Facebook news - amended complaint filed to what I previously called "Mother of all lawsuits" - insider trading allegations tied to FB knowingly leaking data for $, paying $5B to cover it up, governance failure, etc. I'll add more context in 15 tweets and link to prior thread. /1

It includes maybe ten new paragraphs - many in insider trading and governance failure sections. Includes new heavily redacted details regarding Facebook's "board" setting up an alleged scapegoat "Special Committee" just in time to settle for $5 billion and protect Zuckerberg. /2

Reminder, the allegation is this was done to avoid Zuckerberg being deposed or having his communications subject to discovery. To end the SEC and FTC lawsuits. There is also new info on the settlement and how many orders of magnitude larger it was than prior settlements. /3

All sorts of board members bailed in that time period. The lawsuit claims it was in part due to "clashes with Zuckerberg." Again, the board, the committees, the special committee, everything pretending to hold Zuckerberg accountable is controlled by Zuckerberg. /4

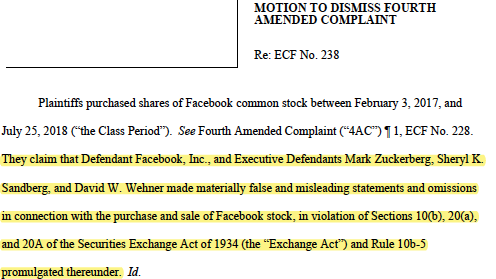

Many of the allegations relate to people both benefiting and failing in their governance roles. eg it adds a # to Sheryl Sandberg's stock trades during the cover-up in the insider trading allegations allegations. It's a whopping $1.6 billion. /5

There is actually an entire list of defendants in the lawsuit categorized as the "Insider Trading Defendants." Narrator: it's generally good to avoid being labeled this way. /6

Also new is a bunch of detail on one of Zuckerberg's board members who is a partner at WilmerHale. That's insane to me since they represent Facebook in many of its most sensitive lawsuits, coached Zuckerberg when he testified and reportedly do a lotta influencing on Congress. /7

It also adds details on how Peter Thiel has benefited being on the board. When Facebook was opening its platform providing its incredibly valuable data to other companies, some of them were Thiel investments being given special access according to the allegations. /8

On that note. Reminder much of case dates back to Facebook's slowing growth ahead of IPO. They were "running out of humans" as Sam Lessin (yes, that one) noted to Zuckerberg in emails only to regain scale for advertisers by trading on their access to users' personal data. /9

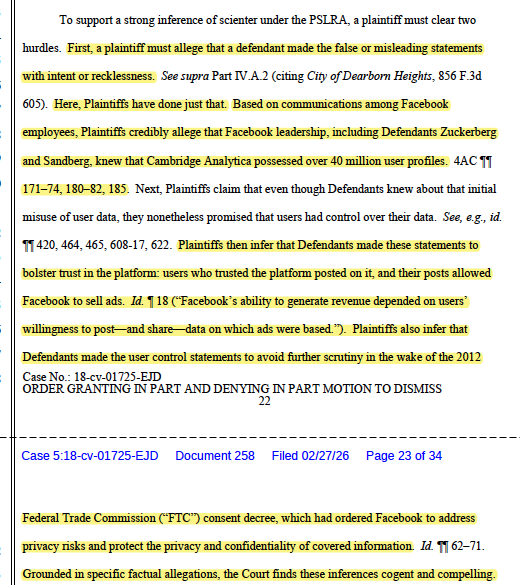

As they opened up platform data, FB whitelisted and gave special access to apps which were categorized as "Mark's friends" and "Sheryl's friends" among others. It's hard to underplay the economic and relationship value of being on those lists. But no, they didn't *sell* data. /10

When Cambridge Analytica happened, leadership and PR flipped out on the word "breach." They likely did this because it didn't fit California's definition of a security breach which would require notification. Instead, the platform was leaking data by design for profits. /11

This is also new. Zuckerberg and Sandberg's admission of direct responsibility. I assume this is intended to set up why it would be wrong to simultaneously be responsible and also drive the decision to pay Billions to settle and protect their own liability from a cover-up. /12

A couple other random notes. Who knew Peter Thiel gets to decide how much Zuckerberg gets compensated? Sleep well my friends. /13

I also didn't know Papamiltiadis left just a couple months ago at the same time he was being named in these lawsuits. I betcha he has an interesting story to tell. /14

OK, that's all for now. Here is a link to my full thread from when this lawsuit was filed by very large pension funds after winning rights to inspect Facebook's books including actual messages between its board and leadership during the cover-up. /15 /eof

https://twitter.com/jason_kint/status/1440304941428473857

• • •

Missing some Tweet in this thread? You can try to

force a refresh