Looks like the Federal Trade Commission's opposition to Facebook's attempt to dismiss their case to break the company into bits for anticompetitive behavior was just filed. Night reading...

this summary of amended complaint's metrics to establish market power is a reminder how absurdly Facebook's lobby tried to argue FTC hadn't backed up their monopoly claim. Having been around a few digital media businesses for 25+yrs, these are valid metrics to move forward. /2

Yes, Facebook argued Daily Active Users and Monthly Active Users didn't measure intensity and then ignored the 3rd metric (Time Spent) which very much measures intensity because according to FB not 100% of the app usage was personal social networking services. Seriously. /4

those who have been around long enough to know the history of comscore (or the company formerly known as MediaMetrix) may enjoy this point to the courts. Amen. Just give us the data, please. /5

Damnit, Mark. As our autocratic CEO, you can't entirely undermine our attempt to create a legal argument to protect you. /6

There they go again - facebook employees serving up the evidence to entirely undermine our legal arguments. This is why Google reportedly sent out a list of rules of what not to say in writing. /7

I've yet to find anyone to argue with me that the world, and I mean the entire world, would be different if Facebook and Instagram would have had to actually compete with each other over the last five years. /8

side note, little known but we learned through leak documents that this "enforcer" on the legal side was Monika Bickert - years before she pivoted into being Sheryl and Mark's trusted lieutenant on policing content and defending the company in front of lawmakers and on CNN. /9

I mean it doesn't read well - they weaponized their app platform and access to their data by restricting any other app from competing with them in exchange for access while at the same time not letting any app integrated with a competitive personal social network. /10

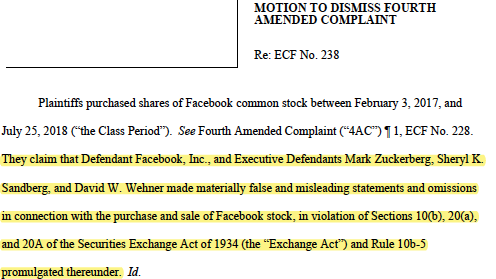

Zuckerberg and Sandberg have pulled the football on the industry so many times it isn't funny. The word of the company has zero value - I have too many examples to count. /11

I may know someone who signed a multimillion dollar deal for access to those APIs then was cut off from them going forward. I bet we all do. /12

If I were God for a day, I would just restrict Facebook from collecting any/all data from outside and across each of its respective apps (if they're not split up in this case) as the German Cartel Office has ordered. It's a reasonable remedy for their data abuses. /13

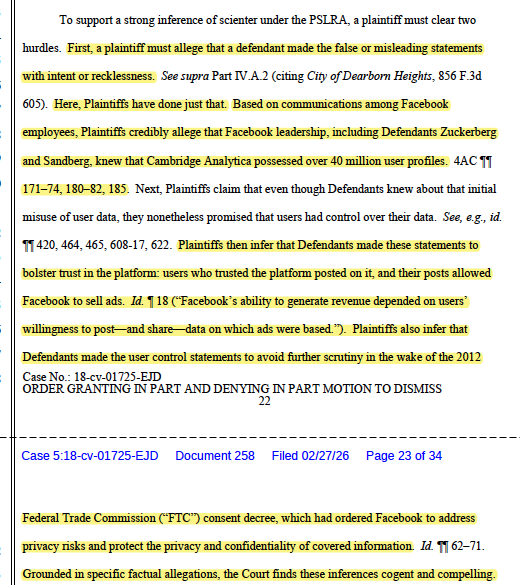

It seems like with the $5 billion pay-off and ***second*** consent decree with the Federal Trade Commission, the regulator may be now taking a hint about the moral bankruptcy of the company. /14

Ha, and there it is. Exactly to my last tweet, the Federal Trade Commission says the quiet part out loud, "no one trust you, Facebook. Your word is 'meaningless.'" /15

And glad FTC made this argument regarding the Chair. Imagine if having an adverse opinion of Facebook Inc actually disqualified people from prosecuting a case against Facebook, there would be no lawyer left standing. /16

Here is a link to my thread on the full amended FTC complaint. My abbreviated analysis of tonight's filing is this case is moving forward regardless of the spin Facebook fed through its lobby and influencer-flex when it was originally filed. /eof

https://twitter.com/jason_kint/status/1428436960239046657?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh