Indian Energy Exchange (iexindia.com), a marketplace that provides nationwide automated & transparent trading platform for the physical delivery of electricity, renewables and certificates.

Publicly listed company with NSE: IEX and BSE: 540750 since Oct'17 @iexindia

Publicly listed company with NSE: IEX and BSE: 540750 since Oct'17 @iexindia

Commenced operations in 2008; CERC regulated

Current Price : ₹776 (~400% above the IPO price)

52 WH – 52 WL : ₹ 956 / ₹199

Market Cap : ₹ 23,261 Cr.

Enterprise Value : ₹ 23,105 Cr.

P/E : 88

Div Yield : 0.17 %

ROCE : 59.7 %

Debt to equity : 0.02

Sales growth 3Yrs : 11.2 %

Current Price : ₹776 (~400% above the IPO price)

52 WH – 52 WL : ₹ 956 / ₹199

Market Cap : ₹ 23,261 Cr.

Enterprise Value : ₹ 23,105 Cr.

P/E : 88

Div Yield : 0.17 %

ROCE : 59.7 %

Debt to equity : 0.02

Sales growth 3Yrs : 11.2 %

Energy Sector in India is rapidly transforming underpinned by

1. Decarbonization (50% RE capacity by 2030)

2. Decentralization (move from centralized generation to distributed)

3. Democratization (giving customer the economic choice)

4. Digitization (use of tech to optimize)

1. Decarbonization (50% RE capacity by 2030)

2. Decentralization (move from centralized generation to distributed)

3. Democratization (giving customer the economic choice)

4. Digitization (use of tech to optimize)

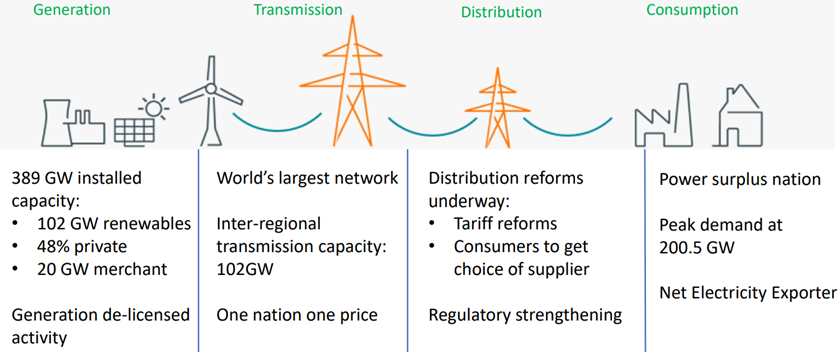

Electricity value chain

- Generation: NTPC, NHPC, Tata Power, Reliance Power, Adani Green

- Transmission: Nearly 55% is under State, 38% is owned by Power Grid,8% by private sector

- Distribution: DISCOMS: Torrent Power, SEB, DGVCL

- Consumption: Industries, DISCOMS

- Generation: NTPC, NHPC, Tata Power, Reliance Power, Adani Green

- Transmission: Nearly 55% is under State, 38% is owned by Power Grid,8% by private sector

- Distribution: DISCOMS: Torrent Power, SEB, DGVCL

- Consumption: Industries, DISCOMS

Demand / Supply : Capacity CAGR of 8% and generation CAGR of 5% dominated by Thermal has outpaced electricity demand in the last 10 years leading to surplus generation in India. Still India has blackouts due to inefficient management of distribution infrastructure.

Over the years electricity generation has shifted from being dominated by State (>50% in mid-2000's) to increased participation by the private sector (>45% in 2019) this has also led to increased renewable penetration

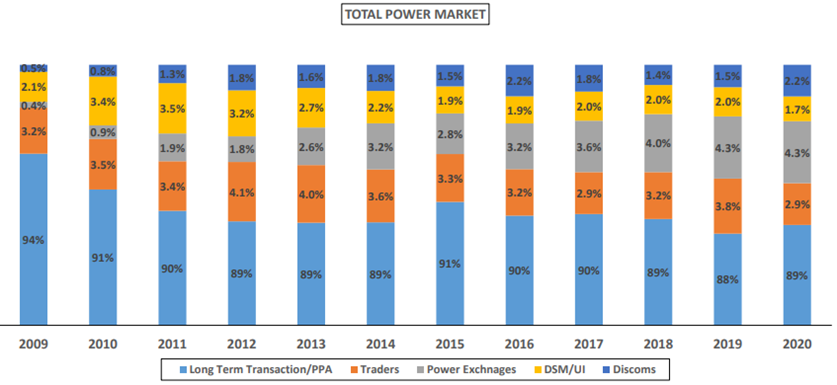

Contracts in Indian electricity market are either

- Long term (7+ yrs, usually 25 yrs) PPAs constituting ~88% of Total Power Market

- Short term (<=1 yr) consists of 12% of Total Power Market. This is the Target Market for IEX.

- Medium term contracts are not present in India

- Long term (7+ yrs, usually 25 yrs) PPAs constituting ~88% of Total Power Market

- Short term (<=1 yr) consists of 12% of Total Power Market. This is the Target Market for IEX.

- Medium term contracts are not present in India

Although PPA's comprise of majority of Indian power market, overtime the share of power exchange participation has increased from miniscule 0.4% to >5% in 2020. This is forecasted to further increase overtime

Within the short-term power contract market there are 4 types of players

1. Traders

2. Power Exchanges

3. DISCOMS

4. DSM / UI

1. Traders

2. Power Exchanges

3. DISCOMS

4. DSM / UI

Exchange Markets are fast growing within the short-term power contract market driven by competition and flexible procurement, the Exchange markets constitute >50% of power market.

Power transacted through the exchange markets are in the range of 30-80% in developed economies. At 6%, India has an opportunity to further deepen the exchange penetration in the power markets

Energy Consumption is bound to grow in India driven by increased per capita consumption, rapid urbanization, accelerated economic activity and consumer demand growth

India is a huge opportunity driven by increased penetration of exchange trading and per capita electricity consumption

IEX business model is no different to any other exchange - matching the buyer and seller and enabling efficient price discovery

IEX provides three traded products

1. Day Ahead Market (DAM)

2. Term Ahead Market (TAM)

3. Renewable Energy Certificates (RECs)

1. Day Ahead Market (DAM)

2. Term Ahead Market (TAM)

3. Renewable Energy Certificates (RECs)

Within the exchange traded power markets in India - IEX is a market leader with 95% share (DAM & RTM >99%)

Power Trading Corporation (PTC) has also got the nod to set-up the third exchange. Likely launch this FY.

Power Trading Corporation (PTC) has also got the nod to set-up the third exchange. Likely launch this FY.

In the short-term power market IEX is gaining volumes

- IEX electricity volume CAGR 32% since 2008

- Highest yearly volumes – 74BU in FY’21

- Bilateral has CAGR (09-20) - 9% and CAGR (15-20) - 5%, while

- IEX has CAGR (09-20) - 32% and CAGR (15-20) - 14%

- IEX electricity volume CAGR 32% since 2008

- Highest yearly volumes – 74BU in FY’21

- Bilateral has CAGR (09-20) - 9% and CAGR (15-20) - 5%, while

- IEX has CAGR (09-20) - 32% and CAGR (15-20) - 14%

IEX delivering most competitive market clearing prices consistently over the years leading to further exchange traded power penetration enticing DISCOMS to buy power from power exchanges

All major PSUs and Industries are IEX clients. It has a robust ecosystem which is a key to the success of exchange operations

-> 4400+ Industries

-> 55+ Distribution Utilities

-> 500+ Generators

-> 100+ ESCert entities

-> 1500+ RE generators and obliged entities

-> 4400+ Industries

-> 55+ Distribution Utilities

-> 500+ Generators

-> 100+ ESCert entities

-> 1500+ RE generators and obliged entities

IEX has grown at 32% CAGR since inception.

The whole DSM volume shifting to IEX through RTM i.e. 22 BU every year from 2022, provide a near term growth trigger.

Longer term IEX is expected to grow volumes at 14% CAGR, so volumes in 2022 are expected to be (75*1.14) + 22= 108 BU

The whole DSM volume shifting to IEX through RTM i.e. 22 BU every year from 2022, provide a near term growth trigger.

Longer term IEX is expected to grow volumes at 14% CAGR, so volumes in 2022 are expected to be (75*1.14) + 22= 108 BU

IEX has demonstrated robust financial performance and has a strong balance sheet

- Negligible debt (Debt to equity: 0.02)

- Negative working capital

- No capex required to fuel the growth (scalable tech business model)

- Negligible debt (Debt to equity: 0.02)

- Negative working capital

- No capex required to fuel the growth (scalable tech business model)

Institutional investors have increased their shareholding overtime.

Top 5 shareholder:

1. Dalmia Power 10.02%

2. TVS Shriram Growth Fund 10.02%

3. WF Asian Reconn Fund 5%

4. Small Cap world Fund 4.70%

5. RIMCO (Mauritius) 4.55%

Top 5 shareholder:

1. Dalmia Power 10.02%

2. TVS Shriram Growth Fund 10.02%

3. WF Asian Reconn Fund 5%

4. Small Cap world Fund 4.70%

5. RIMCO (Mauritius) 4.55%

Appreciate your inputs

@itsTarH @Investor_Mohit @Investor_Mohit @Akshat_World @KevalAshar @BahirwaniKrish @SejalSud @Longterm_wealth @WealthEnrich @AimInvestments @Arpit1223 @indian_stockss @StocktwitsIndia @skhetpal @Arunstockguru @ishmohit1 @abhymurarka

@itsTarH @Investor_Mohit @Investor_Mohit @Akshat_World @KevalAshar @BahirwaniKrish @SejalSud @Longterm_wealth @WealthEnrich @AimInvestments @Arpit1223 @indian_stockss @StocktwitsIndia @skhetpal @Arunstockguru @ishmohit1 @abhymurarka

• • •

Missing some Tweet in this thread? You can try to

force a refresh