🚨 DAO research op!

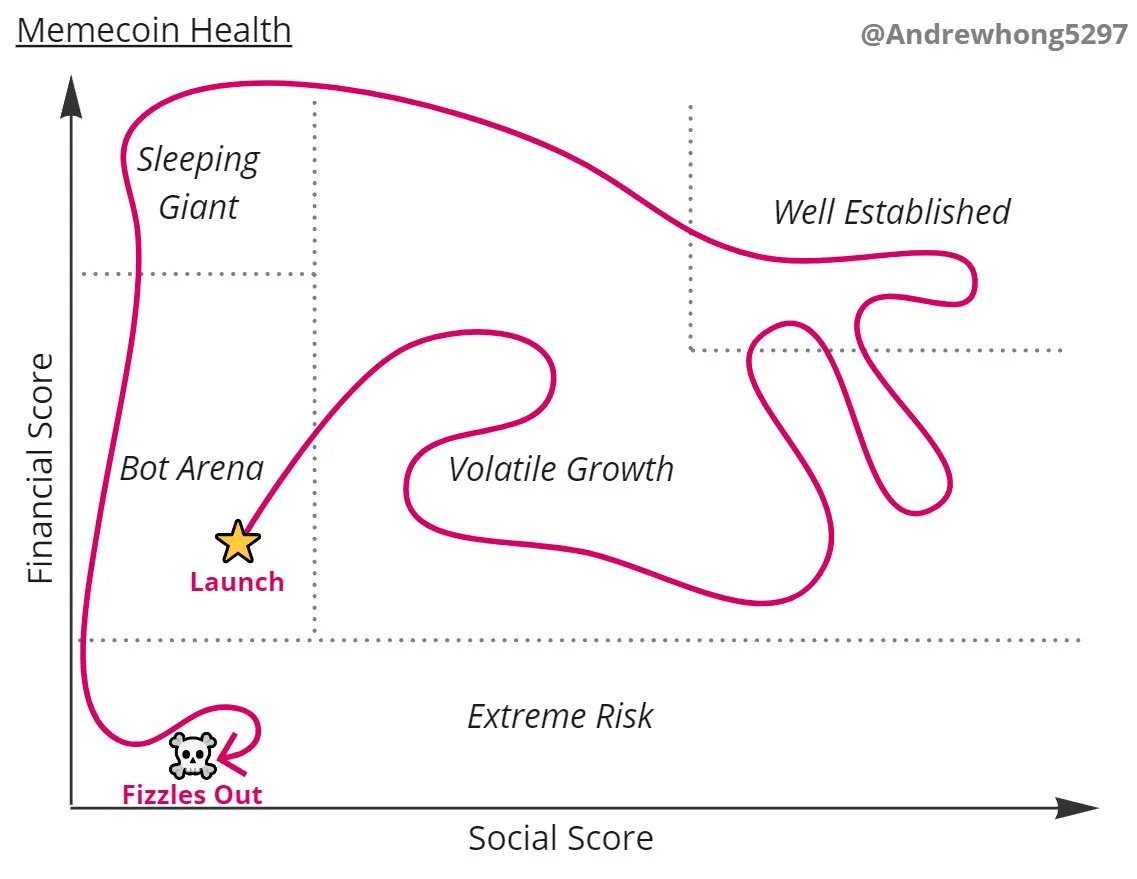

Question: How do we provide more context around tokens and their communities? Can this be represented by a "pulse"?

I dive into a framework for thinking about it and some research goals in the article, but here's a summary...

ath.mirror.xyz/Hiijmt_gzv5_Hf…

Question: How do we provide more context around tokens and their communities? Can this be represented by a "pulse"?

I dive into a framework for thinking about it and some research goals in the article, but here's a summary...

ath.mirror.xyz/Hiijmt_gzv5_Hf…

Right now, when I joined a community like @FWBtweets one of the main screens I see is this:

it tells me nothing about the token really, or the community around it. To really think deeply about this and what we should show, we need to examine web2 vs web3 communities again.

it tells me nothing about the token really, or the community around it. To really think deeply about this and what we should show, we need to examine web2 vs web3 communities again.

In web2, the management of a community is fairly top-down and discovery is fairly shallow. The area of discovery is likely highly customized and moderated by the community leaders!

In web3, community leaders have full control of their stack. But they have less power on the largest surfaces of discovery, given the inherent composability of the ecosystem.

I go into some examples of this with @viamirror , @PoolTogether_ , @FWBtweets, @graphprotocol, and more

I go into some examples of this with @viamirror , @PoolTogether_ , @FWBtweets, @graphprotocol, and more

Given this uncontrollable surface area and much deeper discovery stack - we have our work cut out for us!

I propose trying to find the "pulse" of a token at each layer of context, to really convey information about a community much more concisely. Some starter questions:

I propose trying to find the "pulse" of a token at each layer of context, to really convey information about a community much more concisely. Some starter questions:

But this matters for more than just presenting a better interface - it brings together token health with community health!

Having this data impacts three key groups:

Having this data impacts three key groups:

Web3 communities can't really bankrupt like a typical company, but they can definitely still become zombies - no pulse at all. And if your token is trading actively but has no pulse/context - well that’s a clear warning sign too.

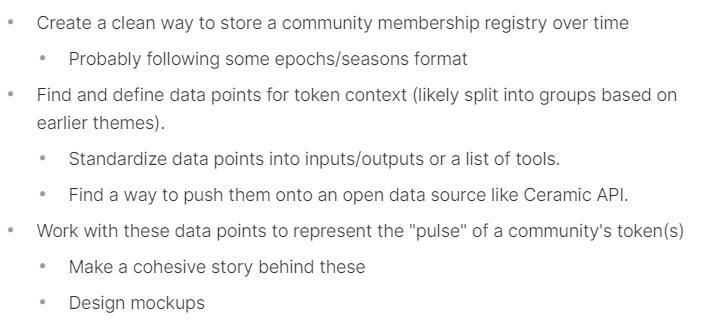

tldr; we need to identify the right data points on tokens/communities and standardize them into an open API.

I've listed some goals for this research below. If you're interested in being a core contributor, please fill out this form by Nov 26! docs.google.com/forms/d/e/1FAI…

I've listed some goals for this research below. If you're interested in being a core contributor, please fill out this form by Nov 26! docs.google.com/forms/d/e/1FAI…

• • •

Missing some Tweet in this thread? You can try to

force a refresh