To fully master AMMs, you must understand the holy trinity of Slippage, Price Impact, and Minimum Received.

As Astroport's launch approaches (Dec 20 👀), let's take a look at all three so Astrochads everywhere can ape safely.

🧵👇 /n

As Astroport's launch approaches (Dec 20 👀), let's take a look at all three so Astrochads everywhere can ape safely.

🧵👇 /n

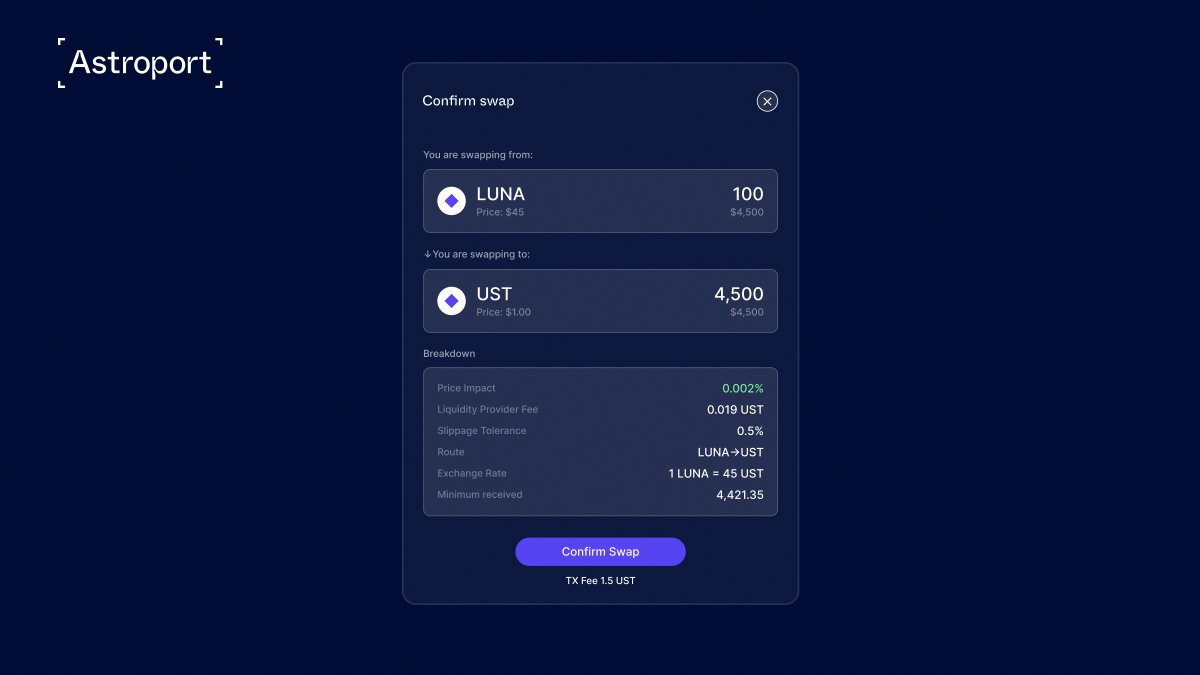

1/ Imagine you want to swap 100 $LUNA for $UST.

Astroport’s "Breakdown" section gives us an insight into the swap. We expect 4500 $UST in return, but a minimum of 4421 $UST. We also see a Price Impact of 0.002% and a Slippage Tolerance of 0.5%.

Why is that? 🤔

Astroport’s "Breakdown" section gives us an insight into the swap. We expect 4500 $UST in return, but a minimum of 4421 $UST. We also see a Price Impact of 0.002% and a Slippage Tolerance of 0.5%.

Why is that? 🤔

2/ AMMs like Astroport do not update their price as other markets move.

Instead, the price moves as the reserve ratio of the tokens in the liquidity pool changes based on swaps.

Instead, the price moves as the reserve ratio of the tokens in the liquidity pool changes based on swaps.

3/ Arbitrageurs benefit from balancing the pool, taking benefit of a premium.

As a result, the price for $LUNA and $UST quoted by Astroport should always be close to the market.

As a result, the price for $LUNA and $UST quoted by Astroport should always be close to the market.

4/ Now, your swap has a direct impact on the liquidity pool. In simple terms: You unbalance the pool.

This effect is called Price Impact.

The extent of your impact on the pool depends on two factors:

- Order size (hello, whale 🐳)

- Pool type (pool formula)

This effect is called Price Impact.

The extent of your impact on the pool depends on two factors:

- Order size (hello, whale 🐳)

- Pool type (pool formula)

5/ You can envision your interaction with the pool like this: Every $LUNA will cost slightly less than the previous one.

Thus, the bigger the trade, the more significant the effect on the AMM.

Thus, the bigger the trade, the more significant the effect on the AMM.

6/ Wait, isn't that slippage?

Well, some say that the price slipped due to your order. However, slippage represents the difference between the quoted price & paid cost.

Most commonly, that’s caused by other swaps completed between the submission and conclusion of your order.

Well, some say that the price slipped due to your order. However, slippage represents the difference between the quoted price & paid cost.

Most commonly, that’s caused by other swaps completed between the submission and conclusion of your order.

7/ So, the size of your order will have a price impact that’s influenced by the pool size and your order size.

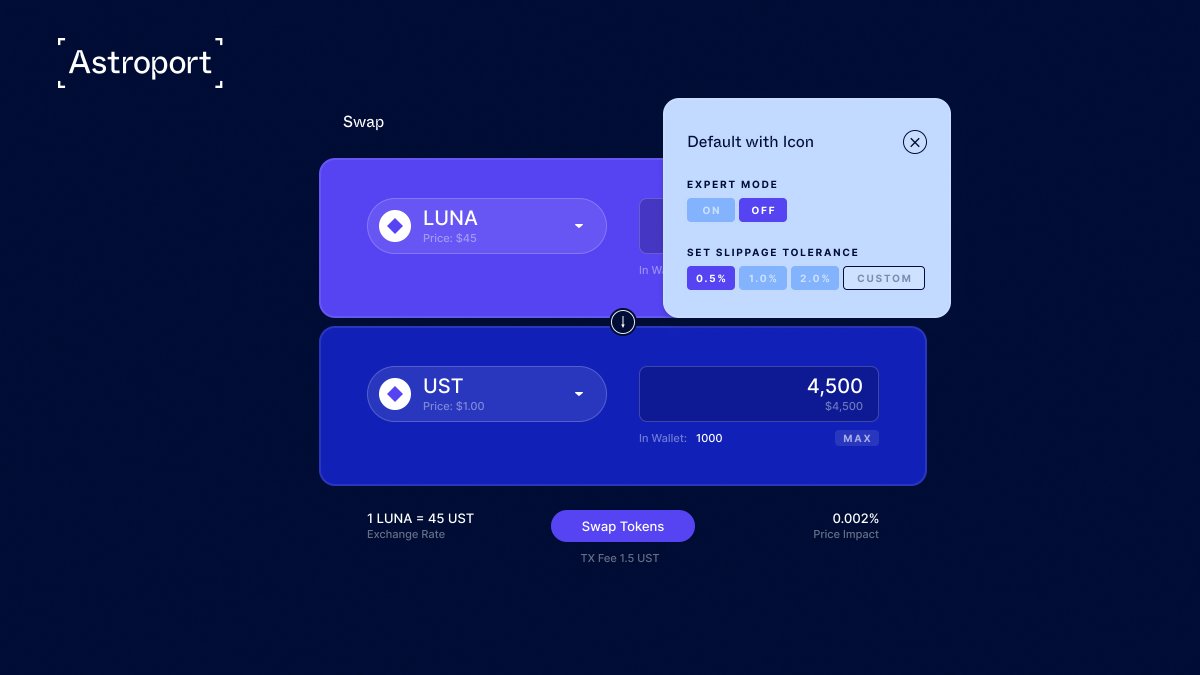

Astroport will do its best to predict the minimum amount of tokens you will receive. If you’re not happy with that minimum, lower your Slippage Tolerance 👇

Astroport will do its best to predict the minimum amount of tokens you will receive. If you’re not happy with that minimum, lower your Slippage Tolerance 👇

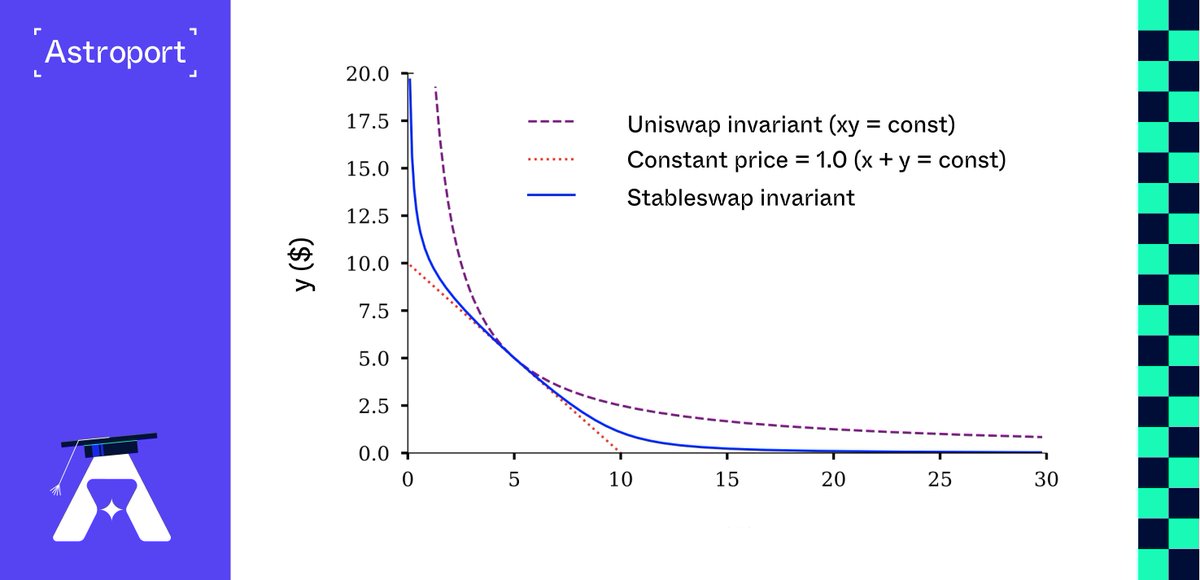

8/ Ultimately, efficient trades require the right pool curves or algorithms and immense liquidity.

By supporting two pool types at launch, Astroport should immediately help Astrochads make the most efficient swaps in the Terraverse… and eventually beyond Astronaut

IYKYK

By supporting two pool types at launch, Astroport should immediately help Astrochads make the most efficient swaps in the Terraverse… and eventually beyond Astronaut

IYKYK

• • •

Missing some Tweet in this thread? You can try to

force a refresh