🧵/My friends @YieldLabs @Tobirichmond @Kevintrouble1 @bradders1yield @Crypto_Flippin reviewed the latest, most exciting DeFi protocol on @terra_money — @prism_protocol! 💎

Here's my ✌️🪙🪙 (no financial advice ofc)

Here's my ✌️🪙🪙 (no financial advice ofc)

Before we jump in, keep in mind that:

•@prism_protocol is NOT live, and there's no official release date YET

•Analysis is based on litepaper + founder's interviews

Keep an eye on this one, and stick around! 💅

•@prism_protocol is NOT live, and there's no official release date YET

•Analysis is based on litepaper + founder's interviews

Keep an eye on this one, and stick around! 💅

Let's dive into:

•Fundamentals, use cases & market signals

•Product roadmap & team

•Tokenomics

•Community

•Fundamentals, use cases & market signals

•Product roadmap & team

•Tokenomics

•Community

1/🌾 Imagine you own a crop farm:

•It's made of 2 assets: land (principal) + crop (yield/cashflow)

•If u build a house on the land, your land value could double, but you'd lose the crop

Thx 4 the analogy @rebel_defi — crypto needs more of these! 👏

•It's made of 2 assets: land (principal) + crop (yield/cashflow)

•If u build a house on the land, your land value could double, but you'd lose the crop

Thx 4 the analogy @rebel_defi — crypto needs more of these! 👏

2/🤝 What does this tell us?

•Principal & yield don't grow together in value

•If you invest (stake) the principal, you're also locking its yield

•If you use your land as collateral to borrow money and get liquidated, you'll lose both principal & yield

investopedia.com/articles/inves…

•Principal & yield don't grow together in value

•If you invest (stake) the principal, you're also locking its yield

•If you use your land as collateral to borrow money and get liquidated, you'll lose both principal & yield

investopedia.com/articles/inves…

3/💎 @prism_protocol is a DeFi protocol that:

•Splits the land from the crops

•To invest them as separate assets (eg. sell crops for cash, use land as collateral to borrow)

•AND also keep them together as a crop-generating farm

•Removing liquidation risk on underlying asset

•Splits the land from the crops

•To invest them as separate assets (eg. sell crops for cash, use land as collateral to borrow)

•AND also keep them together as a crop-generating farm

•Removing liquidation risk on underlying asset

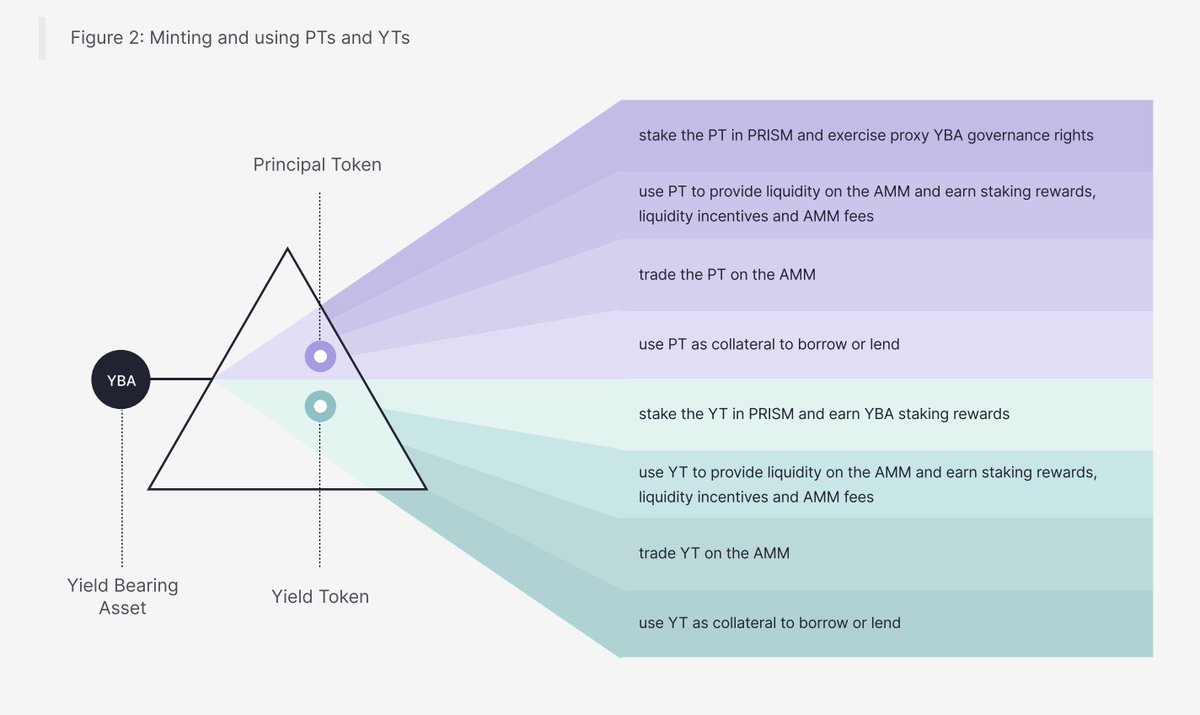

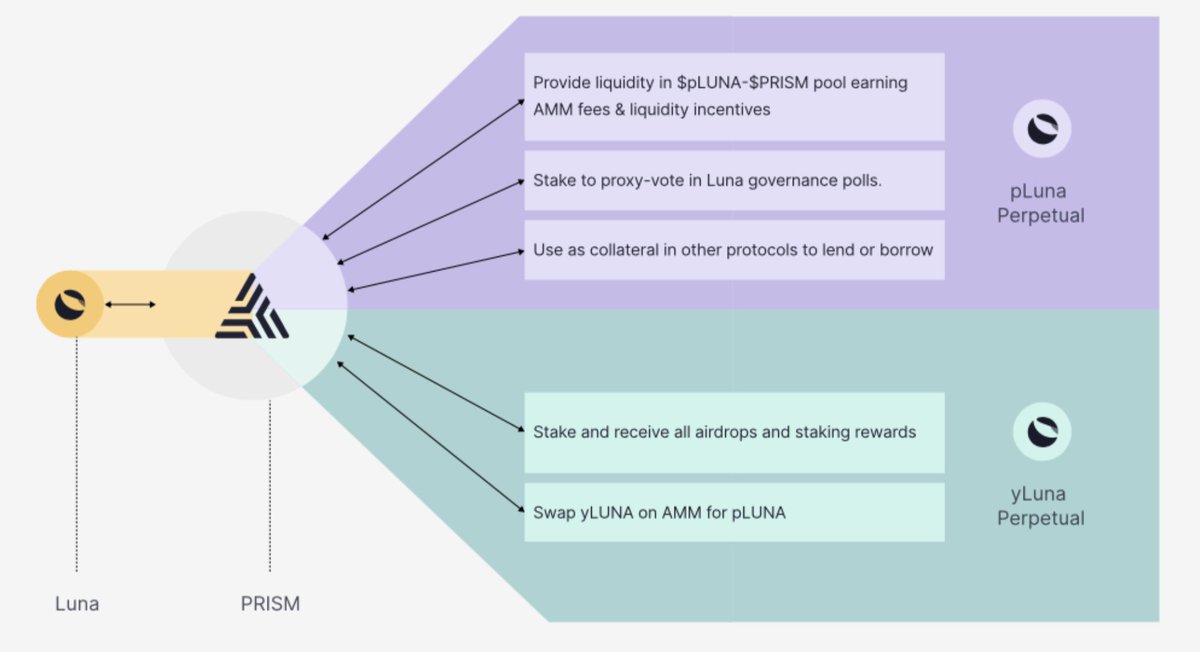

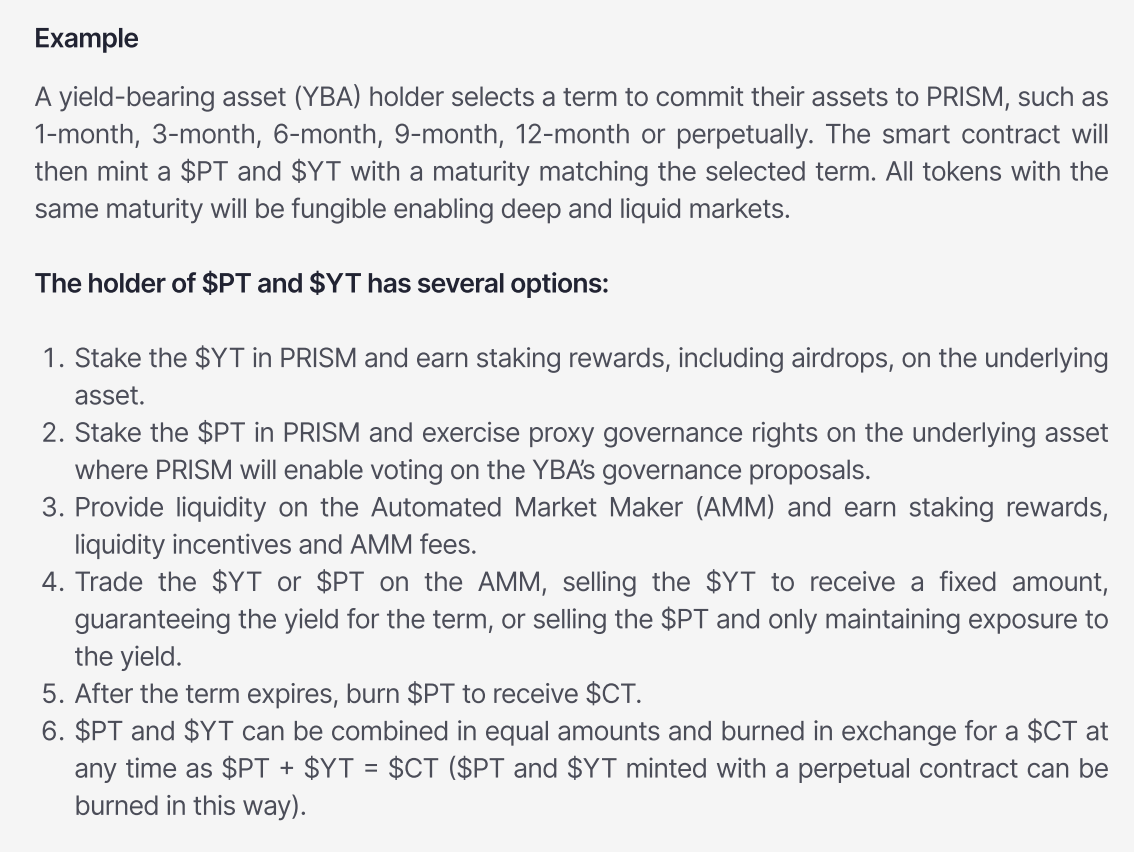

4/👨💻 Effectively, you'd:

•Deposit an asset that earns yield (eg. $LUNA) in a PRISM vault to create a derivative called collateral token (CT)

•Split your CT into principal token (PT, eg. pLUNA) & yield token (YT, eg. yLUNA)

•So you now own 3 assets, 2 of which liquid (YT, PT)

•Deposit an asset that earns yield (eg. $LUNA) in a PRISM vault to create a derivative called collateral token (CT)

•Split your CT into principal token (PT, eg. pLUNA) & yield token (YT, eg. yLUNA)

•So you now own 3 assets, 2 of which liquid (YT, PT)

5/🔀 What does this give you?

•yLUNA gets you $LUNA airdrops + staking rewards as if you'd normally staked $LUNA

.pLUNA can be lent it in PRISM liquidity pools to earn more yield, used as collateral to borrow, leverage trading, governance votes, and more

•yLUNA gets you $LUNA airdrops + staking rewards as if you'd normally staked $LUNA

.pLUNA can be lent it in PRISM liquidity pools to earn more yield, used as collateral to borrow, leverage trading, governance votes, and more

6/📶 You basically multiply the opportunities of your underlying $LUNA by *refracting* (splitting) it:

•Decide whether you want to maximize exposure to $LUNA price (w/pLUNA) or to yield (w/yLUNA)

•Without incurring liquidation risk, daily funding costs, or unstaking periods

•Decide whether you want to maximize exposure to $LUNA price (w/pLUNA) or to yield (w/yLUNA)

•Without incurring liquidation risk, daily funding costs, or unstaking periods

7/🦄 Use cases are VERY strong — get more bang for your bucks, while removing liquidation risk.

And as TeFi (@terra_money's DeFi) becomes more popular/sophisticated, many users will be attracted to PRISM + more assets options will become available.

And as TeFi (@terra_money's DeFi) becomes more popular/sophisticated, many users will be attracted to PRISM + more assets options will become available.

8/🥸 Content reads TOO niche/technical (eg. 'refracting'). Crypto desperately needs product marketing talent that uses analogies/examples/visuals AND provides context upfront (e.g. what is what/how-to/why) — this is key for large adoption and trust.

Eg. FAQs could be way simpler

Eg. FAQs could be way simpler

9/🛣 Once you understand how it works tho, roadmap is clear:

•Add more assets to refract: $ETH $SOL $ATOM $DOT $UST

•Leverage $PTs $YTs for borrowing/shorting

•Add refracting for NFTs & more

•Add specific period beyond perpetual assets

Need dates tho

prismfinance.app/PRISM-litepape…

•Add more assets to refract: $ETH $SOL $ATOM $DOT $UST

•Leverage $PTs $YTs for borrowing/shorting

•Add refracting for NFTs & more

•Add specific period beyond perpetual assets

Need dates tho

prismfinance.app/PRISM-litepape…

🚨 *SIDE NOTE*: DYOR re: leverage — not to be threaded lightly, and probs not for the avg. Joe!

coindesk.com/markets/2021/0…

coindesk.com/markets/2021/0…

10/😵🏴☠️ Also, website points to a dead @github — it'd be good to see how active/transparent their technical team is to see how they're executing on this roadmap.

github.com/prism-finance

github.com/prism-finance

11/🤝 Another good sign is their partnership announcements with @pylon_protocol (to redirect LUNA staking rewards and more!) and @SandclockOrg.

medium.com/pylon-protocol…

https://twitter.com/SandclockOrg/status/1438136454773936145?s=20

medium.com/pylon-protocol…

12/🔥 Also, their @discord is really organized, informative, and fun — with the founder actively replying/engaging with the community. Their TG is just a Twitter repost channel but overall, the seed community of 2k engaged members is a good start.

discord.gg/WatSFZtg

discord.gg/WatSFZtg

13/🧐 Not a lot of details re: team, other than:

•Anonymous founder @MrRefactor

•Strong finance exp in TradFi (derivatives trading)

•Not technical, but from podcasts sounds he's prepared product-wise

•Engaged w/community, sounds humble/fair

But where rest of the team?

•Anonymous founder @MrRefactor

•Strong finance exp in TradFi (derivatives trading)

•Not technical, but from podcasts sounds he's prepared product-wise

•Engaged w/community, sounds humble/fair

But where rest of the team?

14/🪙 Now over to the $PRISM tokenomics:

•1T max supply, good there's a cap

•35% to team/advisors (🚨 *need vesting schedules*)

•Some utility pipeline which needs more clarity

It's a start!

•1T max supply, good there's a cap

•35% to team/advisors (🚨 *need vesting schedules*)

•Some utility pipeline which needs more clarity

It's a start!

15/📒 To recap:

•Really strong use cases and market signals (@terra_money 🤝)

•Clear roadmap and good tokenomics

•Strong seed community

•Really strong use cases and market signals (@terra_money 🤝)

•Clear roadmap and good tokenomics

•Strong seed community

16/😶🌫️ Some questions to be uncovered/feedback:

•Much simpler messaging (explainer video 🙏)

•Product UX and launch/roadmap DATES

•it'd be good to have a PRISM blog

•$PRISM allocation (vesting schedules!) & utility pipeline

•More transparency on team & development

•Much simpler messaging (explainer video 🙏)

•Product UX and launch/roadmap DATES

•it'd be good to have a PRISM blog

•$PRISM allocation (vesting schedules!) & utility pipeline

•More transparency on team & development

17/🥳 What this means for the avg. Joe?

•For every asset you own that generates yield, you can have 3 assets that generate yield

•This can stack the compounding growth of your portfolio by X multiples

•And increase the velocity that gets you to financial freedom

•W/less risk

•For every asset you own that generates yield, you can have 3 assets that generate yield

•This can stack the compounding growth of your portfolio by X multiples

•And increase the velocity that gets you to financial freedom

•W/less risk

18/🤓 And despite use cases are very technical:

•Great potential returns could encourage more avg. Joes to become technical, in a way that TradFi never made it possible

•And nurture not only skills/return, but also sense of responsibility/ownership of your own assets

•Great potential returns could encourage more avg. Joes to become technical, in a way that TradFi never made it possible

•And nurture not only skills/return, but also sense of responsibility/ownership of your own assets

END/🔖 Once you understand it, @prism_protocol IS really exciting. Don't miss out on their IDO:

•Discord: discord.com/invite/mx4kjVG…

•Site: prismfinance.app

•Discord: discord.com/invite/mx4kjVG…

•Site: prismfinance.app

And definitely tune in to hear @YieldLabs podcast with @prism_protocol's founder themselves @MrRefractor, hosted by my homie @Kevintrouble1 🎙

• • •

Missing some Tweet in this thread? You can try to

force a refresh