Spurs (admirably detailed) publish 2021 accounts: Key numbers are

Revenue down £60m

Wages up £20m

Loss before tax up to £80m

Player purchases £110m

Borrowings £853m

Transfer fees owed to other clubs £170m #THFC

Revenue down £60m

Wages up £20m

Loss before tax up to £80m

Player purchases £110m

Borrowings £853m

Transfer fees owed to other clubs £170m #THFC

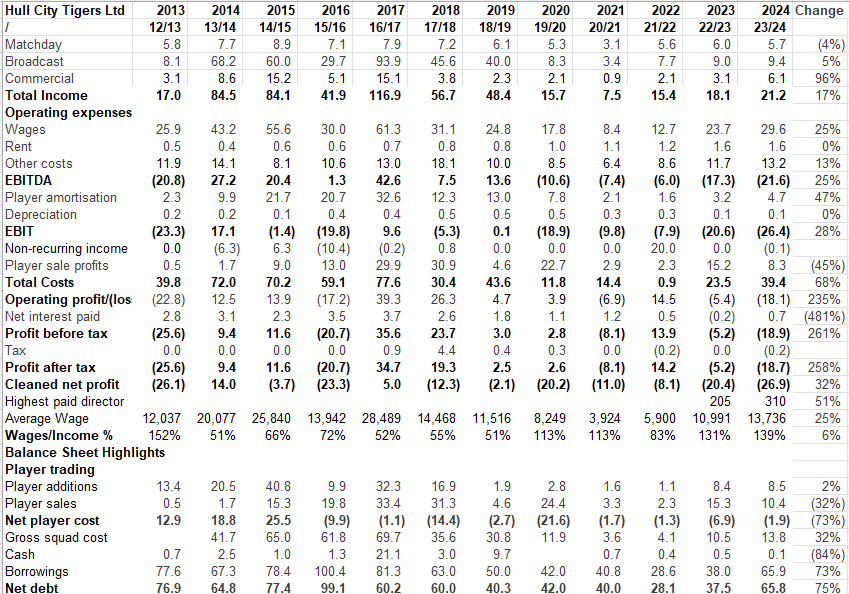

Spurs revenue ⬇️ by £60m mainly due to matches behind closed doors. UEFA money down £27m due to lack of CL participation. EPL 📺 money ⬆️ £89m as played 44 games in year to 30 June 2021 compared to 32

Spurs wage bill up £23m to £204m but still over £100m lower than MCFC, MUFC and LFC. Amortisation (transfer fees spread over contract life) down but may be due to a player impairment (writedown) of £8.5m

Daniel Levy pay ⬇️ £261,000 to just £2,698,000. Spurs fans considering crowdfunding to make up the deficit.

Spurs are owed £19m from player sale transfer instalments and owe other clubs £170 million in instalments

Spurs revenue still > £100m lower than that of Manchester United. The new stadium (full) and CL participation should take them beyond £500m, significant rise over the last decade.

Spurs matchday only £2m but could be the highest in the PL due to *cough* price discrimination strategies (closes textbook) that maximise take from different wealth levels of fan groups. £120m in a full season is feasible with decent domestic/Euro cup runs.

Broadcast income could be higher still if make CL and have better position in table than at present. New US TV deal will kick in a few years too which will increase numbers further.

Commercial income impacted by Covid but still shows that move to new stadium popular with sponsors. Spurs will be happy to be above Arsenal but not a global brand to same extent as some other clubs.

After a few years in which there was wage restraint as club moved to new stadium, Spurs now paying substantially more than many clubs.

Spurs squad now costs £481m, sizeable but a long way behind some of its peer group in terms of wanting to win trophies.

• • •

Missing some Tweet in this thread? You can try to

force a refresh