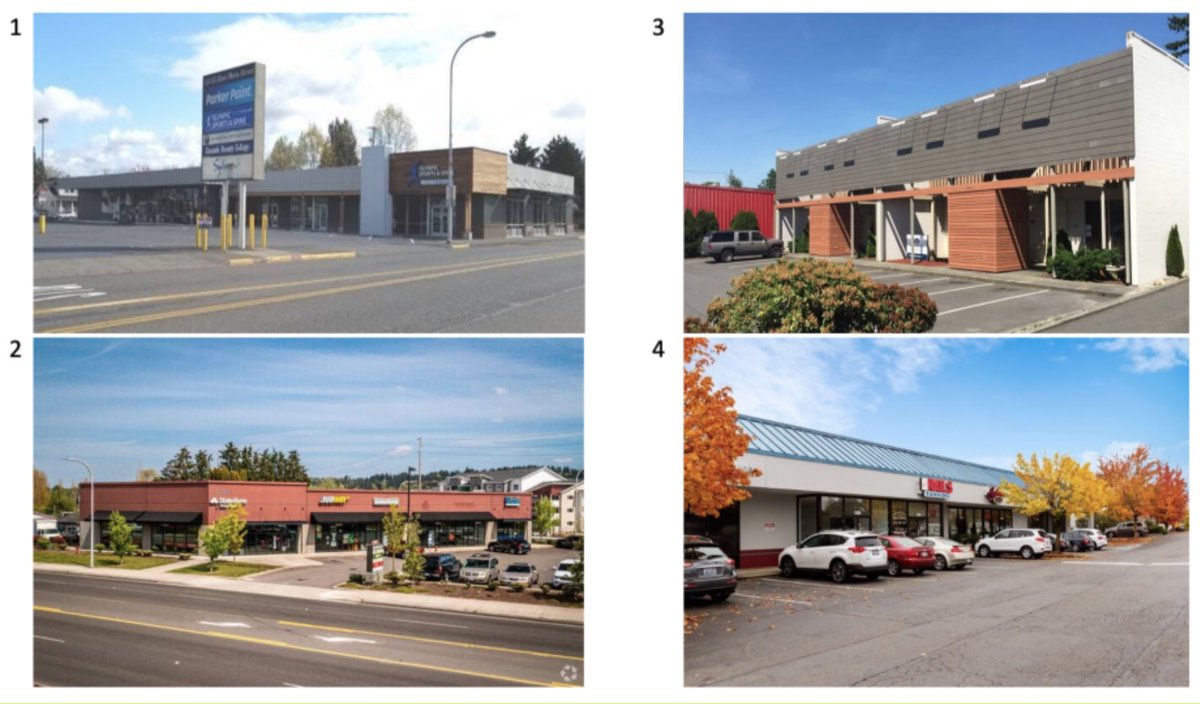

Here's a story on how my brother and I closed on a $3.2M retail strip center #retwit

It was off-market. We've been pursuing the owner for a while now and timing was never right. We stayed persistent and the owner finally gave us a call letting us know he was ready to sell and do a 1031 Exchange. Extreme persistence worked here!

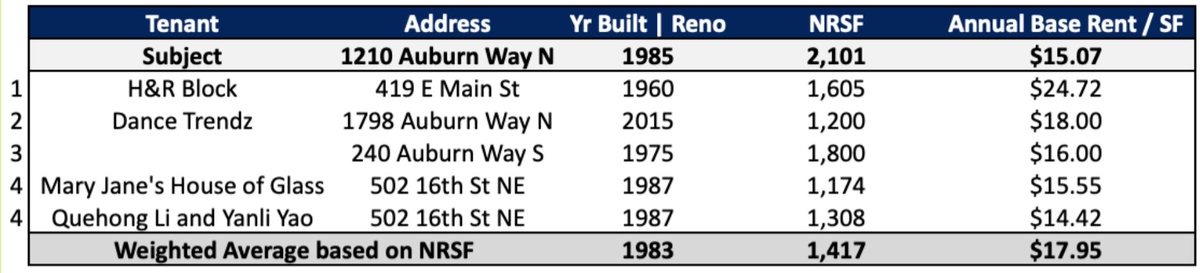

The current weighted average rent is $15.07 per sf. ft. CoStar indicates that the average submarket rent for strip center properties is $20.80. This gives us plenty of room to increase rents. Here are some comps we looked at:

To maximize the value of the property, we anticipate minor renovations and upgrades, like

- re-stripping of the parking lot

- enhancing the landscaping

- adding awnings to the back exterior doors

- converting all exterior lighting to LED

- Painting the exterior

+ more

- re-stripping of the parking lot

- enhancing the landscaping

- adding awnings to the back exterior doors

- converting all exterior lighting to LED

- Painting the exterior

+ more

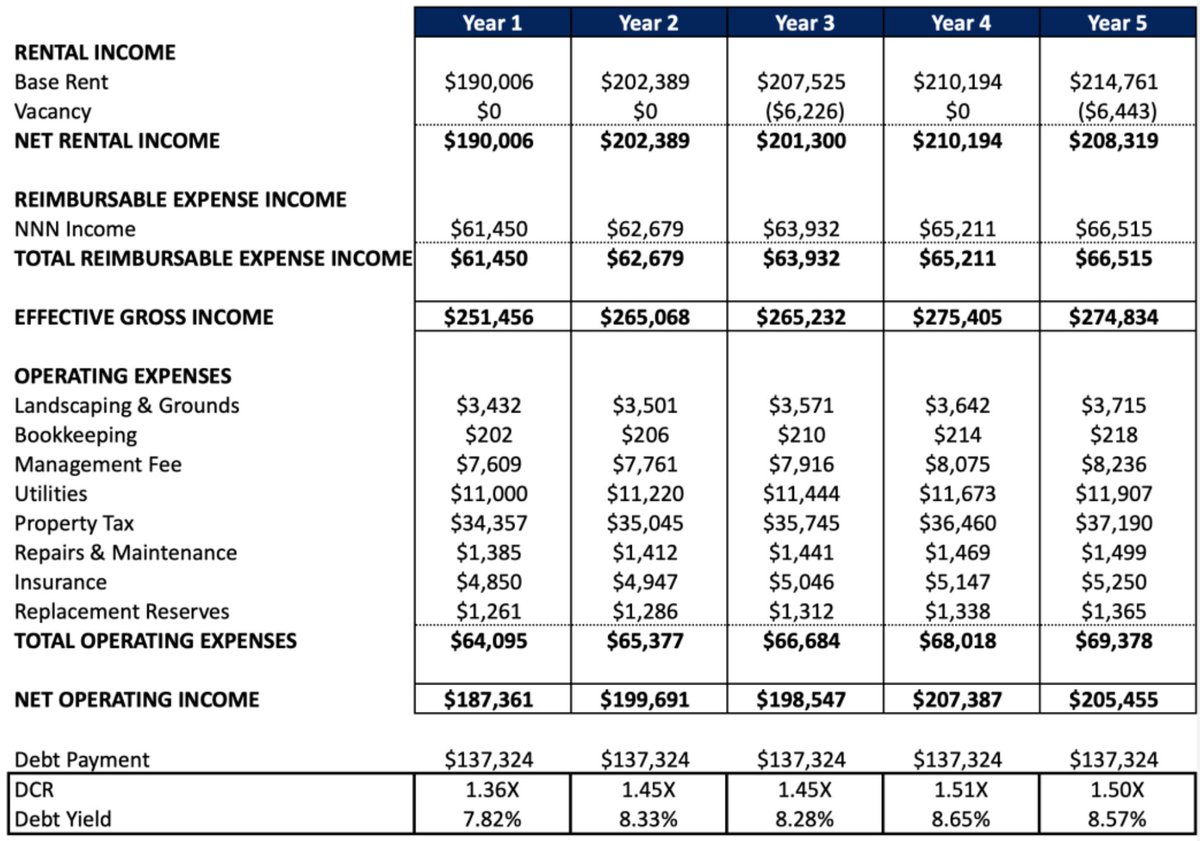

Since they are all NNN leases, we are able to better predict cash flow (avg. 7.47%). Our initial equity investment was $835,000 by the way.

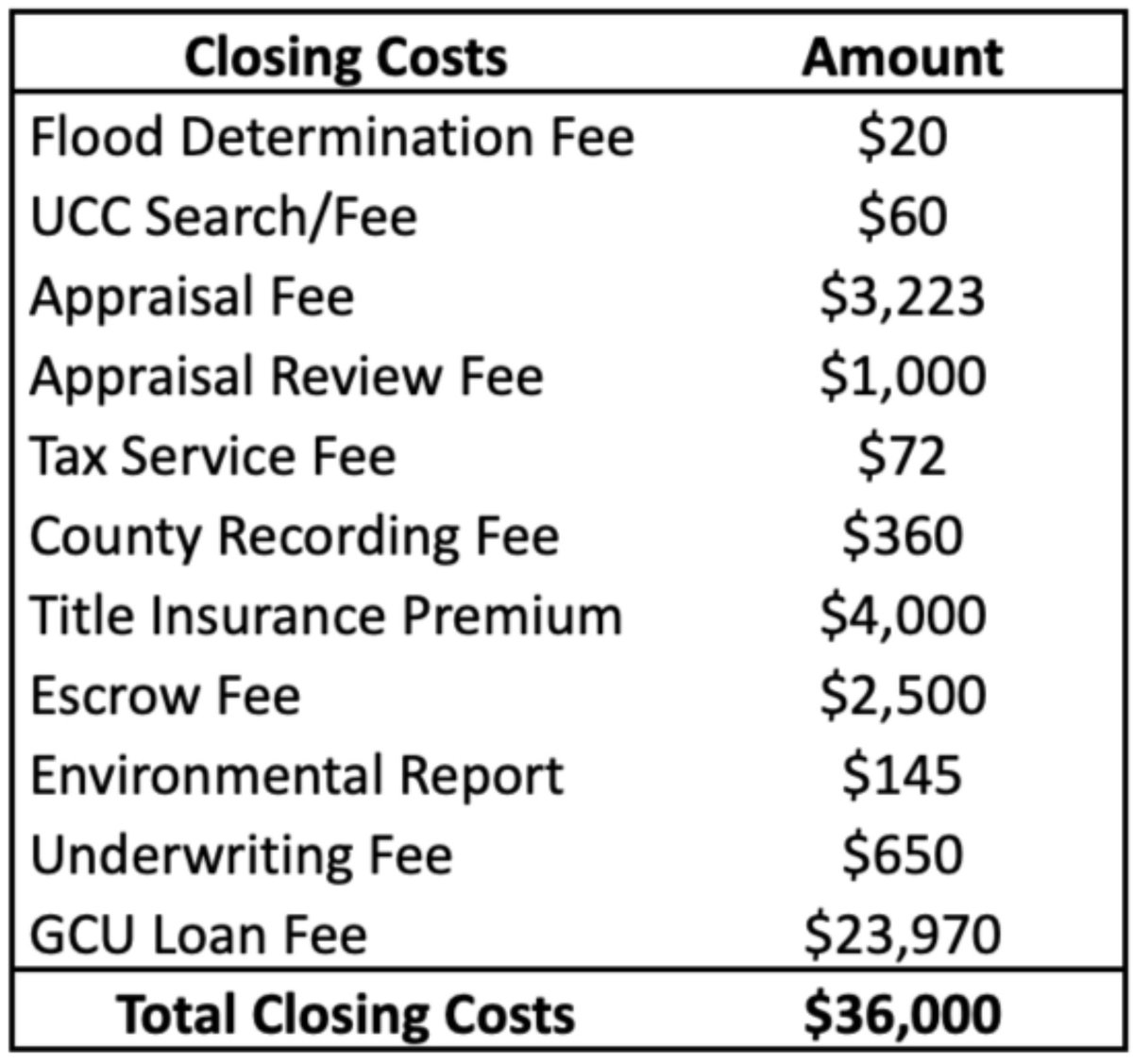

We met with nearly 30 lenders and most had cut back on their retail lending portfolios, increased rates and lowered proceeds due to the uncertainties from COVID-19. We stayed persistent till we found someone that believed in us/the property.

We finally found a local lender and landed with these terms:

- 75.00% loan to purchase price ($2,397,000)

- Term - 10 years fixed

- Amortization - 30 years

- Interest Rate - 4.00%

- Loan Fee - 1.00% (of committed loan amount)

- No prepayment penalties

- No interest minimums

- 75.00% loan to purchase price ($2,397,000)

- Term - 10 years fixed

- Amortization - 30 years

- Interest Rate - 4.00%

- Loan Fee - 1.00% (of committed loan amount)

- No prepayment penalties

- No interest minimums

By getting 30 yrs, we improved our CoC. W/ no prepayment penalties and no interest minimums, we have a lot of flexibility in the future for potential exit strategies. In addition, the 10 year fixed term provides better predictability of cash flow from fixed mortgage payments.

How we funded this deal: Over the past yr we built up a database of a few dozen potential investors from existing relationships, coworkers, and mutual connections. For this deal, we ended up going with a single investor who also signed off on the loan.

Main lesson learned is the importance of presenting a solid deal, business plan, and building trust with everyone involved (investors, partners, lenders, property owner, etc.)

Hopefully this was helpful. If you enjoyed this summary, please retweet and show some love! You can also view a more detailed analysis here: michaelcapital.substack.com/p/auburnretail…

Please tear this apart @realEstateTrent @RohunJauhar @Levijameshere @sweatystartup @EstateRanger @thejay2 @jkostecki_rei @austinpatsine @MarcSGilbert @kriskrohnrei

• • •

Missing some Tweet in this thread? You can try to

force a refresh