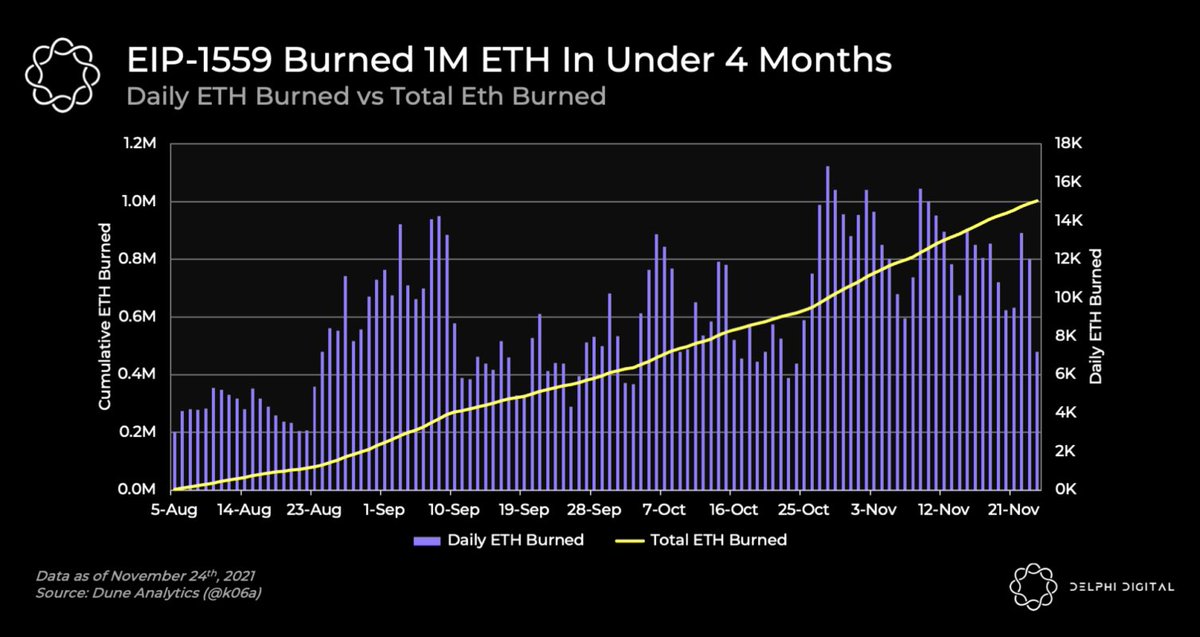

0/ Over 1 million ETH burned!

In today’s Delphi Daily, we analyzed total $ETH burned since EIP-1559, @bobanetwork’s TVL, $CRO and $AVAX outperforming other L1s, and rate hike expectations increase on Powell’s renomination.

🧵👇

In today’s Delphi Daily, we analyzed total $ETH burned since EIP-1559, @bobanetwork’s TVL, $CRO and $AVAX outperforming other L1s, and rate hike expectations increase on Powell’s renomination.

🧵👇

1/ @BobaNetwork is an L2 @OptimismPBC Rollup developed by core contributors of the OMG foundation and based on the open-sourced Optimism codebase.

TVL on Boba Network has grown exponentially since the middle of Nov, coinciding with the start of @OolongSwap’s liquidity mining.

TVL on Boba Network has grown exponentially since the middle of Nov, coinciding with the start of @OolongSwap’s liquidity mining.

2/ The $CRO token has outperformed other Layer 1 tokens this month, clocking and at an impressive ~344% in the month to date.

The CRO token is Crypto.com’s token and is also used as gas on Crypto.com’s chain, Cronos.

The CRO token is Crypto.com’s token and is also used as gas on Crypto.com’s chain, Cronos.

3/ Over 1M $ETH has been burned since the EIP-1559 implementation that resulted in the base fee portion of every transaction being burned.

@OpenSea interactions accounted for ~11% of the ETH burned due to the NFT bull season in August and September.

@OpenSea interactions accounted for ~11% of the ETH burned due to the NFT bull season in August and September.

4/ US Treasury Yields have been soaring over the past week, coinciding with Powell’s renomination as the Fed Chair.

Markets seem to have reacted with greater expectations of a rate hike over the next year, strengthening the dollar as demand for it is expected to increase.

Markets seem to have reacted with greater expectations of a rate hike over the next year, strengthening the dollar as demand for it is expected to increase.

5/ Tweets of the day!

Reasons for UST to Be Added Onto Aave

Reasons for UST to Be Added Onto Aave

https://twitter.com/genye0h/status/1463500963013185544

9/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh