Many people try to value layer 1 blockchain tokens like stocks.

That’s absurd.

Instead of pricing Ethereum, Solana & so on like *companies*, you should price them like *countries*.

Here’s how.

That’s absurd.

Instead of pricing Ethereum, Solana & so on like *companies*, you should price them like *countries*.

Here’s how.

The #1 wrong way to value layer 1 tokens: earnings multiples.

Some people apply value investing framework for stocks to blockchains, and come up with price/earnings, price/sales ratios for ETH, SOL, AVAX, etc.

Some people apply value investing framework for stocks to blockchains, and come up with price/earnings, price/sales ratios for ETH, SOL, AVAX, etc.

Unsurprisingly, these ratios look astronomically high. So high that they’d give any value investing devotee a heart attack.

Here’s the problem. Earnings are the end-all-be-all of a company’s value. But they are not of a public blockchain’s value.

If Ethereum cuts average gas fee by half tomorrow, other things equal the P/E ratio would double. Does that mean Ethereum is doubly overvalued? No. To the opposite, it’d be a boon to platform growth.

Since token holders, i.e. owners, are also users of the blockchain, the value of the chain comes from how much economic activity it supports, regardless of what percentage of that activity is captured by the platform as “profits”.

If you think of public blockchains as sovereign economic ecosystems, similar to countries, the absurdity of valuation ratios is immediately clear.

If the US doubles all tax rates, the “P/E” of US government would drop by half. But is that good for US economy? Hardly.

If the US doubles all tax rates, the “P/E” of US government would drop by half. But is that good for US economy? Hardly.

And structurally, in some countries government activities take up a higher share of total economy than in others. Everything else equal, China (bigger gov) would have a lower P/E than US (smaller gov). Does that tell you anything about the value of those two economies? None.

The #2 wrong way to value layer 1 tokens: discounted cash flow.

DCF is another common framework borrowed from stock valuation that is actually even more absurd.

DCF is another common framework borrowed from stock valuation that is actually even more absurd.

https://twitter.com/RealNatashaChe/status/1455294728870633474?s=20

This is well & good since the company’s future cashflows are in same currency, e.g. USD, as its stock price.

But the future cashflows of Solana & Ethereum are in SOL & ETH, not in USD. So you need to make up assumptions for what the exchange rate would be for every future period to arrive at a DCF denominated in USD.

What DCF model looks like for Solana:

What DCF model looks like for Solana:

This is completely useless as the USD/SOL exchange rate is what you were trying to calculate in the first place.

Instead of applying company valuation models, layer 1 tokens should be valued as currencies of crypto nation states.

Instead of applying company valuation models, layer 1 tokens should be valued as currencies of crypto nation states.

Layer 1 tokens are a new breed of assets. They’re sorta stocks, sorta bonds, sorta currencies. But the bigger a blockchain platform gets, the more it acts like a sovereign economy & its native token a bonafide currency.

https://twitter.com/RealNatashaChe/status/1454523509917376513?s=20

Therefore exchange rate models for currencies are more useful than stock dividend models in valuing L1 tokens.

Unfortunately when you try to evaluate exchange rate, you open a can of worms. There’re a million factors affecting relative prices of different currencies, and hundreds of frameworks & hypotheses you can write a library of books on.

But a simple & elegant framework— and arguably the closest thing to a ‘fundamentals analysis’— is the quantitative model of money.

It says:

money supply (M) · velocity of money (V) = price (P) · real GDP (Y)

Rearrange the equation & you can express the price level as:

It says:

money supply (M) · velocity of money (V) = price (P) · real GDP (Y)

Rearrange the equation & you can express the price level as:

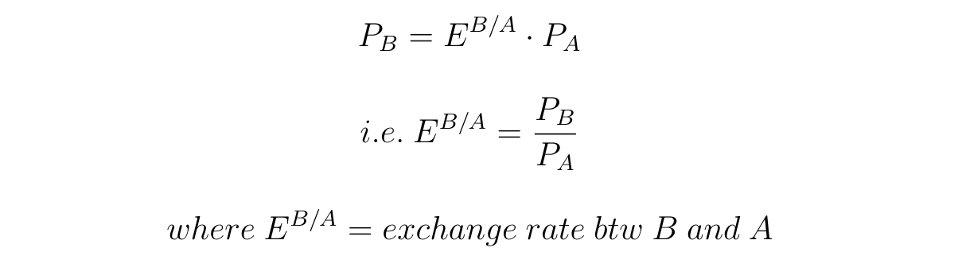

How is this relevant for exchange rate?

Assuming outputs of any two economies are substitutable so price differences can be arbitraged away (it’s obviously not true in so many cases, but doesn’t affect our purpose as long as it’s directionally correct), the relationship btw price levels in country A & country B is:

Simple example: a burger sells for 1 Euro in Germany & 1.5 dollars in US, so USD/Euro exchange rate = 1.5.

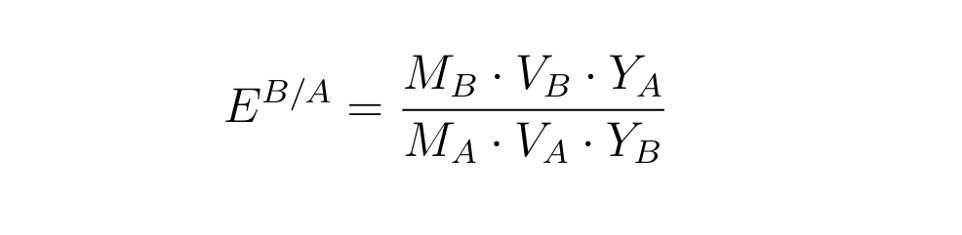

Plug this equation back into the previous equation for within-country price level & you get:

Plug this equation back into the previous equation for within-country price level & you get:

What this says is ETH appreciates against USD when:

1/ ethereum GDP (Y_ETH) grows faster than US GDP (Y_US)

2/ US money supply (M_US) grows faster than ethereum money supply (M_ETH)

3/ USD money velocity (V_US) grows faster than ETH money velocity (V_ETH)

1/ ethereum GDP (Y_ETH) grows faster than US GDP (Y_US)

2/ US money supply (M_US) grows faster than ethereum money supply (M_ETH)

3/ USD money velocity (V_US) grows faster than ETH money velocity (V_ETH)

If you take this equation at face value, there should be a 1:1 relationship btw ETH price growth rate in USD terms & growth rate of US money supply. What happened to ETH price since last yr w/ large Fed balance sheet expansion is evidence to that.

But that’s not the most interesting part.

The interesting part is there should also be a 1:1 relationship btw ETH price growth rate & growth rate of Ethereum GDP, i.e. the aggregate output of Ethereum economy.

The interesting part is there should also be a 1:1 relationship btw ETH price growth rate & growth rate of Ethereum GDP, i.e. the aggregate output of Ethereum economy.

Obviously there’s no statistics bureau out there compiling “GDP” for the Ethereum nation. But a GDP growth can be indirectly inferred from growth rates of transactions, wallets, TVL, etc.

Almost every transaction involves some additional economic output being produced. Wallet growth can be thought of as an increase in “working population” of the country. And TVL increase reflects growth of financial sector in the economy.

Granted, none of these are perfect measures. But the point is they’re positively correlated w/ additional economic outputs produced on the platform.

Actual data confirms the relationship btw these variables & token/USD exchange rate.

Actual data confirms the relationship btw these variables & token/USD exchange rate.

BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 taschalabs.com/newsletter)

There’s a near linear correlation btw growth of transaction volumes on ethereum & ETH price growth: 10% growth in txn volumes translates to 13% price increase on average.

This one below is even more striking. The acceleration of wallet growth (i.e. growth rate of new wallets) has an almost 1:1 relationship w/ ETH price growth.

That’s not all.

Software development in virtual world is like the construction sector in real economy— a leading indicator of GDP growth. Developer activities on a layer 1 platform is arguably more telling about the economic expansion to come than transactions or wallets.

Software development in virtual world is like the construction sector in real economy— a leading indicator of GDP growth. Developer activities on a layer 1 platform is arguably more telling about the economic expansion to come than transactions or wallets.

Back in May if you searched ‘ethereum’ and ‘solana’ on Github, the former returned 65x more repo results than the latter. By October the multiple had shrunk to 17x— closely tracking the fast growth of Solana nation.

All of this is NOT to say the platform’s own cashflow doesn’t matter.

It matters a lot, for the stability of a L1 token.

It matters a lot, for the stability of a L1 token.

Governments didn't become monopoly money issuers by accident. There have been many private currencies throughout history. But they never lasted long & were always out competed by government money.

Among many problems of private money, lack of a “fiscal anchor” is a most serious one.

Governments can protect the value of their currency through tax, which is the most stable, almost guaranteed income. Even though a fiat is “unbacked”, govs can raise resources by taxation & use those resources to buy/sell their currency to defend its value.

This is a big deal & gives confidence to currency holders.

The same couldn’t be said about non-government money, well…not until now.

The same couldn’t be said about non-government money, well…not until now.

W/ transaction fees programmed into every economic activity on the platform & used for token burn or staking reward, currencies of blockchain nations are achieving fiscal backings similar to currencies from governments.

While those cashflows do not pin down the token price, as we already discussed, they help keep exchange rate stable in the long run.

But what matters most for token price is still the GDP growth of a crypto nation. With metaverses only at primitive stage, we’re not even seeing the 1st inning of this growth yet.

Like this? Don’t forget to

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @RealNatashaChe

Questions? Thoughts? Put in the comments & I’ll address the interesting ones in future articles. Be civil.

• retweet

• follow me for more ideas to help you become smarter, richer, freer 👉 @RealNatashaChe

Questions? Thoughts? Put in the comments & I’ll address the interesting ones in future articles. Be civil.

• • •

Missing some Tweet in this thread? You can try to

force a refresh