It’s time for some big brain quotes, from Ludovicus Jan van der Velde. The “CEO”. Of Bitfinex/Tether.

“Financial stability is an absence of instability.” -Ludovicus Jan van der Velde

“Financial stability is an absence of instability.” -Ludovicus Jan van der Velde

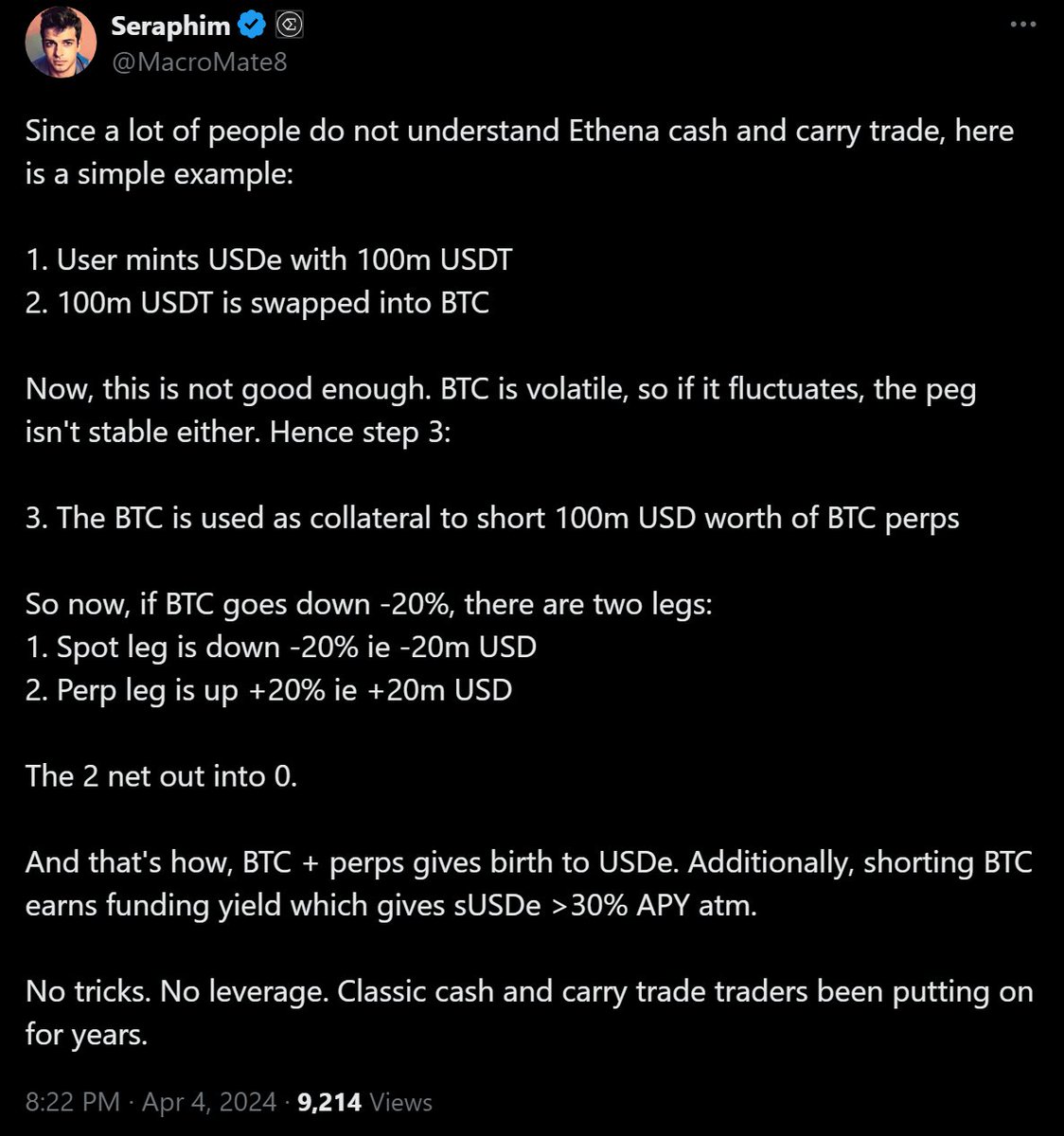

“Where the stablecoin is collateralized predominantly by the asset to which it is pegged, or an asset with a similar risk profile, the management of reserve assets requires little more than the provision of basic banking services.” -Ludovicus Jan van der Velde

The report lists “custodian failure”, “fraud”, “liquidity”, and “lack of legal clarity regarding rights to assets” as vulnerabilities, all fall under the main overlooked issue referenced above: failures or deficiencies in the provision of basic banking services by third parties.

“There is no formal technological mechanism which links the value of the stablecoin to the value of the reserve asset. It is a matter of market-based incentives rather than of technology.” -Ludovicus Jan van der Velde

“If “financial stability” is conceived of as an absence of large price movements in widely held assets, then global stablecoins would work to mitigate threats to financial stability by facilitating enhanced price discovery in global markets.” -Ludovicus Jan van der Velde

• • •

Missing some Tweet in this thread? You can try to

force a refresh