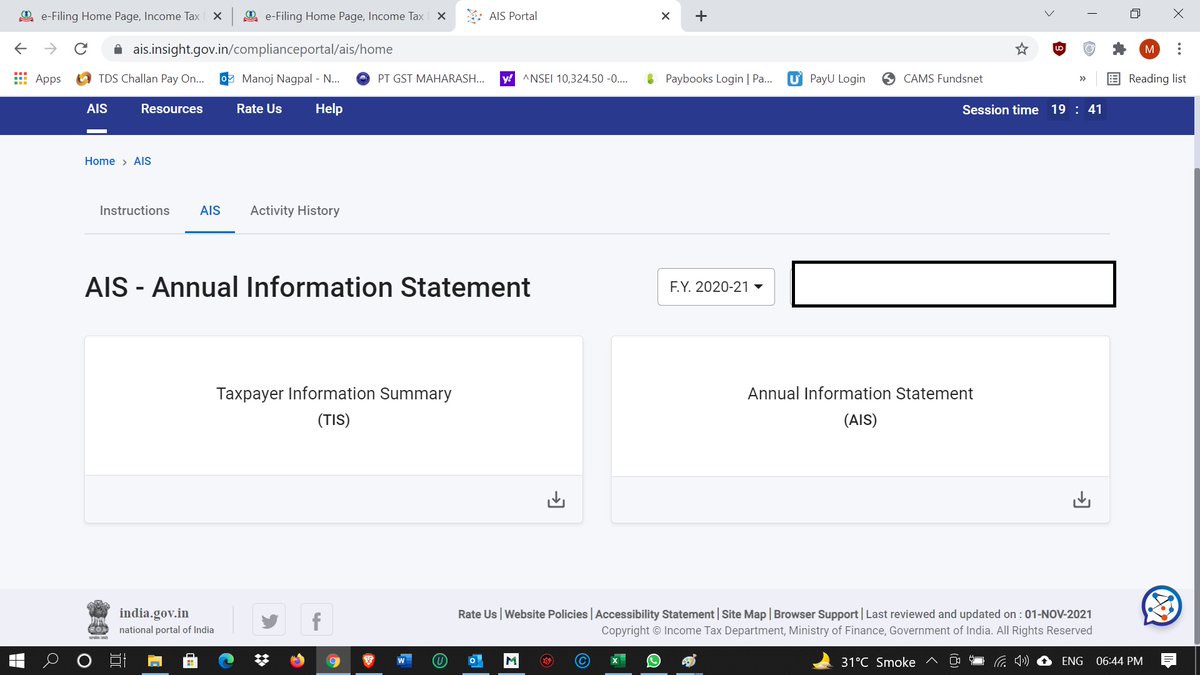

When u click on the AIS option in the above dropdown

it will open a new tab withbelow options

It has two options

a) Left side - Tax Information Summary (TIS)

b) Right side - AIS

Both are the same. TIS is a summary and AIS is the detailed statement. You can download both

it will open a new tab withbelow options

It has two options

a) Left side - Tax Information Summary (TIS)

b) Right side - AIS

Both are the same. TIS is a summary and AIS is the detailed statement. You can download both

When u download u get a pdf statement (There is json option also, but let's stick to PDF now)

PDF will be password protected

Password is ur PAN Number (in CAPITAL) + Date of Birth

EG: AABPN4678A if this is ur PAN and Date of birth is 28 Nov 1980

Pwd: AABPN4678A28111980

PDF will be password protected

Password is ur PAN Number (in CAPITAL) + Date of Birth

EG: AABPN4678A if this is ur PAN and Date of birth is 28 Nov 1980

Pwd: AABPN4678A28111980

AIS captures all ur financial txns of last year

a) Interest u got (even of ur Savings Account)

b) Salary or Income

c) Mutual Fund Txns

d) Any Dividends

A snapshot of summary is shown below. Details are given in the pdf

Any Qs will be happy to answer

*** End***

a) Interest u got (even of ur Savings Account)

b) Salary or Income

c) Mutual Fund Txns

d) Any Dividends

A snapshot of summary is shown below. Details are given in the pdf

Any Qs will be happy to answer

*** End***

• • •

Missing some Tweet in this thread? You can try to

force a refresh