Confluent: The Central Nervous System that is empowering Data in Motion for the Leading Corporations.

Why Confluent could become as dominant as Snowflake as a leading Open-Source Data Infrastructure.

This is my long-awaited $CFLT Investment Thesis:

Why Confluent could become as dominant as Snowflake as a leading Open-Source Data Infrastructure.

This is my long-awaited $CFLT Investment Thesis:

1/Thread Overview:

1) First Principles Analogy for Kafta (the foundations of Apache Kafta is needed to know CFLT)

2) $CFLT Overview and how it fits Kafta

3) Investment Thesis

4) The AI & Data Analytics Opportunity

Let's GO!

1) First Principles Analogy for Kafta (the foundations of Apache Kafta is needed to know CFLT)

2) $CFLT Overview and how it fits Kafta

3) Investment Thesis

4) The AI & Data Analytics Opportunity

Let's GO!

2/First, we need to know Apache Kafta?

An analogy: Imagine the task of going shopping, arriving home and you need to distribute those bought items across a BIG house FAST. Hassle? What if I gave you a robot to perform that task? Yay!

Kafta helps distribute from source > target

An analogy: Imagine the task of going shopping, arriving home and you need to distribute those bought items across a BIG house FAST. Hassle? What if I gave you a robot to perform that task? Yay!

Kafta helps distribute from source > target

3/ Now, in my analogy.

In a corporation, Data & Info are the bought items (orange colors) that comes from say, websites, apps etc.

Kafta helps to take those data and put them into the fridge & storage rooms (databases, data warehouse)- (Blue colors)

See more below

In a corporation, Data & Info are the bought items (orange colors) that comes from say, websites, apps etc.

Kafta helps to take those data and put them into the fridge & storage rooms (databases, data warehouse)- (Blue colors)

See more below

4/Finally, What is Kafta?

Apache Kafka is a system for streams or better yet managing data btw internal systems/databases in an organization and speedily helping to process vast amount of data & distribute it thru an enterprise in real-time events

Image:CFLT turns left to right

Apache Kafka is a system for streams or better yet managing data btw internal systems/databases in an organization and speedily helping to process vast amount of data & distribute it thru an enterprise in real-time events

Image:CFLT turns left to right

5/What's $CFLT role?

CFLT offer and hosts Kafka as a managed service for large enterprises primarily bcos they were the inventors of the OS Apache Kafta!

CFLT integrates real-time messy data from left image > "centralizes" it into the (right) then > distributes across the corp.

CFLT offer and hosts Kafka as a managed service for large enterprises primarily bcos they were the inventors of the OS Apache Kafta!

CFLT integrates real-time messy data from left image > "centralizes" it into the (right) then > distributes across the corp.

6/The caveat now is that CFLT Founder made Kafta an Open-Source Software, so any developer globally has access to it.

There is good and bad w/ OS.

Good: It goes viral, Infact Kafta is the leading OS amongst developers globally and its constantly improved.

Bad: Why pay for it?

There is good and bad w/ OS.

Good: It goes viral, Infact Kafta is the leading OS amongst developers globally and its constantly improved.

Bad: Why pay for it?

7/Similar to my earlier analogy, the BIGGER the house, the more you say yes to a robot to help do the shopping & distribitution.

The challenge is that Kafta is hard to implement, requires deep expertise & the inventors locked up some codes.

But w/ CFLT, you get a FULL package.

The challenge is that Kafta is hard to implement, requires deep expertise & the inventors locked up some codes.

But w/ CFLT, you get a FULL package.

8/ CFLT provides this full package with two key Product Services:

1) Fully-Managed: $CFLT manages everything and has more control while implementing it on the Cloud (This is key!)

2) Self-Managed Platform (A company manages CFLT Kafta itself)

3) Consulting Services

1) Fully-Managed: $CFLT manages everything and has more control while implementing it on the Cloud (This is key!)

2) Self-Managed Platform (A company manages CFLT Kafta itself)

3) Consulting Services

9/What drives the Investment thesis for $CFLT's thesis:

1) Adoption of the $CFLT Cloud Solution + Revenue Contribution

2) Net ARR Added

3) NRR and the Usage-Rates

4) Net Customer Added (Over the LT, SMB's)

1) Adoption of the $CFLT Cloud Solution + Revenue Contribution

2) Net ARR Added

3) NRR and the Usage-Rates

4) Net Customer Added (Over the LT, SMB's)

The Moat/Competitive Advantage (My Own Opinion)

10/

First, Enterprise:

+ 70% of the Fortune 500 use Apache Kafka

+ 80% of Fortune 100 companies

+ 60K Kafka global community

Pretty much all the major corps you know use CFLT and look at the acceleration with existing clients (!!)

10/

First, Enterprise:

+ 70% of the Fortune 500 use Apache Kafka

+ 80% of Fortune 100 companies

+ 60K Kafka global community

Pretty much all the major corps you know use CFLT and look at the acceleration with existing clients (!!)

11) Enterprise Growth Strength:

1. Customers over >$1M ARR grew the most. (90% YoY)

2. ARR Customers that contribute >$100K, 664 (48%YoY)

3. Total Customers, 3020 (75% YoY)

Though, there's a slowdown QoQ, the additions are strong and cloud is getting bigger. Very strong still!

1. Customers over >$1M ARR grew the most. (90% YoY)

2. ARR Customers that contribute >$100K, 664 (48%YoY)

3. Total Customers, 3020 (75% YoY)

Though, there's a slowdown QoQ, the additions are strong and cloud is getting bigger. Very strong still!

12) Network Effects:

Once Department A implements CFLT to manage data, you're more likely going to need to connect it to B.

Additionally, think about the impact of similar industries (above) adopting CFLT and

Also leads to the land & expand business model -> $ NRR of >130%+!

Once Department A implements CFLT to manage data, you're more likely going to need to connect it to B.

Additionally, think about the impact of similar industries (above) adopting CFLT and

Also leads to the land & expand business model -> $ NRR of >130%+!

13) BIG Brand/Developer Mind-share:

The virality and size of the Kafta developer community (Bottoms-up) globally and strength of ecosystem partners, connectors to hundreds of sources is a moat

This helps GTM strategy as Kafta is the renowned leader for event streaming of data.

The virality and size of the Kafta developer community (Bottoms-up) globally and strength of ecosystem partners, connectors to hundreds of sources is a moat

This helps GTM strategy as Kafta is the renowned leader for event streaming of data.

14) High SWITCHING COSTS!!

Lol, I had to emphasize this one.

$CFLT's Kafka is hard to displace once you have built their software over your infrastructure and databases especially as more departments adopt it.

Primarily since it serves as a central repository and hub for data.

Lol, I had to emphasize this one.

$CFLT's Kafka is hard to displace once you have built their software over your infrastructure and databases especially as more departments adopt it.

Primarily since it serves as a central repository and hub for data.

15) Optionality is IMMENSE!

Since they're the underlying infrastructure that controls data that comes in/out of a company. (Pic 1)

There's a tremendous amount of Analytics and AI Services that can be built across a variety of verticals. I see them penetrating $SNOW market soon.

Since they're the underlying infrastructure that controls data that comes in/out of a company. (Pic 1)

There's a tremendous amount of Analytics and AI Services that can be built across a variety of verticals. I see them penetrating $SNOW market soon.

16/ Revenue Growth:

+ CAGR since FY 2018 - FY 201 -> 90% YoY!! Crazy!

+ Quarterly: Accelerating from Q4 2020 -> Potentially; 74% YoY

+ RPO Growth: 75%

+ Cloud Revenue accelerated to 245% and now makes up 26% of Revenues (This is SOO Important)

+ CAGR since FY 2018 - FY 201 -> 90% YoY!! Crazy!

+ Quarterly: Accelerating from Q4 2020 -> Potentially; 74% YoY

+ RPO Growth: 75%

+ Cloud Revenue accelerated to 245% and now makes up 26% of Revenues (This is SOO Important)

17/ Competition:

Their competition is primarily a company's IT department or Big Tech. Comps are as strong.

Big Tech players don't have a COMPLETE Kafta solution and access like the inventors especially as you go up the larger enterprise. This is what makes $CFLT Moat solid.

Their competition is primarily a company's IT department or Big Tech. Comps are as strong.

Big Tech players don't have a COMPLETE Kafta solution and access like the inventors especially as you go up the larger enterprise. This is what makes $CFLT Moat solid.

18/ Future Opportunity: BIG TAM Expansion happening!

My framework for analyzing TAM is to value TAM relative to a Company's Market Share.

CFLT is #1. Unrivaled access to a rapidly growing Data & Infrastructure market GROWING 22% CAGR! CTO's are spending big on AI in 2022.

My framework for analyzing TAM is to value TAM relative to a Company's Market Share.

CFLT is #1. Unrivaled access to a rapidly growing Data & Infrastructure market GROWING 22% CAGR! CTO's are spending big on AI in 2022.

19/ CIO Spending:

Future evidence of this SaaS AI Spending is best captured in this thread by @Chris_Conforti (a really good follow for SaaS btw)

This thread captures most of the points that is driving the valuation for companies like $CFLT $SNOW $DDOG

Future evidence of this SaaS AI Spending is best captured in this thread by @Chris_Conforti (a really good follow for SaaS btw)

This thread captures most of the points that is driving the valuation for companies like $CFLT $SNOW $DDOG

https://twitter.com/Chris_Conforti/status/1456638225724944384?s=20

20/ The Negatives I'm Watching:

+ Operating Exp. & cash-burn are increasing- Too high!

+ High SBC/Lock-up

+ AWS Kafta

+ G-Margins are low due to costs to cloud providers

+ NRR in 2022

+ Can $CFLT make their Mgmd solution sticky for adoption & successfully move down-SME Market?

+ Operating Exp. & cash-burn are increasing- Too high!

+ High SBC/Lock-up

+ AWS Kafta

+ G-Margins are low due to costs to cloud providers

+ NRR in 2022

+ Can $CFLT make their Mgmd solution sticky for adoption & successfully move down-SME Market?

21/ Founders/CEO are Inventors/Scientists (Rockstars!)

@jaykreps: Super smart + Technical. Passionate! Tough guy. Eloquent Speaker.

CFO is from $GOOGL (Understands Wall Street!)

Importantly, They have over 24%! Ownership (Aligned). J's are everything, 5-Star Mgmt Team!

@jaykreps: Super smart + Technical. Passionate! Tough guy. Eloquent Speaker.

CFO is from $GOOGL (Understands Wall Street!)

Importantly, They have over 24%! Ownership (Aligned). J's are everything, 5-Star Mgmt Team!

22/ Personal Journey:

- Started tracking at IPO

- However, it kept going up. I got frustrated & picked up shares Sept-8:

- Told my followers it was a high-conviction last month

- After the strong Q3 beat, I added more at the Open Yst

- Started tracking at IPO

- However, it kept going up. I got frustrated & picked up shares Sept-8:

https://twitter.com/InvestiAnalyst/status/1435659306305740802?s=20

- Told my followers it was a high-conviction last month

- After the strong Q3 beat, I added more at the Open Yst

https://twitter.com/InvestiAnalyst/status/1400116244666368015?s=20

23/ This Thread is getting long. So I'll start wraping-up.

I will add $CFLT to my list of backlogs for Write-ups I'd hope to release.

I've tried to make it simple but $CFLT & Apache Kafta is a MORE complex technology than this thread.

My link:

investianalystnewsletter.substack.com/welcome

I will add $CFLT to my list of backlogs for Write-ups I'd hope to release.

I've tried to make it simple but $CFLT & Apache Kafta is a MORE complex technology than this thread.

My link:

investianalystnewsletter.substack.com/welcome

24/ My background in Analytics helped me realize this CFLT would be important, however, I've learned a tremendous amount from many.

a) Technically Substack

b) Talk to OS Developers

c) @hhhypergrowth Premium has a good $CFLT deep-dive.

I'm open to questions/feedback!

a) Technically Substack

b) Talk to OS Developers

c) @hhhypergrowth Premium has a good $CFLT deep-dive.

I'm open to questions/feedback!

25/ To wrap-up, the valuation is stretched!

However, $CFLT valuation is a combination of the Product Moat relative to Competitors + Big budget spending happening by CTO's on Data & AI Infrastructure (Similar $SNOW) + Rapid To-line Growth.

This is a summary of my thread below:

However, $CFLT valuation is a combination of the Product Moat relative to Competitors + Big budget spending happening by CTO's on Data & AI Infrastructure (Similar $SNOW) + Rapid To-line Growth.

This is a summary of my thread below:

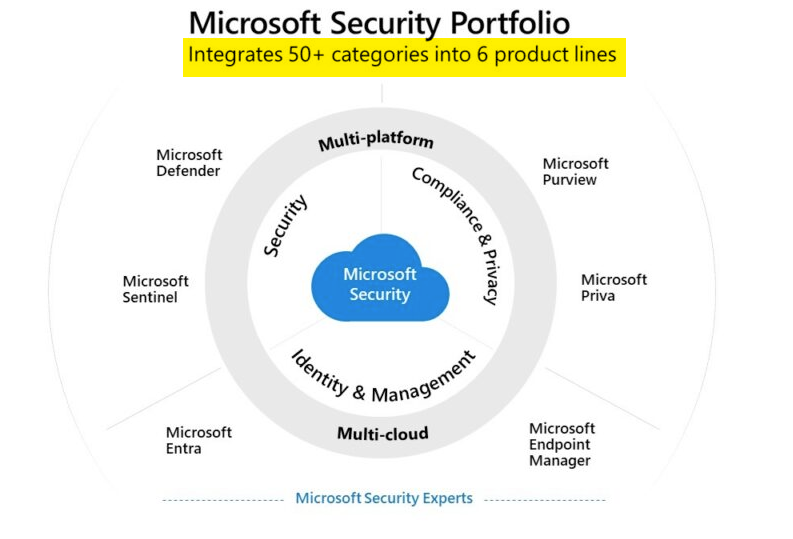

26/ These 2-final images summarizes my $CFLT thesis:

A Complete foundational data infrastructure that nodes as a central nervous system for Large Enterprise Data on Kafta.

If you found this helpful, feel free to share. Thanks for reading.

Open to Your Questions/Feedback. TY!

A Complete foundational data infrastructure that nodes as a central nervous system for Large Enterprise Data on Kafta.

If you found this helpful, feel free to share. Thanks for reading.

Open to Your Questions/Feedback. TY!

• • •

Missing some Tweet in this thread? You can try to

force a refresh