#CNBCTV18Market | JPMorgan on steel: There are signs of policy easing in China. Exports could further reduce driving regional HRC prices higher

#CNBCTV18Market | Morgan Stanley on Life Insurance: SBI Life continued to gain market share & is our top pick. ICICI Pru's growth for the month was relatively muted

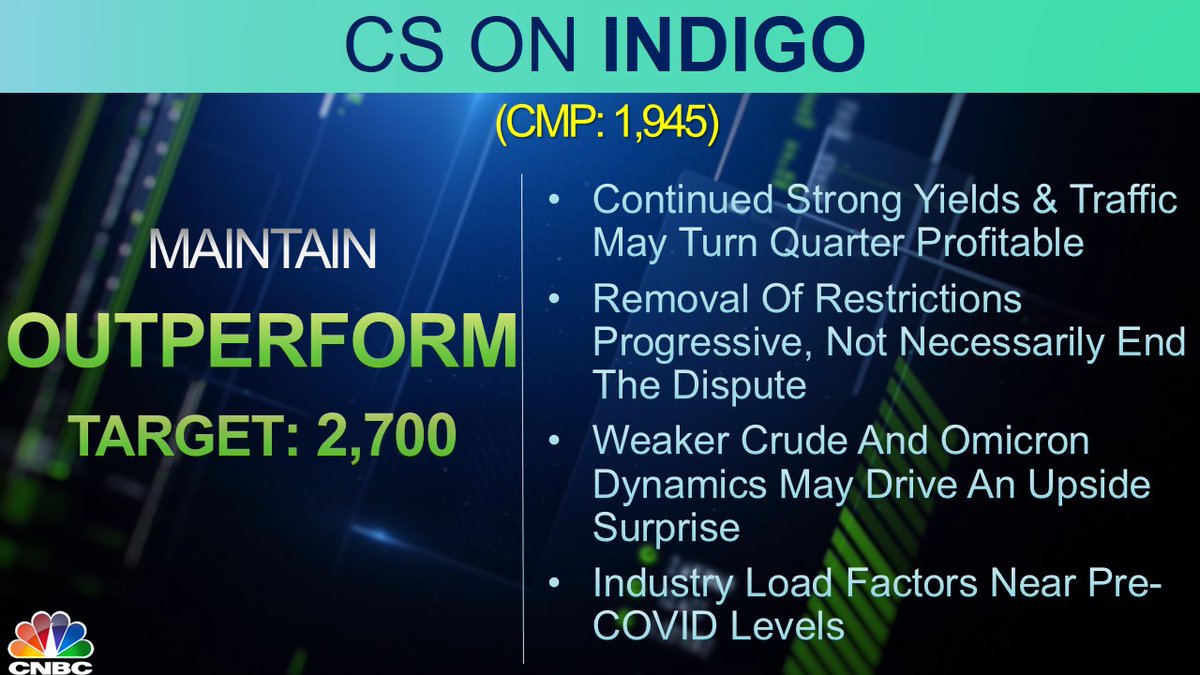

#CNBCTV18Market | Credit Suisse maintains outperform on IndiGo, says continued strong yields & traffic may turn quarter profitable

#CNBCTV18Market | JPMorgan on telecom: Key risk is SIM consolidation and downtrading for price-sensitive customers. Indus Tower is the best play on idea's business stability

#CNBCTV18Market| GS maintains buy call on Bharti Airtel. See upside risks to earnings if ARPUS were to be closer to the company-guided number. Co trades at 8x FY23E EV/EBITDA, broadly in line with its historical trading average

#CNBCTV18Market | Headline Growth of life insurance cos is Strong But YoY Trends Slowing Down. Reiterate Buy Call On SBI Life & HDFC Life, says GS

#CNBCTV18Market | GS reiterate buy call on ICICI Bank says visibility to 2% RoA has strengthened. The loan growth potential of 19% CAGR over FY21-24

• • •

Missing some Tweet in this thread? You can try to

force a refresh