To an economist, the benefit of an interest free loan is the interest you would have had to pay had you borrowed the money on the open market. And the benefit of a cheap loan is the difference between the amount of interest you paid and the open market interest rate.

Putting it another way, the amount of interest the borrower pays that is less than the rate s/he would have paid had s/he borrowed on the open market is a transfer of a benefit by the lender to the borrower.

This is economic commonsense.

And it's also what the tax code says. If you are a director and you receive an interest free or cheap loan you are taxed as if you received a 'benefit-in-kind' and its value is the difference between the interest you paid and the "official rate".

And it's also what the tax code says. If you are a director and you receive an interest free or cheap loan you are taxed as if you received a 'benefit-in-kind' and its value is the difference between the interest you paid and the "official rate".

You can see the "official rate" that HMRC uses to calculate the value of the benefit in kind published here: gov.uk/government/pub…

Here is what @AVMikhailova has reported about loans taken out by @Jacob_Rees_Mogg (dailymail.co.uk/news/article-1…) and which, she says, he has not declared.

The rates are much lower than HMRC's "official rate" so you would expect a "benefit in kind" and a tax charge.

The rates are much lower than HMRC's "official rate" so you would expect a "benefit in kind" and a tax charge.

Mr Rees Mogg says that low interest loans are not "earnings" and so he was not required to declare them in the Registration of Members' Financial Interests.

But is that right?

But is that right?

You can read the rules for directors here: publications.parliament.uk/pa/cm201516/cm…

And you see there is a requirement to declare "taxable... benefits".

And you see there is a requirement to declare "taxable... benefits".

The rule could hardly be clearer. And, as a generality, as I have set out, cheap or free directors' loans are taxable and so the fact that they are different from salary is completely irrelevant to whether or not they are required to be registered by the Member.

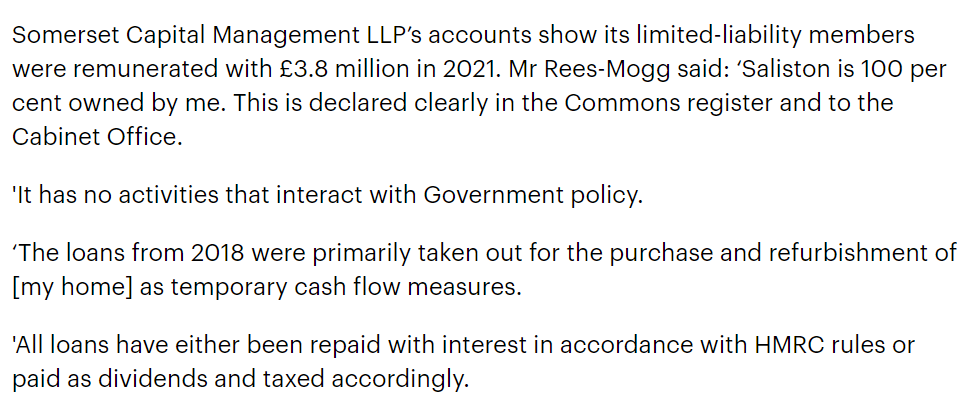

But if you read not how the story is reported but what Mr Rees Mogg actually says, the picture gets muddier rather than clearer.

Here's his statement and he says the loans "have either been repaid with interest... or paid as dividends."

Here's his statement and he says the loans "have either been repaid with interest... or paid as dividends."

In isolation, that statement causes my 'bullshit' antennae to twitch rather than still.

He says they "have been repaid" which leaves open the possibility he (later) repaid the loans or declared them as dividends suggesting they should have been on the Register until that point.

He says they "have been repaid" which leaves open the possibility he (later) repaid the loans or declared them as dividends suggesting they should have been on the Register until that point.

But if you look at the accounts of Saliston Limited for the year ending 31 March 2018, you can see it appears he was charged interest at 3.5% interest which was above the 'official rate'.

If he was being charged above the official rate on the loan there wouldn't be a "taxable... benefit" and so he wouldn't have a duty to register the loan under "Category 1 earnings and employment" and so the predicate of the Mail on Sunday's story (see below) would just be wrong.

There is also a requirement to register both "shareholdings" and "any other financial asset... if... it meets the test of relevance."

A loan is plainly "any other financial asset" but Mr Rees Mogg's interest in Saliston Limited as a shareholder and his interest in it as a borrower are very similar interests and I think one could reasonably take the view one doesn't need to register both.

The TL;DR is, I have very real doubt about whether the story has been reported in a way which is accurate - or fair to Mr Rees Mogg.

Whenever the work that @GoodLawProject is doing uncovering sleaze in his Government is put to Mr Rees Mogg in Parliament he responds with a reference to me killing a fox that caught itself in netting whilst attacking our pet chickens as though that were some answer to the point.

I think that response is hypocritical - he supports the killing of foxes for sport; is demeaning of Parliament for its ad hominem character; and is an ugly attempt to dodge accountability.

But I want to be better than that - and I don't think this story treats him fairly.

But I want to be better than that - and I don't think this story treats him fairly.

• • •

Missing some Tweet in this thread? You can try to

force a refresh