Why I think @AxieInfinity is going to have a crazy next few months 🧵

DAU's - Daily active users have continued to grow ~5% WOW for the past few months. This is likely primarily driven by the rise of many P2E guilds and the expansion of existing guilds such as @YieldGuild

DAU's - Daily active users have continued to grow ~5% WOW for the past few months. This is likely primarily driven by the rise of many P2E guilds and the expansion of existing guilds such as @YieldGuild

However, despite this continued growth in Axie DAU's, we have seen Axie breeding growth remain relatively flat. Keep in mind that for every new @AxieInfinity player there must be at least 3 new #Axies created

Looking at the current supply of Axies we can see that there are just under 9M axies. This means that if every player only had 3 axie's (many players have 10-20+) we could only accommodate 500k new players. (only about 20% growth)

https://twitter.com/DAVEvsAXIE/status/1458118161967063046?s=20

If Axie keeps its current growth up we will run out of available Axie's. This can mean two things

1) Axie's go up in price (demand expansion)

2) More Axie's are bred (supply expansion)

1) Axie's go up in price (demand expansion)

2) More Axie's are bred (supply expansion)

Scenario 1: Axie's go up in price

As available Axie's become more scarce due to growth in players. Demand for new Axie's will increase likely causing the average price of each Axie to increase. This will, in turn, make breeding more profitable and will spark a supply expansion.

As available Axie's become more scarce due to growth in players. Demand for new Axie's will increase likely causing the average price of each Axie to increase. This will, in turn, make breeding more profitable and will spark a supply expansion.

Scenario 2: More Axie's are bred

In order to accommodate the growth in players, Axie breeding growth will need to increase. This will end up burning more $SLP as breeders start breeding more and eat up a significant amount of SLP sell pressure and should have a + effect on $SLP

In order to accommodate the growth in players, Axie breeding growth will need to increase. This will end up burning more $SLP as breeders start breeding more and eat up a significant amount of SLP sell pressure and should have a + effect on $SLP

On top of increased breeding that needs to happen ($SLP sink), @SkyMavisHQ have added another instrumental piece to the Axie economy: Katana

As we know Katana DEX has launched and has already attracted over 1.2B of TVL in just it's first week.

As we know Katana DEX has launched and has already attracted over 1.2B of TVL in just it's first week.

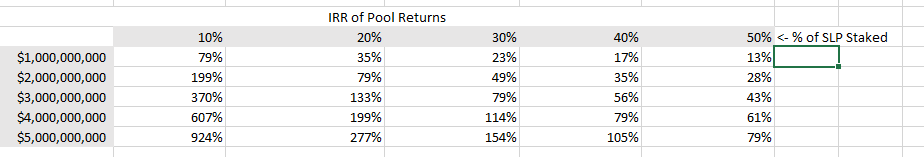

Along with Katana the @AxieInfinity team has also released a RON farm in order to incentive liquidity. RON will be the ecosystem token and will be used to pay gas and fees. Thanks to @TraderNoah we can see that RON incentives present attractive LP yields

Vertical is FDV of RON

Vertical is FDV of RON

This has led to ~250M of SLP (1/4 of supply) deposited into Katana to be used as liquidity. Assuming all of this is staked and RON is at least at $5b FDV ($IMX is 11B), then LP's should be getting ~200% yield. This in turn should add another element of demand for $SLP

These $RON incentives are due to last 90 days which means the majority of that $SLP will be locked up where otherwise it would have been sold (major temp supply sink). Furthermore, with such good yields, there should be increased $SLP demand from farmers and funds.

Couple this with the need to aggressively grow supply and we should see the SLP mint/burn + lock up balance get closer to an equilibrium. This should have a positive effect on $SLP price which in turn will make farming SLP more attractive -> more breeding -> more growth

This flywheel effect + $SLP locked should kickstart another wave of massive growth for Axie's and DAU's. This should allow the token econ to sustain itself until more gameplay features are released giving the economy more supply sinks and balance.

Although concerns around Axie's economic sustainability are valid. I think RON farming and the need for more Axie's will give @AxieInfinity another few months of run-way where they can implement more gameplay features to be able more organically balance the economy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh