1/17 You can learn a LOT about a community from just on-chain token data. I've split the data into three themes:

- trending user actions

- liquidity and inflation

- membership and inequality

Let's look at tokens from @blvkhvnd , @banklessDAO , @AxieInfinity , and @FWBtweets

- trending user actions

- liquidity and inflation

- membership and inequality

Let's look at tokens from @blvkhvnd , @banklessDAO , @AxieInfinity , and @FWBtweets

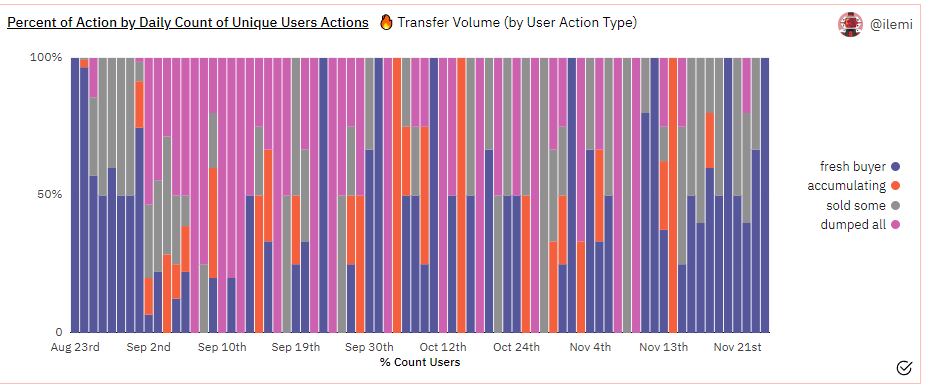

2/17 Trending user actions: this tells us high-level how many people are entering/exiting a community, and how existing members act (accumulate or rotate/sell). Communities naturally go through cycles and turnover, below we'll see how each community has evolved.

3/17 Over 50% of token activity in @banklessDAO comes from new members, with lower trending dump/exit numbers recently. It's clear they're doing a great job building up their community in a consistent manner.

4/17 @blvkhvnd is still seeing healthy turnover in new members and exiting members as a more consistent community forms around the team. It's worth noting that Bankless did an airdrop versus Blvkhvnd which did a crowdfund - so it's possible that causes differences as well.

5/17 @FWBtweets has seen an increase in new buyers and also dumpers recently. looking at past trending activity, it looks like this is mostly cyclical (possibly around large events/product releases?).

6/17 @AxieInfinity is super interesting here, they have a lot fewer users who are just selling some or accumulating, most are either buying in or selling out completely. Probably requires some deeper cohort analysis here, but makes sense as people gain/lose interest in the game.

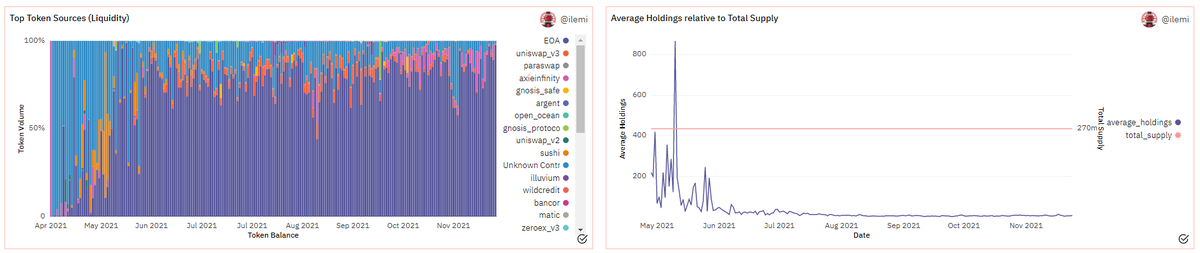

7/17 Liquidity and inflation: Where tokens are sourced and the supply of tokens is very important to a community (and price). We'll see below that each community is actually fairly different in terms of where users get their tokens, and how their balance trends over time.

8/17 For @blvkhvnd, their liquidity is most off of Uniswap. Average balances are still wildly swinging over time, as tokens find more stable holders and get spread out over a larger community.

Unknown contracts haven't been decoded on Dune, but this one is a staking contract.

Unknown contracts haven't been decoded on Dune, but this one is a staking contract.

9/17 @AxieInfinity has a really interesting trend, more most AXS comes from user sending to user versus from an exchange. I'm sure this has to do with some game mechanic - if anyone knows please comment below! Average holdings have stabilized at around 5 AXS over time.

10/17 @banklessDAO seems to have the most amount of liquidity sources, from Gnosis Safe payouts to all sorts of exchanges. I'm going to assume there isn't a clear liquidity or rewards strategy.

Average tokens sit around 32k, which I think was the average airdrop amount.

Average tokens sit around 32k, which I think was the average airdrop amount.

11/17 @FWBtweets has most of their liquidity on Uniswap, and clearly has migrated all of it to Uniswap v3. It's interesting that less liquidity seems to come from user to user over time - could be less tipping. Average holdings have settled around 75 tokens.

12/17 Membership and Inequality: The last section shows the cumulative average balances and also the Gini coefficient over time. This is to help us understand how many users have access to certain membership tiers, and if the token distribution is "fair" or not.

13/17 First up is @blvkhvnd, it's clear to me there are possible membership tiers at 100, 300, and 800 tokens. The Gini coefficient is going down over time, which I'm going to interpret as quite a few whales sold out to new members.

This is consistent with what we saw earlier.

This is consistent with what we saw earlier.

14/17 @FWBtweets looks like it has membership tiers at 1, 5, 75, and 100 tokens. The Gini coefficient has trended evenly across time - looks like early holders/whales likely haven't sold much out yet. Pretty cool!

15/17 @BanklessDAO doesn't seem to have super clear membership tiers, but instead a fairly linear pattern. Maybe there's more they could do to motivate buying up to tiers? The Gini coefficient has trended up recently, which seems counterintuitive given the number of new buyers.

16/17 @AxieInfinity has the distribution and Gini coefficient I would expect of any game that's been around for a while. Some legendary users have likely amassed a war chest of AXS, while new players have just begun the grind.

Scaling game economies is hard!

Scaling game economies is hard!

17/17 I see this dashboard as a tool to give us a jumping-off point for community/token planning and analysis.

I'll personally be diving deeper and doing some write-ups soon, so be sure to follow me for more web3 data threads like this!

dune.xyz/ilemi/Token-Ov…

I'll personally be diving deeper and doing some write-ups soon, so be sure to follow me for more web3 data threads like this!

dune.xyz/ilemi/Token-Ov…

• • •

Missing some Tweet in this thread? You can try to

force a refresh