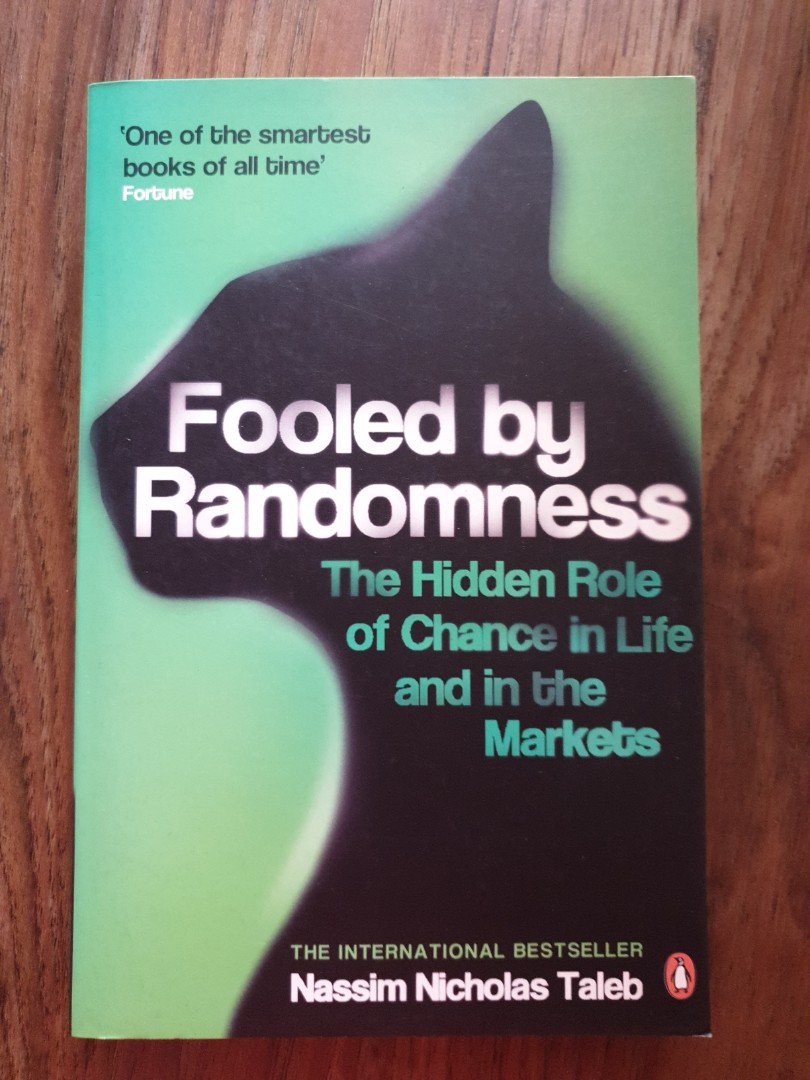

2 weeks ago, I started reading "Fooled by Randomness" by Nassim Taleb.

WOW, It's been mindblowing!

Thanks to @dvassallo 's recommendation.

Inside, there's a part he talks about how to deal with volatility.

Here’s 6 big lessons that are useful in the current market crash:

WOW, It's been mindblowing!

Thanks to @dvassallo 's recommendation.

Inside, there's a part he talks about how to deal with volatility.

Here’s 6 big lessons that are useful in the current market crash:

Lesson #1:

Negative emotions of seeing your stocks drop > Positive emotion from seeing your stocks rise.

Negative emotions of seeing your stocks drop > Positive emotion from seeing your stocks rise.

"A negative pang is not offset by a positive one...

Some psychologists estimate the negative effect for an average loss to be up to 2.5 the magnitude of a positive one)...

Some psychologists estimate the negative effect for an average loss to be up to 2.5 the magnitude of a positive one)...

... At the end of every day the dentist will be emotionally drained.

If the unpleasurable minute is worse in reverse pleasure than the pleasurable minute is in pleasure terms, then the dentist incurs a large deficit when examining his performance at a high frequency."

If the unpleasurable minute is worse in reverse pleasure than the pleasurable minute is in pleasure terms, then the dentist incurs a large deficit when examining his performance at a high frequency."

Lesson #2:

When we zoom out and check the prices less frequently, we are less affected by negative emotions.

Because over a longer time horizon, the market tends to rise more than it goes down.

When we zoom out and check the prices less frequently, we are less affected by negative emotions.

Because over a longer time horizon, the market tends to rise more than it goes down.

"Consider the situation where the dentist examines his portfolio only upon receiving the monthly account from the brokerage house.

As 67% of his months will be positive, he incurs only four pangs of pain per annum and eight uplifting experiences...

As 67% of his months will be positive, he incurs only four pangs of pain per annum and eight uplifting experiences...

This is the same dentist following the same strategy.

Now consider the dentist looking at his performance only every year.

Over the next 20 years that he is expected to live, he will experience 19 pleasant surprises for every unpleasant one!

Now consider the dentist looking at his performance only every year.

Over the next 20 years that he is expected to live, he will experience 19 pleasant surprises for every unpleasant one!

Our emotions are not designed to understand the point.

The dentist did better when he dealt with monthly statements rather than more frequent ones.

Perhaps it would be even better for him if he limited himself to yearly statements."

The dentist did better when he dealt with monthly statements rather than more frequent ones.

Perhaps it would be even better for him if he limited himself to yearly statements."

Lesson #3:

When we look at something too closely, we tend to mix up the signal with all the noise.

We end up focusing on all the movements that may not carry much useful information at all!

When we look at something too closely, we tend to mix up the signal with all the noise.

We end up focusing on all the movements that may not carry much useful information at all!

"Over a short time increment, one observes the variability of the portfolio, not the returns.

In other words, one sees the variance, little else.

I always remind myself that what one observes is at best a combination of variance and returns, not just returns"

In other words, one sees the variance, little else.

I always remind myself that what one observes is at best a combination of variance and returns, not just returns"

Lesson #4:

It’s hard to fight our human emotions of fear.

Instead, it’s wiser to just create an environment where we are not exposed to such noise that affect our decision making.

It’s hard to fight our human emotions of fear.

Instead, it’s wiser to just create an environment where we are not exposed to such noise that affect our decision making.

"Finally, I reckon that I am not immune to such an emotional defect.

But I deal with it by having no access to information, except in rare circumstances.

Again, I prefer to read poetry. If an event is important enough, it will find its way to my ears...

But I deal with it by having no access to information, except in rare circumstances.

Again, I prefer to read poetry. If an event is important enough, it will find its way to my ears...

My sole advantage in life is that I know some of my weaknesses.

Mostly that I am incapable of taming my emotions facing news and incapable of seeing a performance with a clear head.

Silence is far better."

Mostly that I am incapable of taming my emotions facing news and incapable of seeing a performance with a clear head.

Silence is far better."

Lesson #5:

Don't read the news.

It’s full of noise because of how much data it contains.

Instead, spend more time studying history as it’s more zoomed out.

Don't read the news.

It’s full of noise because of how much data it contains.

Instead, spend more time studying history as it’s more zoomed out.

"The news (the high scale) is full of noise and history (the low scale) is largely stripped of it (though fraught with interpretation problems).

This explains why I prefer not to read the newspaper (outside of the obituary), and why I never chitchat about markets."

This explains why I prefer not to read the newspaper (outside of the obituary), and why I never chitchat about markets."

Lesson #6:

The actions we take after seeing a loss is different from the actions we take after seeing a gain.

This could cause us to make sub optimal decisions

The actions we take after seeing a loss is different from the actions we take after seeing a gain.

This could cause us to make sub optimal decisions

"What economists did not understand for a long time about positive and negative kicks is that both their biology and their intensity are different.

The degree of rationality in decisions made subsequent to a gain is extremely different from the one after a loss."

The degree of rationality in decisions made subsequent to a gain is extremely different from the one after a loss."

If you like this, follow me here at @heymaxkoh

I share how I crossed 7 figures before age 30, and achieved my own version of financial freedom.

Stuff I tweet about:

• My investing strategy

• Books that inspire me

• How I built high income skills i.e. public speaking

I share how I crossed 7 figures before age 30, and achieved my own version of financial freedom.

Stuff I tweet about:

• My investing strategy

• Books that inspire me

• How I built high income skills i.e. public speaking

• • •

Missing some Tweet in this thread? You can try to

force a refresh