How to make it in DeFi: part 1 (starting out in DeFi)

This thread will be thread 1 (will make 5 or 6 in total).

The purpose of these threads is to get you from knowing nothing about DeFi to become an advanced DeFi degen.

/THREAD

This thread will be thread 1 (will make 5 or 6 in total).

The purpose of these threads is to get you from knowing nothing about DeFi to become an advanced DeFi degen.

/THREAD

I know what you’re thinking anon, why get out of Coinbase and Binance where everything is safe and well-known?

If you’re happy with buying/selling and trading tokens, this may be enough.

But crypto is so much bigger now. Why not...

1/

If you’re happy with buying/selling and trading tokens, this may be enough.

But crypto is so much bigger now. Why not...

1/

explore all the golden opportunities that are out there.

But why care about DeFi at all?

Let me present some of the opportunities in DeFi (maybe you don't understand everything now, but during all my 5-6 threads you will):

/2

But why care about DeFi at all?

Let me present some of the opportunities in DeFi (maybe you don't understand everything now, but during all my 5-6 threads you will):

/2

1. Use any token as collateral to borrow money

2. Stake your tokens (single-side staking) to earn APY, eg. stablecoins to get 20-120% APY

3. Yield farm your tokens (two or several tokens in an LP-pair) to earn APY

4. Lend your tokens to earn money

/3

2. Stake your tokens (single-side staking) to earn APY, eg. stablecoins to get 20-120% APY

3. Yield farm your tokens (two or several tokens in an LP-pair) to earn APY

4. Lend your tokens to earn money

/3

5. Buy NFT’s (which is way more than a jpeg), and you can stake your NFT to earn passive income

6. Send money to anyone in your preferred currency without using a CEX (centralized exchange) as a middleman

7. -Buy tokens at a lower price than the market price (liq. protocols)

/4

6. Send money to anyone in your preferred currency without using a CEX (centralized exchange) as a middleman

7. -Buy tokens at a lower price than the market price (liq. protocols)

/4

8. Use stablecoins to buy stocks and commodities

9. Self-repaying loans

10. Buy real estate (digital and physical)

+++

(I could probably continue this list forever with all the possibilities)

But for now, let's focus on how to start out in DeFi.

Read on.

/5

9. Self-repaying loans

10. Buy real estate (digital and physical)

+++

(I could probably continue this list forever with all the possibilities)

But for now, let's focus on how to start out in DeFi.

Read on.

/5

How to start?

You need online wallets like Metamask, xDEFI, Liquality, Phantom, Terra Station +++.

As a practical example, let’s use the most known, Metamask, for now.

Step 1: Go to Metamask.io and create a wallet.

cont.

/6

You need online wallets like Metamask, xDEFI, Liquality, Phantom, Terra Station +++.

As a practical example, let’s use the most known, Metamask, for now.

Step 1: Go to Metamask.io and create a wallet.

cont.

/6

Never share your seed phrase and password with anyone ( there are a lot of scammers on Twitter asking you for this)

And when I say no one, I mean it.

Not even Metamask themselves needs to know this.

Read eg. this guide for how to set up your wallet: blog.wetrust.io/how-to-install…

/7

And when I say no one, I mean it.

Not even Metamask themselves needs to know this.

Read eg. this guide for how to set up your wallet: blog.wetrust.io/how-to-install…

/7

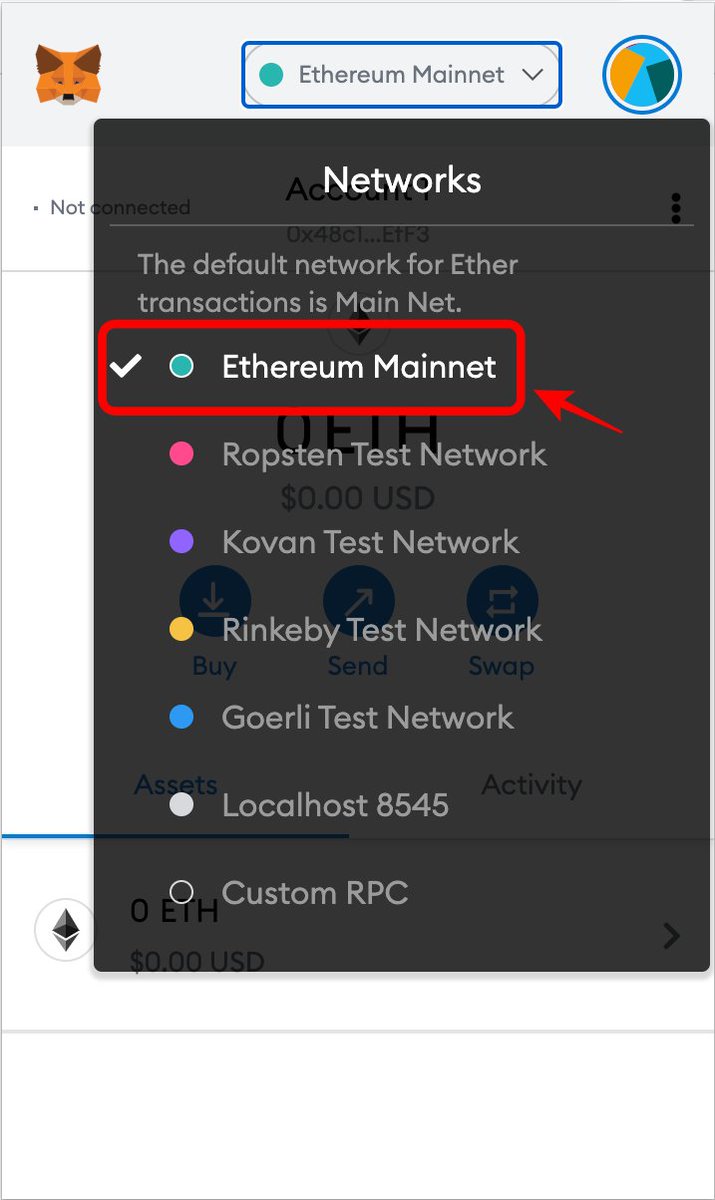

Step 2: Your wallet is automatically set up for the $ETH network.

But on the top screen in Metamask you can see that you can change networks.

Let’s say you want to use the Fantom Opera Network instead because you are bullish on $FTM and want to send some $FTM tokens...

/8

But on the top screen in Metamask you can see that you can change networks.

Let’s say you want to use the Fantom Opera Network instead because you are bullish on $FTM and want to send some $FTM tokens...

/8

from Binance to your Metamask.

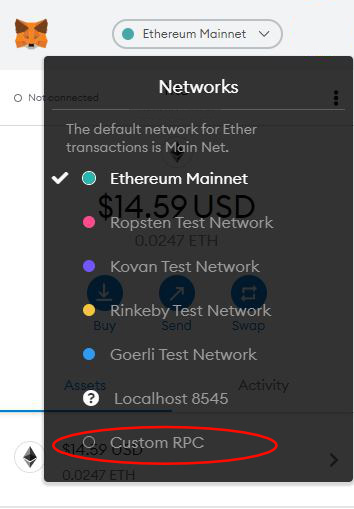

Step 3: Switch network from Ethereum mainnet to Fantom Opera network. Copy your wallet address.

If you don't have the Fantom network in your Metamask already, read this quick guide on how to add it: docs.fantom.foundation/tutorials/set-…

/9

Step 3: Switch network from Ethereum mainnet to Fantom Opera network. Copy your wallet address.

If you don't have the Fantom network in your Metamask already, read this quick guide on how to add it: docs.fantom.foundation/tutorials/set-…

/9

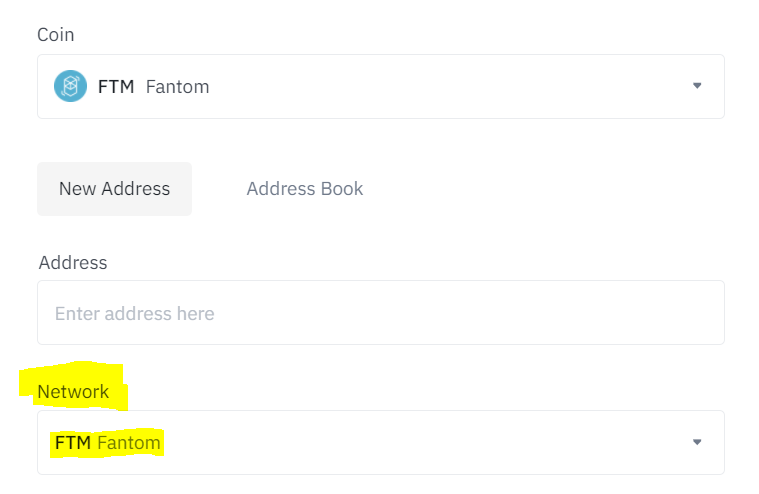

Step 4: Go to Binance.

First, you need to buy $FTM.

Then go to wallet --> fiat/spot --> search for FTM

Choose to withdraw FTM.

Step 5: Paste your Fantom address. Choose the Fantom network

10/

First, you need to buy $FTM.

Then go to wallet --> fiat/spot --> search for FTM

Choose to withdraw FTM.

Step 5: Paste your Fantom address. Choose the Fantom network

10/

Step 6: Enter your amount and press send.

If this is the first time you do this, choose the smallest amount possible.

For some reason, a lot of people do this too quickly and end up losing their funds because they entered the wrong address or chose the wrong network.

11/

If this is the first time you do this, choose the smallest amount possible.

For some reason, a lot of people do this too quickly and end up losing their funds because they entered the wrong address or chose the wrong network.

11/

The gas fees are very small on $FTM, so it’s basically free to send money through this network.

If you use another exchange, make sure that the exchange is sending your Fantom through the Fantom network.

Step 7: Your money should now be in your Metamask.

cont.

12/

If you use another exchange, make sure that the exchange is sending your Fantom through the Fantom network.

Step 7: Your money should now be in your Metamask.

cont.

12/

The transaction happens in seconds, but it’s the CEX (Binance) that uses the time to transfer the money.

If your money hasn’t arrived yet, check the status of your transfer in Binance.

Let’s just pause for a second now.

Because if you want to be in DeFi with more...

/13

If your money hasn’t arrived yet, check the status of your transfer in Binance.

Let’s just pause for a second now.

Because if you want to be in DeFi with more...

/13

than $1,000 you should absolutely get yourself a hardware wallet.

Why? Because of security purposes.

If someone knows your wallet password, they could immediately transfer all your funds to themselves.

But if you use a hardware wallet you must connect this to...

/14

Why? Because of security purposes.

If someone knows your wallet password, they could immediately transfer all your funds to themselves.

But if you use a hardware wallet you must connect this to...

/14

your online wallet in order to transfer anything out of it.

You can read more about this here: ledger.com/academy/securi…

The two most known hardware wallets are Ledger and Trezor.

Personally, I use Ledger, but in my opinion, they’re equally good.

/15

You can read more about this here: ledger.com/academy/securi…

The two most known hardware wallets are Ledger and Trezor.

Personally, I use Ledger, but in my opinion, they’re equally good.

/15

The reason why I chose Ledger was that they support the Terra $LUNA network which I use a lot.

You can read more about wallets here and a comparison between Ledger and Trezor: investopedia.com/trezor-vs-ledg…

/16

You can read more about wallets here and a comparison between Ledger and Trezor: investopedia.com/trezor-vs-ledg…

/16

Step 8: You now have $FTM in your Metamask and you’re ready to explore DeFi.

Step 9: I’ve already written a huge thread about $FTM and all the DeFi opportunities which I definitely recommend you to read before you move to step 10.

Link to thread:

/17

Step 9: I’ve already written a huge thread about $FTM and all the DeFi opportunities which I definitely recommend you to read before you move to step 10.

Link to thread:

https://twitter.com/Route2FI/status/1463814714304212992?s=20

/17

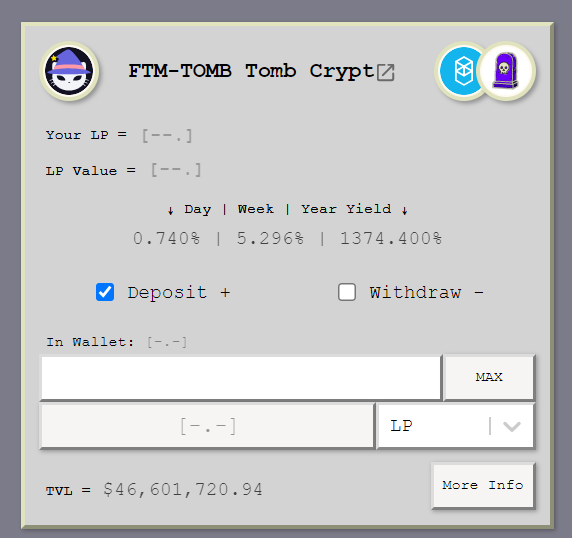

Step 10: Let’s just try one of the opportunities that I like which is the $FTM-$TOMB lp.

Go to reaper.farm, connect your Metamask to the Fantom network, and find the $FTM-$TOMB-pool.

If you thread my $FTM-thread, you already know what $TOMB is.

/18

Go to reaper.farm, connect your Metamask to the Fantom network, and find the $FTM-$TOMB-pool.

If you thread my $FTM-thread, you already know what $TOMB is.

/18

To enter this FTM-TOMB crypt you need an LP-token (liquidity-pair) which consists of 50% $FTM and 50% $TOMB.

You already have $FTM, but you need $TOMB.

Step 11: Go to spookyswap.finance, connect your wallet, and go to "Swap"

/19

You already have $FTM, but you need $TOMB.

Step 11: Go to spookyswap.finance, connect your wallet, and go to "Swap"

/19

Step 12: Swap 50% of your Fantom to $TOMB. You have to confirm with your wallet and pay $0.5 in gas fee.

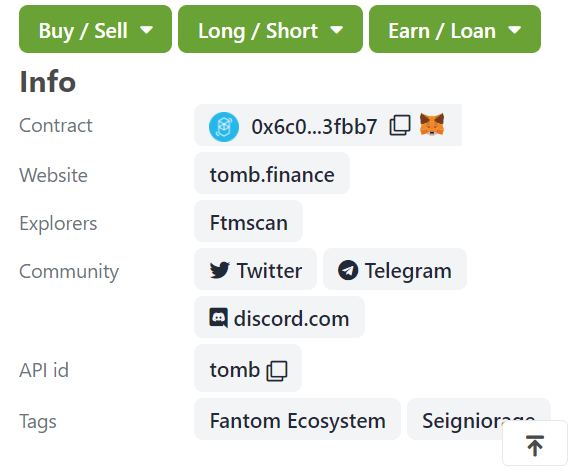

Step 13: You now have both $FTM and $TOMB in your Metamask. If you can't see your $TOMB yet, add the token from CoinGecko (screenshot)

/20

Step 13: You now have both $FTM and $TOMB in your Metamask. If you can't see your $TOMB yet, add the token from CoinGecko (screenshot)

/20

Step 14: You need to pair your $FTM and $TMB together so it makes an LP-pair.

Go to: spookyswap.finance/add

and choose 50% of $FTM and 50% of $TOMB

You approve first, then you add the supply. Confirm with Metamask and pay gas 2 times (max $1).

/21

Go to: spookyswap.finance/add

and choose 50% of $FTM and 50% of $TOMB

You approve first, then you add the supply. Confirm with Metamask and pay gas 2 times (max $1).

/21

Step 15: You have now made an LP pair.

Go back to reaper.farm again.

Find the FTM-TOMB crypt, press max, and choose "Approve LP". Confirm with Metamask.

Then choose "Deposit". Confirm with Metamask again.

Congratulations, you are now in a yield farm!

/22

Go back to reaper.farm again.

Find the FTM-TOMB crypt, press max, and choose "Approve LP". Confirm with Metamask.

Then choose "Deposit". Confirm with Metamask again.

Congratulations, you are now in a yield farm!

/22

If you think this was too advanced, NGMI.

Just kidding. $FTM-$TOMB is probably some of the more advanced things you could do, but I'm 100% sure you can do this right if you follow the instructions.

Try with $10 the first time.

/23

Just kidding. $FTM-$TOMB is probably some of the more advanced things you could do, but I'm 100% sure you can do this right if you follow the instructions.

Try with $10 the first time.

/23

About risks in DeFi, this is something I want to make a full thread about next time.

$FTM-$TOMB: 6/10 risk.

So for now, try a small amount with the instructions I gave you. I just wanted to give you a head start.

If you understood this, you will definitely make it in DeFi

/24

$FTM-$TOMB: 6/10 risk.

So for now, try a small amount with the instructions I gave you. I just wanted to give you a head start.

If you understood this, you will definitely make it in DeFi

/24

What do you receive for being in this $FTM-$TOMB yield farm?

The interest rate is 1374% per year. Is that sustainable? No.

The rate will go lower.

Read more about how much you can expect to earn if you're in $FTM-$TOMB in my thread:

/25

The interest rate is 1374% per year. Is that sustainable? No.

The rate will go lower.

Read more about how much you can expect to earn if you're in $FTM-$TOMB in my thread:

https://twitter.com/Route2FI/status/1463814714304212992?s=20

/25

Why did I say the risk was a 6/10 (medium risk)?

This is, of course, my personal opinion, but in the next thread we will look at risks in DeFi and we'll explore the full specter from 1-10 on the risk scale.

You should never go all-in into something like this.

26/

This is, of course, my personal opinion, but in the next thread we will look at risks in DeFi and we'll explore the full specter from 1-10 on the risk scale.

You should never go all-in into something like this.

26/

I hope you learned something new, and please request subjects that you want to learn more about.

I could definitely start this thread with simpler DeFi-concepts, but I wanted to show you that this is relatively easy if you try.

Everyone can do it.

27/

I could definitely start this thread with simpler DeFi-concepts, but I wanted to show you that this is relatively easy if you try.

Everyone can do it.

27/

Stay tuned for part 2 in how to make it in DeFi.

If you liked the thread, please help me share the first tweet by retweeting this one 👇

Thank you!

If you liked the thread, please help me share the first tweet by retweeting this one 👇

https://twitter.com/Route2FI/status/1469645315301122048?s=20

Thank you!

• • •

Missing some Tweet in this thread? You can try to

force a refresh