Short🧵on Mold-Tek Packaging Ltd.

In the Old West, it was common for people to put their valuable possessions in a coffee can and keep it under the mattress. Since this approach involved no transaction costs,

In the Old West, it was common for people to put their valuable possessions in a coffee can and keep it under the mattress. Since this approach involved no transaction costs,

the value of the coffee can in the long term was entirely dependent on the wisdom and foresight used to pick the objects to in the coffee can. Impressed with the power of this approach –

Of buying great companies and then letting them for ten years – Robert Kirby coined the term “Coffee Can Investing”.

While this BUY and HOLD for 10 years approach is designed to protect the investor from herself, it forces investors to pick yesterday’s proven winners.

As the disclaimer goes, “Past performance is not indicative of future returns”, the GOAT of investing Mr. Warren Buffett has potently articulated it:

"Clearly, Berkshire’s results would have been far better if I had caught this swing of the pendulum. That may seem easy to do when one looks through an always-clean, rear-view mirror.

Contd...

Contd...

Unfortunately, however, it’s the windshield through which investors must peer, and that glass is invariably fogged."

-Warren Buffett, Berkshire Hathaway: Letter to Shareholders (2004)

-Warren Buffett, Berkshire Hathaway: Letter to Shareholders (2004)

Mold-Tek Packaging

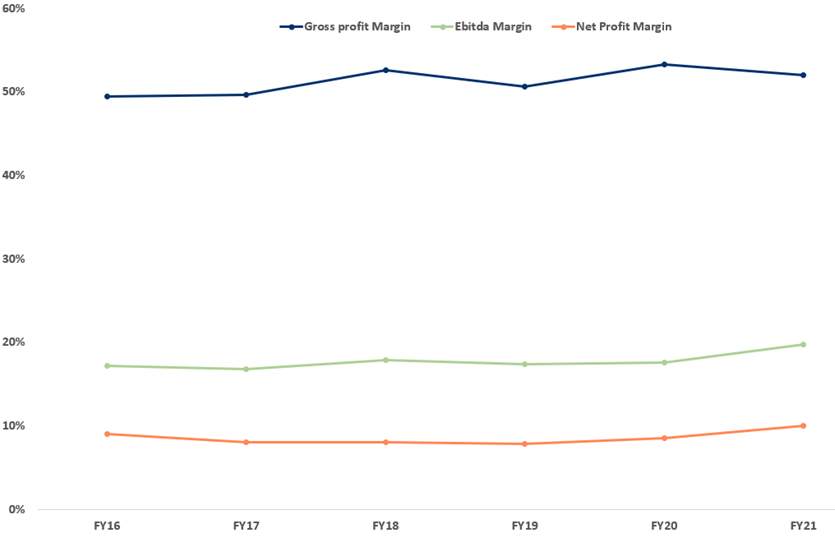

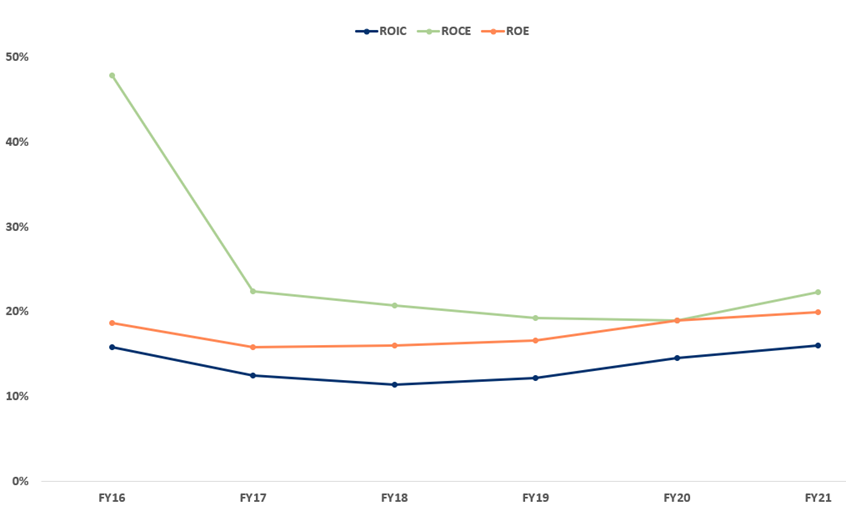

Rear-view: Over past 5 years, the company has grown 10% CAGR in volume, 12% CAGR in revenues and 16% CAGR in EBITDA. Mold-Tek Packaging is definitely among yesterday’s proven winners.

Now, Let us analyze Mold Tek Packaging business through a foggy windshield😉

Rear-view: Over past 5 years, the company has grown 10% CAGR in volume, 12% CAGR in revenues and 16% CAGR in EBITDA. Mold-Tek Packaging is definitely among yesterday’s proven winners.

Now, Let us analyze Mold Tek Packaging business through a foggy windshield😉

Indian packaging industry valued at $75 billion in 2020, is expected to reach $204 billion by 2025, CAGR of 26.7%. The growth will be driven by

a) Lifestyle changes

b) Boom in e-commerce

c) Consumer awareness of packaged food

d) Rise in organized retail footprint.

a) Lifestyle changes

b) Boom in e-commerce

c) Consumer awareness of packaged food

d) Rise in organized retail footprint.

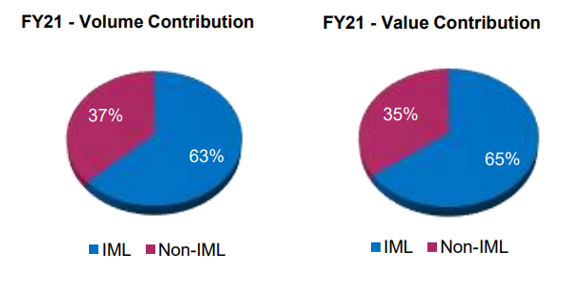

Mold-Tek Packaging is a leading player in the rigid packaging business and is into manufacturing decorative packaging containers for paint, lubricant, FMCG & foods (F&F) industry. It was the first to introduce in-mould label(IML) products and QR coded packaging products in India

Product segments:

Paints: Mold-Tek enjoys 25%market share in paints industry. Paints remains the largest contributor for Mold-Tek’s revenue,thanks to the ever-growing volumes. The company supplies to all big players in the paints industry,Asian Paints being its largest client.

Paints: Mold-Tek enjoys 25%market share in paints industry. Paints remains the largest contributor for Mold-Tek’s revenue,thanks to the ever-growing volumes. The company supplies to all big players in the paints industry,Asian Paints being its largest client.

IML Vs Non-IML mix for FY21 was 63% Vs 37%, while majority of non-IML was attributed to paints segment. So, there is a wiggle room for IML growth in paint industry.

Lubricants: Lubricant face maximum risk of duplication, hence they’d want to make the most of IML technology. Most lube companies have already shifted their packaging completely to IML.

Food & FMCG: Packaging industry is witnessing solid traction across various F&F segments such as ice-creams, chocolates, edible oils, and other dairy products etc. Edible Oil and Ghee are growing at 30-40% and are expected to do better in future as well.

These segments enjoy ~2x realization at a normalized level compared to Paints and Lubes segments.

Pumps: Addition of Pumps has opened the Personal Care market for Mold-Tek. Apart from the better quality of pumps, MTEP has an edge on account of import duty on pumps (~27%).

Pumps: Addition of Pumps has opened the Personal Care market for Mold-Tek. Apart from the better quality of pumps, MTEP has an edge on account of import duty on pumps (~27%).

Also, management is in discussion with a major MNC for the shampoo portfolio. Currently the company is producing 1.5 mn pumps/ month and expects to end the year with 4-5 mn/month.

Capex: Total capex of 50 Crs for FY2022 is approved of which 33 crores has been committed. FY22 & FY23 capex for Berger and Nerolac will be approximately 20 Cr.

New Customers: BPCL, Gulf Oil orders are worth 90 Cr. Mold-Tek is looking to venture into agrochemicals space as well.

New Customers: BPCL, Gulf Oil orders are worth 90 Cr. Mold-Tek is looking to venture into agrochemicals space as well.

Value Add Services: QR Enabled IML. IML products already deliver 150% higher EBITDA/kg compared to Non-IML products. QR enabled IML will further this gap.

Sustainability: All the pails/packs manufactured by MTEP are reusable and are more than 700 microns in thickness. The higher thickness ensures that the life of the pack is far beyond the initial usage cycle.

MTEP’s products are 100% recyclable as the entire package including jar, lid, handle and even labels are made up of the same type of RM – PP (polypropylene plastic), making segregation unnecessary while reprocessing, thereby allowing complete recyclability.

The pandemic has further helped Mold-Tek gain more clients as demand for IML packaging (no human intervention) has increased.

With expansion planned for Mysore and Vizag for paints and at Hyd for F&F, total installed capacity will be 44000 MTPA. With future growth visibility, it is capable of achieving 800 cr revenue in couple years. Back-of-the-envelope calc suggests EPS can be 28-30 Rs in couple years

Risks:

Competition: The closest competitor of Mold-Tek is Hitech Corp which is the largest supplier to Asian Paints (a related company to AP).

Demand slowdown: Any slowdown in demand from key end-user industries Paints, F&F and Lube may impact its operational performance.

Competition: The closest competitor of Mold-Tek is Hitech Corp which is the largest supplier to Asian Paints (a related company to AP).

Demand slowdown: Any slowdown in demand from key end-user industries Paints, F&F and Lube may impact its operational performance.

• • •

Missing some Tweet in this thread? You can try to

force a refresh