Looking at Nokia, I noticed there's a non-trivial open interest sitting at January 10-strike call:

327,961 contracts.

This is the largest OI across Nokia options.

With $NOK trading at $5.68, the option is quite deep OTM, and its gamma impact is muted...

Unless...

327,961 contracts.

This is the largest OI across Nokia options.

With $NOK trading at $5.68, the option is quite deep OTM, and its gamma impact is muted...

Unless...

Unless $NOK rises and wakes up the sleeping beauty 🙂

How many shares would market makers need to buy to delta hedge this option?

Let's completely ignore any call overwriting and assume that OI is held long by investors and short by market-makers (a bold assumption, I know).

How many shares would market makers need to buy to delta hedge this option?

Let's completely ignore any call overwriting and assume that OI is held long by investors and short by market-makers (a bold assumption, I know).

If dealers are short this option, they need to buy $NOK in order to delta hedge.

At the moment, this option's delta is ~0.05.

If (and only if) on 21 Jan 2022, $NOK closes just above $10, its delta will become 1.

At the moment, this option's delta is ~0.05.

If (and only if) on 21 Jan 2022, $NOK closes just above $10, its delta will become 1.

Hence, market-makers will need to purchase 0.95 of delta, which is:

0.95 * 100 * $5.68 * 327,961 = $177 mill worth of Nokia shares.

Which is 31,156,295 shares (or rather ADRs).

Is that a lot?

Over the last few months, $NOK averaged around 15-20 million shares per day.

0.95 * 100 * $5.68 * 327,961 = $177 mill worth of Nokia shares.

Which is 31,156,295 shares (or rather ADRs).

Is that a lot?

Over the last few months, $NOK averaged around 15-20 million shares per day.

If $NOK moves to $10, the flow resulting from a 10-strike January call is equivalent to ~2 days trading volume.

But that was just one option.

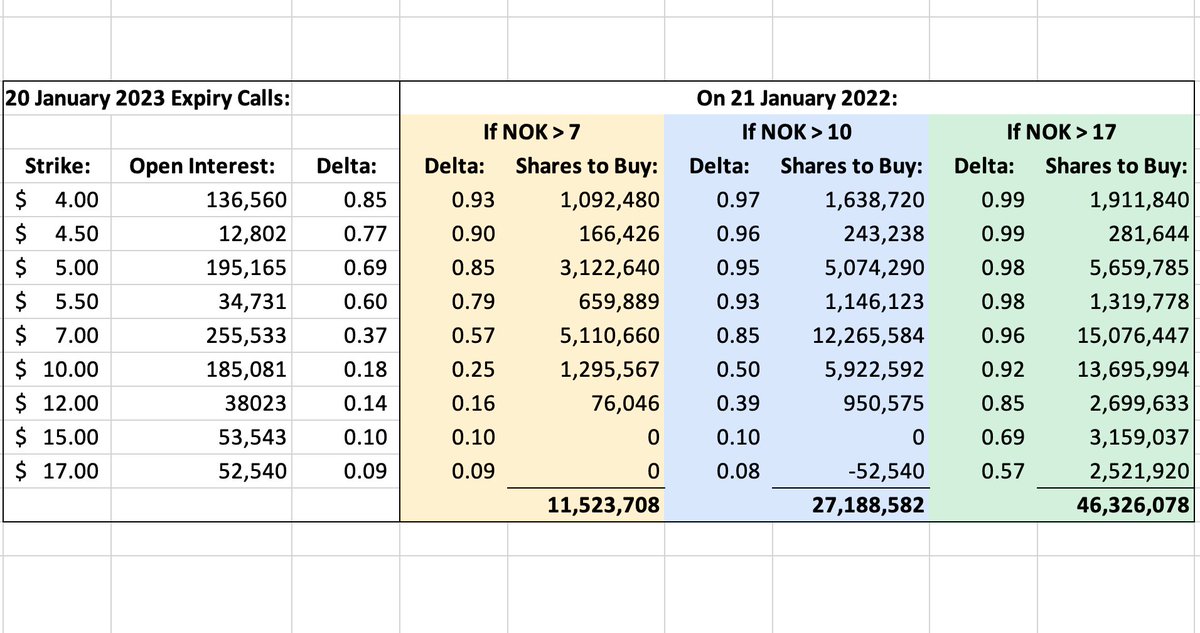

$NOK has a substantial OI sitting across Jan 2022 and Jan 2023 expiries - let's take them into account.

But that was just one option.

$NOK has a substantial OI sitting across Jan 2022 and Jan 2023 expiries - let's take them into account.

What we're trying to find out is:

How much delta-hedging activity will Nokia trigger if it starts drifting north between now and January?

I will consider three scenarios - $NOK closes just above $7, $10 and $17 on 21 January 2022.

How much delta-hedging activity will Nokia trigger if it starts drifting north between now and January?

I will consider three scenarios - $NOK closes just above $7, $10 and $17 on 21 January 2022.

For each price target, we'll do the above back-of-the-envelope calculation.

Below are the results for Jan 2022 expiry:

Below are the results for Jan 2022 expiry:

We can also throw in the puts - Jan 22 has the largest OI.

If puts were bought for protection, then dealers who sold them will buy $NOK if puts expire worthless:

If puts were bought for protection, then dealers who sold them will buy $NOK if puts expire worthless:

So what does this tell us?

If Nokia closes just over $7 on 21 Jan, dealers will have to buy around 47 mill shares of $NOK between now and expiration.

Given the daily average volume of ~18 mill, this doesn't look that significant.

If Nokia closes just over $7 on 21 Jan, dealers will have to buy around 47 mill shares of $NOK between now and expiration.

Given the daily average volume of ~18 mill, this doesn't look that significant.

However, if Nokia reaches $10 per share over the next two months, market makers will need to purchase 98 million shares to delta hedge.

This is roughly 5-6 times the average daily volume.

This is roughly 5-6 times the average daily volume.

It also represents a one-sided demand that has to meet an equivalent amount of supply.

If $NOK sellers are hard to find 'his Christmas season, then these buy orders will start pushing the price higher until someone gives in and sells.

If $NOK sellers are hard to find 'his Christmas season, then these buy orders will start pushing the price higher until someone gives in and sells.

Moreover, this analysis outlines the current exposure and doesn’t account for any new $NOK positions initiated between now and 21 of January.

Any additional calls or longs will add to the 98 mill shares bought by the market makers.

Any additional calls or longs will add to the 98 mill shares bought by the market makers.

Calls purchases, specifically, will result in the dealers' immediate buying of delta, followed by additional rebalancing when the price moves around.

And $NOK options could be attractive, as implied volatility came down since Jan 2021 highs and sits around the lows for the year.

And $NOK options could be attractive, as implied volatility came down since Jan 2021 highs and sits around the lows for the year.

So is this enough to trigger a Gamma squeeze?

While the setup might look promising, unfortunately, a Gamma squeeze requires a feedback loop that usually begins with a catalyst.

A meaningful catalyst is earnings, but next time Nokia reports is 3 Feb 2022 - after January expiry.

While the setup might look promising, unfortunately, a Gamma squeeze requires a feedback loop that usually begins with a catalyst.

A meaningful catalyst is earnings, but next time Nokia reports is 3 Feb 2022 - after January expiry.

And so far, I haven't found any other significant events that could serve as a trigger.

There are, however, some positive fundamental factors that could help push the stock higher:

• Nokia continues to roll out and expand its 5G business - it acquired many contracts with telecom providers around the world:

investorplace.com/2021/10/nok-st…

• Nokia continues to roll out and expand its 5G business - it acquired many contracts with telecom providers around the world:

investorplace.com/2021/10/nok-st…

• $NOK trades at P/E of ~15x, compared to $SPX PE of ~25x. At 25x PE, $NOK price should be ~$9.

• Moreover, it recently reported solid earnings and a strong growth outlook, despite shortages in semiconductors:

barrons.com/articles/nokia…

• Moreover, it recently reported solid earnings and a strong growth outlook, despite shortages in semiconductors:

barrons.com/articles/nokia…

Nonetheless, the price target of $10 that I assumed is still quite ambitious - it's double where we are now.

The last time $NOK trade >$10 was in 2011.

Fundamentally, it's unlikely that we'll get there in the next two months, but then... we have seen crazier things this year...

The last time $NOK trade >$10 was in 2011.

Fundamentally, it's unlikely that we'll get there in the next two months, but then... we have seen crazier things this year...

So what does everyone think?

Big deal or "probably nothing?"

I did open a VERY SMALL position in the 7-strike January call with money that I can lose comfortably.

Big deal or "probably nothing?"

I did open a VERY SMALL position in the 7-strike January call with money that I can lose comfortably.

• • •

Missing some Tweet in this thread? You can try to

force a refresh