In preparation for our Twitter Spaces tomorrow evening on the MTN Uganda [@mtnug] IPO, it's time do a thread on the #MTNIPO.

🧵👇

🧵👇

1.

On Monday 11th October 2021, MTN Uganda announced the opening of its initial public offer of 20% of its ordinary shares

This was after approvals by the Capital Markets Authority of Uganda [@CmaUganda] and the Uganda Securities Exchange [@USEUganda]

On Monday 11th October 2021, MTN Uganda announced the opening of its initial public offer of 20% of its ordinary shares

This was after approvals by the Capital Markets Authority of Uganda [@CmaUganda] and the Uganda Securities Exchange [@USEUganda]

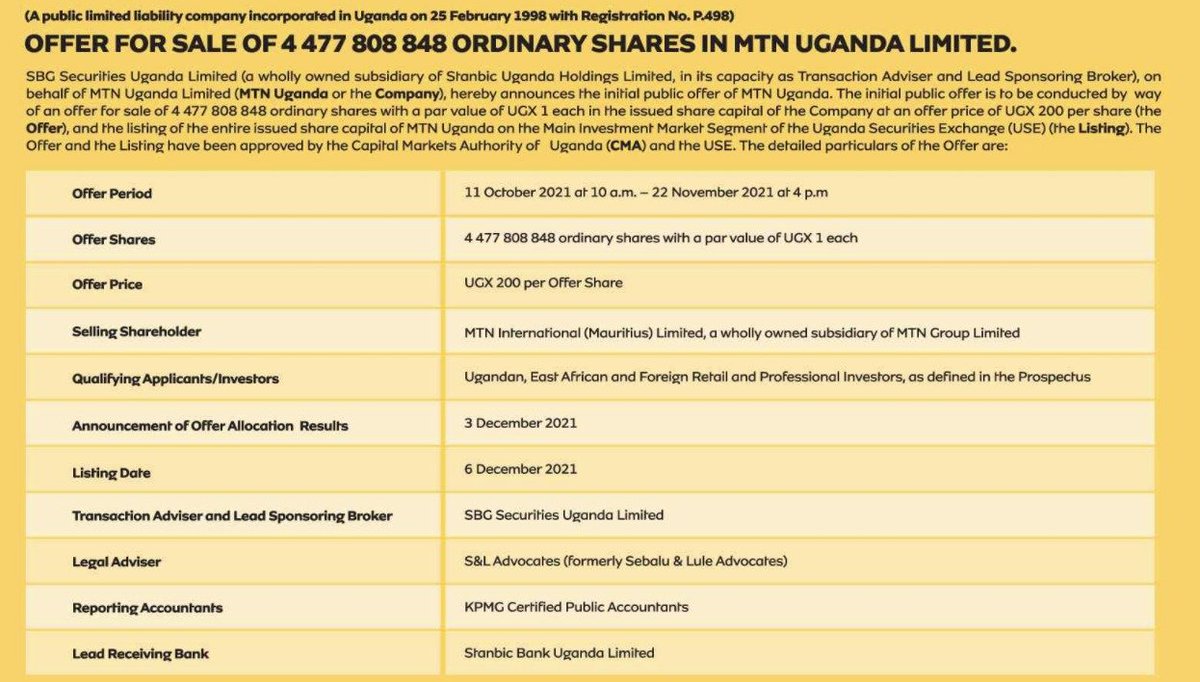

2. What is on Offer?

4.47B shares (20% of ordinary shares) are on offer at a price of UGX 200 ($0.06) each valuing MTN Uganda at UGX 895.56B ($250m)

MTN Group currently holds 96% of MTN Uganda.

Offer is open to investors in Uganda, Kenya, Tanzania, Rwanda & Burundi.

4.47B shares (20% of ordinary shares) are on offer at a price of UGX 200 ($0.06) each valuing MTN Uganda at UGX 895.56B ($250m)

MTN Group currently holds 96% of MTN Uganda.

Offer is open to investors in Uganda, Kenya, Tanzania, Rwanda & Burundi.

3. Get to know the key players in the IPO including legal advisors, lead receiving and sponsoring brokers and reporting accountants:

4. Incentive in the event of an oversubscription:

The offer also comes with a rare incentive scheme signalling the issuer’s intent to ensure the offer is successful.

The offer also comes with a rare incentive scheme signalling the issuer’s intent to ensure the offer is successful.

5. After IPO:

After the successful completion of the offer, MTN Uganda will list on the Main Investment Market segment of USE.

MTN Uganda will become the 10th domestic company listed on the USE.

There are 8 cross border listings from Kenya on USE.

After the successful completion of the offer, MTN Uganda will list on the Main Investment Market segment of USE.

MTN Uganda will become the 10th domestic company listed on the USE.

There are 8 cross border listings from Kenya on USE.

6. About the company:

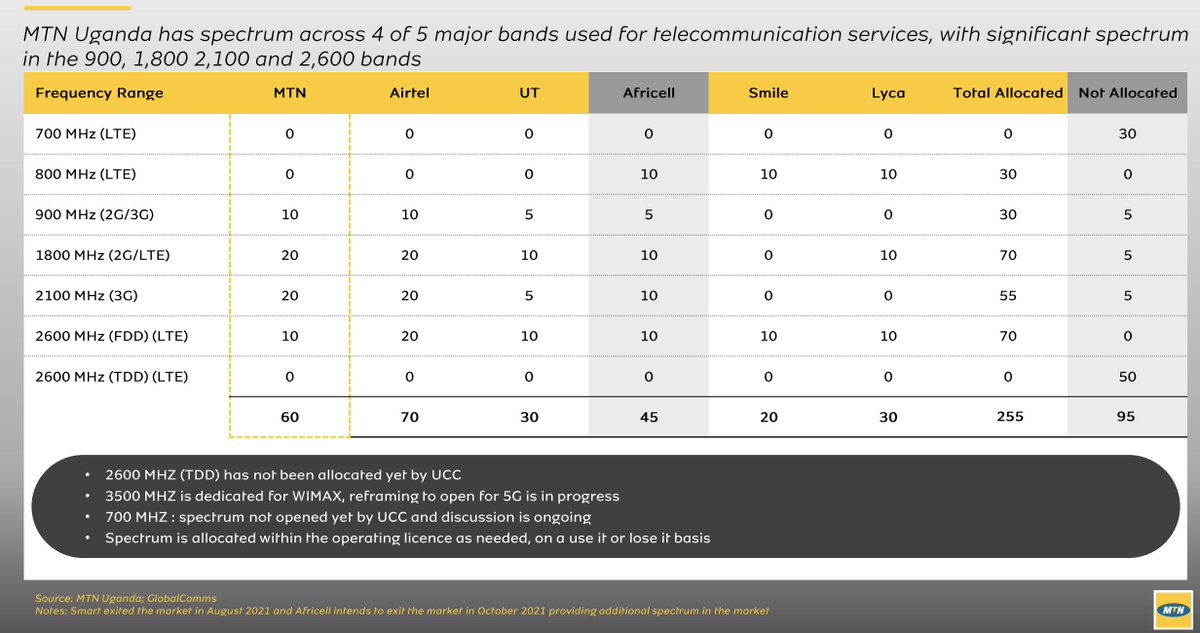

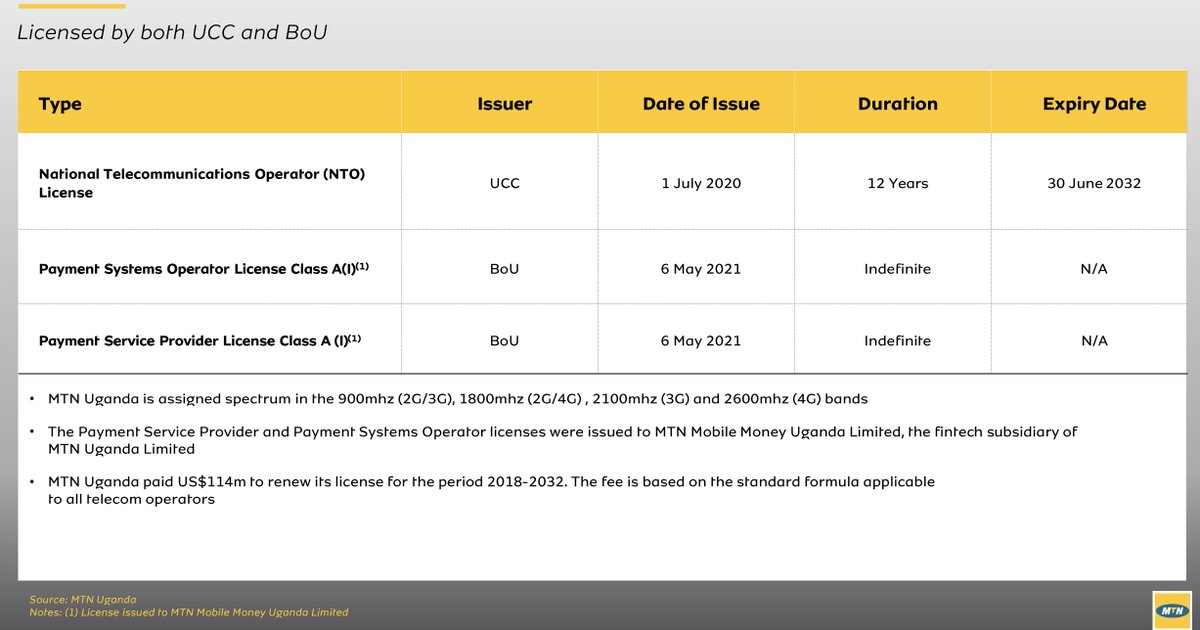

MTN Uganda [@mtnug] started operations in 1998 and is a leading telecoms company in Uganda

The main objective was to carry out the business of a national operator of a telecommunications network pursuant to the NTO licence granted by the UCC.

MTN Uganda [@mtnug] started operations in 1998 and is a leading telecoms company in Uganda

The main objective was to carry out the business of a national operator of a telecommunications network pursuant to the NTO licence granted by the UCC.

7. Ownership structure:

The company is a subsidiary of subsidiary of MTN Group [@MTNGroup] a mobile operator that has a presence in 20 markets in Africa and the Middle East.

Here is the current shareholding structure and the 2020 financial highlights of the MTN Group

The company is a subsidiary of subsidiary of MTN Group [@MTNGroup] a mobile operator that has a presence in 20 markets in Africa and the Middle East.

Here is the current shareholding structure and the 2020 financial highlights of the MTN Group

8. Products:

@mtnug offers network services, digital & financial technology services, interconnect & roaming, sale of mobile devices & MTN Mobile Money (conducted through subsidiary MTN Mobile Money Uganda Limited).

You compare its revenue mix with that of @SafaricomPLC here:

@mtnug offers network services, digital & financial technology services, interconnect & roaming, sale of mobile devices & MTN Mobile Money (conducted through subsidiary MTN Mobile Money Uganda Limited).

You compare its revenue mix with that of @SafaricomPLC here:

9. Coverage:

MTN Uganda has presence in all 134 districts of Uganda delivering services through a network of 119,077 mobile money agents, 200 service stores and 13 main distributors.

MTN Uganda has presence in all 134 districts of Uganda delivering services through a network of 119,077 mobile money agents, 200 service stores and 13 main distributors.

10. Subscribers and market share:

In the first half of 2021, it had 14.9 million subscribers, 8.6 million mobile money users and 4.7 million active data users.

The main competitor is @AirtelUganda1:

In the first half of 2021, it had 14.9 million subscribers, 8.6 million mobile money users and 4.7 million active data users.

The main competitor is @AirtelUganda1:

11. Current shareholding before offer and how it has changed over the last 5 years.

Remember MTN Group is the selling company.

Remember MTN Group is the selling company.

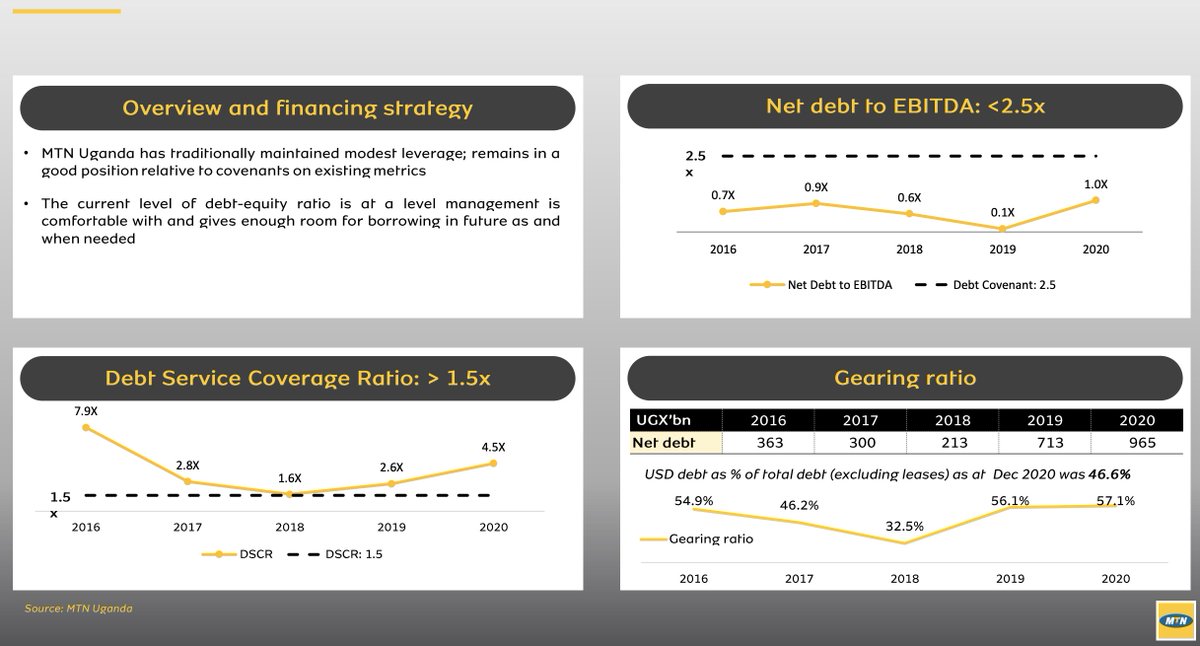

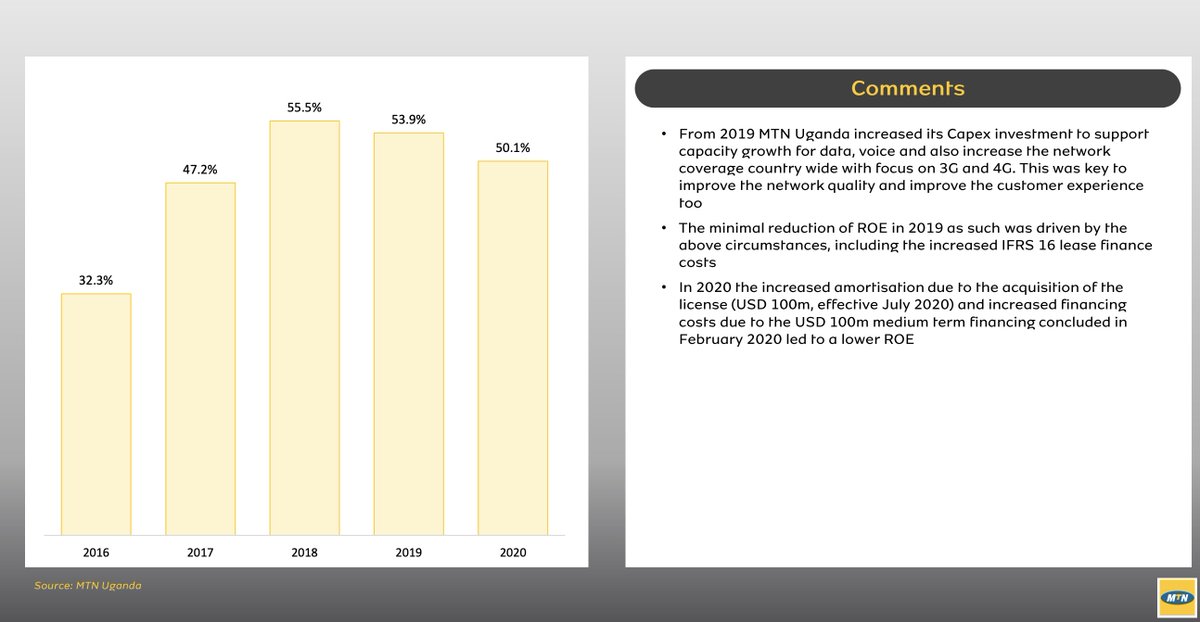

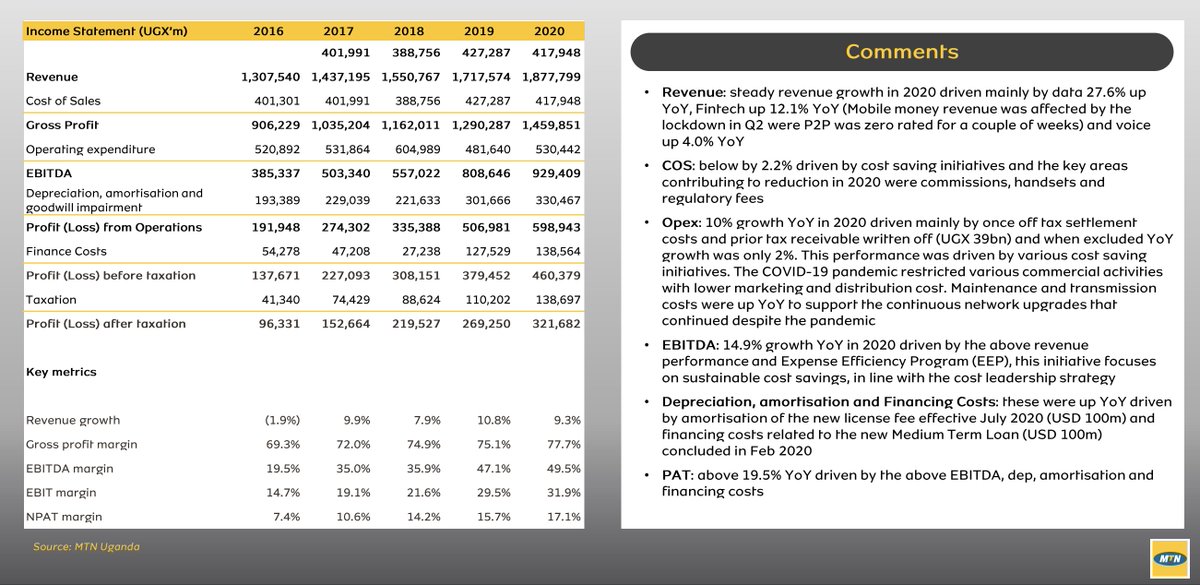

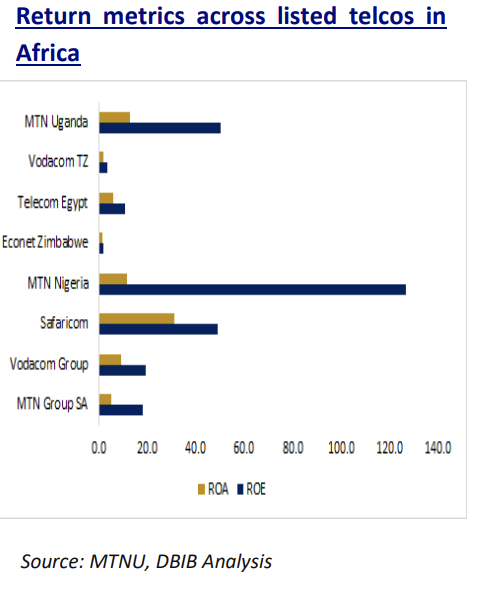

12. A quick look at the financials:

- Revenues have grown at a CAGR of 9.5% from UGX from UGX 1.31T in 2016 to UGX 1.88T in 2020

- Revenues driven by voice as the country’s mobile penetration continues to increase.

- Revenues have grown at a CAGR of 9.5% from UGX from UGX 1.31T in 2016 to UGX 1.88T in 2020

- Revenues driven by voice as the country’s mobile penetration continues to increase.

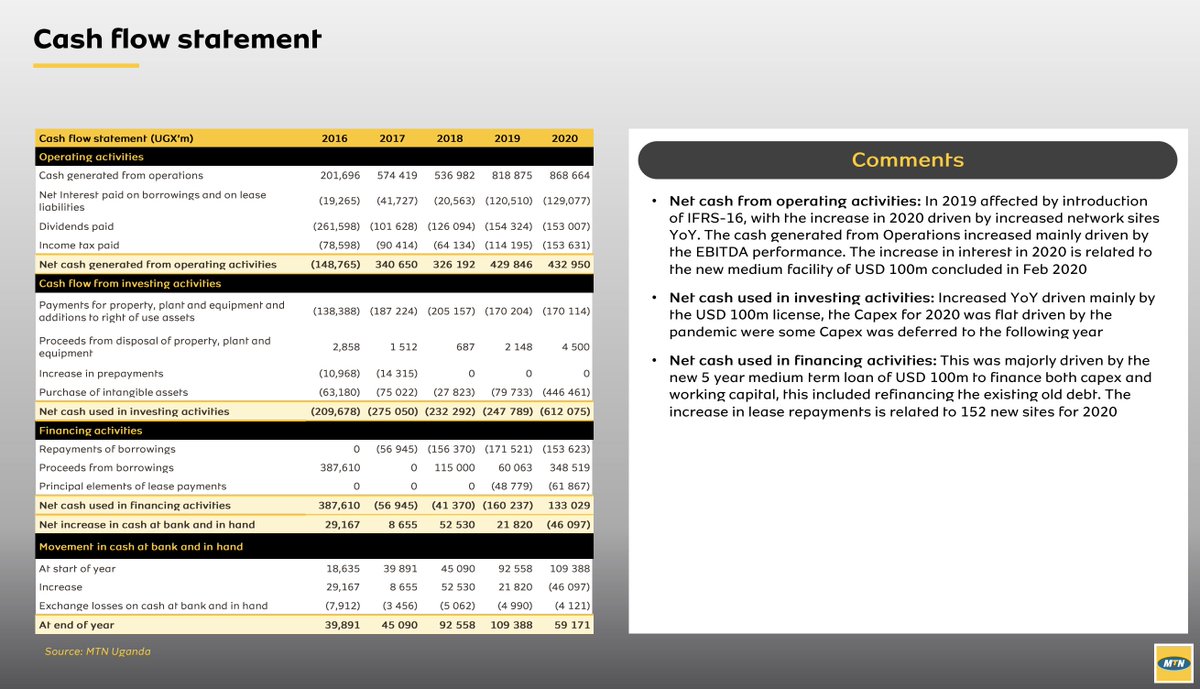

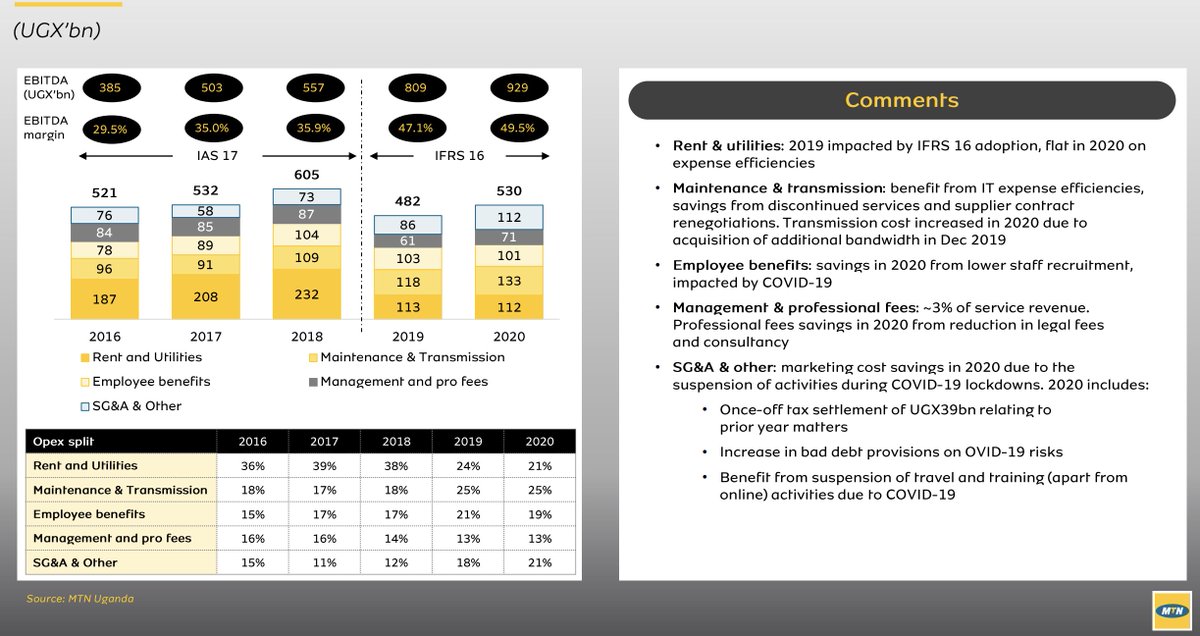

13. Financials continued:

- EBITDA margins of ~50% in FY 2020.

- Capex intensity of 13% in FY 2020

- 18.7% CAGR growth in Free-cashflows over FY 2016 to FY 2020

- EBITDA margins of ~50% in FY 2020.

- Capex intensity of 13% in FY 2020

- 18.7% CAGR growth in Free-cashflows over FY 2016 to FY 2020

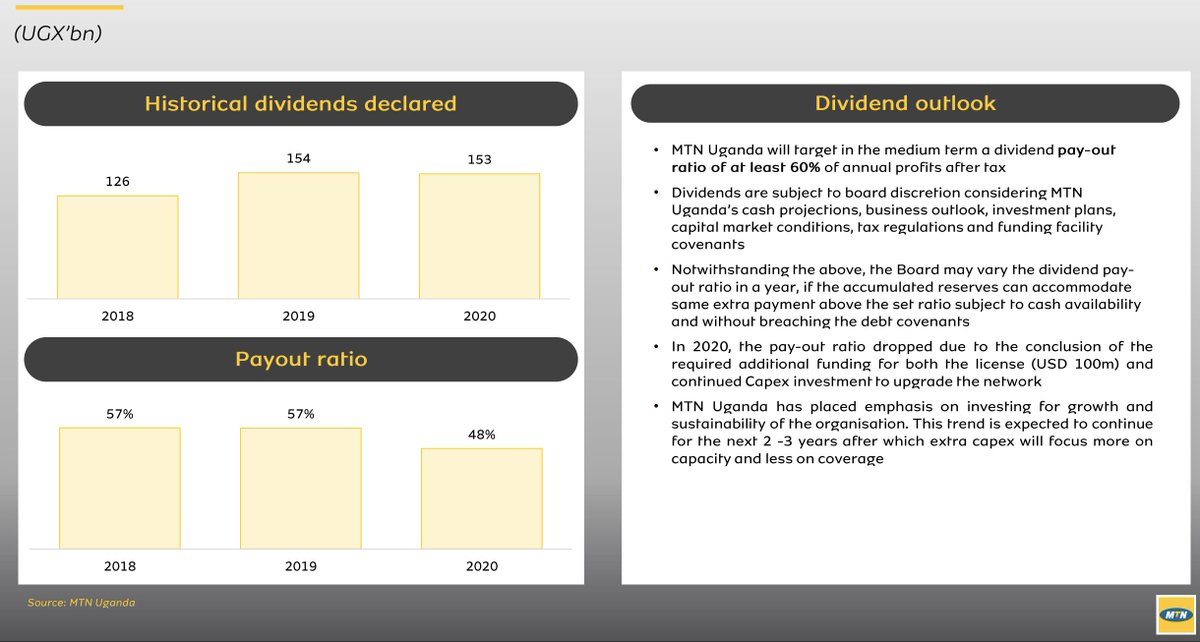

15. Dividend payout policy:

- Targets a 60% dividend payout ratio

- Pays out dividend 3 times a year (H1, Q3 & Q4)

- New shareholders to get any final dividend declared

- Financial year ends in December btw

- Targets a 60% dividend payout ratio

- Pays out dividend 3 times a year (H1, Q3 & Q4)

- New shareholders to get any final dividend declared

- Financial year ends in December btw

19. The board of directors led by Charles Mbire who is also a shareholder in MTN Uganda (~4%).

He is also the Chairman of the Uganda Securities Exchange [@USEUganda].

None of the other directors own shares in MTN Uganda.

He is also the Chairman of the Uganda Securities Exchange [@USEUganda].

None of the other directors own shares in MTN Uganda.

23. Links to important documents:

1. Prospectus: mtn.co.ug/wp-content/upl…

2. Presentation: mtn.co.ug/wp-content/upl…

3. Factsheet: mtn.co.ug/wp-content/upl…

Contact @StanbicKE, @stanbicug, @DyerandBlair, and @dyerandblairug for information on how to invest from across the region

1. Prospectus: mtn.co.ug/wp-content/upl…

2. Presentation: mtn.co.ug/wp-content/upl…

3. Factsheet: mtn.co.ug/wp-content/upl…

Contact @StanbicKE, @stanbicug, @DyerandBlair, and @dyerandblairug for information on how to invest from across the region

24. Join us tomorrow to breakdown all this and more in our Twitter spaces here:

Link to event: twitter.com/i/spaces/1ynJO…

Link to event: twitter.com/i/spaces/1ynJO…

25/25 If you enjoyed this breakdown, subscribe to our weekly newsletter to get more on our analyses.

We give you coverage of the best business information from across East Africa.

Also join our Telegram channel: t.me/joinchat/Oci6o…

thebaobab.substack.com

We give you coverage of the best business information from across East Africa.

Also join our Telegram channel: t.me/joinchat/Oci6o…

thebaobab.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh