1/ Yesterday's impressive CA judgment in the Motherhood Plan case challenging as discriminatory the calculation of profits that would have been earned but for Covid under the Self-Employment Income Support Scheme bears reading in full but I want to hone in on 1 area.

#ukemplaw

#ukemplaw

2/ The reason for honing in is, principally, that the case in large part concerns the approach to justification under Art 14 ECHR specific to the provision of state benefits, which is not a test of general application.

3/ What to my mind is of particular use to #ukemplaw-yers in the judgment is the analysis of the HL decision in Barry v Midland Bank.

4/ Barry, you'll recall, had gone down from f/t to p/t hours after her child was born, some time before being made redundant. The bank had a severance scheme for redundant employees, giving them a lump sum calculated in light of their final salary.

5/ Ms Barry claimed that was indirectly discriminatory (among other things) against women, given that they were more likely to have reduced their hours following maternity, and hence more likely to receive lower severance figures. Her claim failed.

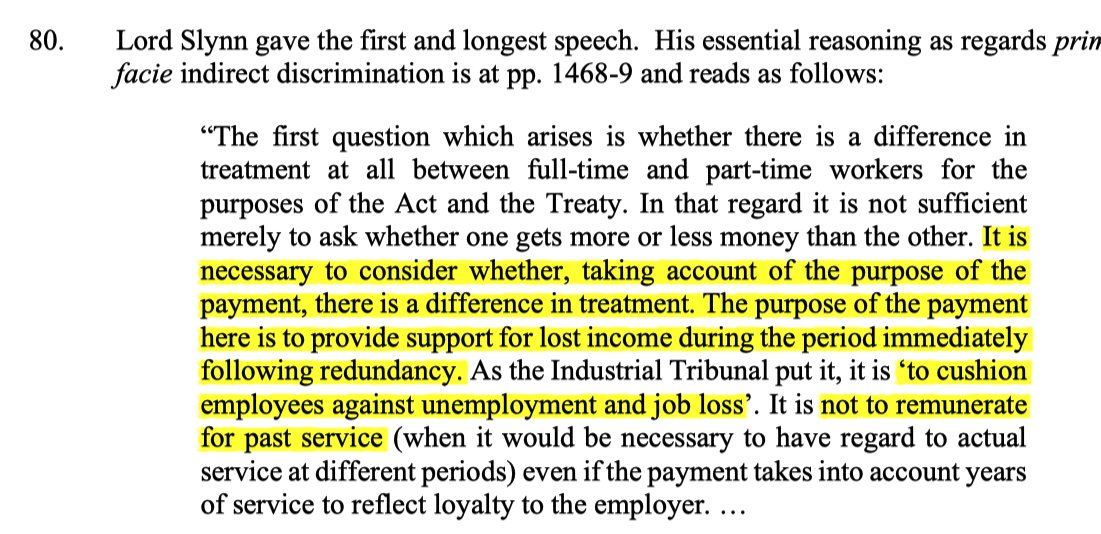

6/ The CA in Motherhood Plan does a lot of work in identifying the ratio in Barry, but ultimately finds that the reason for finding (4-1) no prima facie discrimination was that the 'purpose' of the severance sum was to cushion against loss of earnings resulting from redundancy.

7/ Given the scheme's purpose, it was not a relevant difference in treatment between f/t & p/t workers to leave out of account historic earnings over the course of the individual's career. The purpose was to cushion against loss & cushioning was by reference to what was lost.

8/ It's an important & useful amplification of the fact that sometimes there's a need to focus on the purpose of the PCP in order to determine whether there's been any relevant differential treatment at all on which particular disadvantage can be built.

9/ In Motherhood Plan, the 1st instance judge had relied on Barry as excluding as irrelevant the fact of the claimants' past earnings in determining whether there was prima facie discrimination in the method of calculating the support that should be provided.

10/ The CA had no hesitation in finding that wrong given that the purpose was to place a figure on profits lost as a result of Covid. The SEISS made that calculation on profits from the past 3 years. Here that did disadvantage new mothers, falsely reflecting current likely profit

11/ It did so because it would take account of accounting years in which new mothers focused less on their business due to maternal care responsibiliities. Unlike in Barry, the past position was clearly relevant to the purpose behind the PCP - calculating likely lost profits.

12/ As I say, the judgment merits close reading in any event - especially if you have an Art 14 argument to raise in a case, but I thought this part may be of particular interest.

The full judgment is here: bailii.org/ew/cases/EWCA/…

#ukemplaw

The full judgment is here: bailii.org/ew/cases/EWCA/…

#ukemplaw

• • •

Missing some Tweet in this thread? You can try to

force a refresh