Yesterday, Restaurant Brands International announced they acquired Firehouse Subs for $1 Billion, despite Firehouse Subs reporting just $50M in adjusted EBITDA for 2021.

Here's why paying 20x EBITDA makes sense, & shows that RBI is playing the long game👇

Here's why paying 20x EBITDA makes sense, & shows that RBI is playing the long game👇

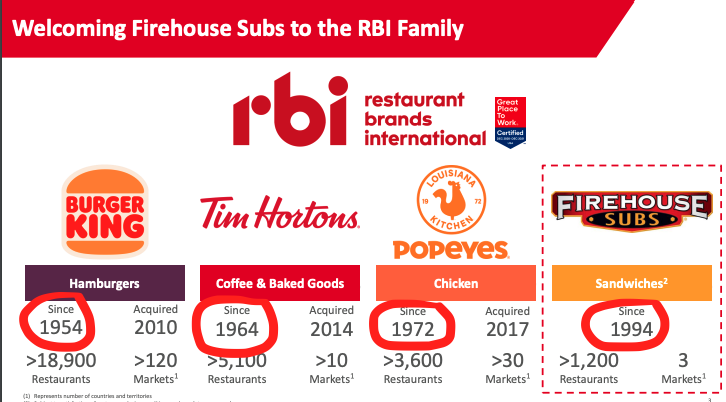

First let's note that RBI currently owns Tim Hortons, Burger King, & Popeyes.

That's 2 pure-play fast food brands, and a coffee QSR.

Firehouse Subs is a QSR with fresh sandwiches that appeal to a customer base RBI currently isn't hitting with its existing portfolio.

That's 2 pure-play fast food brands, and a coffee QSR.

Firehouse Subs is a QSR with fresh sandwiches that appeal to a customer base RBI currently isn't hitting with its existing portfolio.

Secondly - take a look at the dates these brands got started. Surprised at how old they are?

Don't be.

For 99% of franchises, scale + brand development take decades (most aren't F45).

Remember this if you're evaluating franchises that only started in the last few years.

Don't be.

For 99% of franchises, scale + brand development take decades (most aren't F45).

Remember this if you're evaluating franchises that only started in the last few years.

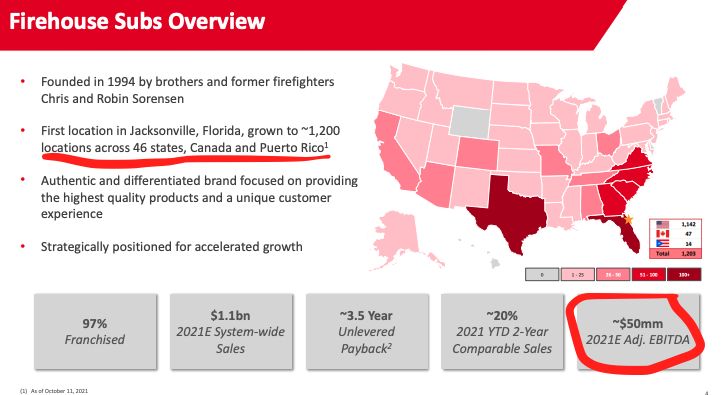

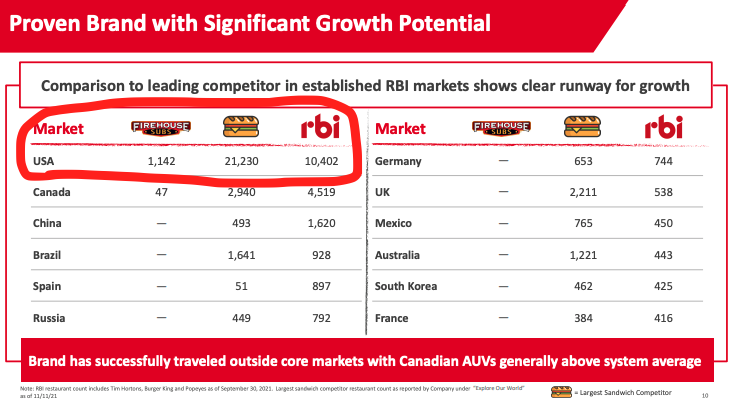

With that in mind, at 1,200 locations it's still VERY early in their unit trajectory.

Subway, which has aggressively expanded (to the detriment of franchisees) has ~21k shops in the U.S. alone.

Firehouse has PLENTY of room to grow domestically & internationally.

Subway, which has aggressively expanded (to the detriment of franchisees) has ~21k shops in the U.S. alone.

Firehouse has PLENTY of room to grow domestically & internationally.

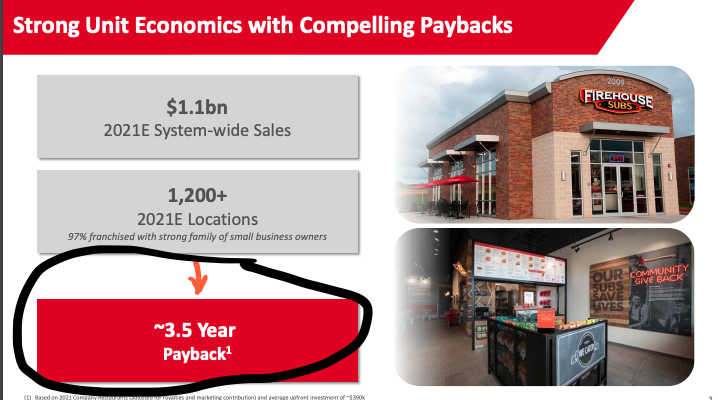

At 97% of locations franchisee owned, growth won't continue unless FS convinces new owners they'll make their $ back.

Most recent data shows an avg investment/location of $390k, yielding a 3.5 year UNLEVERED payback.

This is a strong return profile (+ smart owners do lever up).

Most recent data shows an avg investment/location of $390k, yielding a 3.5 year UNLEVERED payback.

This is a strong return profile (+ smart owners do lever up).

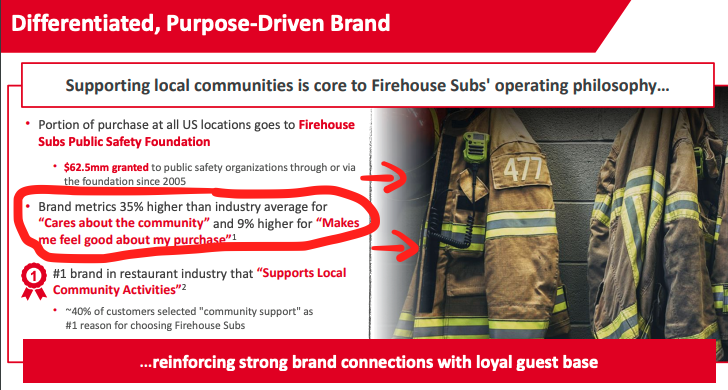

However, Firehouse Subs needs more than good unit economics to become a global brand (from both a franchisee & consumer POV).

From the name, to the decor inside shops, & to their Public Safety foundation - they've done a great job connecting their brand to a community & purpose.

From the name, to the decor inside shops, & to their Public Safety foundation - they've done a great job connecting their brand to a community & purpose.

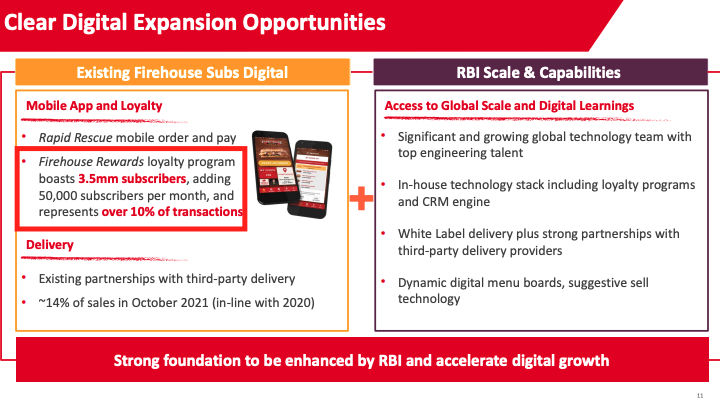

This translates to customer loyalty via the Firehouse Rewards program.

Starbucks, the 👑 of QSR has 24M reward members & ~33k stores worldwide.

Firehouse Subs has just 3% of Starbuck's units, but 15% of their rewards members!

As unit count increases, so will rewards members📈

Starbucks, the 👑 of QSR has 24M reward members & ~33k stores worldwide.

Firehouse Subs has just 3% of Starbuck's units, but 15% of their rewards members!

As unit count increases, so will rewards members📈

Between the strength of Firehouse, & RBI's expertise in growing brands domestically & internationally, in the next decade they can CONSERVATIVELY 5-7x current unit count between the U.S. & abroad.

At that scale, a $1B price tag for Firehouse Subs will look cheap.

At that scale, a $1B price tag for Firehouse Subs will look cheap.

You can expect RBI will have some big early wins by selling large chunks of territory to their biggest Popeyes, Burger King, and Tim Horton's franchisees.

A $390k investment per location is a drop in the bucket for them!

A $390k investment per location is a drop in the bucket for them!

If you liked this thread and want more insight into franchises and the entrepreneurs behind them, give me a follow @franchisewolf.

You can also subscribe to my weekly email below:

thewolfoffranchises.substack.com

You can also subscribe to my weekly email below:

thewolfoffranchises.substack.com

P.S.

If you want to read why @TomBrady partnered with the wrong sub franchise, here's my thread on Subway's history:

If you want to read why @TomBrady partnered with the wrong sub franchise, here's my thread on Subway's history:

https://twitter.com/franchisewolf/status/1456273989597208586?s=20

TL;DR...Firehouse Subs:

• Is early in their growth trajectory

• Has a strong brand + unit economics

• Will benefit from RBI's development experience + network of big time franchisees

This is a great forward thinking acquisition for RBI!

• Is early in their growth trajectory

• Has a strong brand + unit economics

• Will benefit from RBI's development experience + network of big time franchisees

This is a great forward thinking acquisition for RBI!

• • •

Missing some Tweet in this thread? You can try to

force a refresh