🩸US v Holmes again🩸

The lawyers are fighting about whether to discuss the lost database of Theranos tests.

(Some background on it here: cnbc.com/2021/07/07/mis…)

The lawyers are fighting about whether to discuss the lost database of Theranos tests.

(Some background on it here: cnbc.com/2021/07/07/mis…)

Now Holmes lawyer Richard Cleary is arguing the defense should be able to include testimony of positive reviews / surveys of Theranos tests.

Judge Davila is skeptical. He said the majority of the customer comments talk about pricing bc they had no health insurance. Or they were given $100 gift cards by doctors. Not about the accuracy of the tests.

Judge further notes that there are lots of comments from phlebotomists, who are employees of Theranos.

John Bostic argues that the patient reviews aren't relevant. The reports were only sent to Holmes in 2015, and the majority of the investments in the case happened before that.

John Bostic argues that the patient reviews aren't relevant. The reports were only sent to Holmes in 2015, and the majority of the investments in the case happened before that.

Bostic further argues that Holmes had "better sources of information" about Theranos results... from her own lab. And "if positive information is admissible just bc Holmes saw it, then negative information that Holmes saw should also be admissible," ie, the 2015 WSJ article.

Judge Davila says he sees nothing to disturb the court's previous ruling on this issue. Glad we just spent an hour debating it!!

And Alan Eisenman has left town. So we will be getting a new witness this morning.

The prosecution has called Danise Yam aka So Han Spivey, likely to re-introduce a certain email.

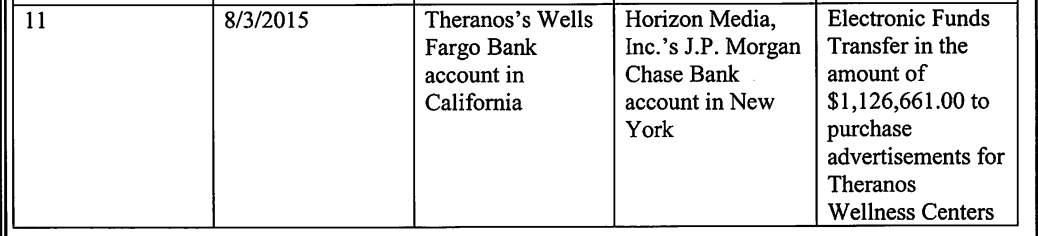

We see a late 2015 email regarding expenses for an ad campaign (TV, print, etc) in the millions of dollars in Arizona.

* $1.1 million to be precise, wired to Horizon Media, the marketing firm. This is one of the wire fraud counts outlined in the indictment.

Lance Wade is questioning Yam on whether the wire transfers discussed in the email actually happened ...can't we just verify that somewhere?

Yam is excused.

The U.S. has called Brian Grossman, a managing partner at PFM Health Sciences, a San Francisco firm that runs a hedge fund and growth equity fund.

The U.S. has called Brian Grossman, a managing partner at PFM Health Sciences, a San Francisco firm that runs a hedge fund and growth equity fund.

Grossman offers up a little lesson on limited partners. PFM's include pension funds. AKA, hey jury, it's not just rich people who were burned by Theranos!

Grossman met with Balwani and Theranos at its lab in December 2013. He testifies that the security to enter the building, including its NDAs, was unusually strict.

Grossman goes into a very long and detailed tale of the claims Holmes made to him about Theranos's technology and business. She told him the usual: Theranos was more reliable than Labcorp/Quest and they worked with pharma companies and on medevacs on the battlefield.

Grossman testifies: "Ms. Holmes was actually very clear that they could match every test on the Labcorp and Quest menu of tests."

We see an email from Grossman to Holmes and Balwani containing due diligence questions. There are seven areas of question (technology, IP + barriers to entry, Regulatory, Financial Model/Projections, etc) with lonnnnnng lists of detailed questions for each.

Grossman had three analysts working on the deal and says "there’s a lot of analytic labor" that goes into his firm's modeling. This appears to be the most diligence that any Theranos investor has done so far...

Or at least attempted diligence. Holmes and Balwani answered the questions in meetings. It appears we are going to go through their spoken answers on every one of these questions (there are many...).

Grossman said he saw various different versions of the Theranos blood testing machines at their manufacturing facility in Newark, at their CLIA lab in Palo Alto and in the lobby of their California St. office.

Grossman: "They were emphatic that this was not another point of care testing company. This was the entire laboratory shrunk down into a box."

So we have walked through the same slideshow that Theranos presented to most of its investors including being "comprehensively validated by pharma companies.

Grossman asked to talk to Walgreens and Sunny Balwani told him he was "very uncomfortable" with that. He told Grossman it “would be a strange conversation, they have a great relationship, it wouldn’t look good."

“He had a series of responses along those lines."

“He had a series of responses along those lines."

Grossman also wanted to talk to United Healthcare, which (apparently) had a contract with Theranos.

Similar to Walgreens, Balwani said no. "It will look badly on us, if investors are asking to speak to someone at the company."

Similar to Walgreens, Balwani said no. "It will look badly on us, if investors are asking to speak to someone at the company."

Grossman spoke to Channing Robertson (Theranos board member, former Stanford professor) twice. Robertson said Theranos had no technical risk its technology inside the MiniLab was sound.

This is totally separate but the hostile emails between Eisenman and Balwani/Holmes are really a marvel and I feel the need to share this one.

Now Grossman is looking at Theranos's revenue projections. Its so very tiny and I did not bring binoculars but it seems to be even wilder than what we've seen in the past: Theranos projected $1.68 billion in revenue by the end of 2015.

I believe Grossman is the only investor we've heard from who went to a Walgreens to get his blood tested on his own.

Afterward he asked Balwani why he had to have a venous draw (no fingerstick) and why it took more than 4 hours.

Afterward he asked Balwani why he had to have a venous draw (no fingerstick) and why it took more than 4 hours.

Balwani blamed a rare test and a lab failure. Thanked him for "highlighting this issue."

We see internal Theranos emails discussing Grossman's results. He is a "VIP" and they push to get his results out quickly. The results appear to be run on a third party machine, which Balwani never told him about.

At the very end we saw that Grossman's firm invested $96 million across several funds.

Lance Wade is up for cross-exam. Unlike with past investors, who Wade attempted to discredit by criticizing their lack of diligence, the strategy here seems to be building up how much diligence Grossman's firm did.

Wade asks Grossman to define a hedge fund and he runs down all the various attributes ending with "and obviously, a hedge fund can hedge." Somewhere Carol Loomis is smiling.

how many hedges can a hedge fund hedge if a hedge fund could hedge funds

Sorry anyway back to testimony. Wade appears to be doing his bore-em-to-death thing going into tedious detail about the mechanics of private market investments.

Wade: Have you made more than 100 investment decisions? Yes.

Sometimes you win and sometimes you lose, right? <heavy sigh> Uh. Yes.

It's fair to say in investing, the more risk, the more reward? Uh, yes.

And you're not just investing just on gut, right? Yes.

Sometimes you win and sometimes you lose, right? <heavy sigh> Uh. Yes.

It's fair to say in investing, the more risk, the more reward? Uh, yes.

And you're not just investing just on gut, right? Yes.

Wade is now taking Grossman through the team of people at PFM who worked on the deal, explaining their expertise.

He mentions Philippe Laffont of Coatue, who introduced PFM to Theranos. Wade pronounces Coatue "Cut-OH" lol. Grossman corrects him.

He mentions Philippe Laffont of Coatue, who introduced PFM to Theranos. Wade pronounces Coatue "Cut-OH" lol. Grossman corrects him.

We see an email from Laffont to Chris James, an investor at PFM, saying Theranos is "one of the most impressive boards I've ever seen."

James fwds the email to Grossman with one word: "Wowsy"

James fwds the email to Grossman with one word: "Wowsy"

I'm sorry but I need to dwell for a moment on "Wowsy"

Oh god Lance Wade just said "wowsy" aloud.

Elsewhere on this email thread Grossman asks his partner, "What time u picking us up? U want us to brink bevies for the drive?"

Important Wowsy development

https://twitter.com/ethanbaron/status/1460734563219509248

We see some emails between Grossman and some of his analysts about Walgreens and Theranos. They are discussing Cowen's take on the Theranos / WAG partnership.

Wade suggests Cowen analyst reports are a respected source of information. Grossman says that's "debatable."

Wade suggests Cowen analyst reports are a respected source of information. Grossman says that's "debatable."

We got a brief glimpse of the email from Grossman re WAG and Theranos: "Wowzer. That's quite an endorsement."

Regarding, Grossman says Theranos's confidentiality documents and security detail. "In general they were very protective of their information."

Grossman says the initial meeting at Theranos was "more high level" and Wade points out that they hadn't yet signed the NDA.

Grossman says the initial meeting at Theranos was "more high level" and Wade points out that they hadn't yet signed the NDA.

We go through many emails just to refresh Grossman's memory that the confidential disclosure document was not signed until the second meeting with Theranos. Glad we cleared that up.

We now see a PFM email summarizing the Theranos discussion during a Walgreens earnings call

Point being that PFM took other information into account beyond what Holmes said to decide on the investment.

Point being that PFM took other information into account beyond what Holmes said to decide on the investment.

Whoops one of the tweets above is not a complete sentence. Likely several. I also broke the thread again. 🙃

Wade hits Grossman over the fact that he invested in Theranos even after the refused to let him talk to Walgreens or United in diligence.

Grossman says that forced his firm to rely on information from Theranos.

Grossman says that forced his firm to rely on information from Theranos.

Wade continues to press this point which is a question I have too - Grossman did all the right stuff regarding diligence, and yet he still invested.

Wade tries to nail down Grossman over this language in a press release about the Walgreens partnership: "or traditional methods" means venous draw, duh. Grossman pushes back that the term "microsample" still means it should be run on a Theranos machine.

There's another issue over the fact that Theranos venous draws used a "butterfly" needle and the language "as small as" preceding "a few drops of blood." Which clearly means that Theranos was using modified Siemens Advia machines all along.

Another Grossman email to one of his analysts ahead of the Theranos diligence meeting: "Bring you’re A game. U are the technical expert, need u to be really skeptical (but not an A hole)"

Grossman and jury are dismissed for the day and its time for our usual lawyer chat. Downey wants to talk about an issue in camera and the judge is lightly ribbing Wade for how long his cross-exam is going. Back tomorrow!

Wow, egregious oversight on my part (or undersight? Shoulda brought binoculars!)

James responded to Grossman’s proposal to “brink bevies” for the drive:

“Def bevies.”

James responded to Grossman’s proposal to “brink bevies” for the drive:

“Def bevies.”

https://twitter.com/milesgcohen/status/1460732962161377281

• • •

Missing some Tweet in this thread? You can try to

force a refresh