NEW FROM US:

Tecnoglass—Cocaine Cartel Connections, Undisclosed Family Deals, And Accounting Irregularities All In One Nasdaq SPAC

hindenburgresearch.com/tecnoglass/ $TGLS

(1/x)

Tecnoglass—Cocaine Cartel Connections, Undisclosed Family Deals, And Accounting Irregularities All In One Nasdaq SPAC

hindenburgresearch.com/tecnoglass/ $TGLS

(1/x)

$TGLS has surged ~390% this year on record results fueled by a pandemic real estate boom in Florida, the company’s key market. But we believe there's much more to the story. (2/x)

Our months-long investigation of $TGLS has included review of US and Colombian court records, securities filings, corporate registrations, property records, export records and media reports going back decades. (3/x)

We have identified serious red flags regarding management and numerous undisclosed related party transactions that call the company’s reported financial results into question.

We strongly suspect Tecnoglass has faked a significant portion of its revenue. (4/x)

We strongly suspect Tecnoglass has faked a significant portion of its revenue. (4/x)

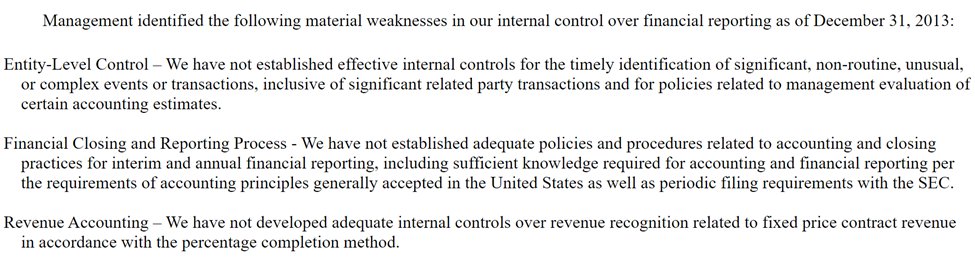

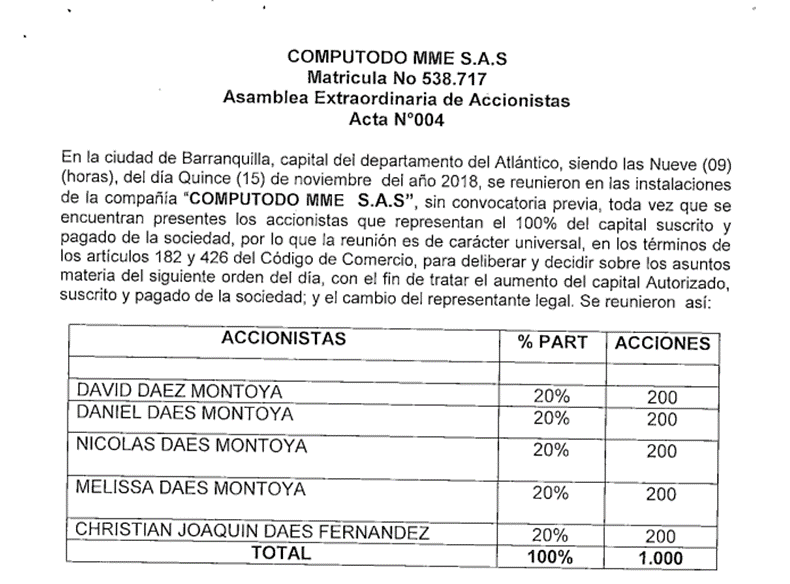

In December 2013, $TGLS went public via a SPAC, cycling through 3 auditors within roughly a 1-year span.

Auditors specifically flagged material weaknesses relating to identification and reconciliation of related party transactions. (5/x)

Auditors specifically flagged material weaknesses relating to identification and reconciliation of related party transactions. (5/x)

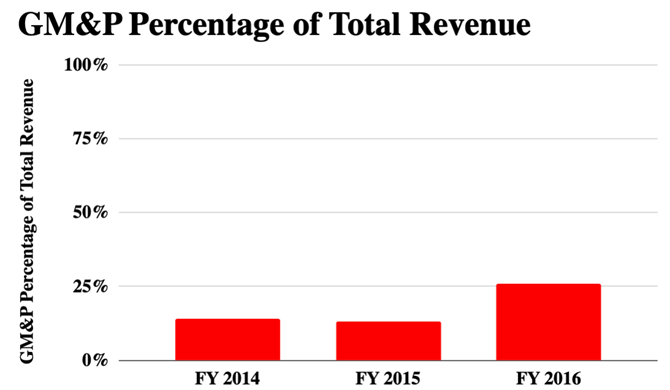

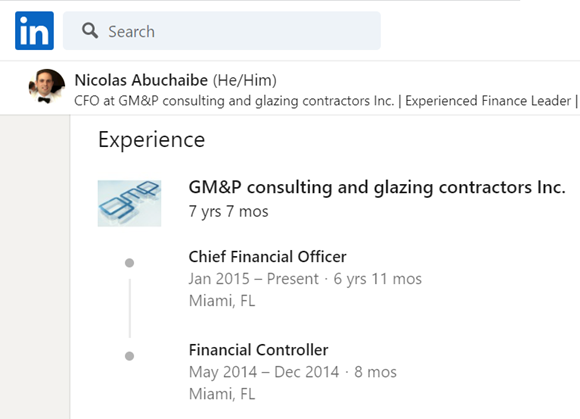

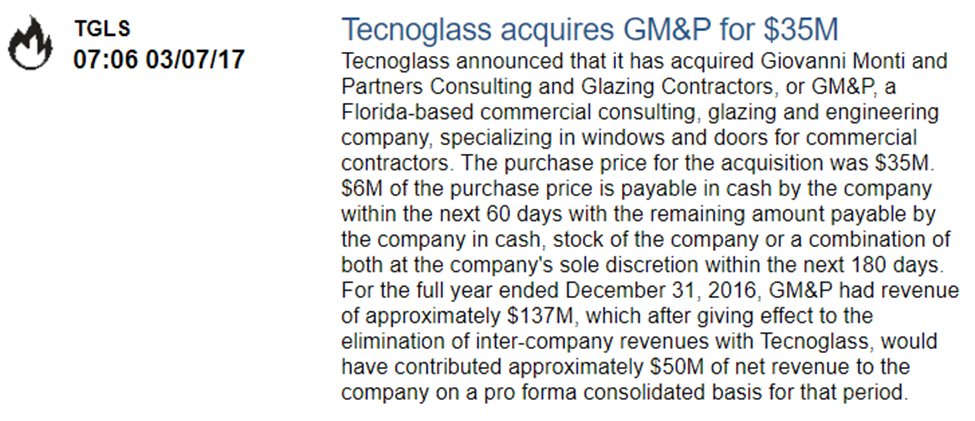

$TGLS largest customer from 2013-2016, a company called GM&P, accounted for 26% of sales in 2016 alone.

The CFO of the ‘independent’ customer is a cousin of Tecnoglass’ CEO & COO, per public records.

We found no disclosure of the familial relationship. (6/x)

The CFO of the ‘independent’ customer is a cousin of Tecnoglass’ CEO & COO, per public records.

We found no disclosure of the familial relationship. (6/x)

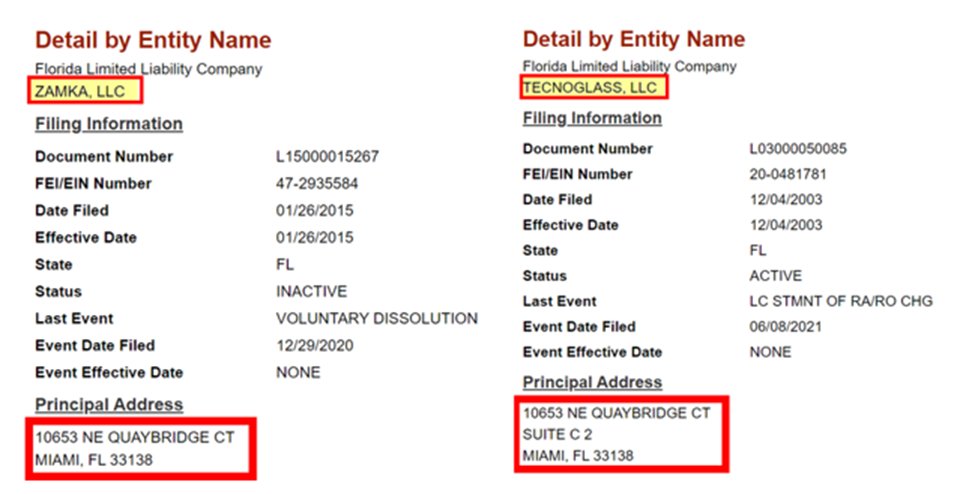

A subsidiary of this supposedly independent customer was managed by the nephews of the CEO & COO of $TGLS via an entity based out of Tecnoglass’ address.

The nephews were, and still are, both senior employees of Tecnoglass. (7/x)

The nephews were, and still are, both senior employees of Tecnoglass. (7/x)

The customer, GM&P, was later acquired by Tecnoglass in 2017, along with a 60% stake in the subsidiary.

No mention was made of any of the familial or related party links in Tecnoglass’ filings. (8/x)

No mention was made of any of the familial or related party links in Tecnoglass’ filings. (8/x)

$TGLS still hasn’t disclosed who owns the other 40% of the subsidiary entity.

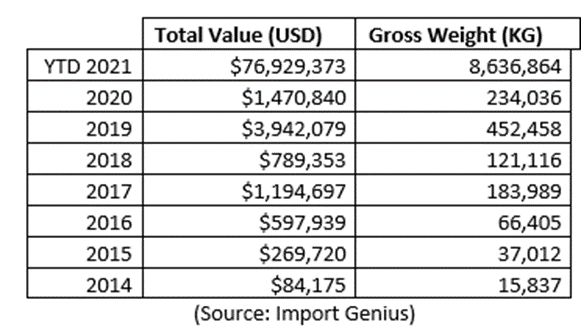

Export records show Tecnoglass’ shipments to the subsidiary entity have exploded in 2021 to $76 million compared to ~$1.5 million in 2020. (9/x)

Export records show Tecnoglass’ shipments to the subsidiary entity have exploded in 2021 to $76 million compared to ~$1.5 million in 2020. (9/x)

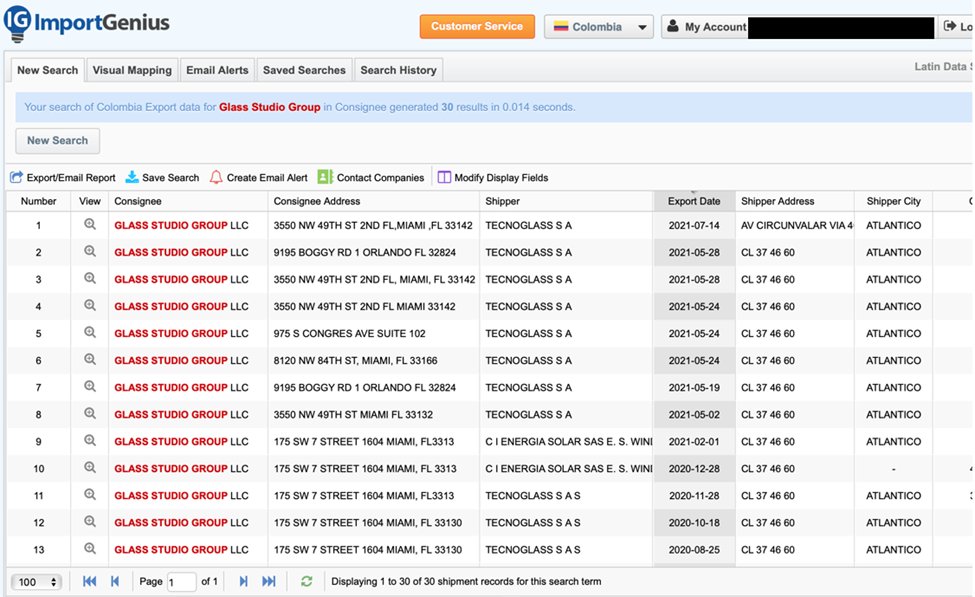

2015-2021: Export records show that Tecnoglass exported product to yet another supposed independent customer called “Glass Studio Group LLC”, which also has undisclosed related party links to the CEO & COO’s nephews. (10/x)

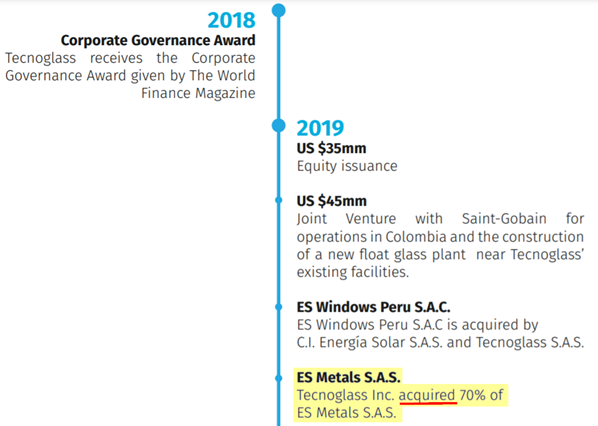

2019: $TGLS acquired a 70% stake in entity “ES Metals” from the CEO & COO’s children, with no disclosure of the relationship. (11/x)

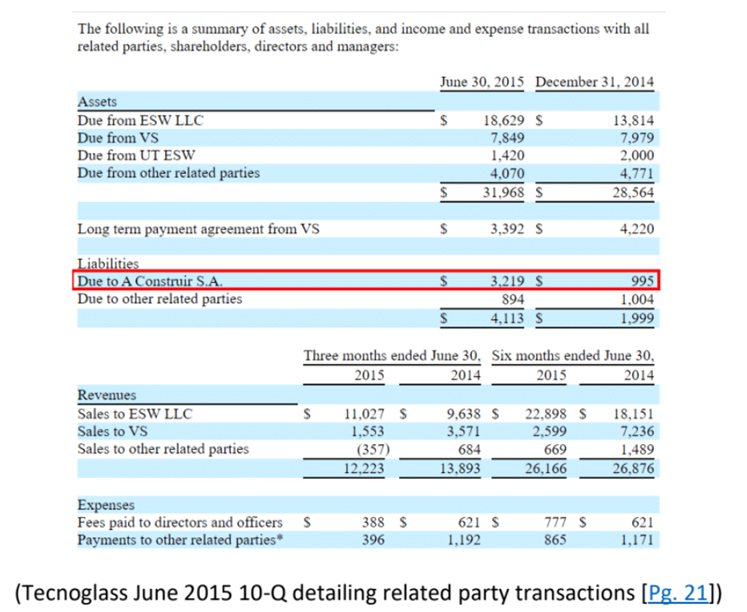

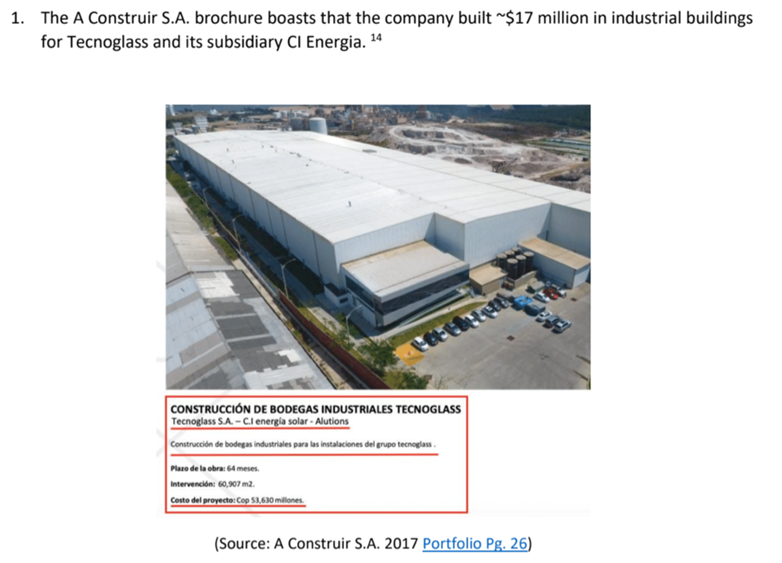

Beyond undisclosed related-party customers, we found issues with capital expenditures.

The Daes brothers own a construction co. that has played an under-disclosed role in construction of at least $24M in co facilities. (12/x)

The Daes brothers own a construction co. that has played an under-disclosed role in construction of at least $24M in co facilities. (12/x)

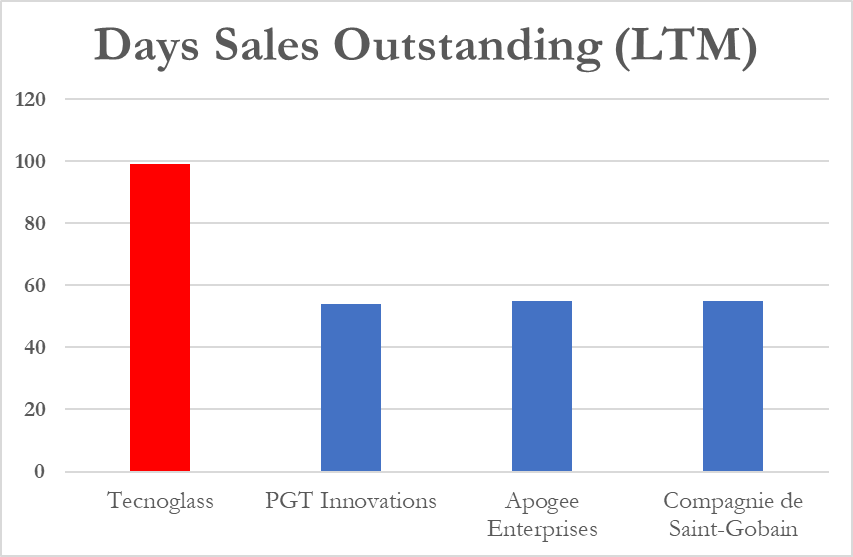

The company has consistently had a difficult time collecting revenue, with its Days Sales Outstanding (DSO) nearly 2x peers, a classic sign of fake revenue, especially when coupled with other red flags. (13/x)

We also identified red flags with management.

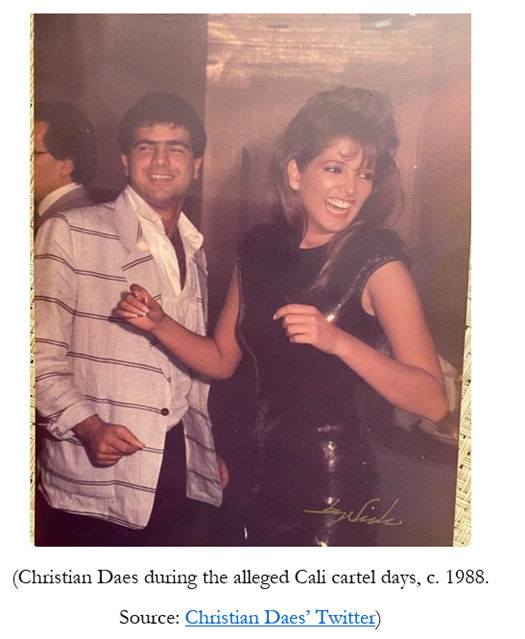

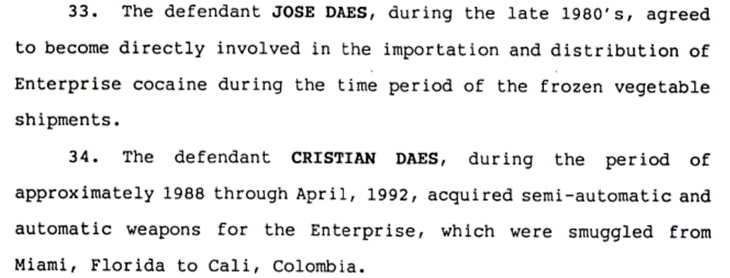

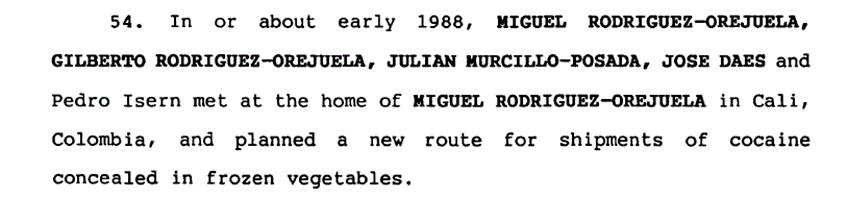

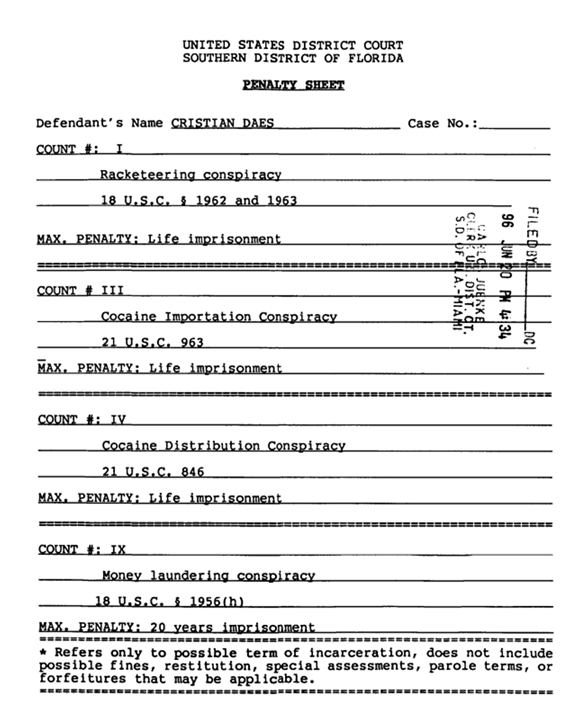

In 1996, U.S. criminal prosecutors filed charges against Jose and Christian Daes, the current CEO & COO of $TGLS, alleging they were "managers & operators" of the Cali Cartel. (14/x)

In 1996, U.S. criminal prosecutors filed charges against Jose and Christian Daes, the current CEO & COO of $TGLS, alleging they were "managers & operators" of the Cali Cartel. (14/x)

In 1999, $TGLS CEO Jose Daes was imprisoned in Colombia over separate allegations of illicit enrichment after prosecutors found checks were paid to a Tecnoglass subsidiary by front companies controlled by the head of the Cali cartel. (15/x)

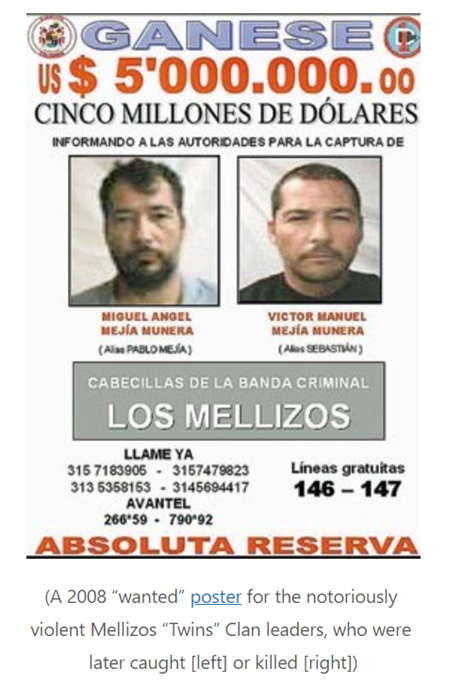

Following the crackdown on the Cali cartel, family of money launderers for a successor cartel known for its death squad appear as key early shareholders in $TGLS and the Daes’ related manufacturing business.

They remained shareholders as recently as 2020. (16/x)

They remained shareholders as recently as 2020. (16/x)

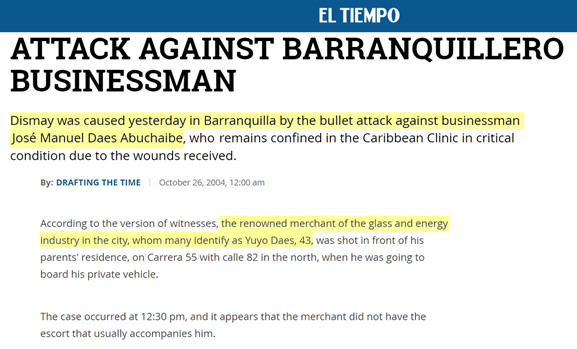

In 2004, $TGLS current CEO Jose Daes was shot in the head and neck during a botched assassination attempt, later attributed to a right-wing paramilitary warlord who believed Daes was taking too many corrupt contracts from the local mayor. (17/x)

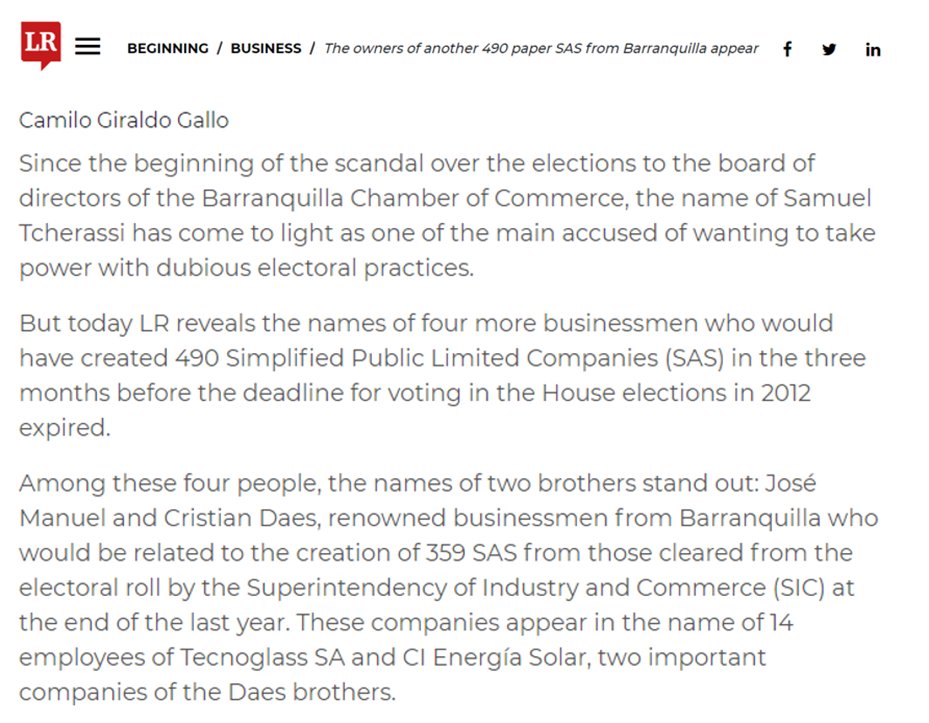

Around 2012-2013, $TGLS CEO & COO came under scrutiny by Colombian regulators over allegations they set up 359 corporate shell entities as part of a scheme to rig local elections.

Authorities later ruled the Tecnoglass’ corporate structure was opaque and fined the Daes'. (18/x)

Authorities later ruled the Tecnoglass’ corporate structure was opaque and fined the Daes'. (18/x)

All told, we have no faith in $TGLS financials given management’s background and the irregularities we have uncovered.

We encourage its auditor to do a full review of its customer transactions and outstanding balances.

hindenburgresearch.com/tecnoglass/

(19/x)

We encourage its auditor to do a full review of its customer transactions and outstanding balances.

hindenburgresearch.com/tecnoglass/

(19/x)

• • •

Missing some Tweet in this thread? You can try to

force a refresh