🚿 The @AaveAave Dai Direct Deposit Module (D3M) is ready to be onboarded on the Maker Protocol 🚿

This is a key milestone for @MakerDAO growth leaded by an alternative source of liquidity to secondary Dai venues

We'll explain how it works and why it's important 🧵

1/17

This is a key milestone for @MakerDAO growth leaded by an alternative source of liquidity to secondary Dai venues

We'll explain how it works and why it's important 🧵

1/17

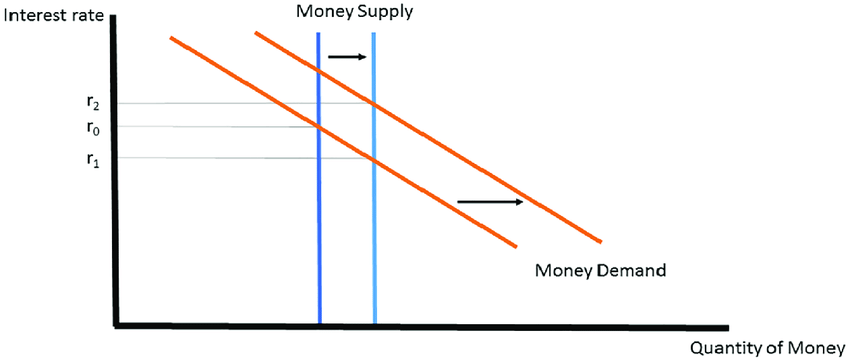

🔁 The market is made up by two things: supply and demand.

In DeFi lending markets, supply (liquidity) and demand (weight of loans requested) determine the borrow rate (interest rate) -how much you'll pay for a loan. 📈

2/17

In DeFi lending markets, supply (liquidity) and demand (weight of loans requested) determine the borrow rate (interest rate) -how much you'll pay for a loan. 📈

2/17

💛 We all know that Dai is very popular where there's a lending market -everyone wants to borrow Dai, because Dai is a rockstar in DeFi.

But, what if everyone wants Dai, but there's not enough: the borrow rate numba go uppppp 📈📈📈

3/17

But, what if everyone wants Dai, but there's not enough: the borrow rate numba go uppppp 📈📈📈

3/17

⏫ This is when the supply is low and the demand is high: the interest that the borrower will pay goes up

😵💫 High borrow rates for Dai means that it's too expensive to borrow Dai compared to other competitive assets, even if there's huge Dai return on another place.

4/17

😵💫 High borrow rates for Dai means that it's too expensive to borrow Dai compared to other competitive assets, even if there's huge Dai return on another place.

4/17

🚿 So, are you ready to flood that market with Dai? We are

🌊 That's what the D3M integration is supposed to do

💵 Due to a high demand of Dai to be borrowed, the D3M will mint Dai directly deposited to that secondary lending market, so the borrow rates will stabilize

5/17

🌊 That's what the D3M integration is supposed to do

💵 Due to a high demand of Dai to be borrowed, the D3M will mint Dai directly deposited to that secondary lending market, so the borrow rates will stabilize

5/17

📉 On the other hand, when there's a lack of demand and a liquidity excess, the interest rate paid to the depositors will go down.

🧽 The D3M will be there for drain liquidity, and then, stabilize the deposit rate -Everyone will love Dai again thanks to its returns 💛💛

6/17

🧽 The D3M will be there for drain liquidity, and then, stabilize the deposit rate -Everyone will love Dai again thanks to its returns 💛💛

6/17

👻 @AaveAave is one of the best secondary lending markets to explore this solution.

😰 Aave's users have unpredictability of Dai borrow rates, which can surge to double digits for entire weeks.

🤔 How will the D3M solve the problem?

7/17

😰 Aave's users have unpredictability of Dai borrow rates, which can surge to double digits for entire weeks.

🤔 How will the D3M solve the problem?

7/17

✌️ First of all, we need to know 3 key participants:

1⃣ aDAI, the native token issued to a user who supplies DAI into Aave.

🪙 aDAI is pegged 1:1 to the value of the underlying DAI that is deposited in Aave. It can accrue Aave lending market interest in real time.

8/17

1⃣ aDAI, the native token issued to a user who supplies DAI into Aave.

🪙 aDAI is pegged 1:1 to the value of the underlying DAI that is deposited in Aave. It can accrue Aave lending market interest in real time.

8/17

2⃣ The target borrow interest rate: It's the borrow rate that @MakerDAO will determine to stabilize the cost of borrowing Dai in Aave and then keep it attractive.

9/17

9/17

❓ Here is how the D3M works:

💎 The D3M is a special aDAI vault with a specific target borrow interest rate

🎯 Actually, that target is set on 4%

10/17

💎 The D3M is a special aDAI vault with a specific target borrow interest rate

🎯 Actually, that target is set on 4%

10/17

🌊 So, if the borrow rate on Aave for DAI goes above 4%, anyone can call the vault's function to re-adjust the amount of DAI in the pool (flooding it with DAI backed by aDAI, actually)

🧮 The D3M will calculate the DAI required to be minted for hitting the 4% target.

11/17

🧮 The D3M will calculate the DAI required to be minted for hitting the 4% target.

11/17

🔄 As you can see, the DAI issued that's backed by aDAI actually is a leveraged possition of DAI in Aave that will allow to increase quickly, safely and massively the liquidity in the Aave protocol.

12/17

12/17

🧽 In the opposite, when the target rate is below 4% and the D3M has previously added liquidity, the D3M function will calculate how much liquidity to remove to bring the target interest rate back up to 4%, and then don't compromise the return DAI rate for depositors

13/17

13/17

🧠 In short, the focus of the D3M is to mint and burn DAI in exchange of aDAI to stay within the 4% interest borrow rate of DAI in Aave.

14/17

14/17

@StaniKulechov, talked about the possible benefits:

- External source of direct income by collection of aDAI interest.

- Maker Governance would have a direct impact on risk assessment by adjusting the D3M minting across DeFi.

- Expanded supply of DAI including L2s

15/17

- External source of direct income by collection of aDAI interest.

- Maker Governance would have a direct impact on risk assessment by adjusting the D3M minting across DeFi.

- Expanded supply of DAI including L2s

15/17

- DAI attractiveness for DeFi borrowers on secondary markets

- If Aave community starts a Liquidity Mining program, MakerDAO will collect AAVE assets and earn governance rights in Aave Governance

16/17

- If Aave community starts a Liquidity Mining program, MakerDAO will collect AAVE assets and earn governance rights in Aave Governance

16/17

Special thanks to @degenwizard for @MakerDAO & @AaveAave frogs meme.

Also you can read the Executive Vote here: vote.makerdao.com/executive/temp…

Also you can read the Executive Vote here: vote.makerdao.com/executive/temp…

• • •

Missing some Tweet in this thread? You can try to

force a refresh