1/22 What is the "cost control mechanism" & why are @TheBMA @BMA_Pensions preparing to go to court over it. An explainer 🧵

You can see the detail of @BMA_Pensions case here👇 read on to understand what it means. Its complicated so stay with me (& pls RT)

You can see the detail of @BMA_Pensions case here👇 read on to understand what it means. Its complicated so stay with me (& pls RT)

https://twitter.com/BMA_Pensions/status/1459465665270751234?s=20

2/n

OK to understand the the "cost control" mechanism we need to revisit history of the NHS pension scheme (and other similar pension schemes).

In yesteryear you gave a lifetime of public service & (deservingly) got a good “final salary” pension.

OK to understand the the "cost control" mechanism we need to revisit history of the NHS pension scheme (and other similar pension schemes).

In yesteryear you gave a lifetime of public service & (deservingly) got a good “final salary” pension.

3/n

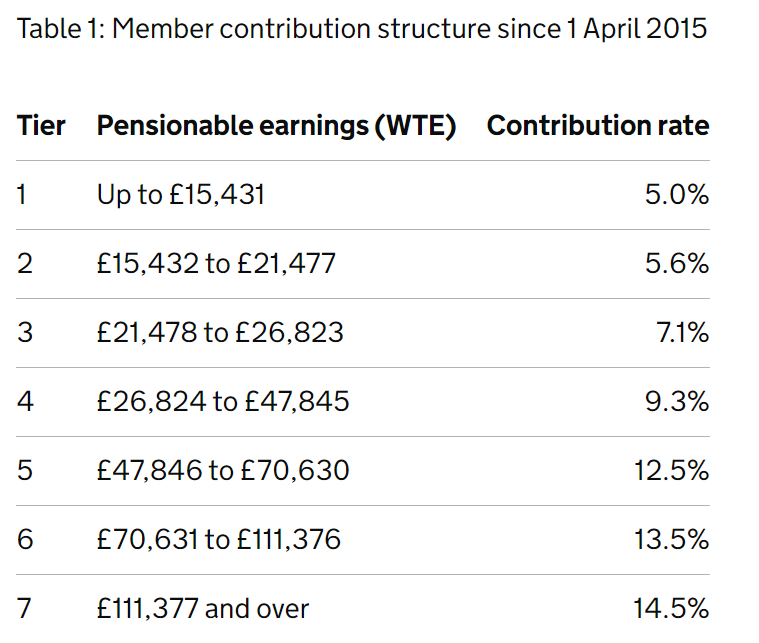

Back in those good old days, you paid 5 or 6% gross salary & got "80ths" for each year.

For example you worked 37 years & final salary £120k, pension= 37/80ths x £120k=£55,500 (& in the old days no AA/LTA but that's another matter!)

Back in those good old days, you paid 5 or 6% gross salary & got "80ths" for each year.

For example you worked 37 years & final salary £120k, pension= 37/80ths x £120k=£55,500 (& in the old days no AA/LTA but that's another matter!)

4/

You would get £55k pension at normal retirement age- 60yrs fo most (even younger for some) & it would be index linked to inflation, plus a lump sum (3/80ths) of £166,500.

But as people lived longer and longer (spending more time in retirement), government worried about cost

You would get £55k pension at normal retirement age- 60yrs fo most (even younger for some) & it would be index linked to inflation, plus a lump sum (3/80ths) of £166,500.

But as people lived longer and longer (spending more time in retirement), government worried about cost

5/

For the NHS they first introduced the 2008 pension scheme. This was

❌more expensive for members than the historical scheme

❌pushed normal retirement age to 65

✔️ introduced an employer cost ceiling could factor in automatic adjustments to maintain a fixed cost level

For the NHS they first introduced the 2008 pension scheme. This was

❌more expensive for members than the historical scheme

❌pushed normal retirement age to 65

✔️ introduced an employer cost ceiling could factor in automatic adjustments to maintain a fixed cost level

6/

But hungry for yet more savings, government commissioned Lord Hutton in 2011 to review public sector pension accross the board, even though the NHS had already taken steps to reduce and fix those costs

But hungry for yet more savings, government commissioned Lord Hutton in 2011 to review public sector pension accross the board, even though the NHS had already taken steps to reduce and fix those costs

7/

Hutton knew those in the NHS & elsewhere would be unhappy with further changes, so there was a "25-year guarantee" to try and prevent yet further changes, but equally to ensure costs to the taxpayer remained within a certain *affordable* envelope. This was the "cost cap".

Hutton knew those in the NHS & elsewhere would be unhappy with further changes, so there was a "25-year guarantee" to try and prevent yet further changes, but equally to ensure costs to the taxpayer remained within a certain *affordable* envelope. This was the "cost cap".

8/

Importantly Lord Hutton also explicitly warned government

⚫it was not necessary to give special protections to older members

⚫doing this would also not be possible due to age discrimination law

Government ignored Lord Hutton & introduced "transitional protection" anyway

Importantly Lord Hutton also explicitly warned government

⚫it was not necessary to give special protections to older members

⚫doing this would also not be possible due to age discrimination law

Government ignored Lord Hutton & introduced "transitional protection" anyway

9/

So Hutton made certain promises to those working in the pubic sector, and also to taxpayers. This came with a 25 year guarantee so that the "fixed cost" would be controlled with a "cost cap".

So Hutton made certain promises to those working in the pubic sector, and also to taxpayers. This came with a 25 year guarantee so that the "fixed cost" would be controlled with a "cost cap".

10/ The intention of the cost cap is to keep scheme costs at a "target" percentage of employee's pensionable pay.

The cost cap currently operates "symmetrically" around this target +/- 2%.

The government's actuary does a valuation every 4 years to compare against this target.

The cost cap currently operates "symmetrically" around this target +/- 2%.

The government's actuary does a valuation every 4 years to compare against this target.

11/

If costs are ⬆️2% thats a "ceiling" breach

If costs are ⬇️2% thats a "floor" breach

Breaches are corrected by changing pension contributions or benefits (accrual) to keep the cost within 2% of target, to keep the 25 year promise to staff & taxpayers alike.

That's fair ?

If costs are ⬆️2% thats a "ceiling" breach

If costs are ⬇️2% thats a "floor" breach

Breaches are corrected by changing pension contributions or benefits (accrual) to keep the cost within 2% of target, to keep the 25 year promise to staff & taxpayers alike.

That's fair ?

12/

So if there is a ceiling breach (i.e. scheme's are too expensive) thats corrected with ⬆️contributions and/or⬇️benefits to bring to target.

If there is a floor breach (i.e. scheme's are too cheap) thats corrected with ⬇️contributions and/or⬆️benefits to bring to target

So if there is a ceiling breach (i.e. scheme's are too expensive) thats corrected with ⬆️contributions and/or⬇️benefits to bring to target.

If there is a floor breach (i.e. scheme's are too cheap) thats corrected with ⬇️contributions and/or⬆️benefits to bring to target

13/

The most recent provisional valuation (2016) showed the NHS scheme was considerably cheaper than anticipated i.e. a floor breach.

The reasons for this are complicated including (disgraceful) pay restraint, the rate of change of longevity & some complex technical factors.

The most recent provisional valuation (2016) showed the NHS scheme was considerably cheaper than anticipated i.e. a floor breach.

The reasons for this are complicated including (disgraceful) pay restraint, the rate of change of longevity & some complex technical factors.

14/

When there is a breach it is discussed in the Scheme Advisory Board / TAG group (which @TheBMA representatives and I sit on).

The "surplus" in the scheme finances should have been used to ⬆️benefits, as per "cost cap" floor breach

When there is a breach it is discussed in the Scheme Advisory Board / TAG group (which @TheBMA representatives and I sit on).

The "surplus" in the scheme finances should have been used to ⬆️benefits, as per "cost cap" floor breach

15/

Specifically the surplus was to have funded for our members (from April 2019) improvements including

- ⬆️benefits to 1/48.1ths from 1/54ths (a really big deal)

- A move to "actual" pay instead of WTE pay (to correct unfair discrimination against LTFT workers)

Specifically the surplus was to have funded for our members (from April 2019) improvements including

- ⬆️benefits to 1/48.1ths from 1/54ths (a really big deal)

- A move to "actual" pay instead of WTE pay (to correct unfair discrimination against LTFT workers)

16/

As you will know, the govenment were subsequently found to have discriminated against younger members by introducing "transitional protection" (despite being told by Lord Hutton this would happen).

As a result of this "McCloud" (and others) litigation, government decided to

As you will know, the govenment were subsequently found to have discriminated against younger members by introducing "transitional protection" (despite being told by Lord Hutton this would happen).

As a result of this "McCloud" (and others) litigation, government decided to

17/

unilaterally "pause" the cost cap mechanism. That is the subject of seperate litigation (including by @TheBMA). However government recently "unpaused" the cost cap, but in doing so also stating that McCloud costs would be a "member cost" in the cost cap process.

unilaterally "pause" the cost cap mechanism. That is the subject of seperate litigation (including by @TheBMA). However government recently "unpaused" the cost cap, but in doing so also stating that McCloud costs would be a "member cost" in the cost cap process.

18/

In doing this goverment said they would waive any ceiling breach but this was an empty promise because there was no ceiling breach.

But in doing this revaluation, they would no longer be a "floor breach" (which would have translated to increased benefits)

In doing this goverment said they would waive any ceiling breach but this was an empty promise because there was no ceiling breach.

But in doing this revaluation, they would no longer be a "floor breach" (which would have translated to increased benefits)

19/

Let me put that into simple terms.

"We messed up. We ignored advice that this would be discrimination. We then discriminated against you. We are sorry but now we want you to pay to fix our errors".

That will be a no from me!

Let me put that into simple terms.

"We messed up. We ignored advice that this would be discrimination. We then discriminated against you. We are sorry but now we want you to pay to fix our errors".

That will be a no from me!

20/

Others including @Meg_HillierMP chair of @CommonsPAC have raised an eyebrow about @hmtreasury's unfair approach to this

Others including @Meg_HillierMP chair of @CommonsPAC have raised an eyebrow about @hmtreasury's unfair approach to this

21/

So @TheBMA are very clear. The cost of rectifying the Government’s discrimination must not be passed on to scheme members.

The improved benefits (1/48.1th vs 1/54ths) and being based on actual pay must be passed on to scheme members it should have been in 2019.

So @TheBMA are very clear. The cost of rectifying the Government’s discrimination must not be passed on to scheme members.

The improved benefits (1/48.1th vs 1/54ths) and being based on actual pay must be passed on to scheme members it should have been in 2019.

22.

As is often the case, its a bit more complicated that that, if you're interested feel free to read the legal letter. We @BMA_Pensions will keep you posted where possible. Its one of several ongoing legal cases aiming to protect your pension.

Pls share/RT to spread awareness

As is often the case, its a bit more complicated that that, if you're interested feel free to read the legal letter. We @BMA_Pensions will keep you posted where possible. Its one of several ongoing legal cases aiming to protect your pension.

Pls share/RT to spread awareness

• • •

Missing some Tweet in this thread? You can try to

force a refresh